Rivian Automotive, Inc. is an American electric vehicle manufacturer and automotive technology company that has been generating a sizable buzz in the market since its IPO in November 2021.

Rivian is known for its focus on producing electric vehicles designed for outdoor adventure, emphasizing sustainability and innovative technology...

...but is that enough to brave through turbulent industry headwinds, a lawsuit from its biggest competitor, and lackluster financial results?

We dived into Rivian's latest 10-K filings as well as it's competitors. Today, we'll be looking at whether Rivian stock deserves a place in the growth-oriented investor's portfolio.

In this article, we'll discuss:

- Summary of Rivian Business Model

- EV Competitive Landscape

- EV Consumer Acceptance Concerns

- Financial Results

- Other Factors to Consider

Summary of Rivian Business Model

We summarize Rivian's overall business business into the following subcategories—direct-to-consumer adventure vehicles, commercial vehicles, charging infrastructure, solutions, and a fleet management platform.

Innovative Electric Adventure Vehicles

At the core of Rivian's consumer product range are the R1T and R1S electric adventure vehicles. The R1T is a two-row, five-passenger pickup truck, while the R1S serves as a three-row, seven-passenger SUV.

These vehicles are designed not just for utility but for the thrill of adventure, combining robust performance with high efficiency. They feature Rivian's proprietary technology systems, including advanced battery technology, electric drive units, and an innovative chassis system.

Rivian's direct-to-customer sales model eliminates traditional dealership networks, favoring a digital-first approach that includes sales, service, and customer engagement through digital platforms, social media, and owned retail spaces.

This strategy not only simplifies the purchasing and service process but also helps Rivian maintain direct relationships with its customers, gathering valuable feedback that drives continuous improvement.

Expanding Commercial Ventures

Rivain stock has also made significant strides in the commercial vehicle sector with its Rivian Commercial Van (RCV) platform, which includes the Electric Delivery Van (EDV).

Developed in collaboration with Amazon, the EDV is engineered for efficiency and scale, aiming to meet the demands of Amazon's massive logistics operations. In fact, Amazon has committed to an initial order of 100,000 EDVs, underscoring the scale and confidence in Rivian's technology. .

Complementary Services & Charging Solutions

To enhance the ownership experience, Rivian offers a comprehensive suite of services, including financing, leasing, insurance, and proactive maintenance.

