With the S&P 500 approaching bear territory and the NASDAQ already in bear territory, it's normal for investors to be concerned about portfolio performance.

"Should I buy the dip?"

As of today, the S&P 500 is down almost 30% from its December 2021 peak which naturally is generating jitters for investors coming off of one of the longest bull markets in history.

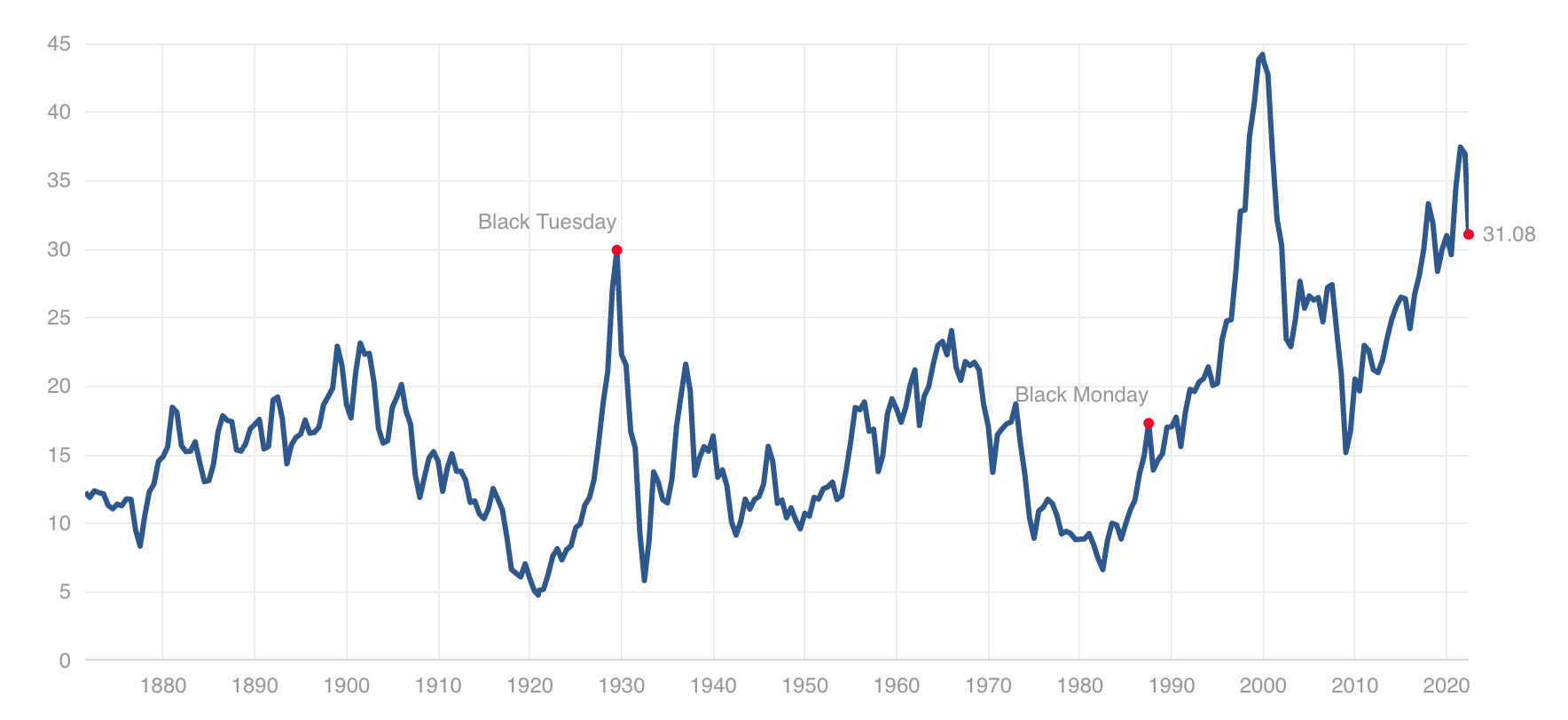

There's no question that there's been a fair-share of frothiness in the markets over the past year, especially in technology and digital-based companies. In fact, price-to-earnings ratios have reached levels for many NASDAQ listed companies that would rival the Dot Com Bubble.

