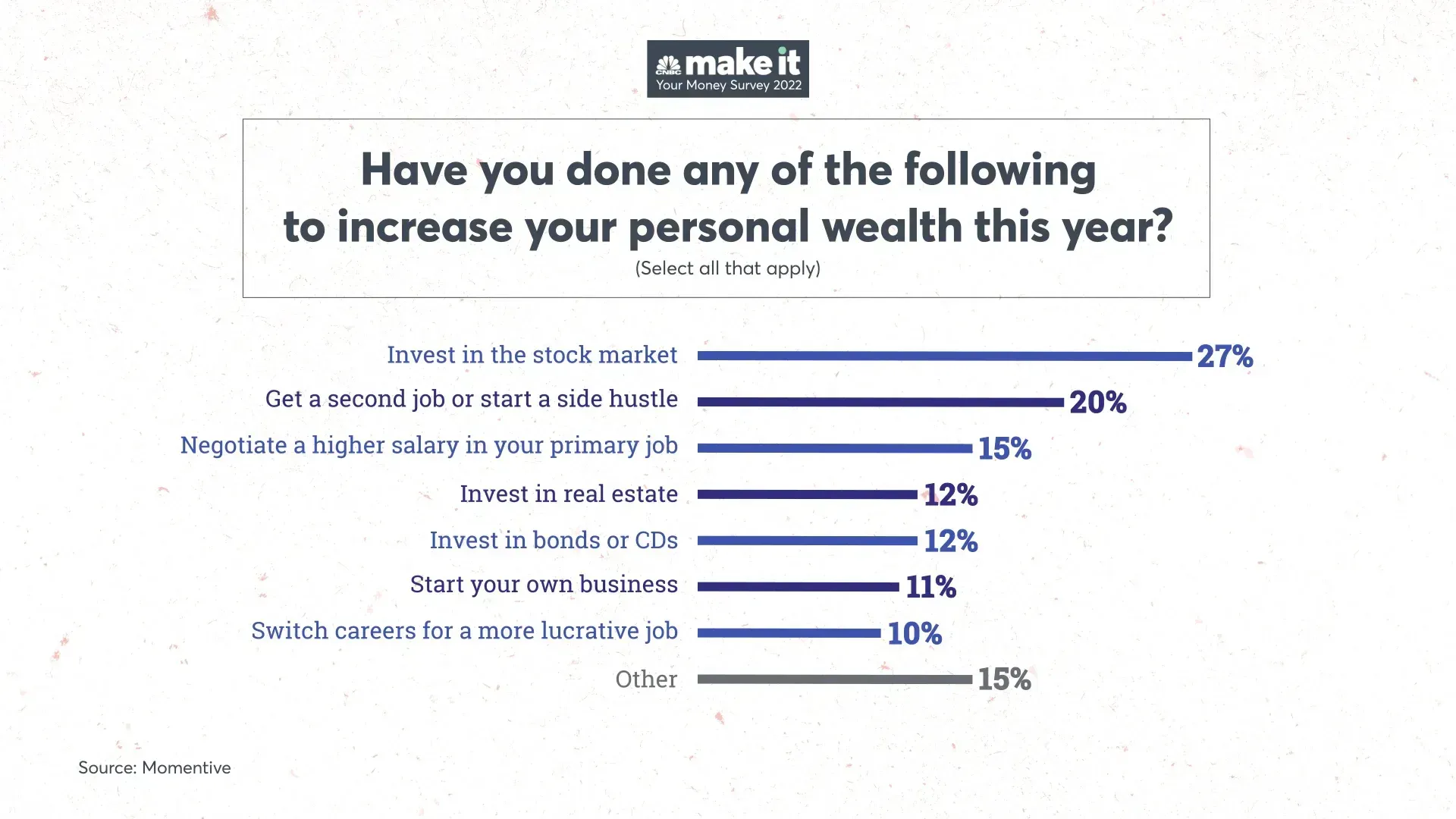

If making more money is a primary focus for you this year, it makes it worthwhile to see what up-and-coming Americans are doing to make their way even closer to financial independence.

