Nearly all 30 stocks in the Dow Jones Industrial Average pay dividends, but not all of them are exceptionally high dividend yields. With that in mind, what are the highest-paying dividend stocks in the Dow today?

While the majority of the 30 stocks listed in the Dow Jones Industrial Average offer dividends, not all of them boast exceptionally high dividend yields. Out of these 30 stocks, only nine yield 3% or more.

However, due to the Dow's selective nature, it presents a promising avenue for investors seeking Dividend Aristocrats (stocks with a track record of raising dividends for at least 25 consecutive years) or high-dividend, blue-chip stocks. Bearing this in mind, which stocks currently offer the highest dividend yields in the Dow?

Top Dividend-Paying Stocks in the Dow

- Verizon (VZ)

- 3M (MMM)

- Dow Inc. (DOW)

- Chevron (CVX)

- IBM Corp (IBM)

- Amgen (AMGN)

- Coca-Cola (KO)

- Cisco (CSCO)

- Johnson & Johnson (JNJ)

- Goldman Sachs (GS)

These highest-paying dividend stocks in the Dow mirror the index's reputation, comprising well-established, top-tier American companies, with many boasting over a century of operation. However, while some continue to thrive, others may be past their prime.

Certain stocks exhibit notably high dividend payout ratios, indicating a focus on returning cash to shareholders rather than reinvesting in business growth. In the following analysis, I delve into each stock to discern the dividend champions from the underperformers.

Verizon (VZ)

Dividend Yield 6.5%

Telecoms typically pay high dividends, and the highest dividend yield in the Dow almost always belongs to Verizon. Verizon is one of the top five U.S. wireless carriers but faces stiff competition from number-one AT&T (T) and its smaller (but recently merged) competitors Sprint and T-Mobile. All the telecoms have spent recent years lowering prices and sweetening plans to lure customers, which has resulted in good deals for consumers but has cut into corporate revenues and earnings. Verizon’s sales initially peaked in 2015, and it saw lower revenues in 2016-2017. But top-line growth swung higher in 2018, and after the 2020 debacle, the top line is once again in the ascendant.

For its part, Verizon is investing heavily in forward-looking ventures, including the “Internet of Things” and digital content. While economic uncertainty persists going forward, it should be kept in mind that VZ has a tendency to outperform other Dow 30 components in periods of economic weakness, thanks largely to its healthy subscription-based business. In the Great Recession of 2008-2009, for instance, VZ experienced a price drop of only 33% compared with a far more devastating 50% drop for the broad market.

3M (MMM)

Dividend Yield 6.0%

Long-time Dow 30 component 3M produces more than 60,000 products under several brands and across numerous industry categories. Of note, 3M is one of the longest-reigning Dividend Aristocrats after 63 years of dividend growth.

The company is known for having superb cash flow generation, guiding for operating cash flow of around $6.5-7.1 billion for 2024. It also has an attractive valuation when compared to many of its Dow 30 peers.

Analysts expect low-single-digit growth in revenues next year and the Combat Arms earplug lawsuit remains an overhang, with a total settlement of $6 billion hitting the bottom line through 2029 (although the lion’s share of that hit last year).

Register using your Google Account. Just click the GIF!

Dow Inc. (DOW)

Dividend Yield 5.0%

Dow is a commodity chemical producer which many investors consider to be both a “contrarian cyclical” play as well as having short-cycle exposure. While DOW’s stock price fell 58% during the early 2020 market rout, its long-term history of maintaining a healthy dividend was left intact and makes it a worthwhile consideration for income-oriented investors.

And while other industries are likely to be negatively impacted by inflation, Dow should thrive in such an environment. Indeed, management recently observed that “inflation has always been a positive for our business, and over the last 30 years, when the Fed raises interest rates, that typically tends to drive outperformance in our sector versus the other sectors.” Moreover, Dow should benefit as global demand for commodities chemicals increases as economies around the world reopen.

Chevron (CVX)

Dividend Yield 4.2%

Chevron is one of the world’s largest oil companies, with energy exploration, production, refining, trading and transport operations that circle the globe. Founded in 1879, Chevron has paid dividends since 1970.

