Fubo stock has staked a claim in the streaming market, catering to sports enthusiasts seeking live game coverage—however, the company faces headwinds ahead.

Investors in fuboTV (NYSE:FUBO) have had a rough ride lately, with shares plummeting by a significant 29% in the past month, adding to the company's ongoing struggles.

This downturn means shareholders who have held on over the past twelve months are now facing a 16% drop in share price, rather than seeing any rewards.

In the realm of streaming services, a seismic shift is underway as traditional media giants band together to launch a sports-centric platform, spelling potential trouble for fuboTV.

In this article, we'll cover:

- Current Landscape of Streaming Services

- Who is FuboTV

- Key Major Competition for Fubo Stock

- Relative Industry Position

- Fubo Stock Performance

- Long Term Outlook For Fubo Stock

Current Landscape of Streaming Services

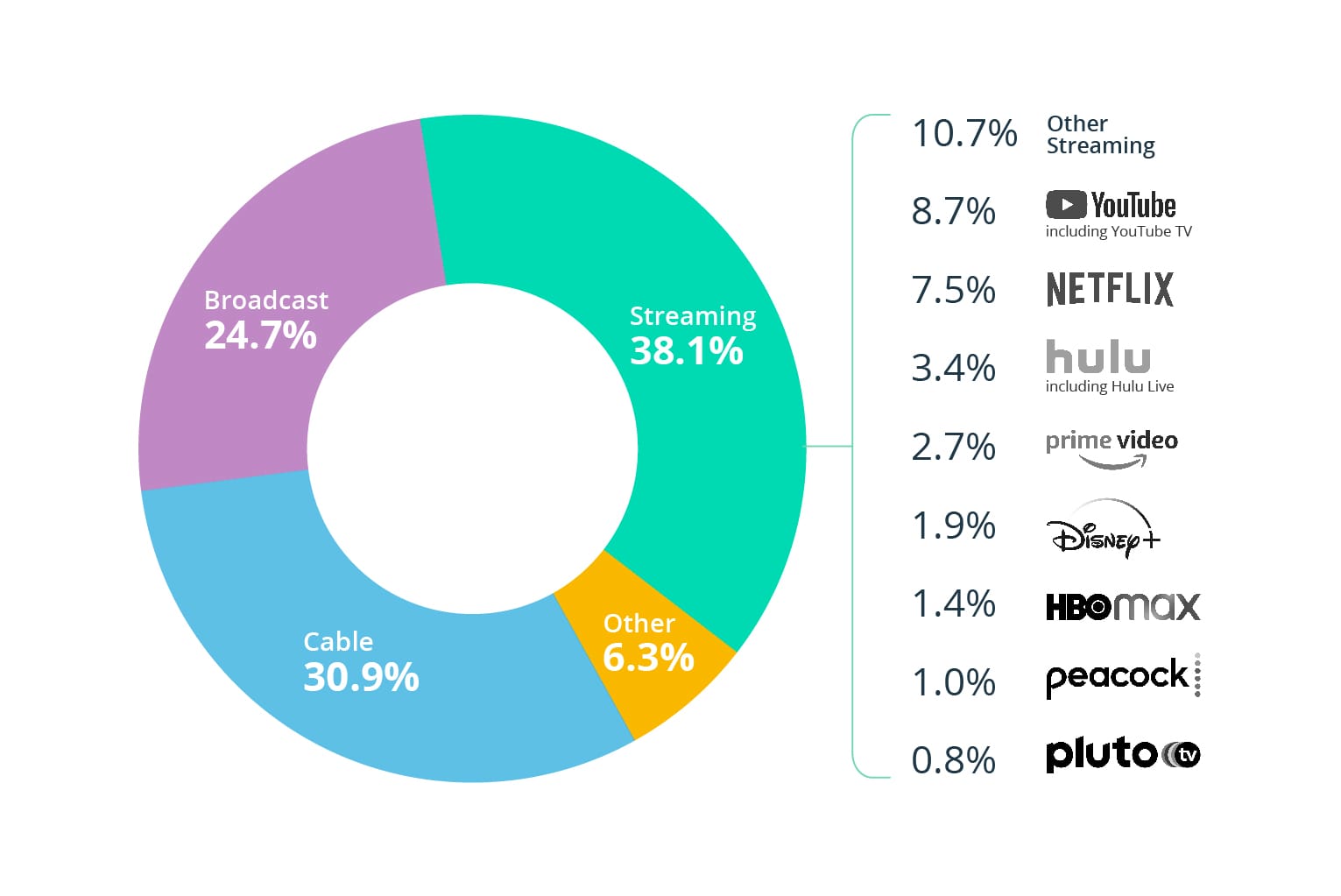

The current market landscape for streaming services is characterized by fierce competition, rapid innovation, and a shift towards consolidation and specialization.