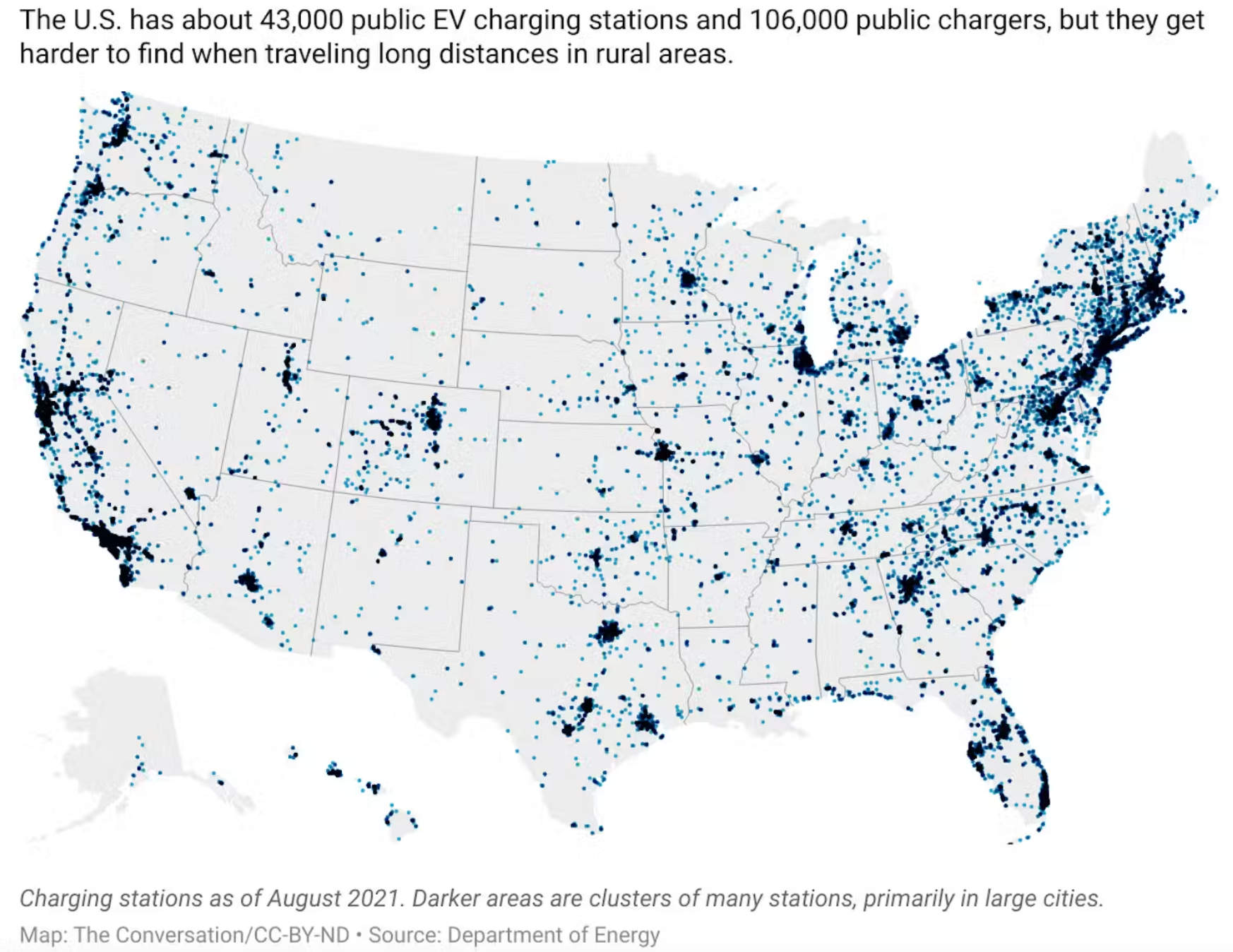

Additionally, the company is developing its Rivian Adventure Network of fast chargers across North America. This network, along with access to CCS public charging stations and an upcoming integration with Tesla Superchargers, ensures that Rivian vehicle owners have extensive, reliable charging options.

