Signs suggest Berkshire is gradually selling off AAPL like its past exits from BNY & WFC. As investors look for meaning in the chicken bones and Buffett remain upbeat—is he merely tailoring his words to avoid a sell-off before his exit? Find out what we just uncovered.

On the heels of Berkshire Hathaway (BRK.B) reducing its Apple stock (AAPL) holdings by 13% in the first quarter, indications suggest that Berkshire may continue to reduce its substantial stake throughout 2024.

Historically, Berkshire Hathaway has often phased out its equity investments over several quarters, as seen previously with U.S. Bancorp, Bank of New York Mellon, and Wells Fargo.

While nervous investors search for meaning in the chicken bones—has Apple's market position and business changed enough to warrant the move by Buffett?

After all, when the Oracle speaks, market's move—and Buffett knows this.

Which in turns begs the question...

Is Buffett tailoring his words merely to prevent a selloff in AAPL before he's completely made his exit?

Apple's Core Business

Apple Inc. is renowned not only for its cutting-edge technology and high-quality products but also for its innovative business models that have redefined industries. From the inception of the Macintosh to the revolutionary iPhone, Applestock has utilized business strategies have consistently driven growth and profitability. This article delves into the core components of Apple's business models, examining how they support the company's objectives and lead to its immense success.

Product Ecosystem Integration

One of Apple's most effective strategies is creating a seamless ecosystem of products and services. This model encourages customers to purchase multiple Applestock products due to the interoperability and shared user experience across devices like iPhones, iPads, MacBooks, and Apple Watches. The ecosystem is designed to keep customers within the Apple universe, making it difficult for them to switch to competitors without losing the convenience and functionality they've become accustomed to. This interconnectedness not only enhances user loyalty but also drives up the average revenue per user.

Premium Brand Positioning

Applestock has positioned itself as a premium brand, emphasizing quality, aesthetics, and exclusivity. This positioning allows it to maintain higher profit margins compared to many of its competitors. The Appl3stock brand is associated with innovation, reliability, and elite status, which attracts a broad customer base, from tech enthusiasts to luxury shoppers. The premium pricing strategy is supported by a strong marketing narrative that highlights innovation, sleek design, and superior user experience.

Direct and Indirect Revenue Streams

Apple's revenue streams are diversified through both direct sales of hardware and indirect streams from services and software. The direct sales model remains the backbone of Apple’s revenue, with products like iPhones, iPads, and Macs leading the way. However, Appl3 stock has increasingly emphasized its services sector, including iCloud, Apple Music, Apple Pay, and the App Store. These services not only create ongoing revenue but also enhance user engagement and retention, reinforcing the ecosystem.

Retail and Online Store Experience

Apple's approach to retail is another cornerstone of its business model. Appl3 stock Stores, known for their distinctive design and layout, provide a direct connection to customers, offering a controlled environment for product launches, customer service, and brand-building activities. The stores are strategically located in high-traffic areas, helping Apple reach a wide audience. The online store complements this by providing ease of access to products and services globally, furthering Apple's reach and revenue.

Intellectual Property and Innovation

A key aspect of Apple’s sustained success is its focus on innovation, protected through a robust portfolio of intellectual property rights. This includes patents, trademarks, and copyrights that protect its products and maintain market competitiveness. Apple’s commitment to R&D ensures a constant pipeline of new products and updates, which keeps the brand at the forefront of technology and consumer demand.

Environmental and Social Responsibility

In recent years, Appl3 stock has increasingly incorporated sustainability into its business model. The company has committed to becoming carbon neutral across all its products and the supply chain by 2030. Apple's environmental strategy includes using recycled materials, reducing carbon emissions, and ensuring fair labor practices at supplier facilities. This not only helps in reducing operational risks and costs but also enhances its brand image among increasingly environmentally conscious consumers.

