Investment's X-Files: Unraveling the Truth Behind Factors Quality & Size

As market regimes change, discovering the best stocks to buy now will rotate according to the prevailing market theme.

In 2020 & 2021, growth and momentum factors reigned supreme; however as valuations in communication services, technology, and FAANG get long in the tooth in 2023, we may be on the verge of other factors performing better.

While growth and momentum should always have some degree of influence investing decisions, they aren't the one size fits all solution for all portfolios.

Size and quality also are factors in investing decisions, with market capitalization and underlying fundamentals taking front and center.

Synvestable Factor Investing Series - Part 4

This we'll be the fourth article in our 6-Part Factor Investing Series. We'll go over exactly what factor-style investing is and how you can apply factors quality and size as an investment strategy. We'll go over specifically:

- What is Factor Style Investing

- What is Factor Quality

- What is Factor Size

- Key Metrics of Factors Quality and Size

- Risks Involved with Factors Quality And Size

- Portfolio Strategies with Quality And Size

- Extending Quality And Size With Other Factors

So let's without first ado—let's see how we can find best stocks to buy now with factors quality and size. But first...

What is Factor Style Investing

Factor style investing, also termed factor-based investing, is a strategic approach to investment centered around the identification of specific attributes or traits thought to be influential in driving stock returns. These factors denote systematic origins of risk and reward that tend to endure and be widespread across diverse asset categories and timeframes.

These factors encompass various qualities or characteristics related to stocks, which encompass:

- Value

- Market Capitalization

- Growth

- Momentum

- Quality

- Low Volatility

- Size

These factors are assumed to wield a lasting influence on stock performance and can be harnessed for the construction of portfolios or investment methodologies. The practice of factor-style investing entails the selection of stocks or securities based on their exposure to one or more of these factors. Investors have the discretion to amplify or diminish emphasis on specific factors contingent on their investment goals, risk tolerance, and perceptions of the market's future trajectory.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

What Is Factor Quality

Factor quality refers to a specific attribute or characteristic of stocks that is believed to contribute to their overall performance and risk profile. In the context of factor-based investing, "quality" is one of the factors that investors consider when constructing portfolios or making investment decisions.

Quality as a factor typically encompasses various qualitative and quantitative measures that assess the financial health, stability, and reliability of a company. High-quality stocks are often associated with companies that exhibit strong fundamentals, consistent earnings growth, stable cash flows, low debt levels, and effective management practices.

Investors who incorporate the factor of quality into their investment strategy aim to identify and invest in companies that are less likely to experience financial distress, market volatility, or adverse events. This can be particularly valuable during periods of economic uncertainty, as high-quality stocks may demonstrate more resilience and potentially deliver more stable returns over the long term.

