What Is Financial Education?

Financial education refers to the knowledge and understanding of how money works and how to make it work for you. It includes understanding and managing personal finances, such as budgeting, saving, investing, and protecting assets. It also involves understanding financial products and services, such as credit cards, loans, and insurance.

Financial education is essential for achieving financial independence and security. It can help individuals make informed decisions about their money, plan for the future, and achieve their financial goals. Financial education can also help individuals understand and manage risks and protect themselves from financial fraud.

However, financial education—while in short supply in previous years—is on the decline in the United States.

In this article, we put together some pretty shocking statistics on financial education in America, along with some resources that will allow you to supercharge your financial education to better guarantee a prosperous and secure financial future.

Article Contents:

- 8 Shocking Insights Show You Need To Act Now

- Financial Education In The U.S. Compared to Other Countries

- The 10 Main Areas of Financial Education

- Best Books On Financial Education

- Best Online Courses For Financial Education

- Best Online Forums For Financial Education

- Working With A Financial Advisor

- How Financial Advisors Charge

- 10 Absolute Musts In A Financial Advisor

- Learn Investing Best Practices

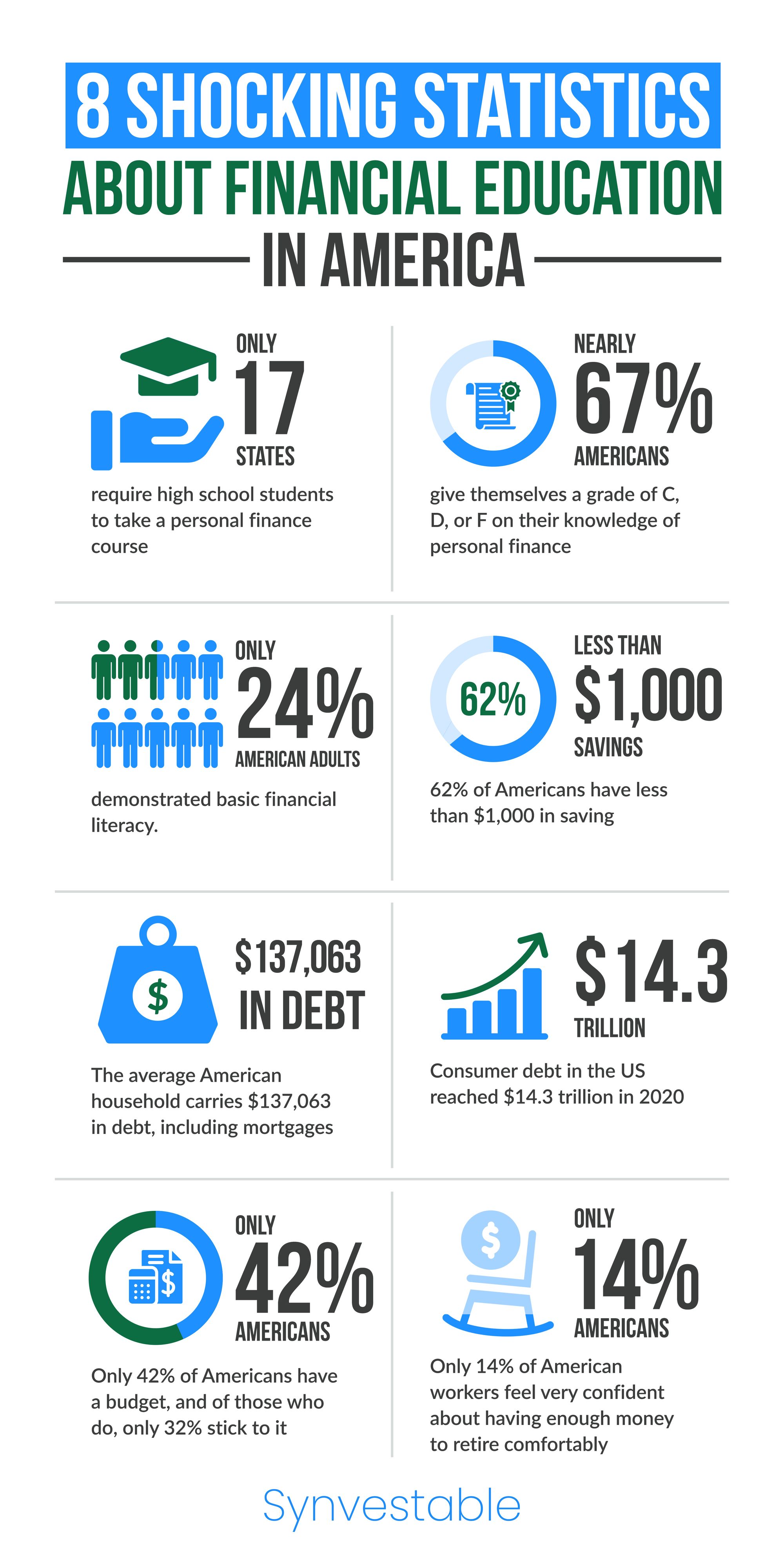

8 Shocking Insights Show You Need To Act Now

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Financial Education In The United States

Compared to Other Countries

When compared to other countries, the United States falls behind in terms of financial education. In Canada, for example, financial education is mandatory in schools, and students are required to take a personal finance course. In the United Kingdom, financial education is also mandatory in schools, and students are required to take a course on personal finance and economics.