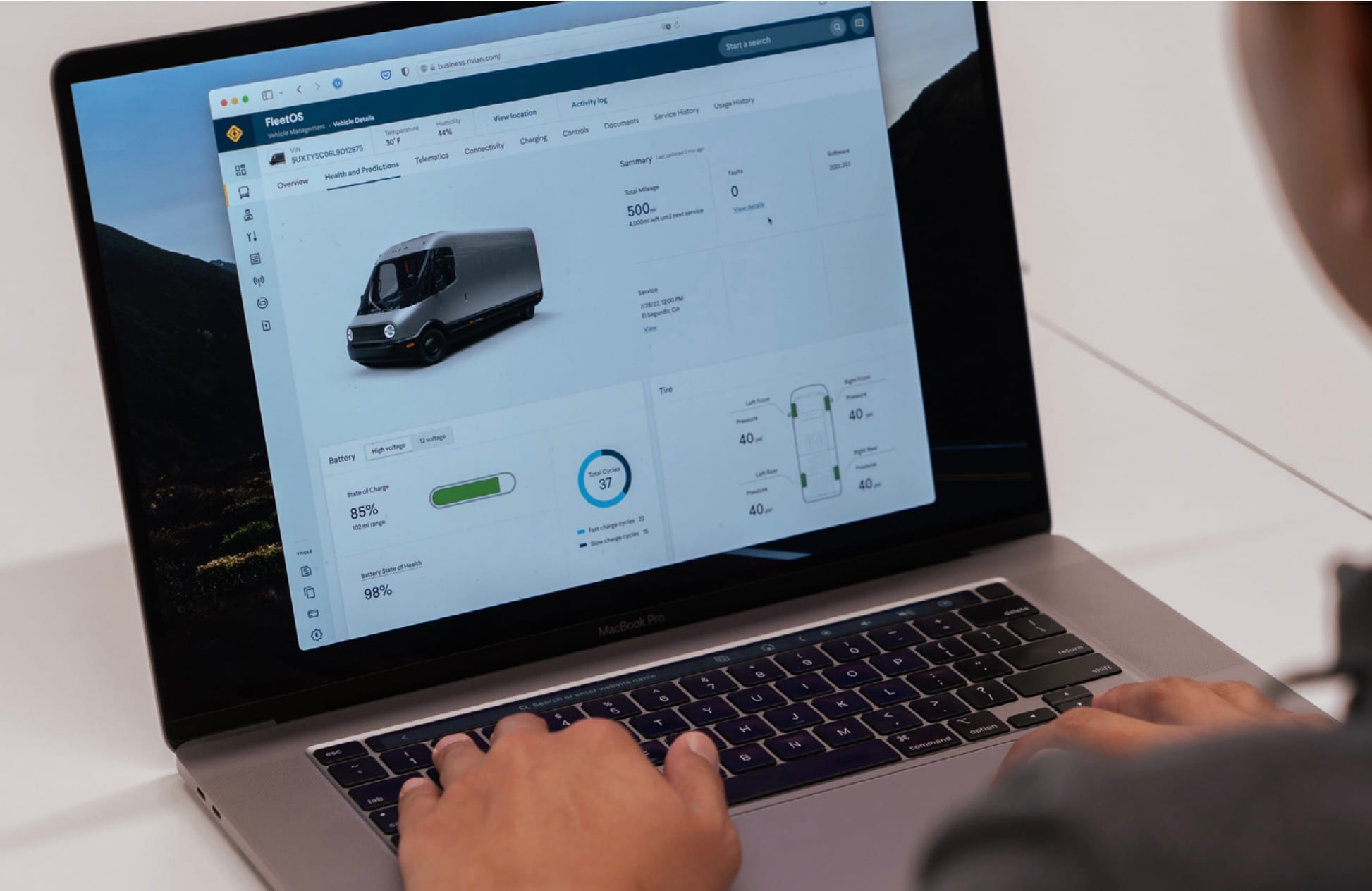

Fleet Management Innovation

For commercial clients, Rivian introduces FleetOS, a centralized fleet management platform that offers a range of services from vehicle telematics to charging solutions.

This platform is designed to evolve, promising to add more functionalities like smart routing, remote diagnostics, and collision reports. FleetOS aims to optimize the total cost of ownership and enhance operational efficiency across fleet operations.

EV Competitive Landscape

The EV market is intensely competitive, dominated by established automakers and a slew of ambitious startups. Tesla stands out as the market leader, particularly in the consumer EV sector, thanks to its early start and robust charging infrastructure.

In fact in July 2020, Tesla sued Rivian and several former Tesla employees now working for Rivian, alleging trade secret misappropriation and breach of contract. Tesla claims these employees took confidential information when they joined Riviain and the trial in ongoing.

In addition to Tesla's offensive maneuvers against rivan stock, legacy automakers like Ford and General Motors have also accelerated their EV strategies, with Ford launching the electric F-150 Lightning and GM investing heavily in its Ultium battery platform.

Register using your Google Account. Just click the GIF!

While Rivian’s primary differentiators—its adventure-focused electric trucks (R1T) and SUVs (R1S), and its partnership with Amazon for electric delivery vans (EDV)—carve out niche markets that offer growth opportunities, these areas are becoming increasingly crowded.

Tesla’s Cybertruck and GM’s Hummer EV are direct competitors to Riviain consumer vehicles, while startups like Arrival and established players such as Ford with its E-Transit van target the commercial EV space.

Industry Challenges

EV automakers collectively are faced with a number of industry challenges that are resulting in higher than normal capital expenditures:

Supply Chain Constraints

The EV industry is currently facing significant supply chain challenges, particularly with the availability of critical components like semiconductors and batteries. These constraints can lead to production delays and increased costs, impacting companies' abilities to scale effectively.

Infrastructure Development

While Rivina stock has been investing in its Rivina Adventure Network, the overall charging infrastructure remains inadequate compared to the needs of the growing EV market. Accessibility to fast and reliable charging stations is crucial for consumer adoption and is an area where Tesla still has a distinct advantage.