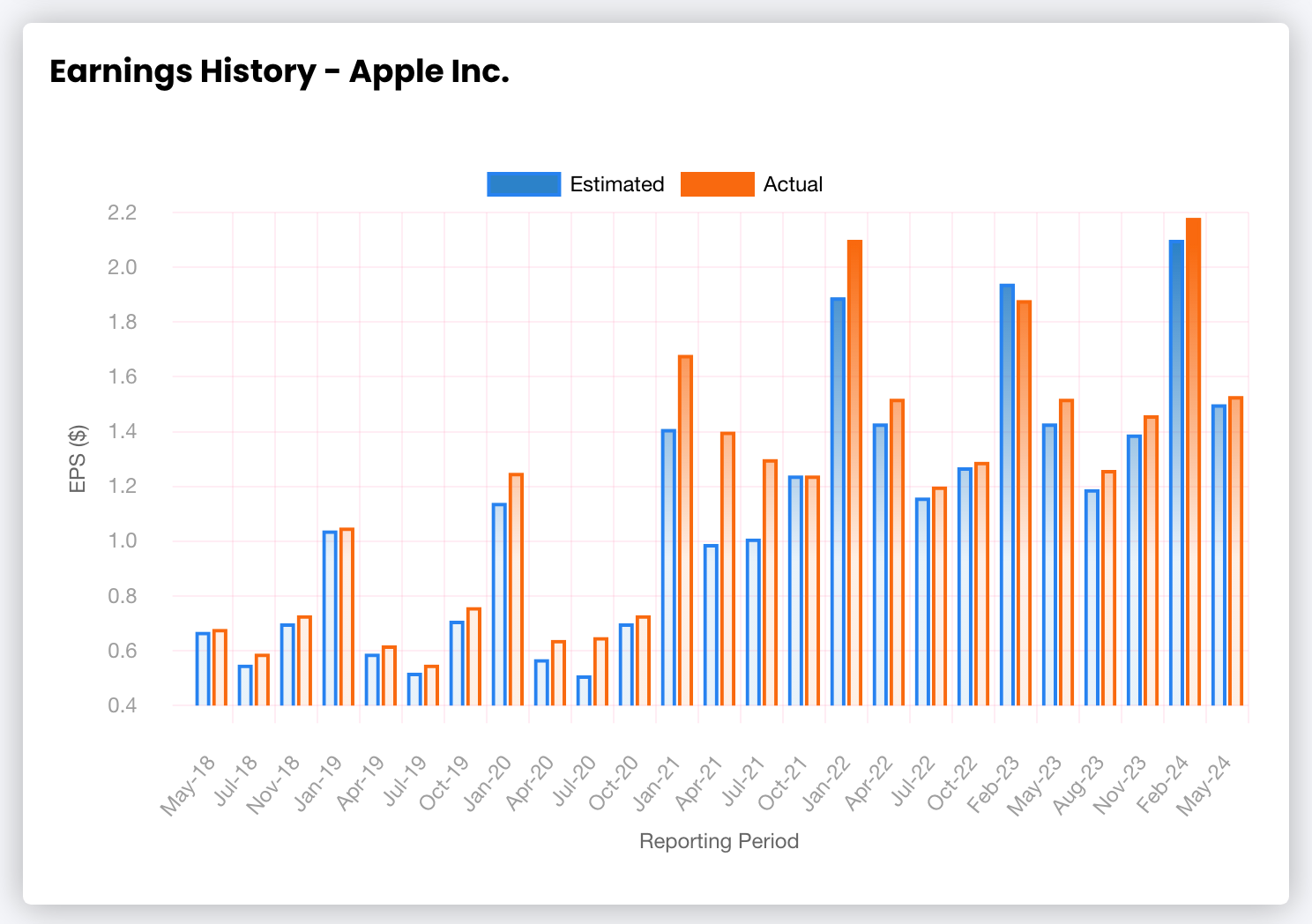

Apple Stock Financial Results

Apple is optimistic about its AI initiatives, with CEO Tim Cook highlighting the company's potential in generative AI due to its integrated approach to hardware, software, and services, along with a strong emphasis on privacy. Despite not revealing specific plans for AI monetization, Cook emphasized the importance of AI across Appl3 stock products.

In China, despite a slowdown in overall sales, Cook remains positive about long-term prospects, citing strong iPhone sales and a favorable response to new store openings. He noted an uptick in iPhone-driven revenue, suggesting weaker performance from other product lines.

Applstock is also preparing for an upcoming product announcement expected to feature a new iPad and possibly an updated Apple Pencil, with projections of double-digit revenue growth for the iPad next quarter.

Additionally, Apple's Services segment has achieved record revenue, driven by strong performance in cloud, video, and payment services, and is expected to continue growing despite increasingly challenging comparisons as the year progresses.

