Coming off of our last post on how interest rate swaps and FX swaps are a banking crisis in the making, we felt it necessary to give a deeper dive into how a swap transaction works so readers can understand exactly where the risk lies.

In a whitepaper published by the Bank of International Settlements (BIS) entitled Clearing risks in OTC derivatives markets: the CCP-Bank, we think this resource is the absolute best whitepaper highlighting the connected dangers of interest rate and FX swaps at major banks—the major banking contagion right now.

The whitepaper is a little long in the tooth for the average reader, but the main takeaways are the following.

How CCP Swap Transactions Work

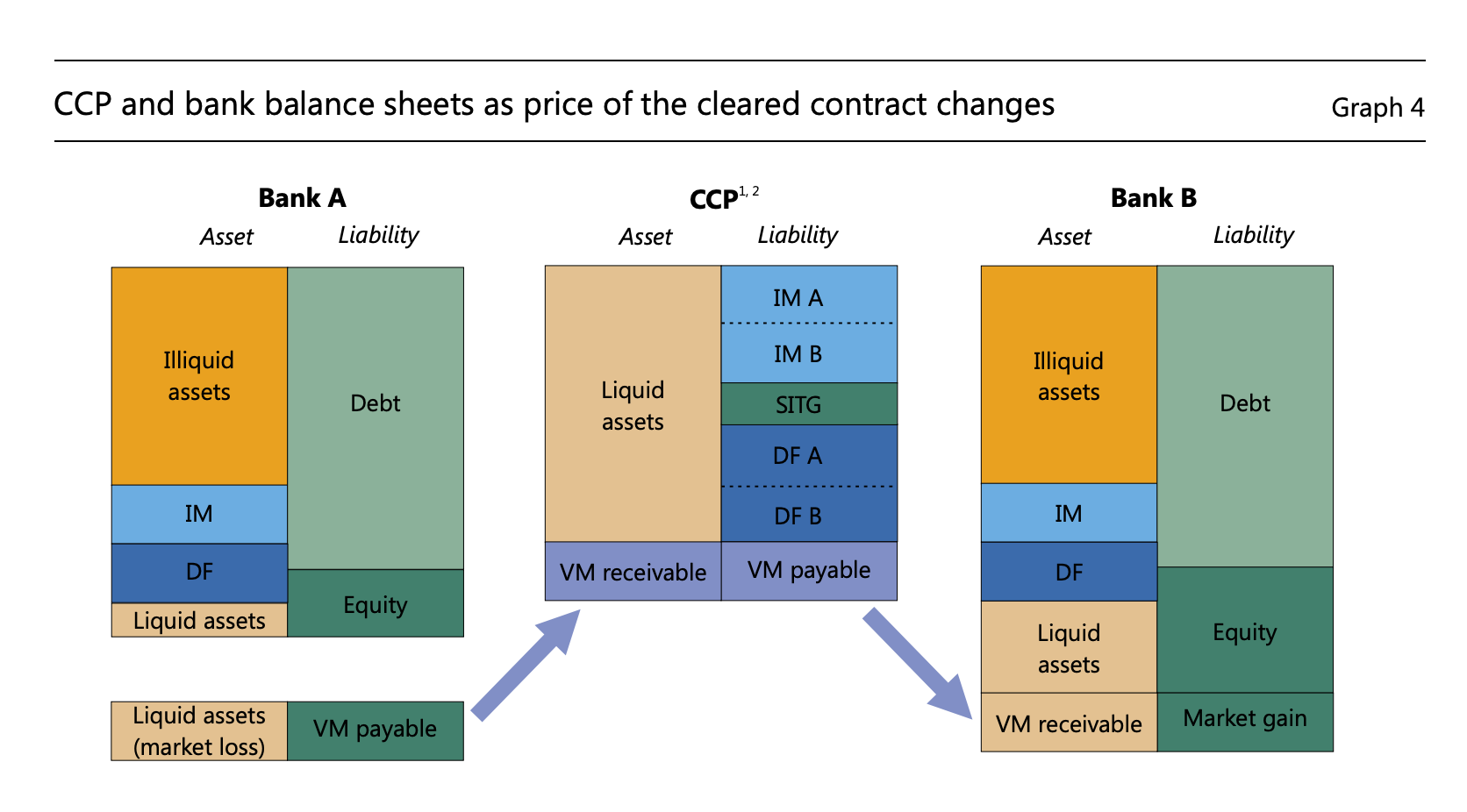

When a bank like First Republic is serving as the central counterparty clearing housing (CCP) in a swap transaction between two banks, it it there to facilitate default funds and margin requirements for each bank, both initial and variation margin.

As the swap contract's value changes against Bank A at a loss, Bank A posts more variation margin to the CCP, and variation margin is returned back to Bank B.

However, in the event of market and yield volatility which both have been rising this month, margin requirements can increase which means both banks will need to post more variation margin—a margin call.