Regulatory and Policy Shifts

EV manufacturers must navigate a complex web of local and international regulations that can impact vehicle design, manufacturing processes, and market entry. Changes in environmental policies, tax incentives, and safety standards can significantly affect business operations and consumer demand.

Technological Innovations

Staying ahead in the EV market requires continuous innovation, particularly in battery technology and autonomous driving features. Companies like Tesla and Google (through Waymo) are pushing the boundaries in these areas, setting high standards for others to meet.

EV Consumer Acceptance Concerns

The EV market, once the beacon of automotive innovation and environmental hope, is also encountering significant turbulence.

Hybrid vehicles are experiencing a resurgence. Toyota, for example, sold over 455,000 hybrid vehicles in the first nine months of 2023, nearly matching Tesla's sales figures. This resurgence is driven by the practicality hybrids offer—less pollution than gasoline cars, quicker charging times than EVs, and fewer compromises on performance and convenience.

As consumer preferences shift subtly but distinctly towards hybrids, major automakers and startups alike face the growing challenge of making EVs profitable amidst slowing demand.

The market's response to upcoming affordable small electric SUVs like the Chevy Equinox and Volvo EX30 will be a critical test. These models aim to fill a market gap for less expensive, small SUVs, which are currently in high demand.

Financial Strain on Automakers

GM and Ford are experiencing a "double whammy" effect: a slowdown in EV sales coupled with rising costs from new labor contracts affecting their internal combustion engine vehicles.

Ford's projected loss on $4.5 billion from EV operations coincide with negative EV margins expected by GM. Both companies are now scaling back their EV capital investments.

Tesla remains a significant player, benefitting from the delays faced by other automakers like GM and Ford in their EV rollout. However, even Tesla hasn't been immune to market dynamics, initiating price cuts in response to a cooling demand—a move that has sent ripples through the EV stock market.

Register using your Google Account. Just click the GIF!

Analysts have pointed out the stark financial implications of this shift, noting that the continuous high level of investment spending is unsustainable compared to the average S&P 500 company.

The implication is clear—without a strategic recalibration, Detroit's automakers risk a severe financial crunch as they navigate this transition.

Rivian's Dilemma

Rivian, which initially surged ahead with promising sales figures, is now facing the harsh realities of a market that is tightening. Riviain stock has had early success in delivering thousands of electric trucks and SUVs is now overshadowed by cash burn concerns, leading to workforce reductions and worries about long-term viability. The broader startup scene in EVs is similarly grim, with predictions of more restrictive capital markets and potential bankruptcies.

