There are many reasons why married couples divorce—but an overwhelming 63% majority said it could have been prevented if they just knew this from beginning.

There are various reasons why individuals choose to file for divorce: lack of family support, infidelity, and incompatibility are the top three, according to a survey by Forbes Advisor that polled 1,000 Americans who are either divorced or currently undergoing separation.

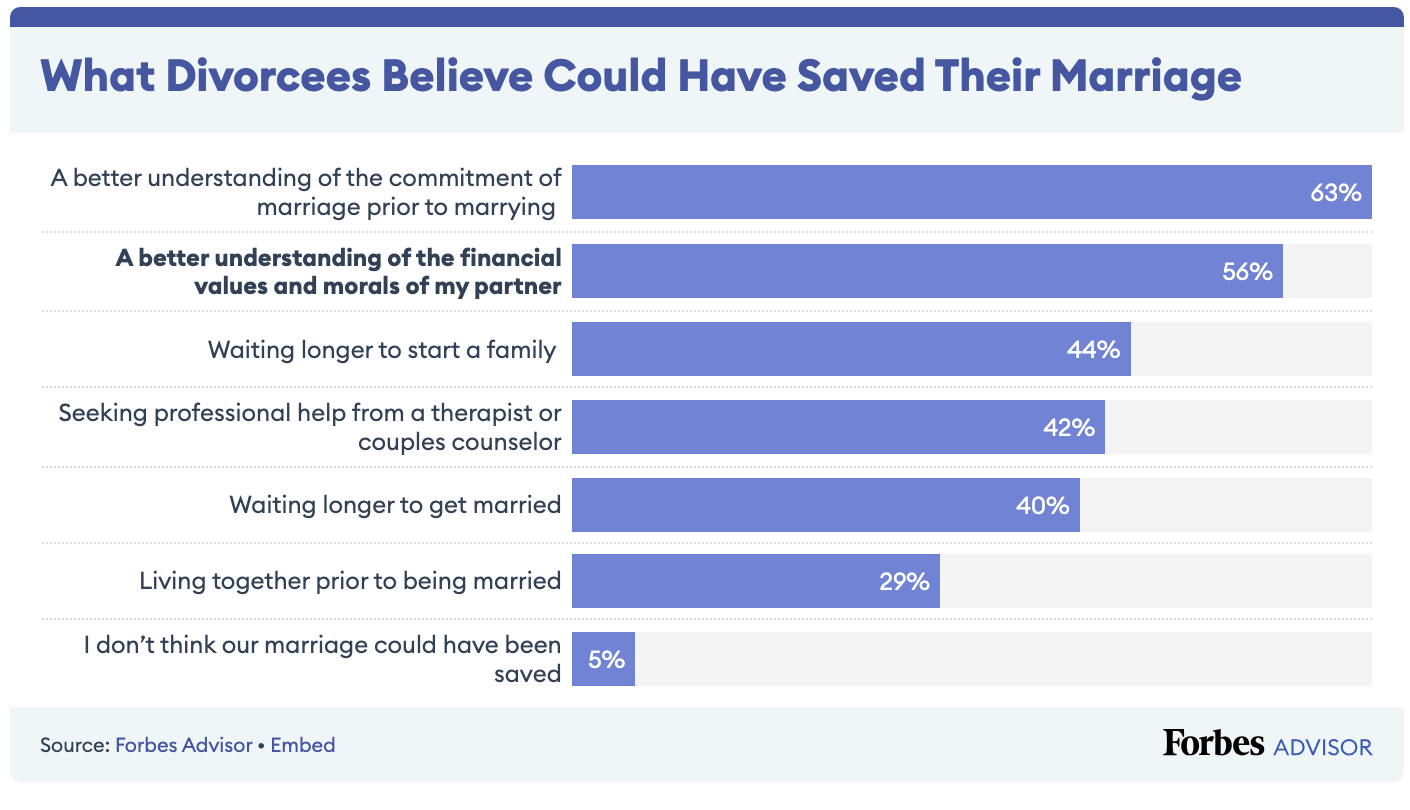

However, nearly all of those surveyed believe their marriage could have been saved by certain factors. In fact, only 5% of respondents said they don't think anything could have fixed their relationship.

Here are the top factors divorcees felt could've saved their marriage.

Of those surveyed, 56% said that a better understanding of the financial values and morals of the partner could've saved their marriage with a proper strategy.

Many couples who decide to get married have unrealistic expectations of happiness, says Lisa Marie Bobby, psychologist and founder of Growing Self Counseling & Coaching in Denver.

"There are myths in our culture that teach us that if you find the right person, it's smooth sailing," she says. "You never have to course correct, and that is not true."

"Getting in a car and going on a drive, let's say you point your steering wheel in the right direction and then just take your hands off the wheel. And then you're surprised when you end up in a ditch or think, 'oh, if I had a new car, I wouldn't have to steer anymore.'"

There is no healthy partnership that will not go through some amount of discomfort, she says. "Relationships are always going through this ebb and flow, growing further apart and then moving towards repair," Bobby says. "And it's this rupture and repair process that actually creates strong enduring relationships."