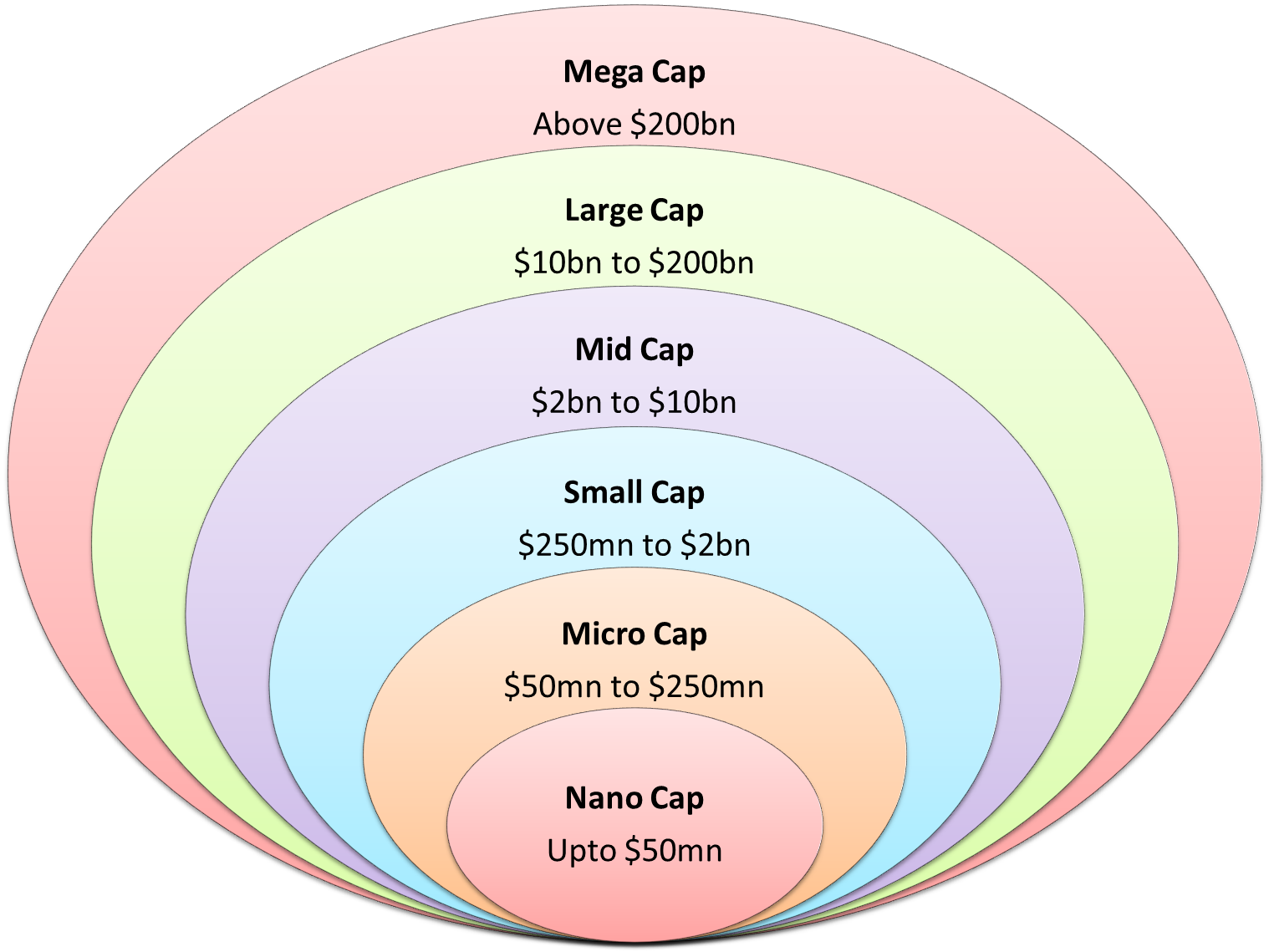

What is Factor Size

Factor size, also known as the "size factor," is a concept within factor-based investing that focuses on the market capitalization of companies as a determinant of their potential returns and risk characteristics. It is one of the factors that investors consider when constructing portfolios or making investment decisions.

The size factor is based on the observation that smaller companies (small-cap stocks) and larger companies (large-cap stocks) tend to exhibit different performance patterns and risk profiles. Historically, researchers and investors have noted that smaller companies often have the potential to outperform larger companies over certain periods, while also being associated with higher levels of risk and volatility.

The size factor is often used as a proxy for exposure to the potential benefits and risks associated with investing in smaller companies. Small-cap stocks are believed to offer greater growth potential due to their ability to capture market niches, innovate more rapidly, and achieve faster earnings growth. However, they can also be more vulnerable to economic downturns and market volatility compared to larger, more established companies.

In contrast, large-cap stocks are typically characterized by stability, well-established operations, and broader market recognition. They may offer more consistent dividends and exhibit lower volatility, but their growth potential might be more limited compared to smaller companies.

Key Metrics of Factors Quality And Size

While size is strictly determined with one metric, market capitalization (see chart above), there are several key metrics and indicators that factor-based investors commonly use to assess factor quality.