Which begs the question: How do we navigate turbulent markets like 2023?

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

Why Dividends Matter

If you had shown up at a cocktail party in 2021 talking about the great dividend paying stocks you recently acquired, you probably would've got some serious eye rolls.

That's because during 2020-2021, capital gains were the star of the show. But gravity within the markets is very real, and what goes up exponentially, often comes down exponentially. This means that overall portfolio strategy and management still remains an investor's best friend.

This goes without saying that investors should be constructing their portfolio with a proper offense and a proper defense, with solid dividend-paying companies being the cornerstone of their defensive foundation.

Dividends matter overall in portfolio because when your capital gains offense moves against you, dividends can help pad some of that volatility.

This is because dividend yield is additive to a stock's overall price appreciation, and subtractive to price depreciation.

If a stock gains 7% and pays a 2% dividend yield, its overall return is 9%. If a stock loses -7% and pays a 2% dividend, its overall loss is only -5%.

Suffice to say, dividends can function both as offensive contributor and defensive cornerstone, and often is one of the most overlooked factors when it comes to portfolio construction.

What Matters Most With Dividends

When it comes to evaluating companies that pay a dividend, there are four factors that matter most:

- The Yield (%)

- Financial Stability

- Dividend History

- Low PE Ratio

The Yield (%)

The yield of a dividend stock is calculated by taking the total annual payout of the stock and dividing into the current stock price. A stock that pays a $2.50 dividend annually and costs $50 per share has a 5% dividend yield. The higher the yield, the better, however too high of a dividend yield may be unsustainable.

The higher the dividend yield, the better, however too high of a dividend yield may be unsustainable.

Financial Stability

Dividends are typically paid out by companies when there is an excess amount of cash on hand and executive leadership determines that there's no economic reason to retain the capital for reinvestment.

This typically is the case for large and mature companies where growth investments in R&D or new products may not add significantly to their overall economic picture in the near future.

In this case, paying out excess capital to shareholders in the form of a dividend is the best use of the capital as it keeps investors happy and stabilizes overall stock ownership.

This of course requires the obvious...excess cash on hand.

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

It also requires the company to have a balance sheet that allows them to reliably pay the dividend long-term without looming debt and interest payments to threaten it. Dividend paying companies should have a low debt-to-equity ratio as well as increasing or stable earnings.

Dividend paying companies should have low debt-to-equity ratios as well as increasing or stable earnings.

Dividend History

Probably the most important factor when it comes to choosing great dividend paying companies is their historical reliability in actually paying the dividend.

If a company offers a high dividend yield, but it hasn't been historically consistent paying it, it may be just a sales tool used by the company executives to temporarily incentivize new stock ownership.