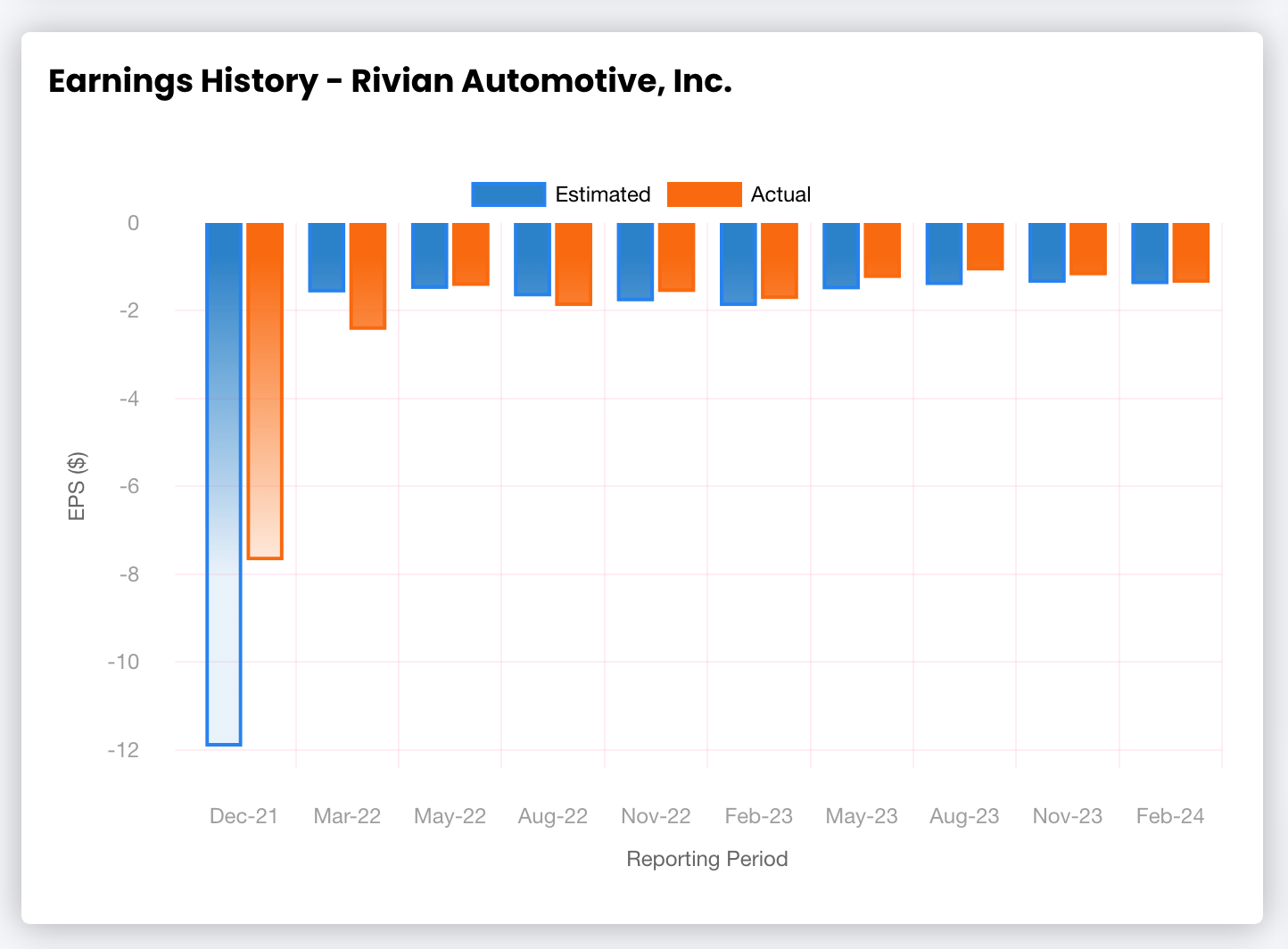

Financial Results

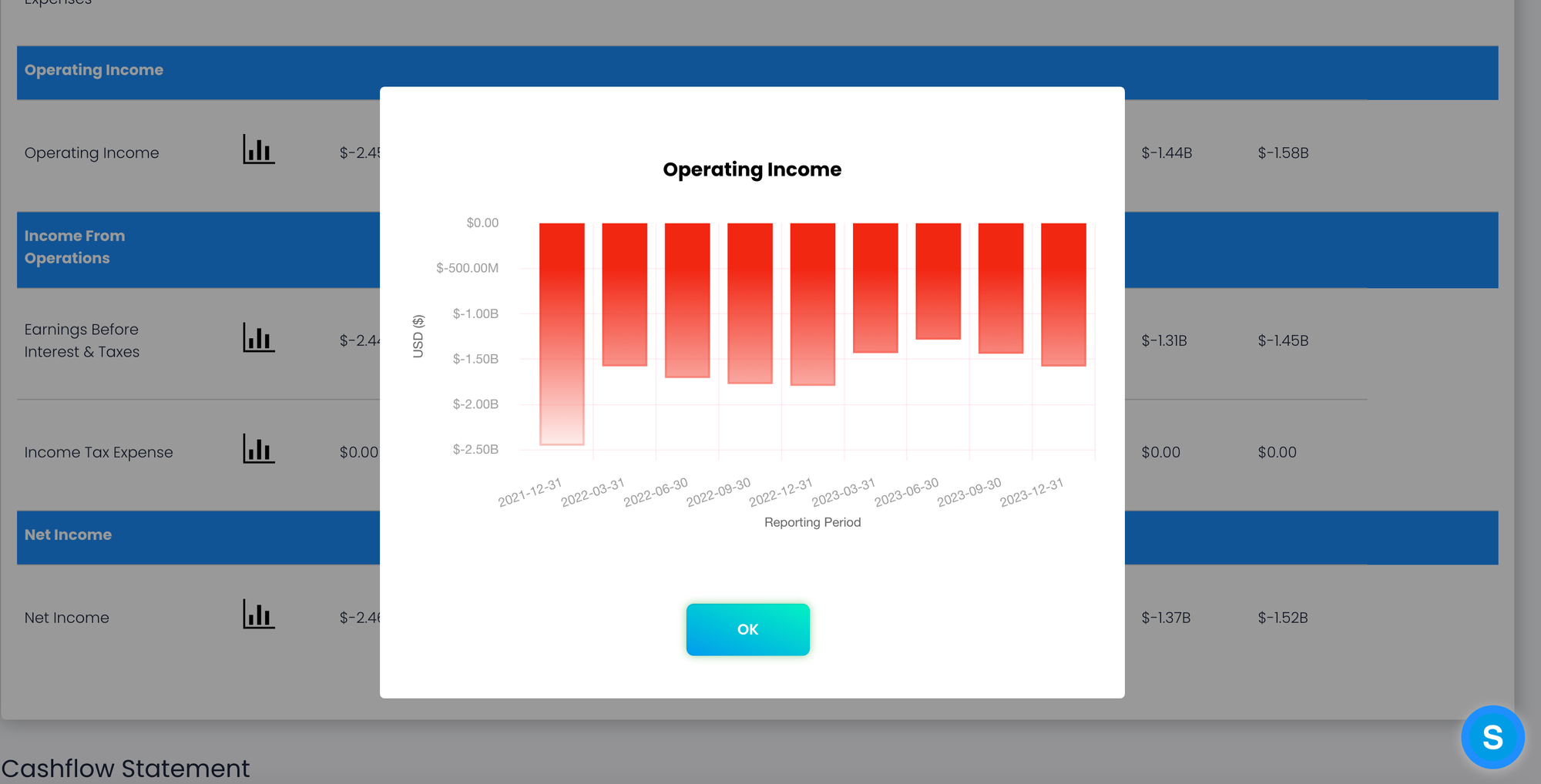

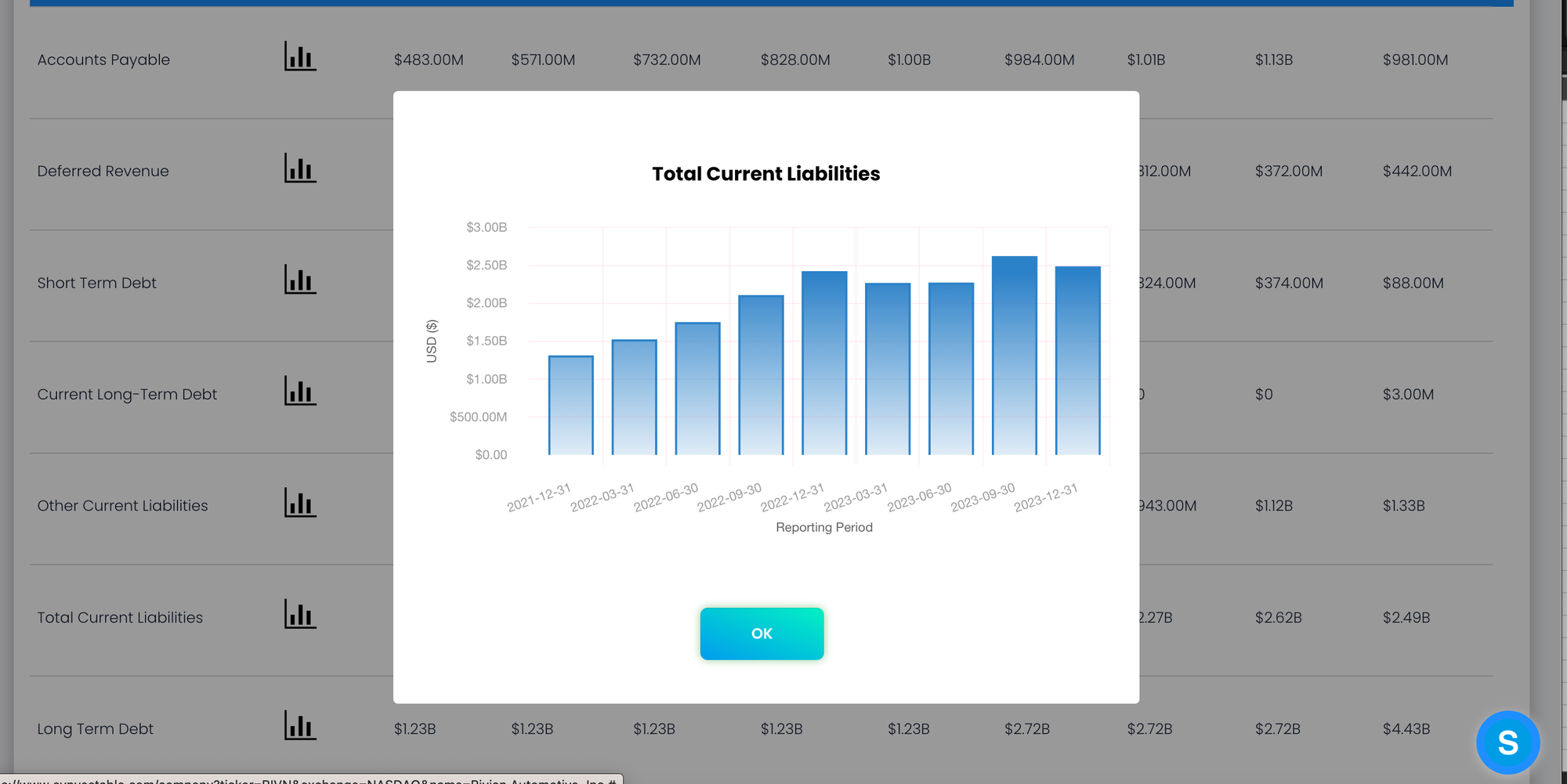

Financial results for Rivin stock over a 5-year period have been lackluster to say the least.

More recent quarterly results don't offer much of a better picture.

Rivian financial results can be summarized in six words—negative operating profits and surmounting debt.