Like the rest of the energy sector, Chevron’s stock tanked in early 2020 but has since returned more than 150%.

Chevron has a steady record of dividend payments despite crises in the energy sector, most recently increasing its dividend 8% this year. Although the stock’s dividend payout ratio has popped over 100% several times, CVX is currently on the Dividend Aristocrats list.

Like its peer Exxon, the stock is choppy at times and has a tendency to surge and crash with oil prices. But should crude hold its recent gains, CVX is a worthwhile choice for investors who want some exposure to the leaner and meaner energy sector.

IBM Corp. (IBM)

Dividend Yield 3.6%

Big Blue has been a laggard performer among Dow 30 stocks in recent years and fell 40% from its high to low during the early 2020 selling panic, to 90, before recovering to just under the 145 level in mid-2021. It then entered a range between 145 and the upper 110s, but broke free and hit new 52-week highs with the year-end rally. That said, it’s still well below its record high of 215.

IBM’s revenues have declined since peaking at $107 billion in 2011 but have gradually been heading higher in the last couple of years. IBM was slow to adapt as computing and data storage moved to the cloud, and competitors were quick to swoop in. IBM reacted by winding down older operations and investing in faster-growing businesses, but margins and cash flow eroded despite their best efforts, and the stock peaked in 2013. The company has increased the dividend each year anyway, with the latest one at $1.66 per share.

Things could be starting to turn around for IBM, however, as management sees “high demand for our capabilities in several areas,” including hybrid cloud, where the company now has over 4,000 clients.

Amgen (AMGN)

Dividend Yield 3.3%

Originally founded in 1980, Amgen is an American biopharmaceutical company that has expanded its presence to 100 countries worldwide. It specializes in cardiovascular disease, oncology, bone health, neuroscience, nephrology and inflammation and specifically targets diseases for which there are no or limited viable alternative treatments.

In the company’s fiscal 2023, revenues came in at a record-high $28 billion and are expected to grow from there, with estimated fiscal 2024 revenues between $32.4 and $33.8 billion. Like most biopharmas, the company is constantly playing defense against generics, but Amgen’s robust pipeline offers it a sizeable moat.

As for the dividend, Amgen recently raised it by nearly 6% from $2.13 to $2.25 per share quarterly. Couple the yield with Amgen’s longer-term performance (up 50% in the last five years with relative stability) and its ability to weather the storm in the event of an economic downturn, and you get an attractive dividend stock.

Coca-Cola (KO)

Dividend Yield 3.2%

Coca-Cola, the ubiquitous beverage company that needs no introduction, is the largest non-alcoholic beverage company in the world with over 200 individual brands comprising a portfolio of soft drinks, energy drinks, juices and beverages sold worldwide. While the stock is something of a slow grower (up only 30% in the last five years), its products are also resilient, which tends to help them hold up in times of trouble.

Analysts are projecting mid-single-digit growth for the next five years, although the company beat revenue expectations in their most recent quarter.

As for the dividend, Coca-Cola increased its quarterly dividend from $0.44 per share to $0.46 in 2023 and again to $0.485 in the beginning of 2024. Coca-Cola has a history of raising dividends at the beginning of the year, so the minor hike should come as no surprise.

Register using your Google Account. Just click the GIF!

Cisco (CSCO)

Dividend Yield 3.2%

Cisco, originally founded in 1984, is a global technology company that specializes in connectivity. Its routers, switching, mobile and data center solutions are widespread and heavily integrated into its end users’ infrastructure.

The company has been steadily paying (and raising) its dividend for years but the shares have struggled in recent history, down 8% in the last five years and 2% in 2024 despite a major rally in tech shares.

The company recently announced the acquisition of cybersecurity analytics firm Splunk (SPLK), which is expected to close in the third quarter of 2024.

More pressing for shares have been signs that order flow is slowing for Cisco, with lower Q2 2024 revenue following a best-ever Q1 report. The firm believes orders accelerated due to supply chain disruptions and, now that those disruptions are resolving, customers will delay orders while they digest the backlog.