In the Your Money survey, over 2 million people were surveyed on what they did to build wealth—the No. 1 answer may come as a surprise.

Before we get to No. 1, the runner up answers included:

- Getting a second job or side hustle (20%)

- Negotiating a higher salary at their primary job (15%).

- Invest in Real Estate (12%)

- Invest in bonds or CDs (12%)

- Start your own business (11%)

- Switch careers for a more lucrative job (10%)

- Other (15%)

However the number one answer came as a surprise.

When asked which steps they took to build their personal wealth—27% of Americans said they invested in the stock market.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Investing During A Down Market

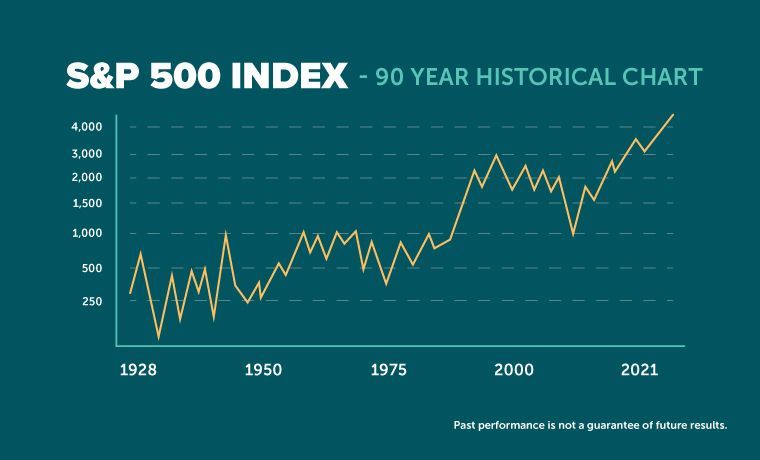

Owning stocks has required somewhat of an iron stomach. Between rampant inflation, interest rate hikes and a tumultuous geopolitical landscape, stock market gyrations were abundant this year. In fact, the S&P 500 index has shed more than 14% year-to-date.

While the drop in stock prices has likely shooed off more than a few traders in the short-term, those looking to build wealth for the long-term have been wise to keep buying during the drops. Historically, the stock market always grinds upwards over the years.

If that trend continues over the next decade, low points in the market represent opportunities to purchase stocks at bargain prices, rather than times to sell.

"If I were a millennial or Gen Z, I'd be thrilled. I'd want the market to stay down for 20 years," opined Brad Klontz, a financial planner & financial psychology faculty member at Creighton University.

Despite what the market does in any given year, you'd be wise to invest consistently in a broadly diversified cross-section of stocks, Klontz says.

Here are three ways to make sure you're buying at the lows for the long-term and taking advantage of continuing market volatility.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