Increased Competition - The streaming industry has seen a proliferation of players, ranging from established giants like Netflix, Amazon Prime Video, and Disney+ to newer entrants such as Apple TV+, HBO Max, and Paramount+. This intense competition has led to a battle for subscribers, content rights, and market share.

Content Wars - Streaming platforms are investing heavily in original content production to differentiate themselves and attract subscribers. This has resulted in a surge of high-quality original programming across genres, including scripted series, movies, documentaries, and reality shows.

Fragmentation - With numerous streaming services available, consumers are faced with the challenge of subscription fatigue and content fragmentation. This has led to a trend of "cord-cutting," where consumers opt to cancel traditional cable or satellite TV subscriptions in favor of multiple streaming services.

Price Wars - As competition heats up, streaming platforms are increasingly offering competitive pricing and promotional deals to attract subscribers. This has led to price wars and bundling options, where subscribers can access multiple services at discounted rates.

Specialization - Some streaming services have adopted a niche or specialized approach to cater to specific audiences or interests. For example, fuboTV focuses on live sports, Crunchyroll specializes in anime, and BritBox offers British TV shows and movies.

Consolidation - Amidst the crowded market, there has been a trend towards consolidation, with media companies merging or forming partnerships to strengthen their positions. Examples include Disney's acquisition of 21st Century Fox and the merger of WarnerMedia and Discovery.

Global Expansion - Streaming services are increasingly expanding their reach beyond their domestic markets to tap into international audiences. This includes localization efforts, content licensing deals, and original productions tailored to specific regions and languages.

Technological Advancements - Streaming platforms continue to innovate with new features, improved user interfaces, and advanced technologies such as 4K Ultra HD, HDR, and Dolby Atmos audio. Additionally, the rise of smart TVs, streaming devices, and mobile apps has made streaming more accessible and convenient for consumers.

We're the best app in finance—Register using your Google Account. Just click the GIF!

Who Is FuboTV

FuboTV is a streaming television service that focuses primarily on live sports content. It offers subscribers access to a wide range of sports channels, including those broadcasting soccer, football, basketball, baseball, and more. In addition to sports, fuboTV also provides entertainment and news channels.

It was founded in 2015 and has since grown to become a significant player in the streaming industry, particularly for sports enthusiasts and cord-cutters seeking alternatives to traditional cable or satellite TV subscriptions. FuboTV is headquartered in New York City, United States.

Key Major Competition for Fubo Stock

- The entertainment and media industry had robust growth in 2023 but is projected to slow down from 2024 to 2027.

- PwC anticipates a decline in growth rate, settling at 2.8% by 2027, signaling recalibration in the industry.

- Factors contributing to this slowdown include consumer spending challenges due to inflation, pandemic fatigue, and global uncertainties.

- Digitalization continues to shape the industry, influencing trends and consumer behavior.

- Advertising revenue forecasted to rise to nearly $1 trillion globally by 2027, reshaping revenue dynamics in the industry.

- Streaming services are evolving, leading to niche platforms catering to specialized interests.

- Personalized, data-driven marketing strategies are replacing conventional approaches.

- Live entertainment sectors are experiencing a resurgence, outperforming the broader industry.

- Sports and cinema box office revenue are expected to reclaim pre-pandemic levels by 2025.

Disney, Fox, and Warner Bros. Discovery to introduce a new streaming service. This union will amalgamate the sports-heavy channels of the three conglomerates, intensifying competition in the market and casting shadows over fuboTV's future.

The crux of the issue lies in fuboTV's business model, which appears unsustainable even in the absence of direct competitors. While other streaming platforms offer fragments of sports content, such as Amazon Prime Video, YouTube, and Disney's ESPN+, none present a comprehensive alternative akin to fuboTV's offerings.

We're the best app in finance—Register using your Google Account. Just click the GIF!

