In a year of economic uncertainties, mastering your finances with a reliable budget planner is crucial—discover how to properly budget and download our FREE monthly budget planner!

In the era of economic fluctuations, managing personal finances effectively is more crucial than ever. Budget planners play a vital role in helping individuals maintain financial stability by tracking their earnings, expenses, and savings. Here, we'll delve into what budget planners are, why they're essential, and what features you should look for when choosing one.

What is a Budget Planner?

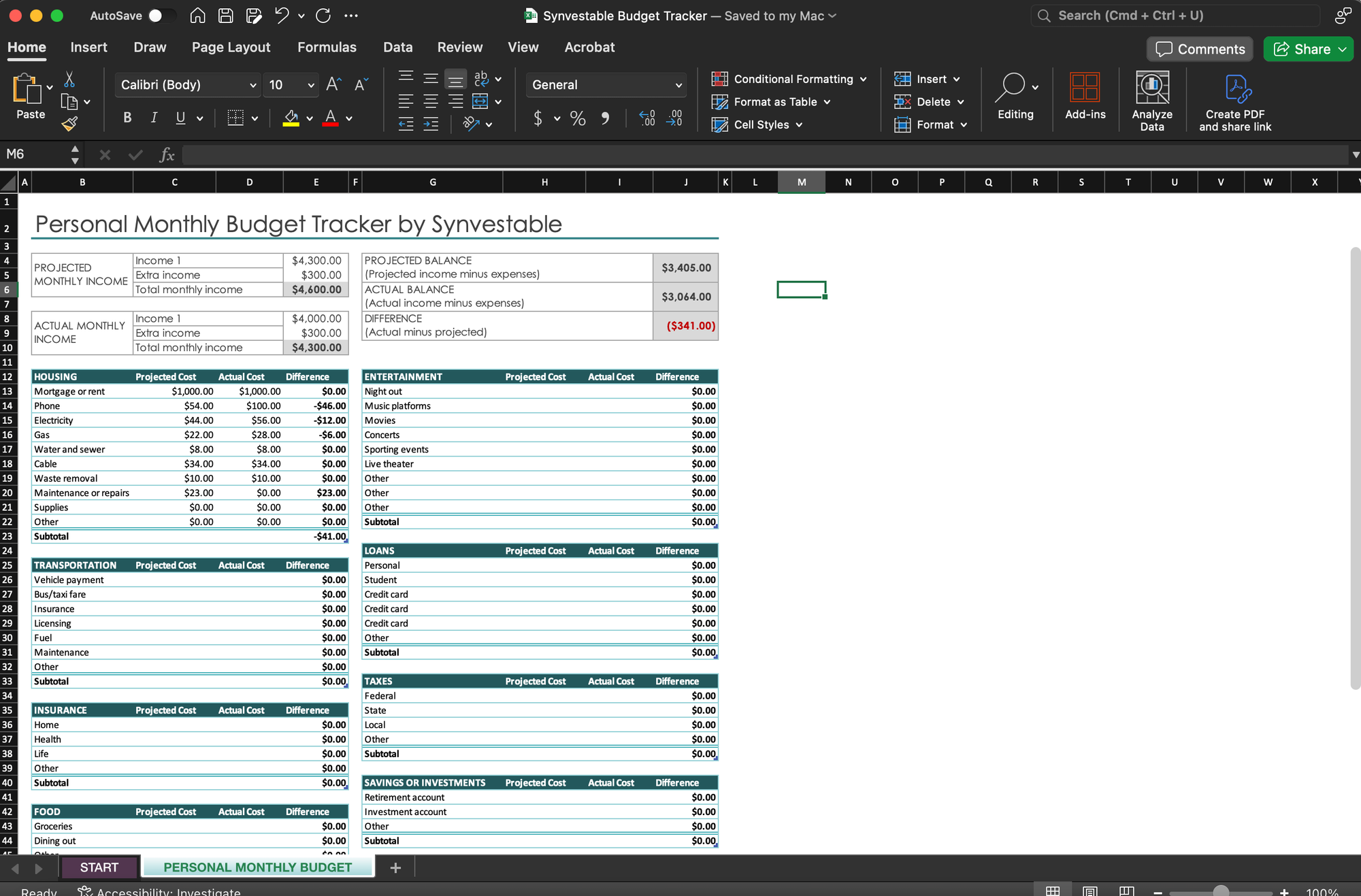

A budget planner is a tool—either digital or physical—that allows you to organize your financial data in one place. This tool helps you monitor your income, allocate funds for various expenses, and plan savings or investments. The ultimate goal of using a budget planner is to ensure you live within your means and plan for future financial goals.