In Australia, students are required to take a course on financial literacy and are also encouraged to participate in financial literacy programs outside of school.

Other countries, such as Japan, South Korea, and Singapore, have implemented financial education programs that have been successful in increasing financial literacy among their citizens. These countries have a strong emphasis on financial education and have implemented programs that are tailored to the needs of their citizens.

In Japan, for example, the government has implemented a financial education program that focuses on teaching people how to save and invest money. In South Korea, the government has implemented a program that teaches citizens about credit and debt management. In Singapore, the government has implemented a program that teaches citizens about retirement planning and investment.

The 10 Main Areas of Financial Education

Gaining financial education means gaining enough knowledge to be dangerous in these essential categories. Remember, you don't have to be a expert in everything, but you need to have working knowledge and a good understanding in each one of these areas.

- Budgeting: Understanding how to create a budget, track expenses, and manage cash flow.

- Saving and Investing: Understanding how to save money, create an emergency fund, and invest for the future.

- Credit management: Understanding how credit works, managing credit cards and loans, and building a good credit score.

- Risk management: Understanding and managing risks, such as inflation, market fluctuations, and fraud.

- Tax planning: Understanding tax laws, deductions, and credits to minimize taxes and maximize savings.

- Retirement planning: Understanding the different options for retirement savings and planning for retirement income.

- Insurance: Understanding different types of insurance, such as health, life, and property insurance, and how to choose the right coverage.

- Estate planning: Understanding how to plan for the distribution of assets after death, including drafting a will and setting up trusts.

- Entrepreneurial finance: understanding how to manage finances as an entrepreneur, including budgeting, cash flow management and tax planning.

- Behavioral finance: understanding how psychology affects financial decisions and personal financial behavior.

Best Books On Financial Education

Financial education starts with finding some of the very best reading material. Try reading a little bit at the end of every day to strengthen your financial chops and make incremental improvements to how you think about money.

Here are some of our favorites:

- "The Intelligent Investor" by Benjamin Graham: This classic book is considered the "bible of value investing" and provides a comprehensive understanding of the principles of value investing and the mindset required to be a successful investor.

- "Rich Dad Poor Dad" by Robert Kiyosaki: This book provides a different perspective on personal finance and investing, emphasizing the importance of financial literacy and the benefits of becoming an entrepreneur.

- "The Total Money Makeover" by Dave Ramsey: This book is a step-by-step guide to achieving financial freedom, providing practical advice and strategies for budgeting, saving, and investing.

- "The Simple Path to Wealth" by JL Collins: This book is a guide to achieving financial independence through low-cost index fund investing and living a frugal lifestyle.

- "Your Money or Your Life" by Vicki Robin & Joe Dominguez: This book provides a comprehensive program for transforming your relationship with money, including exercises and tools to help you track your spending, set financial goals, and create a budget.

- "The Compound Effect" by Darren Hardy: This book explains how small, consistent actions can lead to significant results over time, and provides strategies for developing good habits and achieving long-term success.

- "The Little Book of Common Sense Investing" by John C. Bogle: This book explains the benefits of passive investing and the drawbacks of trying to beat the market through active investing.

- "The 4-Hour Work Week" by Timothy Ferriss: This book provides strategies for achieving financial independence by working less, living more, and automating your income.

Best Online Courses For Financial Education

If you prefer to learn through an instructor rather than by self-study with books, here is our curated list for some of the best financial education courses on the internet, available for little to no investment:

- "Personal Finance Fundamentals" by Khan Academy: This course provides an overview of personal finance, including budgeting, saving, investing, and credit management.

- "Investing 101" by The Motley Fool: This course covers the basics of investing, including types of investments, risk management, and portfolio diversification.

- "Financial Planning for Young Adults" by Dave Ramsey: This course provides practical advice and strategies for young adults to establish a solid financial foundation and achieve their financial goals.

- "Retirement Planning" by edX: This course covers the basics of retirement planning, including savings strategies, investment options, and government benefits.

- "Money Management for Entrepreneurs" by Udemy: This course provides financial strategies and tools for entrepreneurs to manage their business finances, including budgeting, cash flow management, and tax planning.

- "The Science of Getting Rich" by MindValley: This course is based on the classic book by Wallace D. Wattles, and teaches the principles of abundance and wealth creation.

- "Real Estate Investing 101" by BiggerPockets: This course covers the basics of real estate investing, including property analysis, financing options, and rental property management.

- "Behavioral Finance" by Coursera: This course explores the psychology behind financial decision-making and how it affects investment decisions and personal financial behavior.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Best Online Forums For Financial Education

After you've gained some base knowledge from books and online courses, you can stay in the know by joining the various communities available online to learn from others. Here are some of the best forums and communities that we've found:

- Reddit's Personal Finance subreddit: This is a large community of people discussing all aspects of personal finance, including budgeting, saving, investing, and credit management.