Relative Industry Position

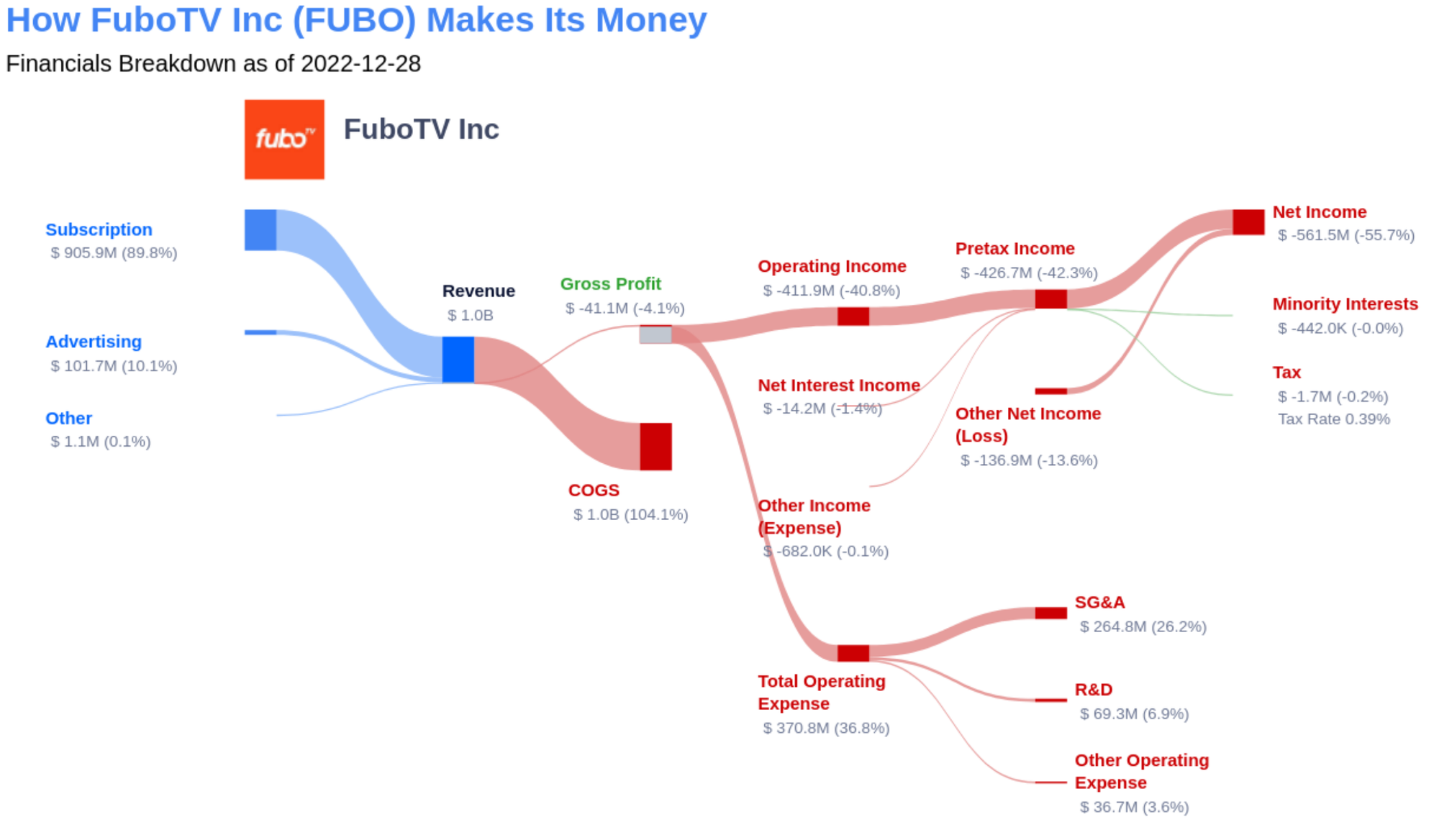

Despite its ability to attract subscribers and implement price hikes without significant pushback due to the lack of viable alternatives, fuboTV continues to hemorrhage cash.

The company boasted 1.48 million paid subscribers in North America by the end of the third quarter, each contributing an average monthly revenue of $83.51. Yet, its third-quarter financials revealed a concerning free cash flow of negative $29.5 million, indicating an annual cash burn rate of approximately $120 million.

Moreover, fuboTV faces escalating content costs tied to its expanding subscriber base, further complicating its financial outlook. The recent joint venture announcement only compounds these challenges, potentially impeding fuboTV's subscriber growth and exacerbating its cash flow woes.