Why Use a Budget Planner?

Financial Clarity: A budget planner provides a clear overview of your financial situation, helping you understand how much money you have, where it's going, and how much you can afford to spend or save.

Goal Setting: It facilitates setting financial goals, such as saving for a house, vacation, or retirement, and tracking progress towards these goals.

Debt Management: For those managing debt, budget planners can help prioritize and plan debt repayment, potentially saving on interest and reducing financial stress.

Spending Habits: Understanding your spending habits can lead to more informed financial decisions and prevent wasteful expenditures.

Key Features To Look For In A Budget Planner

When selecting a budget planner, consider the following essential features:

- Usability: Whether it’s an app or a physical book, the planner should be intuitive and easy to use. A good user interface for digital planners, and a well-organized layout for physical planners, are must-haves.

- Customization: The ability to customize categories and goals is crucial as it needs to reflect your personal financial situation. Customizable fields for different types of income, expenses, and savings goals make the planner more effective.

- Integration: For digital planners, the ability to sync with your bank accounts and credit cards can automate the data entry process, making it easier to keep your budget up to date.

- Security: Especially important for digital planners, robust security features such as encryption and two-factor authentication are essential to protect your financial data.

- Reporting: Look for a planner that can generate useful reports and visualizations, such as expense breakdowns, savings progress, and trend analyses. These features can provide deeper insights into your financial health.

- Accessibility: A digital budget planner should be accessible on multiple devices, including smartphones, tablets, and computers, allowing you to update and check your finances on the go.

- Support and Resources: Additional resources such as financial advice, tutorials, and customer support can be valuable, especially for those new to budgeting.

Choosing The Right Budget Planner

The choice between a digital or physical budget planner often depends on personal preference and lifestyle. Those who are tech-savvy might prefer an app or software due to its convenience and advanced features. In contrast, individuals who prefer writing things down might opt for a physical planner.

Regardless of the format, the effectiveness of a budget planner comes down to regular usage and consistent updating. Choosing a planner that fits your lifestyle and financial goals is the first step towards effective financial management.

Budget Planning Tips

If you're new to budgeting, the task of managing your finances can seem daunting. You need to organize your income and expenses and make important choices about how to allocate your money.