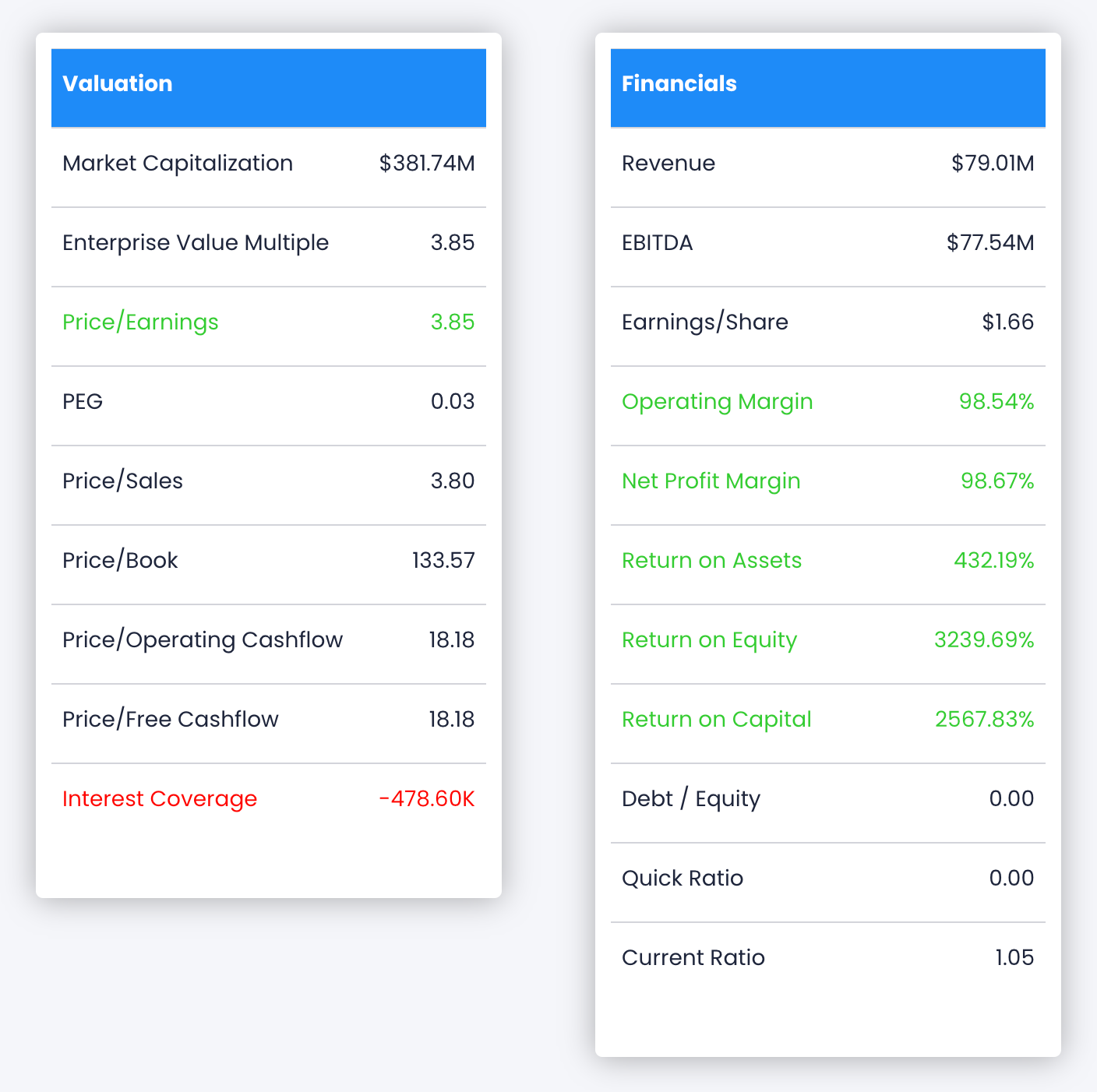

Operating Margins: Operating margin and net profit margin indicate the efficiency of a company's operations. Higher profit margins indicate better cost management and pricing power.

Return on Assets (ROA): ROA measures a company's profitability in relation to its total assets. It provides insight into how efficiently a company is using its assets to generate earnings.

Return on Equity (ROE): ROE measures a company's profitability by expressing its net income as a percentage of shareholders' equity. A high ROE suggests that the company is effectively generating profits from the shareholders' investments.

Return on Invested Capital (ROIC): ROIC evaluates the efficiency and profitability of a company's capital investments. It measures how effectively a company generates returns from the capital it has invested in its operations.