Fubo Stock Performance

To sustain its operations, fuboTV has heavily relied on stock sales, but diminishing share prices pose challenges to this strategy.

The company has raised substantial funds through stock sales in recent years, steadily climbing from $67 million in 2021 to $292 million in 2024—almost a 5x dilutive increase in shares outstanding. However, with a market capitalization now below $600 million, continued reliance on this approach is precarious.

On February 27th, units of the company plunged, closing down 22.7%. This move lower was the result of news breaking that The Walt Disney Company (DIS), Warner Bros. Discovery, Inc. (WBD), and Fox Corporation (FOX) had entered into what might ultimately be known as the largest sports streaming venture in the history of the industry.

Financial Metrics and Synsense Factors

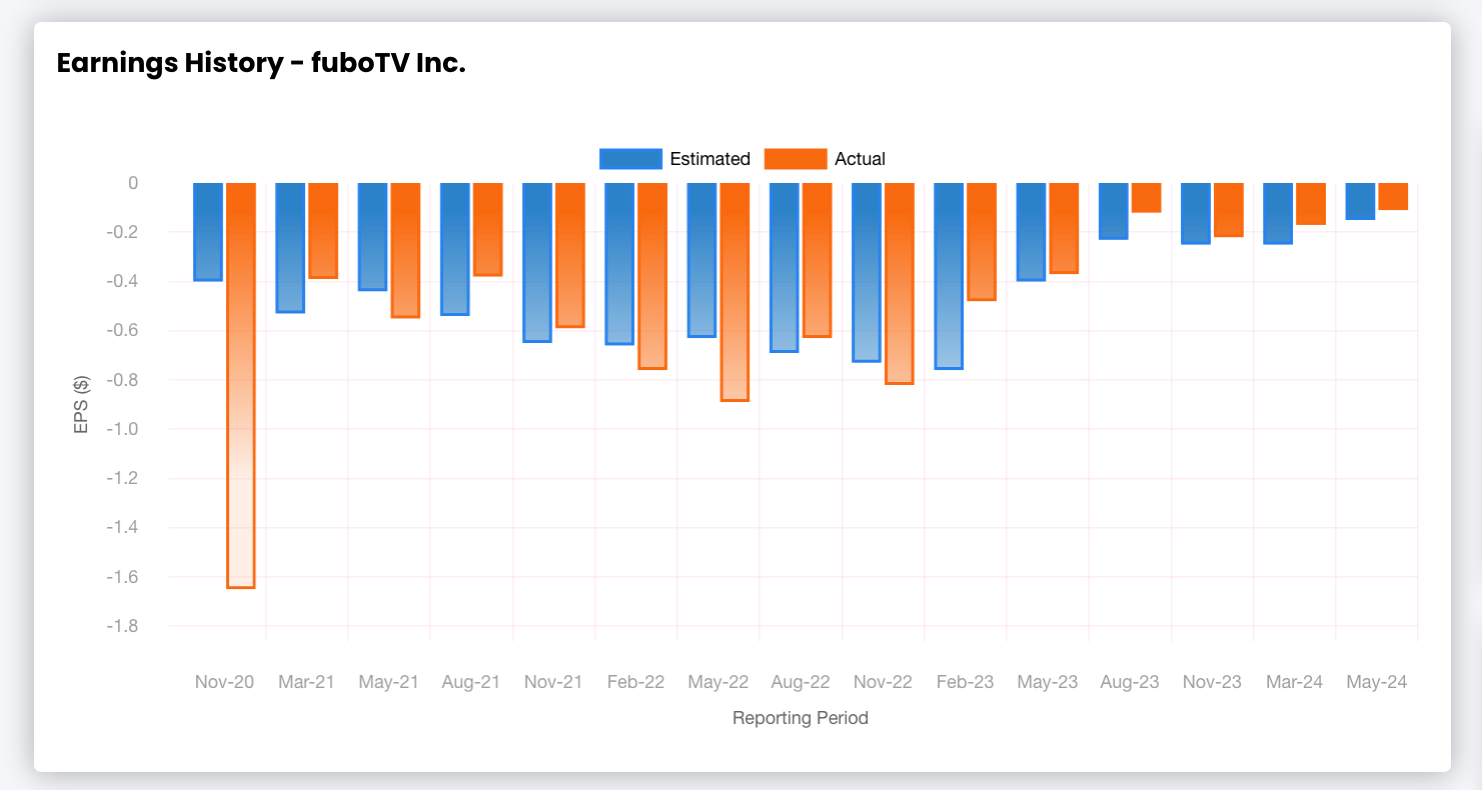

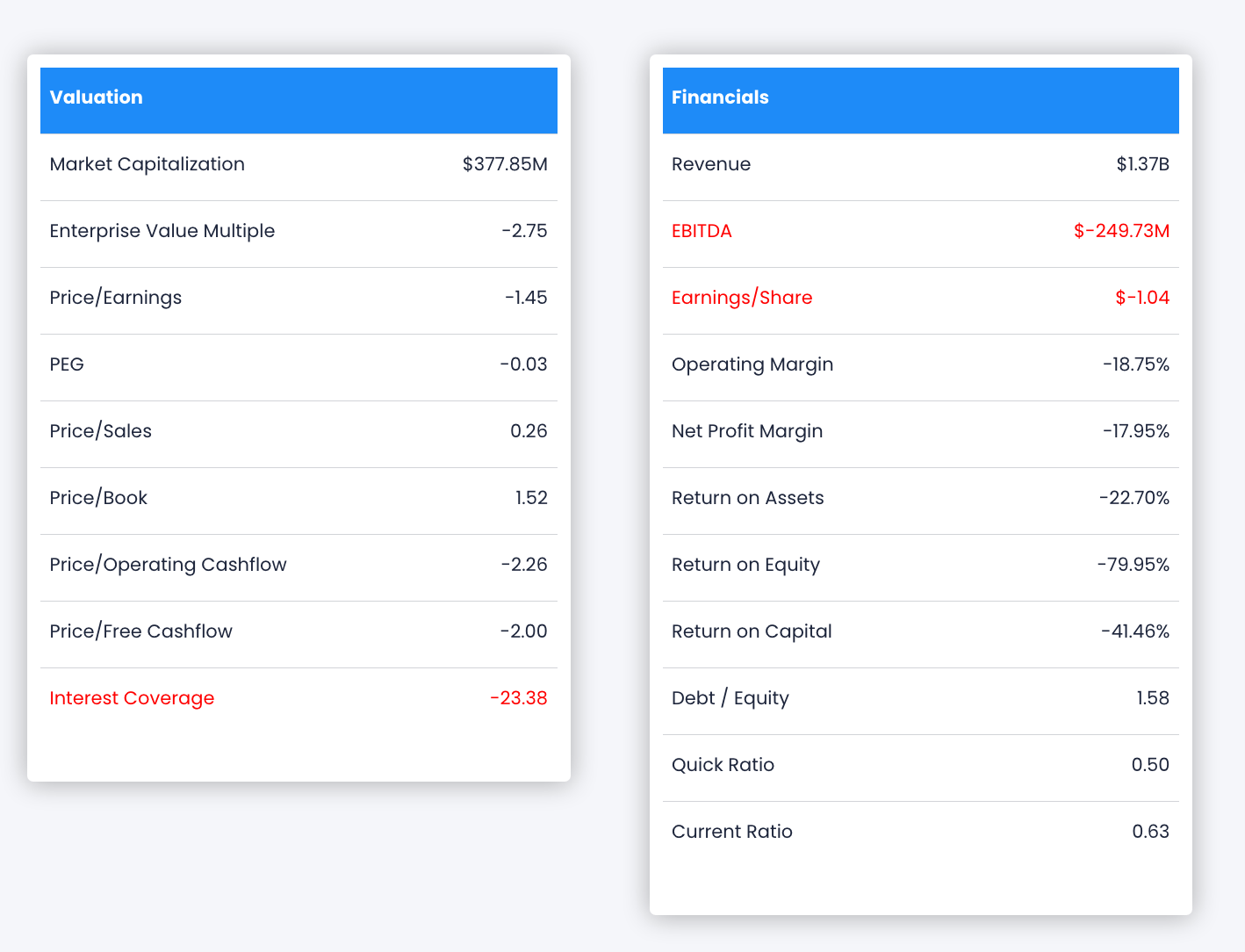

Earnings have been slightly better than expected as of recent, however FuboTv is still an unprofitable venture as of recent.

Most concerning to see is Fubo's capital structure, with their interest coverage ratio being negative, Fubo is currently technically unable to fund it's debt from normal operations. This means that Fubo will continue to need to dilute shareholders by issuing new stock in order to fund operations.