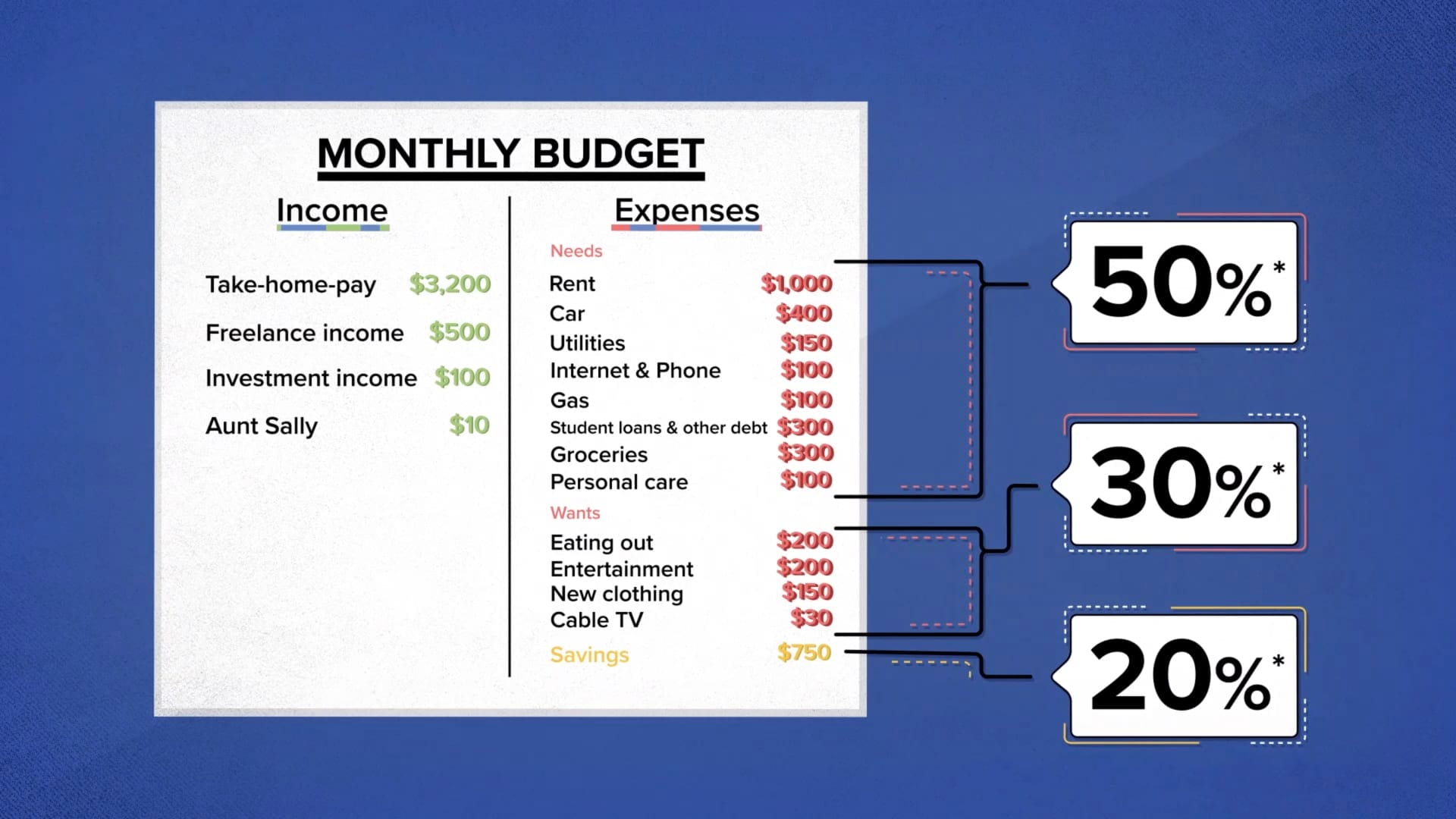

A straightforward method to simplify this process is to adopt a percentage-based budgeting approach. The 50/30/20 rule is a popular example of this strategy, where you allocate your after-tax income into three main categories: 50% for needs, 30% for wants, and 20% for savings.

Allocate 50% for Necessities

Necessities include essential living expenses that consume about 50% of your after-tax income. These are your indispensable costs, as opposed to wants, which are nice to have but not essential for survival.

Examples of necessities are:

- Utilities

- Groceries

- Health care

- Student loan payments

- Rent or mortgage

- Transportation costs

- Debt payments (credit cards, etc.)

- Childcare

- Insurance

As circumstances change, such as paying off a student loan, you may find extra room in your budget. This could be redirected towards other financial obligations, like paying down other debts more quickly.

Allocate 30% for Wants

Wants are the non-essential items that enhance your lifestyle but aren't necessary for basic survival. This category should represent 30% of your after-tax income.

Examples of wants include:

- Dining out

- Spa treatments

- Designer clothing

- Memberships to clubs or gyms

- Event tickets

- Streaming service subscriptions

Spending on wants is a way to reward yourself for hard work and can be used as motivation to achieve personal goals, enhancing your quality of life and satisfaction. Over time, your wants may evolve as you fulfill certain desires and set new ones.

Ready to Save: Finding the Balance

In the 50/30/20 approach, the remaining 20% of your income is earmarked for savings, targeting substantial long-term objectives. You may find it beneficial to maintain multiple savings accounts for different goals.

Examples of savings goals include:

- Saving for a vacation

- Purchasing a new vehicle

- Building an emergency fund

- Accumulating a down payment for a house

- Investing in stocks or retirement accounts like a 401(k) or IRA

Consider automating your savings through direct deposit allocations from your paycheck, which can simplify achieving these financial goals. For instance, 80% of your paycheck could go into a checking account for immediate needs and wants, while 20% is split between an emergency fund and retirement savings.

Download Our Free Budget Planner

A budget planner is more than just a financial tool; it's a roadmap to achieving personal financial health and stability. By carefully considering features that match your financial needs and preferences, you can select a budget planner that not only helps you manage your day-to-day spending but also assists in reaching your long-term financial goals. Start today, and take control of your financial future.

We're the best app in finance—Register using your Google Account. Just click the GIF!