- Bogleheads forum: This forum is dedicated to the principles of low-cost, passive investing as espoused by John C. Bogle, the founder of Vanguard Group.

- Mr. Money Mustache forum: This forum is dedicated to the principles of financial independence and early retirement through frugal living and smart investing.

- Dave Ramsey's financial peace university forum: This forum is for users of Dave Ramsey's financial peace university program, where members can discuss budgeting, saving, investing, and debt management.

- The White Coat Investor forum: This forum is for physician and dentists and aims to help them make smart financial decisions.

- The FIRE (Financial Independence Retire Early) community: This community is for those pursuing Financial independence, Retire Early lifestyle and it's growing fast globally.

- The Mustachian forum: This forum is dedicated to the principles of frugal living and financial independence, as espoused by the blogger Mr. Money Mustache.

- The Financial Independence subreddit: This is a community of people discussing all aspects of financial independence, including budgeting, saving, investing, and FIRE strategies.

Working With A Financial Advisor

Working with a financial advisor can be a valuable asset for anyone looking to take control of their finances and achieve their financial goals.

One of the biggest benefits of working with a financial advisor is the professional advice they can provide. Financial advisors are experts in a wide range of financial topics, including budgeting, saving, investing, and retirement planning. They can help you navigate the often-complex world of personal finance and provide guidance on the best strategies for achieving your goals.

Another benefit of working with a financial advisor is the tailored financial plan they can create for you. A financial advisor will take into account your unique needs, goals, and circumstances and create a customized plan that is tailored to your specific situation. This can include strategies for managing debt, saving for retirement, and investing for growth, among other things.

Tax planning is another area where a financial advisor can be of great help. They can help you optimize your tax situation, minimizing your tax liability and maximizing your savings. They can also help you navigate the often-complex world of tax laws and regulations and ensure that you are taking advantage of all the deductions and credits to which you are entitled.

Working with a financial advisor can also provide an objective perspective on your financial situation. They can help you avoid emotional decisions that can negatively impact your finances, such as impulsive buying or selling, and provide a clear-eyed view of your financial situation.

How Financial Advisors Charge

The cost of working with a financial advisor can vary depending on the type of services they provide and how they are compensated.

Here are some of the most common ways that financial advisors charge:

- Commission-based: Some financial advisors earn commissions on the financial products they sell, such as mutual funds, annuities, or insurance policies. These products may carry higher fees and may not be in the best interest of the client.

- Fee-based: Other financial advisors charge a fee based on a percentage of assets under management (AUM). For example, they may charge 1% of assets under management per year. This fee is in addition to any underlying expenses or fees associated with the investment products.

- Hourly or flat fee: Some financial advisors charge an hourly or flat fee for their services, such as financial planning, tax preparation, or estate planning. These fees can range from $100 to $500 or more per hour, depending on the advisor and the services provided.

- Retainer fee: Some financial advisors charge a retainer fee, which is a set amount paid on a regular basis (e.g., monthly or quarterly) for ongoing financial advice and support.

It's important to understand how an advisor is compensated and what fees they charge. It is also important to understand that the cheapest advisor may not be the best one for you, and a more expensive advisor may provide better service and better results. It's important to do your research and find an advisor that fits your needs and budget.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

10 Absolute Musts In A Financial Advisor

If you do decide to go the route of working with a financial advisor, here is a checklist of things you'll need to verify before you decide to engage any financial professional.

- Credentials: Look for an advisor who holds relevant professional certifications, such as the CFP (Certified Financial Planner) or the CFA (Chartered Financial Analyst). These certifications indicate that the advisor has completed a rigorous education and training program and is held to a strict code of ethics.

- Experience: Consider the advisor's level of experience and track record. Look for an advisor who has been in the industry for a number of years and has a proven track record of success.

- Areas of expertise: Make sure the advisor has expertise in the areas that are important to you, such as retirement planning, investment management, or tax planning.

- Fee structure: Understand how the advisor is compensated and what fees they charge. Some advisors charge a flat fee, some charge a percentage of assets under management, and some charge a combination of both. Understand how these fees can impact your portfolio.

- Investment philosophy: Look for an advisor whose investment philosophy aligns with your own. Understand how they create portfolios and what type of investments they use.

- Communication: Consider how the advisor communicates with you, how often and through what mediums.

- Transparency: Look for an advisor who is transparent about their qualifications, their services, and their fees.

- Compliance: Make sure the advisor is registered with the appropriate regulatory bodies and that they have a clean compliance record.

- Check references: Ask for references from current or previous clients, and reach out to them to get a sense of their experience working with the advisor.

- Check For Complaints & Disciplinary Actions: Look for any regulatory or legal actions taken against the advisor.

Don't Let Years of Lost Compounding Cost You

Get the the special research that still beats the market.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

DISCLOSURE: Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com