Debt-to-Equity Ratio: This ratio shows the proportion of a company's financing that comes from debt compared to equity. Lower debt levels indicate better financial health and reduced risk of default.

Interest Coverage Ratio: This ratio assesses a company's ability to cover its interest payments with its earnings before interest and taxes (EBIT). Higher interest coverage suggests greater capacity to meet debt obligations.

Pro-Tip: Synvestable will automatically use intelligent highlighting for all of these factors and others, letting you know when a quality factor is excellent (green) or cause for concern (red).

Risks Involved With Quality And Size

Both quality and size factors come with their own sets of opportunities and risks.

Risk Factors Associated with Quality:

- Market Risk: Even though quality companies are generally more stable, they can still be affected by overall market fluctuations and economic downturns.

- Regulatory Changes: Changes in regulations or industry standards can impact the operations and profitability of even high-quality companies.

- Competition: Quality companies might face increased competition, which could erode their market share or pricing power.

- Technological Disruption: Changes in technology or industry trends can render existing products or services obsolete, affecting the performance of quality companies.

- Management Changes: Even high-quality companies can be affected by poor strategic decisions or management changes that impact their operational efficiency and performance.

Risk Factors Associated with Size:

- Liquidity Risk: Smaller companies often have lower trading volumes, which can lead to higher bid-ask spreads and difficulty in selling large positions without impacting the stock price.

- Volatility: Smaller companies tend to have higher volatility due to their sensitivity to news, market sentiment, and changes in investor perception.

- Financing Challenges: Small companies might face difficulties in accessing financing at favorable terms, especially during economic downturns.

- Operational Risk: Smaller companies might lack the resources and infrastructure to manage operational risks effectively, potentially leading to disruptions.

- Market Neglect: Smaller companies might not receive as much attention from analysts and institutional investors, leading to mispricing and missed growth opportunities.

- Limited Resources: Smaller companies might have limited resources for research, development, marketing, and expansion, which can impact their ability to compete.

Diversification and thorough research are essential to manage the potential risks associated with any investment strategy, which brings us to how we can best mitigate these risks with specific portfolio strategies.

Portfolio Strategies With Quality And Size

It's often said that diversification is the only free-lunch when it comes to investing, as it can meaningfully reduce portfolio variance across sectors and market caps.

If you're a Synvestable premium member on either the Accredited or Quant Premium plan, you can use our Auto-Diversification feature in the portfolio tools to automatically diversify according to Quality Size.

Just enter any portfolio, click the "Portfolio Actions" button, click Rebalance Portfolio and select Market Cap too diversify by company size.

Pro-Tip: Synvestable can automatically diversify your portfolio according to factor size. When it comes to factor quality—just use our stock screener!

Extending Quality And Size With Other Factors

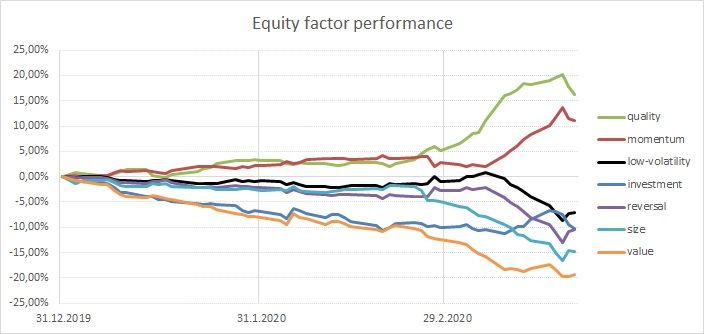

Looking at the performance of quality stocks dating back to 2010 and using the financial metrics listed above, we can see that both quality and momentum have really outperformed.

You can also combine quality and size with momentum, growth, and value factors for outsized returns—which is exactly what we did in our Blueprint Investing Formula.

Our e-book outlines over 25+ quantitative factors—combining financial metrics from value, quality, momentum, and growth factor styles—the result of which created us a simple framework that continues to beat the market when combined with a proper portfolio strategy.

Get the the special research that still beats the market.

Stay tuned on this series when we go into the next type of factor style investing—factor yield. Subscribe or register for free below and you'll be registered to receive all our posts and Factor Style Series via email.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!