When Wall Street talks about bond yields, it's about playing better defense with stocks—but is everything Wall Street thinks about bond yields backwards?

If you ever want to sound super intelligent at a Manhattan cocktail party, the moment someone mentions stocks—start talking about bonds.

It’s a cheeky little secret about Wall Street—that the best way to talk about something is to talk about something else.

And to make it double-impressive while you’re swirling your Stoli at your next soirée, don’t talk about bond prices, talk about the inversion of bond prices—the bond yield.

Bond yields are the Wall Street equivalent of math majors talking about second-order derivatives or even hockey players skating backwards—performing a learned skill straight ahead isn’t noteworthy—if you really want to impress, do it backwards and upside down.

After all, it's not as impressive that you can hit a golf ball straight 300 yards—it’s much more impressive when you can use the back of the club to do it.

Bond yields accomplish that same effect in financial commentary.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

The Logic Baked Into Bond Yields

But it’s not all about just sounding intelligent—right? Presumably, there’s some logic behind inverting or doing something backwards, just like hockey players skate backwards to play better defense.

When Wall Street pros talks about bond yields, they’re essentially talking about playing better defense when it comes to stocks. They’re talking about what the expected return for a bond at maturity tells us about other alternative assets in terms of risk:

Given a guaranteed rate of a return of a bond, how much should you reasonably expect to earn for buying another riskier asset?

So there is some logic there—but is everything Wall Street thinks about bond yields backwards and inverted too?

In this article, we’ll determine the answers to three key questions:

- What causes bond yields to rise and fall?

- What do bond yields say about stocks?

- Is everything we think we know about bond yields wrong?

Grab yourself a dirty martini and get comfortable on the divan—because it’s time to talk about bond yields.

Making The Necessary Distinctions

In every market, there are traders and there are investors.

Investors purchase assets for long term price appreciation related to the growth in economic value of the asset

Traders purchase assets to catch a specific move in price. If the move doesn’t happen, or goes the other direction, they get out quick.

Price movements around news are more related to traders making moves rather than long-term investor activity.

And this makes intuitive sense—if you’re invested in Microsoft for the long haul, why would you sell the stock on one piece of bad news or one earnings miss?

The same goes for if you’re invested in a duplex or triplex in real estate—one change in the tax rate or local real estate market makes little to no difference in whether you put the asset up for sale right now.

Traders and investors exist in every market everywhere—bond markets are no different.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

How Bonds Yields Work

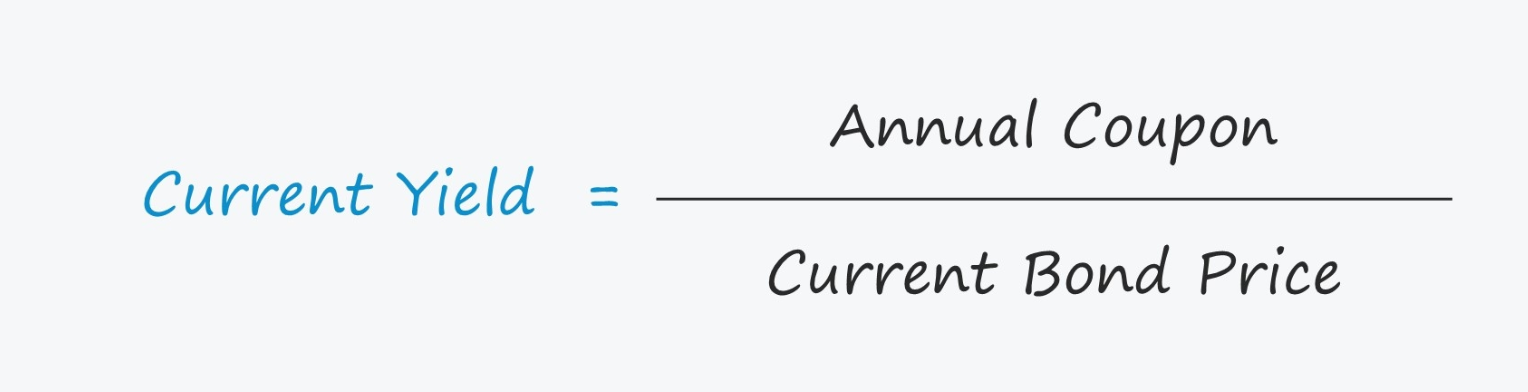

Bond yields move inversely to price and is simply the coupon divided by the price of the bond.

For instance, if a corporate bond with a $1,000 face value and an $80 annual coupon payment is trading at $970, then the current yield is 8.25% ($80 / $970).

A bond investor is someone who is buying a bond expecting to hold the bond until maturity.

A bond trader is someone who is trying to profit on the change in price of a bond by buying at lower prices and selling at higher prices.

Bond yields rise when bond prices fall and vice versa. When traders and investors are currently holding a bond position—rising yields are good for investors, but bad for traders.