This can result in asset fire sales, similar to what happened at SVB and Credit Suisse having to sell off their AFS securities.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

When CCP'S Are Under Stress

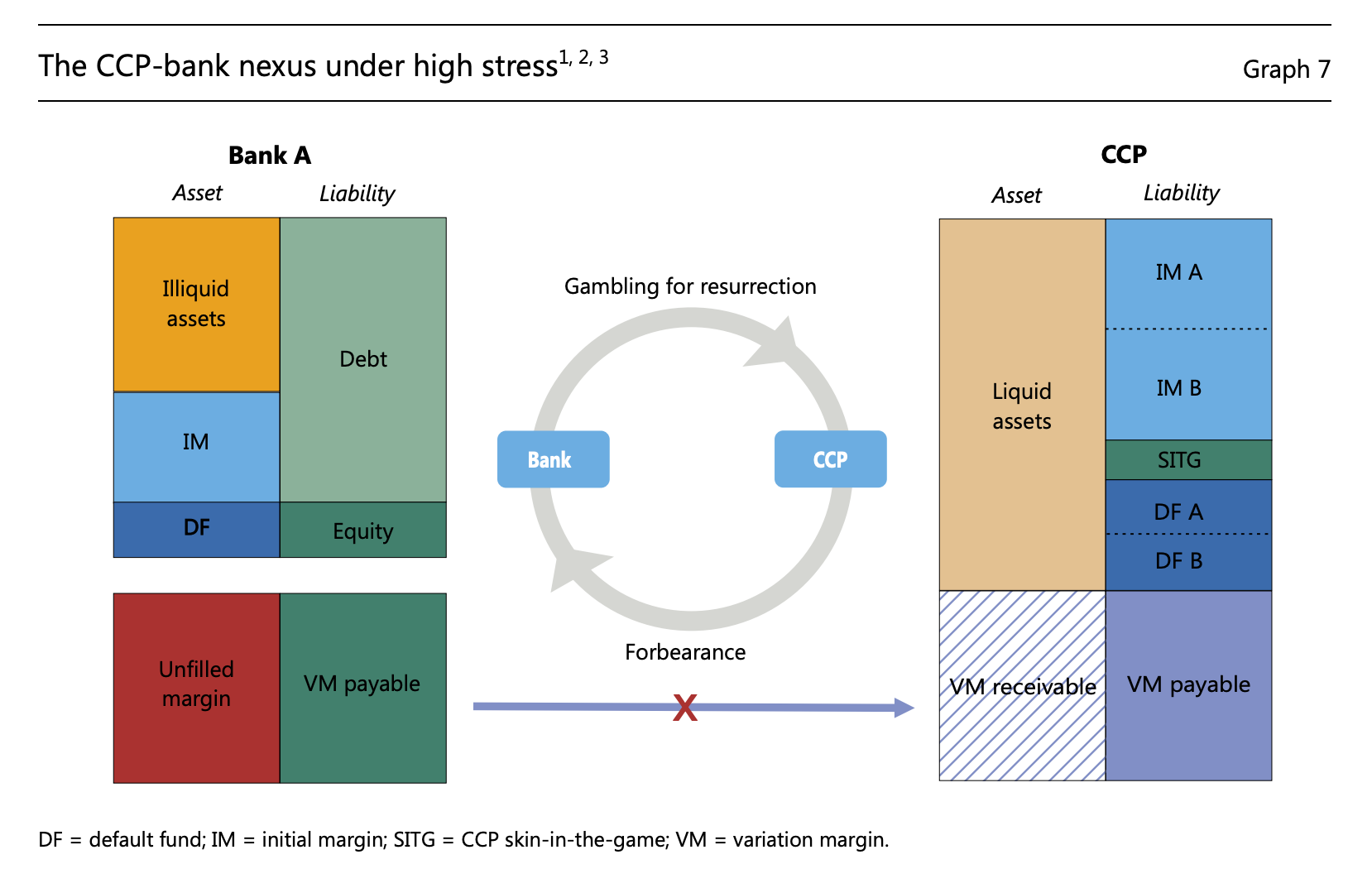

Here's where things get nasty—if Bank A defaults, the default needs to first be acknowledged by the CCP, which oftentimes the CCP will NOT DO because the CCP could face loss of reputation and impaired franchise value—it's Banker's Code.

This is the banking equivalent of just whistling and twiddling one's thumbs when someone says they can't make a payment.

The hope is that the defaulting bank would be able to pay variation margin at a later stage incentivizes the CCP to forbear recognition of the member default, to whatever extent possible.

The CCP’s forbearance allows the stressed bank to continue its usual activities. On one hand, the CCP could potentially avoid destabilizing the financial system—on the other hand, banks that are close to failure are also tempted to gamble for resurrection—a Catch 22.