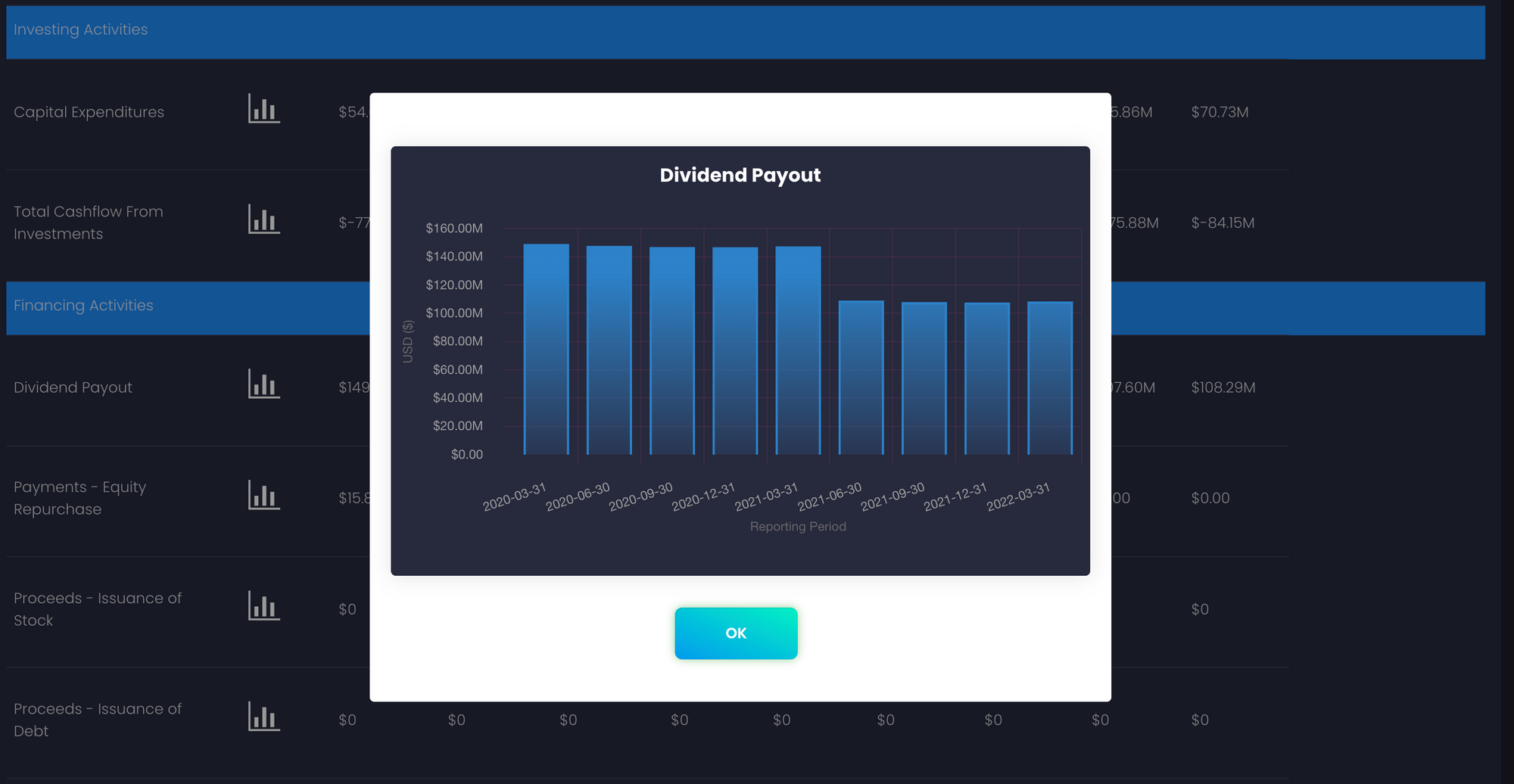

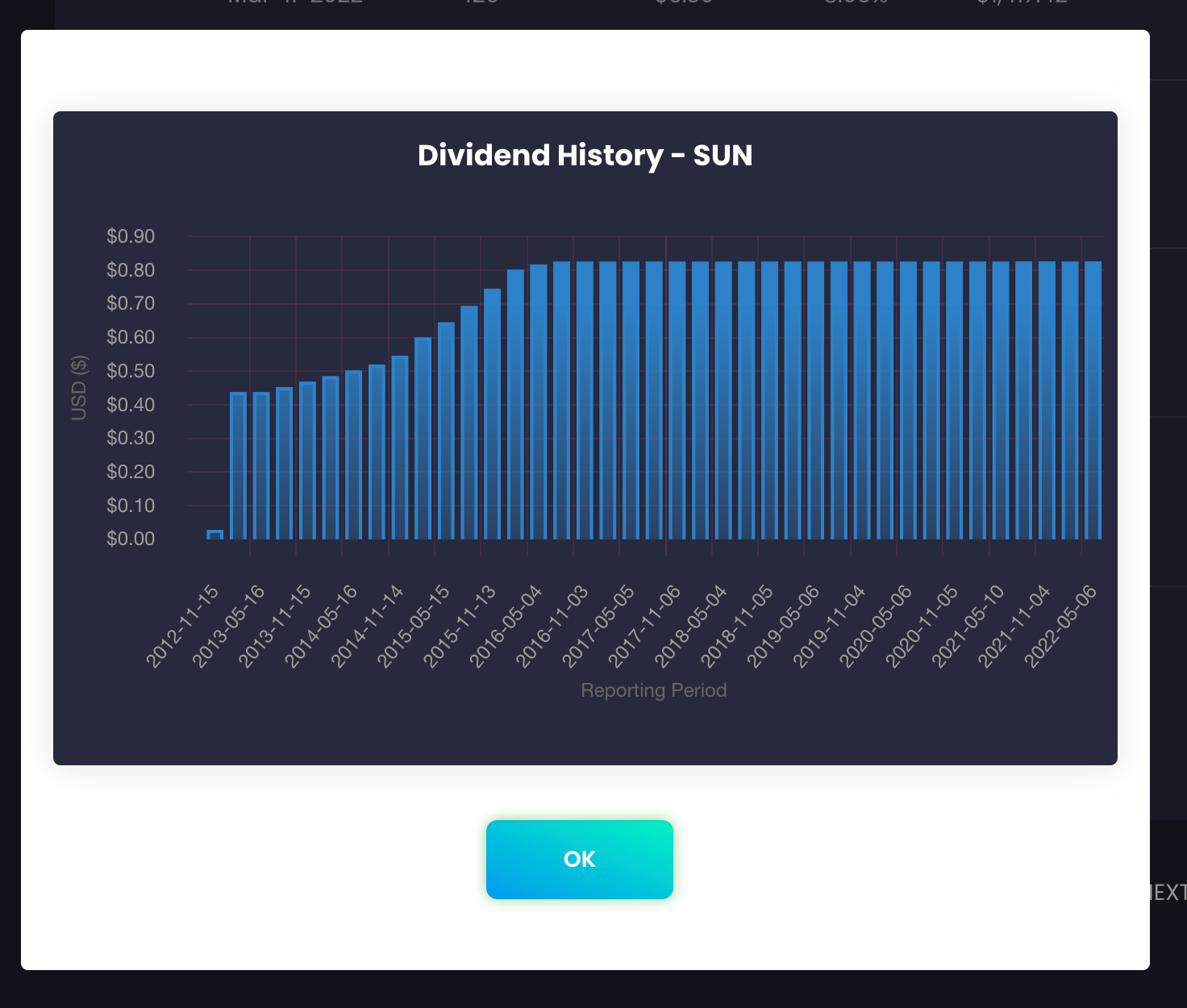

Tip: You can use Synvestable's Dividend Analysis tool to get the full history of a stock's dividend payout, available on Accredited and Quant Premium Plans.

Low PE Ratio

Just because a stock pays a great dividend, doesn't mean it can't still do damage to our portfolio. We want to make sure that the stock is reasonably valued so that in a bear market, we're decently hedged against price depreciation.

3 Great Dividend Paying Stocks For 2023

Using our unique selection criteria (and a little help from the Synvestable's Accredited Premium Plan), we've compiled three great dividend paying stocks that match our above criteria.

Antero Midstream Corporation (AM)

Antero Midstream currently pays an 8.5% dividend yield that has been relatively reliable even through the 2020 pandemic.

The company is profitable, sits with a debt-to-equity ratio of only 1.47, and is fairly valued with a PE Ratio of about 15, which is about half that of the entire S&P 500 sitting at 30.

One Liberty Properties (OLP)

One Liberty Properties is an REIT that currently pays a 6.7% dividend yield, with a PE Ratio of only 12 making it reasonably priced relative to earnings. Debt-to-equity is 1.43 which is reasonable, and has a solid recent history of quarterly dividend payments.

Sunoco LP (SUN)

Sunoco currently has a PE ratio of 6.7 with an annual dividend yield of 8%. Its capital mix includes a low debt-to-equity ratio, and has been consistently raising or maintaining its dividend since 2012.

To dive deeper in some great dividend paying stocks and see their overall dividend paying history, check out our Accredited and Quant Premium Plans on Synvestable.com

Don't Let Years of Lost Compounding Cost You

Get the the special research that still beats the market.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

DISCLOSURE: Synvestable does not have any vested stake in the above mentioned companies, nor does Synvestable represent any stocks mentioned in this article as professional financial advice. Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com