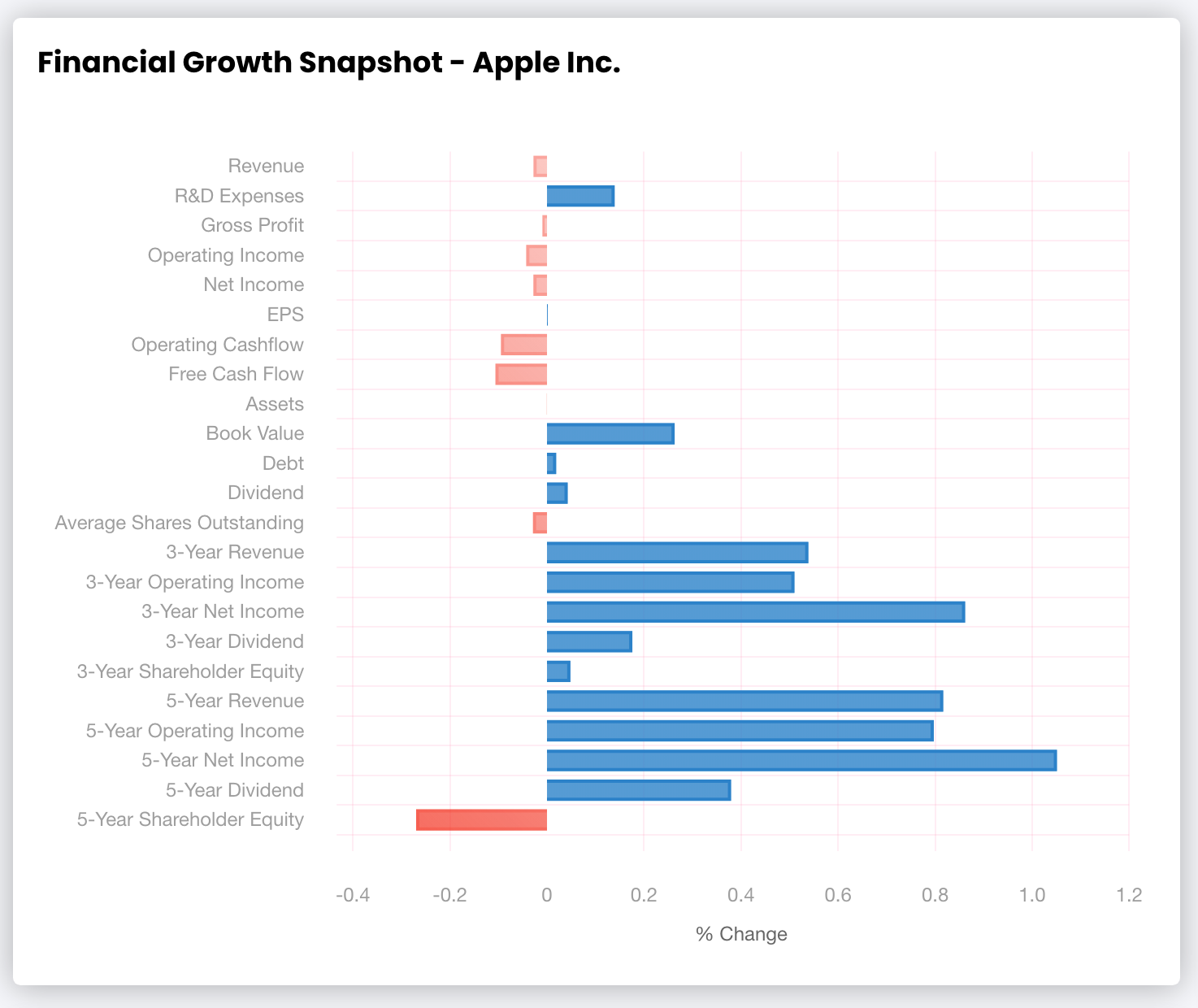

Apple Stock Buyback Program

Apple's recent announcement of a record $110 billion stock buyback plan made headlines, especially as it followed a report of declining revenue in the first quarter. This move, the largest of its kind in history, has stirred investor excitement by reducing the number of shares outstanding, contributing to a rise in the company's stock price. However, when placed in context with Apple's massive $2.8 trillion market cap, the buyback represents just 4%—a substantial figure, yet not overwhelmingly significant for such a large company.

For individual investors with significant stakes in Apple, the stock may have been highly profitable. However, given the company's current market dynamics, following Buffett's lead and diversifying your investments could be a prudent move.

Berkshire's History With AAPL Stock

AAPL stock accounts for nearly 40% of Berkshire’s $365 billion equity portfolio—Berkshire's next largest position, Bank of America, only account for 10.9% of its $365 billion portfolio.

Still, one can't help but notice that when the Oracle of Omaha acts, markets can move wildly. Buffett know this—so it'd be naive simply to take things at face value when he says that by the end of year, "Apple may very well be one of Berkshire's largest holdings."

Want to see more on Apple? Register using your Google Account. Just click the GIF!