Therefore, the CCP’s forbearance enables the gambling-for-resurrection by the stressed bank, leading to even larger credit losses down the road.

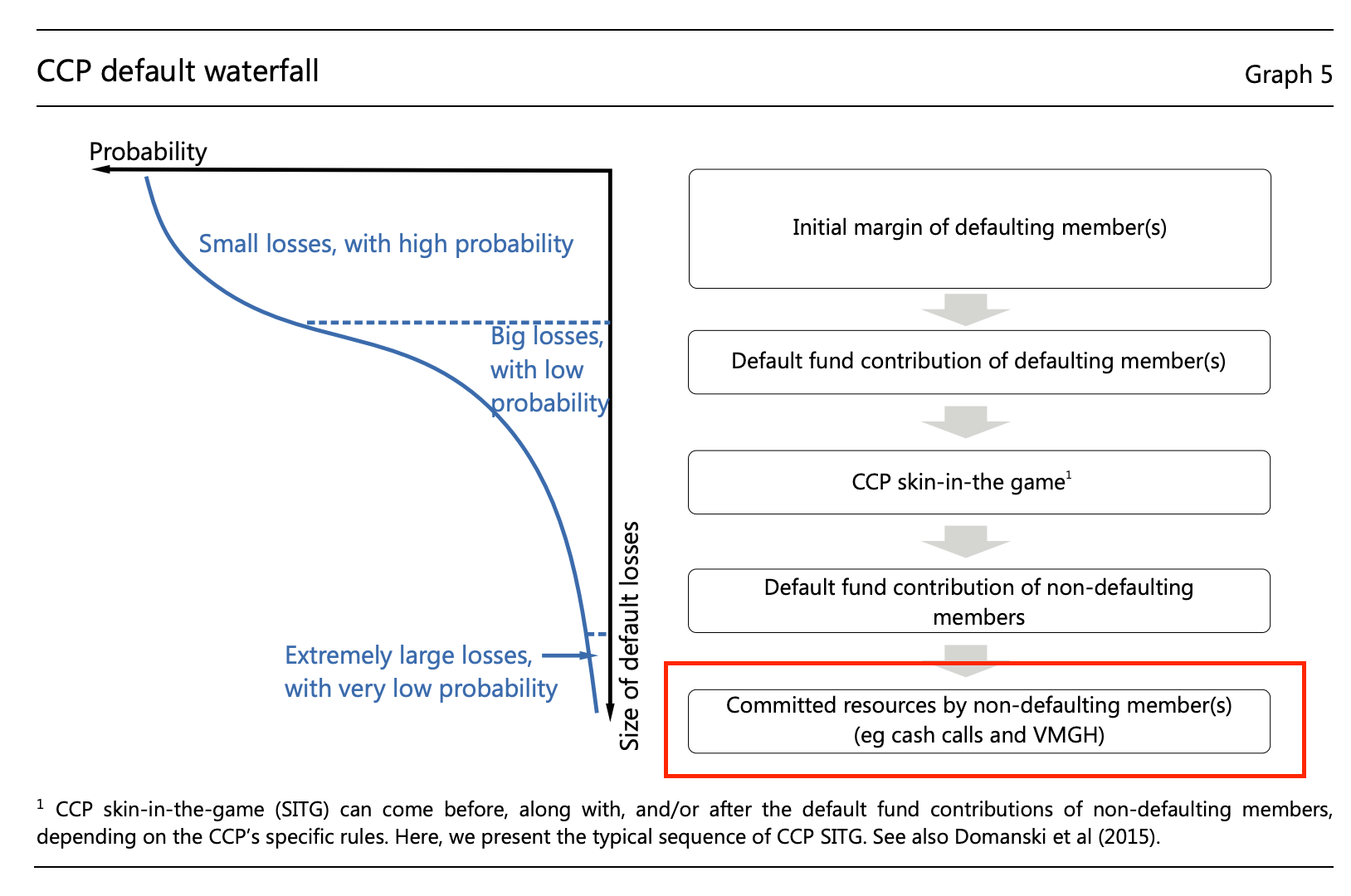

Finally, if the default risk does leak over to the CCP, the CCP can call on other clearing member banks to post the margin for the defaulting bank, even if they aren't party to the transaction.

Which leads us to a key insight—why do you think J.P. Morgan and the other banks injected $30 billion into First Republic?

One of those swap transactions blew up where First Republic was the CCP—SOFR Swap Rates dropped dramatically between 9-13 March.

This means that in Graph 5 above, CCP's are experiencing stress significant enough to bring losses down to Layer 5 of the CCP default waterfall for situations like First Republic, Credit Suisse, and Deutsche Bank.

Again, where there's smoke, there's fire.

Here's the problem with this system—if one transaction blows up, the liquidity of all swap transactions globally thus incur liquidity impairment.

They are all connected together.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!