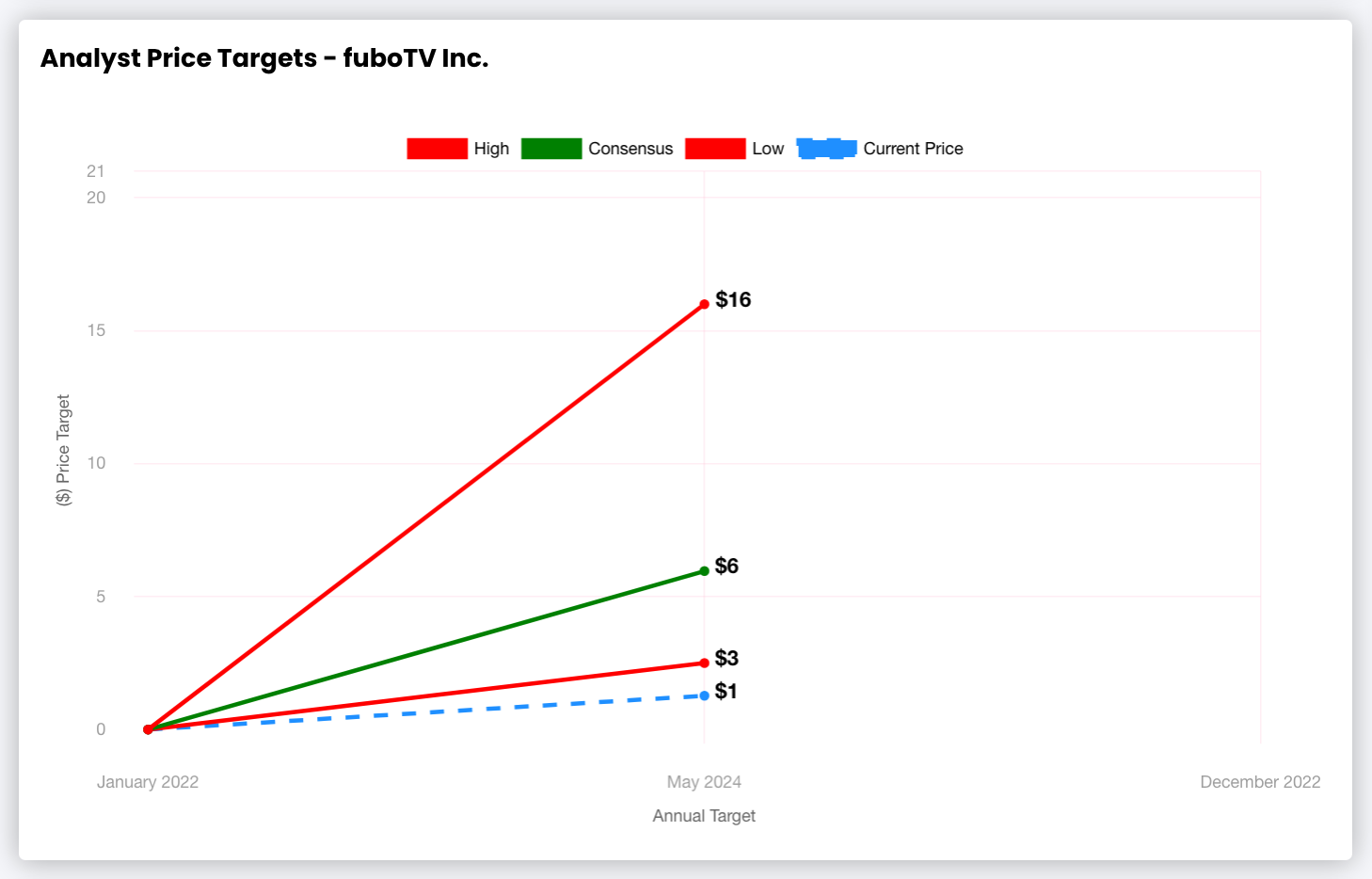

Analyst recommendations seem rosy knowing that equity dilution has been Fubo's historical strategy, but perhaps a pop could happen, but then again penny stocks can prove to be extremely risky if liquidity becomes a concern (wide bid-ask spreads).

On the Synsense side of things, Fubo has been correctly predicted to continue it's decline.

Register For Free in Seconds!

The absolute best app in finance. Register in 3 seconds using your Google Account!