Other Factors To Consider

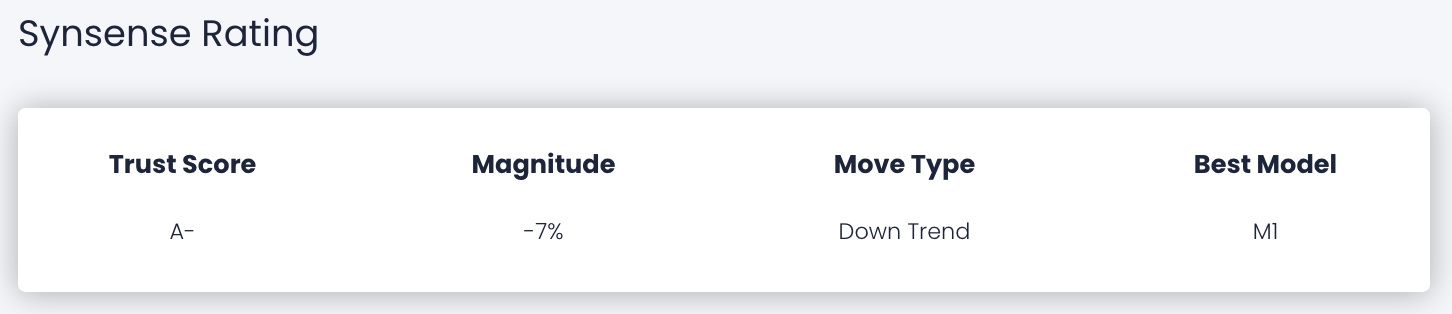

Synsense, our proprietary AI, is predicting a move lower down to $9.05.

What is Trust Score?

Synvestable's proprietary Trust Score™ algorithm measures how accurate our models predicted a stock's movement over the previous measured period—this is known as the validation prediction and is denoted by the green line.

All things being equal in the current market environment, a high Trust Score™ means that our model was highly accurate at explaining a stock's movement during the prior period and is therefore likely to be accurate for the current period.

Note: Synsense and Trust Score™ are not a stock recommendation, but a measure of the quantitative and statistical properties exhibited by a stock.

Want to see more on Rivian? Register using your Google Account. Just click the GIF!