With the current monetary policy set forth by the Federal Reserve, along with the bumpy road currently being seen in the market for the first half of 2022, many investors are wondering what to do and where to turn for the remainder of 2022.

The truth of the matter is everyone can see gains in a bull market because a rising tide raises all ships, but how do we navigate a declining or sideways market?

Everybody can see gains in a bull market, but how do we navigate a tough market?

Short of having a crystal ball to tell when the market will find stability, the best policy for investors with positions experiencing losses is to stay in the market. If you've invested in quality companies and are well-diversified, then you won't have to worry about the long-term.

It's not about timing the market, it's about time in the market.

Great returns come from holding onto positions as they move to higher price levels, with the understanding there will be some jumps and dips along the way.

Using Down Markets To Your Advantage

If your portfolio is too concentrated or you've been heavily investing in risk-on assets, now's a great time to rethink your investment strategy to more of an all-weather strategy.

One of those all-weather strategies comes from reducing overall volatility in your portfolio to best ensure steady returns for the long haul.

In fact, in a 2006 study published in The Journal of Portfolio Management (Clarke, de Silva, and Thorley) showed that minimum variance portfolios exhibited higher risk-adjusted returns than portfolios with high-risk stocks over the years 1968-2005. They achieved a volatility reduction of about 25% while delivering comparable or even higher average returns than the benchmark market portfolio.

In other words, you don't have to take big risks to have great returns. Risk and reward are not the same thing.

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

Putting Low Volatility To The Test

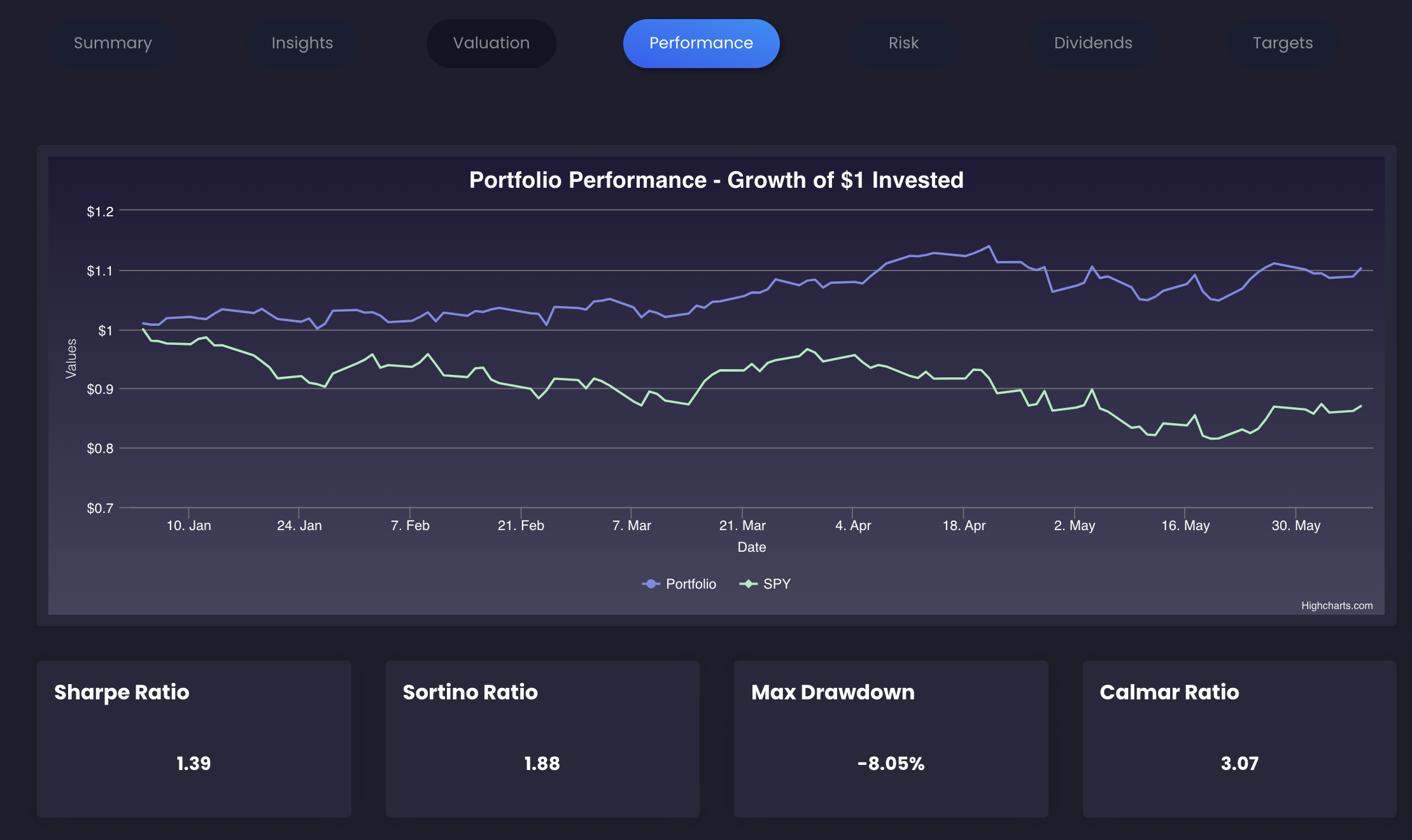

We backtested this strategy using Synvestable's Quant Premium Plan matching the strategy used in the paper by Clarke, de Silva, and Thorley—using overall portfolio beta as a proxy for variance—and found their findings to be correct even in the current time period.

Using a well-diversified portfolio of 10 stocks, exhibiting low-volatility relative to the market, we tested our "Low-Vol" Portfolio starting from January 1st, 2022 up through June 1st, 2022.