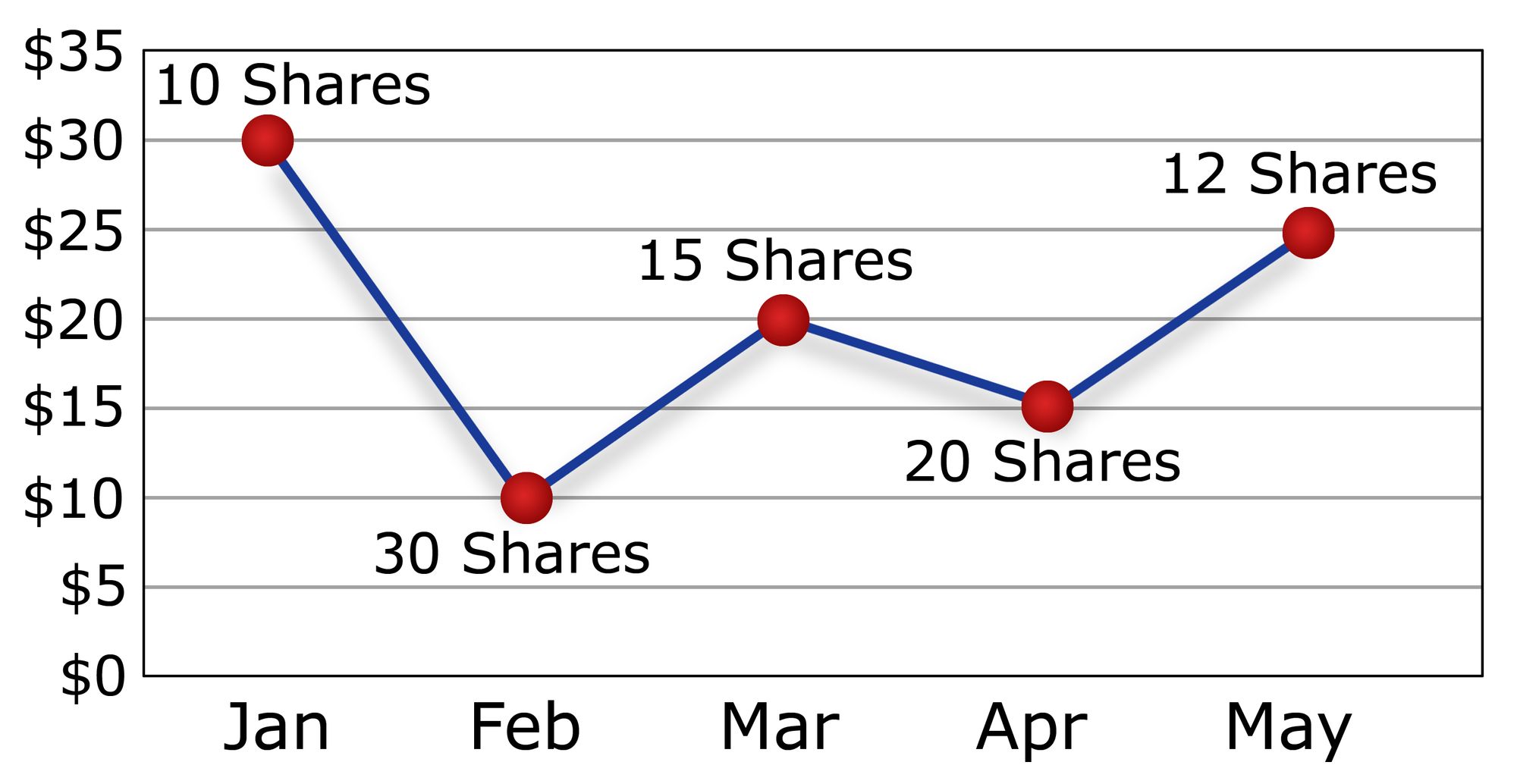

1. Dollar Cost Averaging

Dollar cost averaging is when you invest a fixed amount on a regular time interval, regardless of the share price. This is a great way to develop a disciplined investing habits, and to be more efficient with your investing strategy while lowering your stress levels.

Let's say you invest $1000 every month. When the market extends upwards, your $1000 will buy less shares of each stock, but when the market drops down, your $1000 buys more.

Over time, this strategy lowers the average cost per share—and lowers your cost basis at the time of sale as well.