Johnson & Johnson (JNJ)

Dividend Yield 3.1%

Johnson & Johnson, the world’s largest healthcare company, offers broad exposure to multiple stages of consumer health, from their consumer health products (Like Tylenol, Neutrogena, Listerine, or Band-Aids - basically anything in your medicine cabinet) to medical tech and pharmaceutical products.

The company is a portfolio stalwart for investors and, like Amgen, has been a slow but steady grower, returning only 13% over the last five years but without much in the way of chop or volatility.

The company is guiding for low-to-mid-single-digit growth next year which should not be surprising given the company’s defensive nature.

Goldman Sachs (GS)

Dividend Yield 2.8%

Founded in 1869, Goldman Sachs is a massive multinational investment bank with over $2.8 trillion in assets under management.

Its services run the financial gamut from investment banking, securities underwriting and mergers and acquisitions to investment management, personal wealth management and market making.

Despite difficulties in financial markets for the past few years, Goldman has held up remarkably, and the shares reflect that up more than 100% in the last five years.

As for the dividend, it is the lowest on our list, however, the firm has been raising their dividend payout for decades, most recently hiking it to $2.75 quarterly (from $2.50) in the second half of 2023.

Most of these stocks are solid portfolio additions, but Verizon stands out as one of the best due to its reliably high dividend and solid operating results.

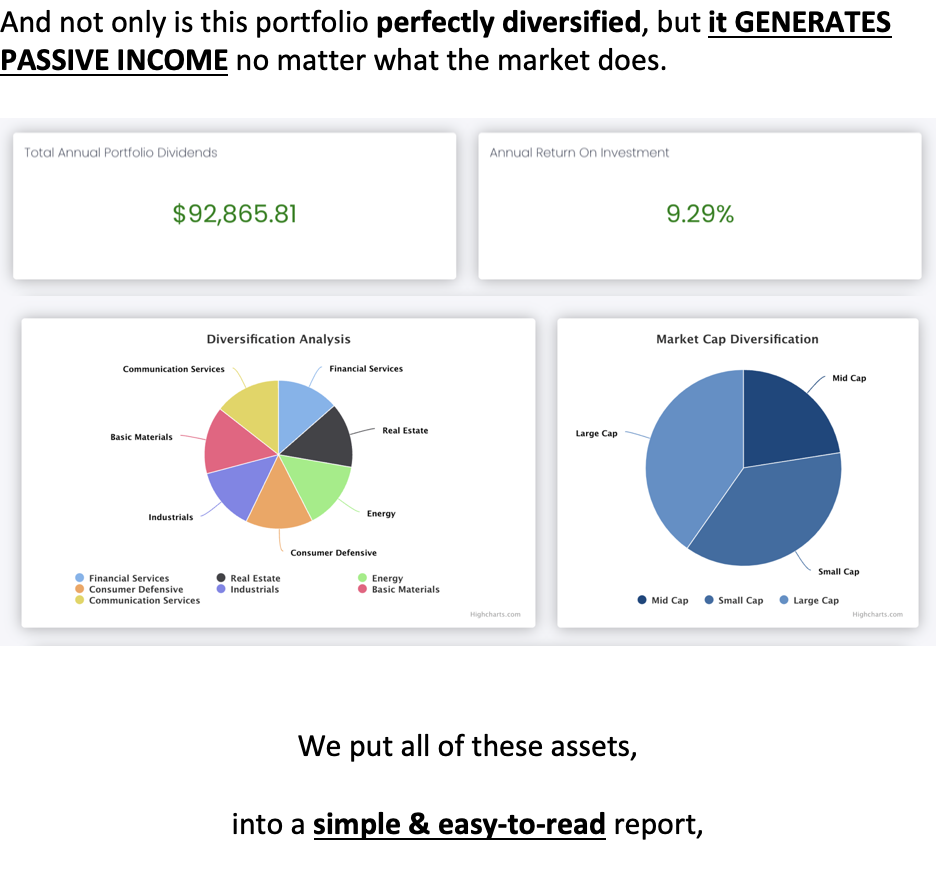

We created a powerful dividend portfolio that since 2022, has been generating income reliably year over year.

Register using your Google Account. Just click the GIF!