The Low-Vol Portfolio significantly outperformed the market both in real returns and risk-adjusted returns. Maximum drawdown was only -8.05% compared to the S&P 500 at -18% over the same period, while both real and risk-adjusted returns were positive for the Low-Vol Portfolio.

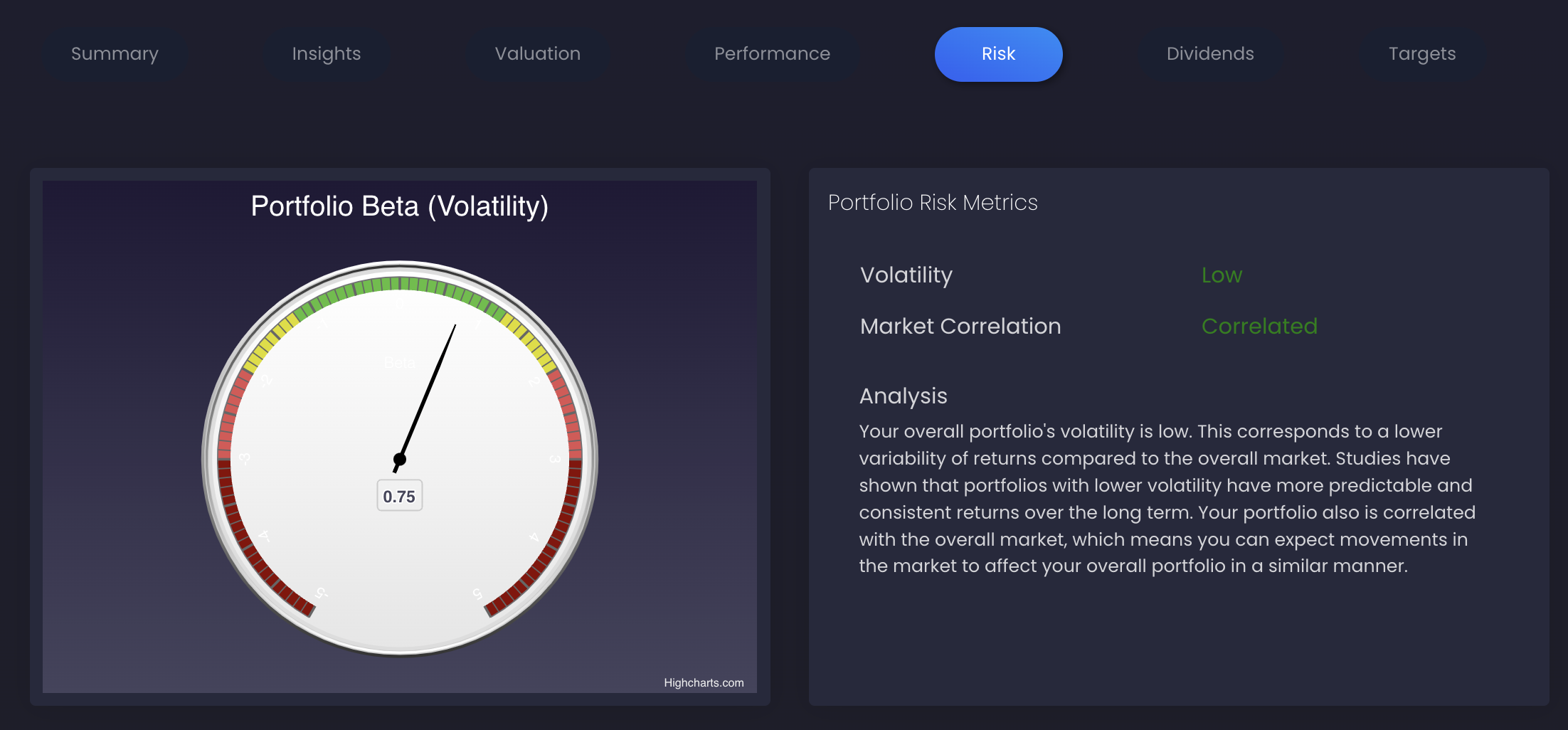

To achieve low overall portfolio variance, we constructed a model portfolio of stocks across industry sectors that exhibited lower beta relative to the market (0.75 portfolio versus 1.00 for the overall market). Our portfolio was still correlated to market movements, however less volatile in each direction.

Best Low-Vol Performers For 2023

So which stocks showed the best performance in the portfolio relative to their overall volatility, we provide three of them below:

Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb discovers, develops, licenses, manufactures, and markets biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, neuroscience, and covid-19 diseases. BMY has an annual beta of 0.48—half that of the overall market—has had positive earnings quarter-over-quarter, and stellar financials.

Lockheed Martin Corporation (LMT)

Lockheed Martin, a security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. Being a large contractor for the Federal Government and the Department of Defense, Lockheed's long-term prospects are iron-clad as it is a cornerstone within the military-industrial complex. Annual beta is 0.76—25% less than that of the S&P 500.

Altria Group, Inc. (MO)

Altria Group, through its subsidiaries, manufactures and sells both smokeable and oral tobacco products in the United States. The company manufacturers cigarettes primarily under the Marlboro brand. Whether you agree with it or not, tobacco still plays a large part in today's society. Altria Group has been making steady investments in the next generation of tobacco and cannabis products, with investments in both JUUL and Cronos, respectively. Altria Group has delivered solid returns on capital for investors, an incredible dividend yield of 7.11%, and beta of only 0.52 relative to the market.

To backtest your own Low Vol Portfolio, check out our Quant Premium Plan on Synvestable.com

Don't Let Years of Lost Compounding Cost You

Get the the special research that still beats the market.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

DISCLOSURE: Synvestable does not have any vested stake in the above mentioned companies, nor does Synvestable represent any stocks mentioned in this article as professional financial advice. Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com