More than half, 63%, said that a better understanding of the commitment of marriage prior to marrying could have saved their relationship. This, Bobby says, is a common issue with her clients as many people "over index" sexual chemistry while dating.

"When people are dating and figuring out who they want to be with, chemistry is one part of that puzzle," she says. "But you should be thinking more about: Is this person emotionally safe? Are they honest? Are they reliable? Are they a good friend? Are they here for me?"

And even if you've asked yourself these questions and are satisfied with the answers, Bobby says waiting to have kids is wise.

"There's also a myth in our culture that having children is a path to happiness," she says. "And what the research shows pretty clearly is that most couples, when they have a child, they will experience a big drop in their relational satisfaction because things get a lot harder."

After all, 44% of respondents said waiting to start a family might have saved their marriage and 43% of divorcees say parenting differences were a large source of conflict for them and their partner.

"What smart couples are doing is really growing, strengthening their relationship, working through these normal and expected growth moments so that by the time they do have kids, they have some things worked out," Bobby says.

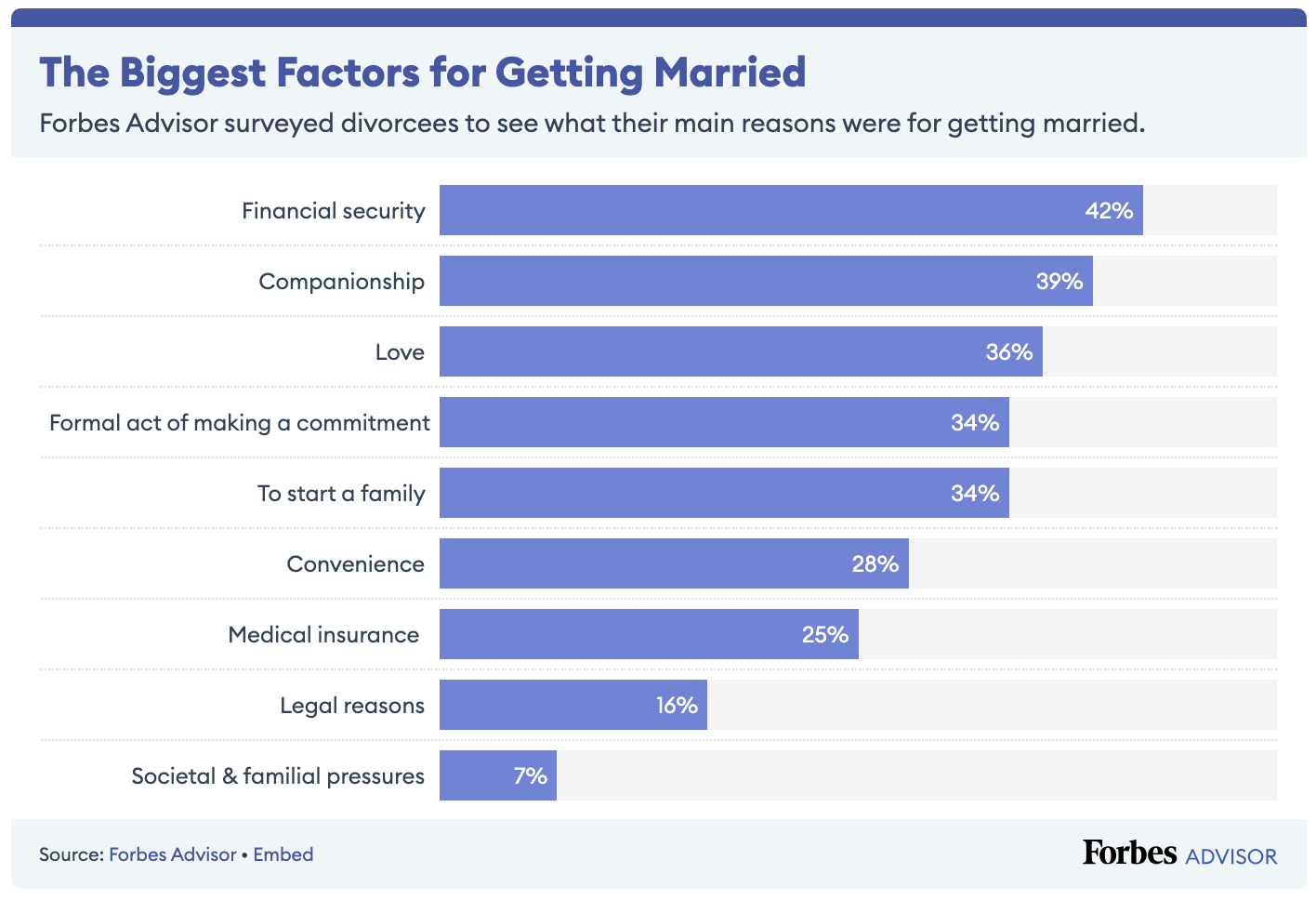

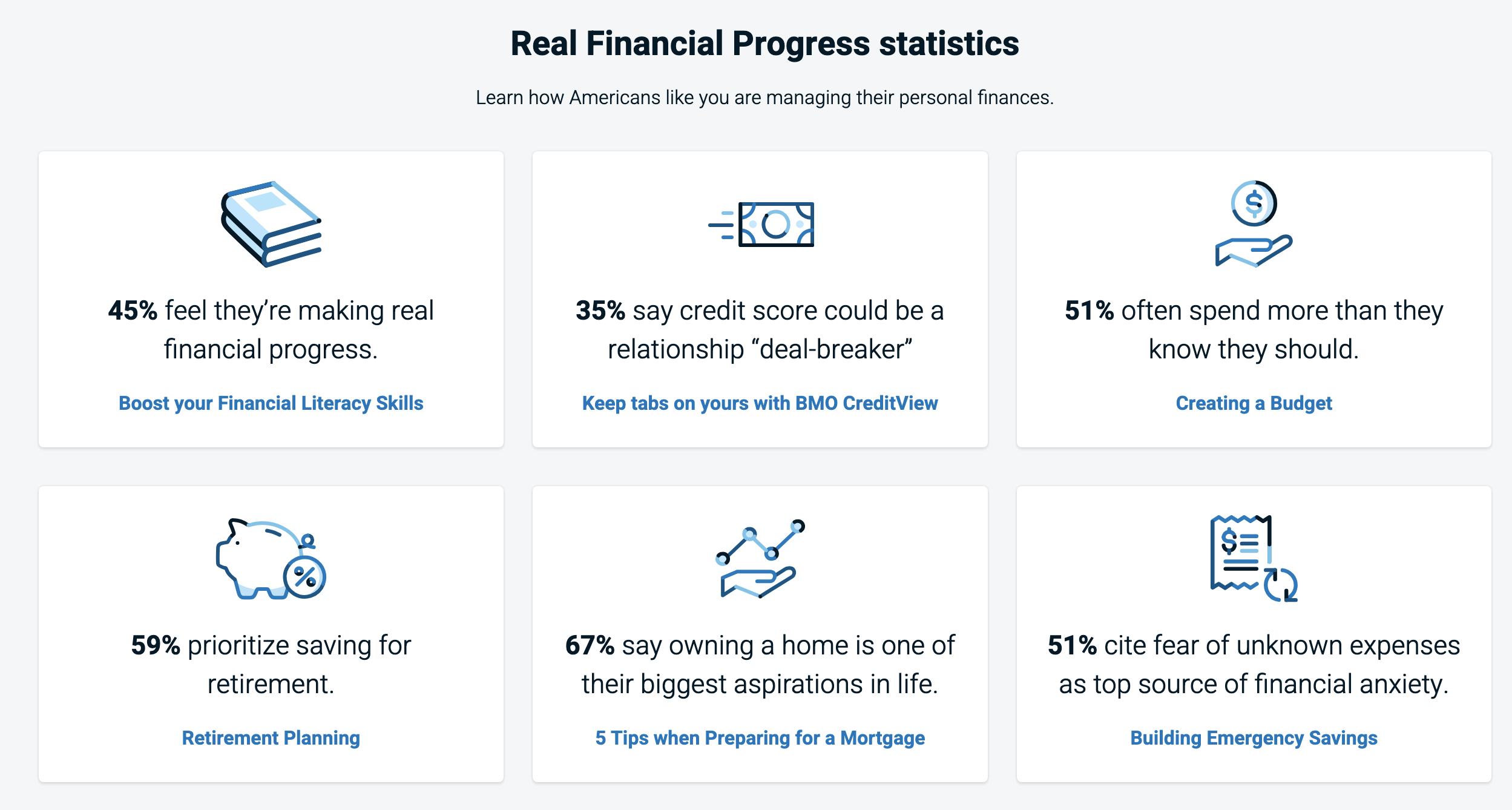

Not only that, having a family is a huge financial responsibility which can put further stress on a couple that has yet to lay the proper foundations. According to BMO Real Financial Progress Index, 34% of partnered Americans say spending is often a source of disagreement in their relationship, with money being the number one source of tension for nearly half (47 percent).

On top of that, over one-third (36 percent) Americans say their partner does not always get an accurate understanding of their finances and 26 percent say they sometimes omit information if it makes them look bad in their partners eyes.

It goes without saying that marriage and relationships are hard enough, your finances don’t have to be.

If you can agree on a plan as a couple to get your financial house in order, you statistically increase the likelihood of the relationship lasting for many, many years.

A Case Study of Marital Success

Nick Ferzoco and his wife, one of Synvestable’s customers understand this concept completely, which is why they agreed to focus on investing for their family’s future and using Synvestable in their journey.

Nick was so successful at it, that he was recently featured by MSN as an early-adopter of AI to augment his own financial intelligence.

Because we understand the importance of financial planning in relationships, we created the “7 Simple Steps to Smarter Investing” Fast Track for all our premium memberships.

Our fast track ensures that Synvestable premium subscribers are immediately successful with our platform on their journey to become world-class investors and create a better financial future for themselves and their loved ones.

Our Fast Track becomes available to all premium subscribers immediately.

Don't lose your partner and don't lose money on divorce—lose your financial stress instead with the best AI financial advisory platform in the world—Synvestable.