Remember—a bond investor is someone who is holding a bond to maturity. If a bond investor buys a bond at a 3.8% yield and then the bond yield rises, the investor does not change their position because they already purchased the bond with the rationale that the yield was satisfactory.

In other words, the ROI just got better, so any rational investor would just buy more.

Why Bond Yields Rise & Fall

Regardless of investors or traders, bond yields rise when bonds sell off.

Both investors and traders sell an asset for only two reasons—to take satisfactory profits or because they perceive an opportunity elsewhere that will provide a higher ROI—for the same level of risk.

Investors and traders sell an asset for only two reasons—to take satisfactory profits or for a better opportunity.

For example, if the 2-Year U.S. Treasury sells off, it’s because the market is perceiving alternative investments to yield a better ROI within two years at a comparable or slightly higher rate of risk.

What Bond Yields Really Signal

If you ask any financial professional or analyst what rising bond yields signal, they’ll tell you that rising bond yields signal that investors are demanding a higher rate of return for the risk incurred.

According to Wall Street lore, rising bond yields signal that investors are demanding a higher rate of return for the risk incurred.

However, this simply cannot be reasonably concluded.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Remember, there are only two reasons both investors and traders sell, and if bond prices are falling from current levels, taking profits is not the reason bonds are selling off—this leads us to conclude that investment opportunities with better returns and comparable risk are being perceived by the market.

Let’s use the 2-Year Treasury again as an example.

Bond Risk

When we talk about risk in a bond, we are talking about the risk of that bond defaulting or not returning its advertised coupon to maturity.

The risk of a treasury bond defaulting—across the entire yield curve—is little to none because it is backed by the promise and sovereignty of the United States Government.

If we assume the default risk of a 2-Year Treasury to be x at 3.8%, if the bond yield increases to 7.2%—the default risk is not 2x, it’s still just x.

Why? Because the U.S. Treasury can print money—your coupon is guaranteed at any yield, therefore the default risk remains unchanged.

If we can’t reasonably conclude that rising yields are a reflection of investors requiring a higher rate of return for a higher perceived risk—then what does a rising bond yield reasonably signal instead?

From our view, it can only signal one thing and one thing only—the market is moving to cash position.

Rising bond yields signal one thing only reliably—the market is moving to cash position.

The Most Important Position of All

Many people don’t think of cash as a position in a portfolio, but it certainly is a position—and as it turns out, a very special position. It’s the most important portfolio position because it facilitates getting into and out of every other position.

Cash is the most unique and important portfolio position, because it facilitates getting into and out of every other position.

If you want to buy Microsoft shares, you have to use cash.

If you want to buy Apple shares, you also have to use cash.

If you own Microsoft shares and you want to get rid of them and get into Apple instead, you can’t just trade Microsoft shares for Apple shares, you have to sell the Microsoft shares, wait for the cash from the trade to settle—and then you can buy Apple.

This is a very, very important distinction—no other asset or position in a portfolio can claim this 'intermediary' functionality that cash has.

In order to buy anything—you need to have cash. Even if you’re buying on margin, you’re still using cash, it’s just your broker's cash—just ask anyone who’s ever received a margin call.

What Cash Positions Signal

As it turns out, while rising bond yields signal the market is moving to cash position, increasing cash positions by themselves don’t send a clear signal.

Increasing cash positions by themselves do not send a clear signal.

But when taken in consideration with other assets—like stocks and bonds—we have four distinct scenarios that are thus reasonable conclusions:

If bond yields rise, and cash positions rise and stay high, this is a clear signal that the market is getting ready for a better opportunity coming, because bonds are selling off and converting into cash but are not being deployed to other assets like stocks.

If bond yields rise, and cash positions remain 'net' unchanged, this is clear signal that the market is piling into an opportunity that is already here—because bonds sold off, converted to cash, and then immediately flowed into other assets.

If bond yields fall, and cash positions rise, then the market is simply fearful of alternative assets.

If bond yields fall, and cash positions fall, then the market is fearful of both declining alternative assets and also perceives a currency devaluation. By piling into bonds, buyers receive a lower yield, but at a yield that will presumably offset the rate of devaluation in the respective currency.

This last scenario is also why negative yields are a thing now.

Why would anyone buy a bond with a negative yield? Because if the negative yield is lower than the rate of currency devaluation, you’re better off than being in cash. Negative yields are for capital preservation relative to currency risk.

Negative yields are used for preservation of capital when there is a risk of currency devaluation.

Take Nothing By Itself In A Vacuum

In complex dynamic systems, no single input variable by itself will tell you much about the output of the system. It’s only when combining several input variables together do we get some insight on causation—and bond yields are no different.

If there’s one thing that Wall Street does have correct, it’s that yields are going to be very important going into 2023—that goes for bond yields and dividend yields.

That’s why we put together a very special report called The Ultimate Stagflation Survival Guide in which we constructed a portfolio that not only has been beating the S&P 500 throughout all of 2022—its currently yielding 9.0% in dividends.

You can get access to that report here.

We hope you enjoyed our analysis on bond yield signals and as usual—happy investing!

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

DISCLOSURE: Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com