2. Risk Monitoring

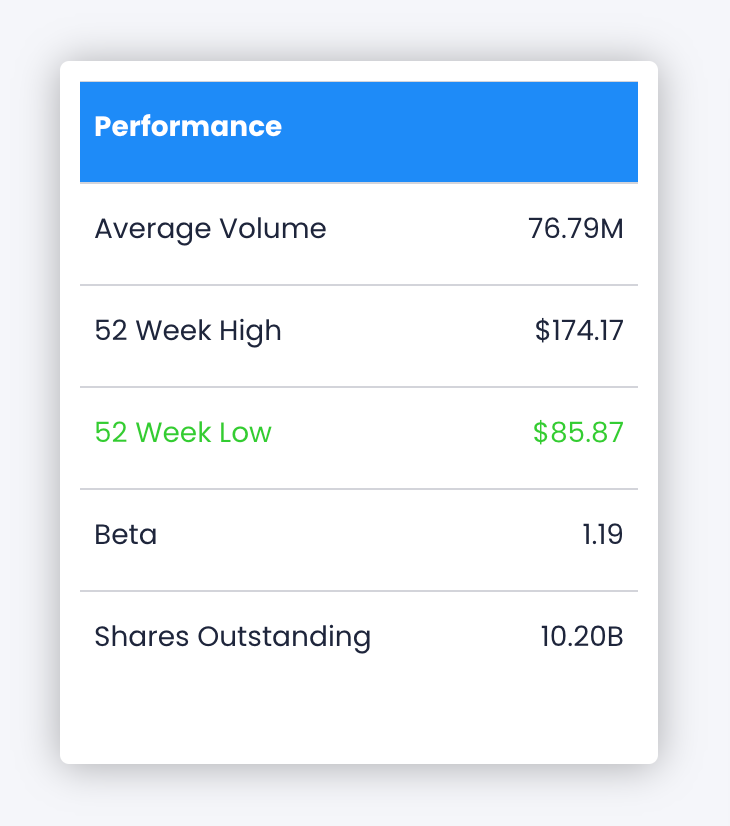

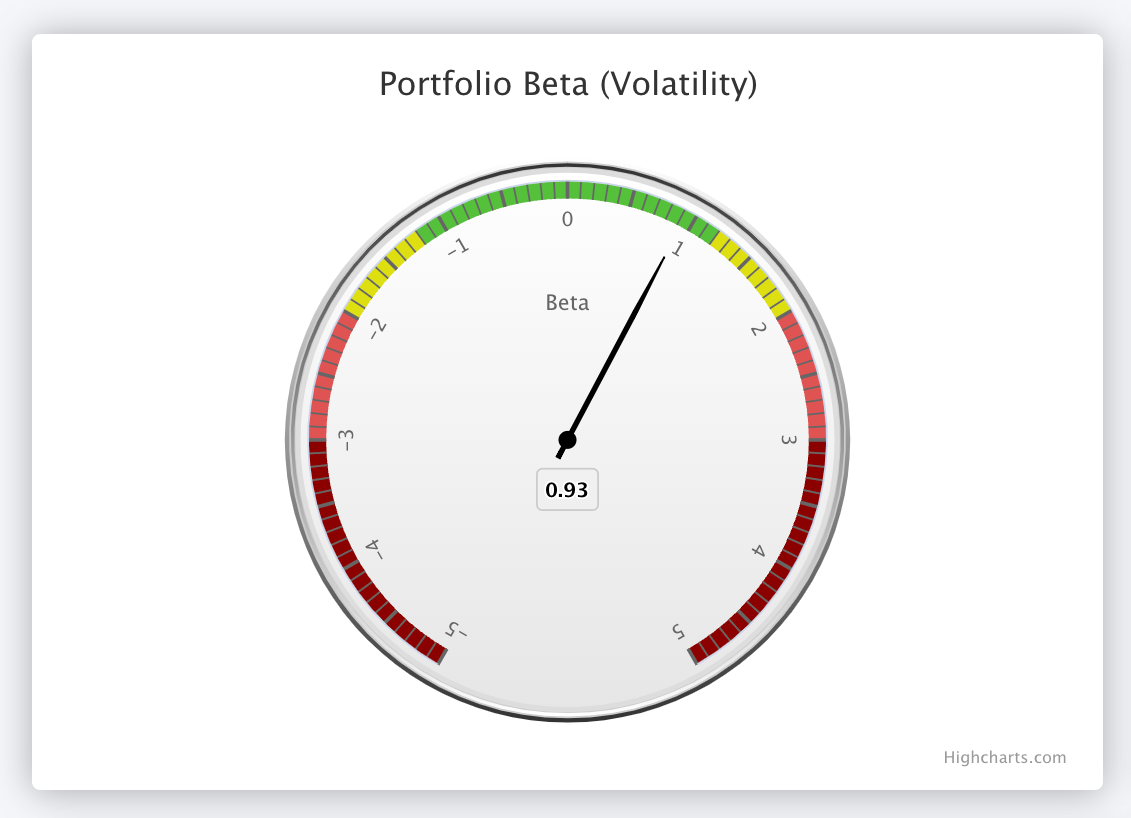

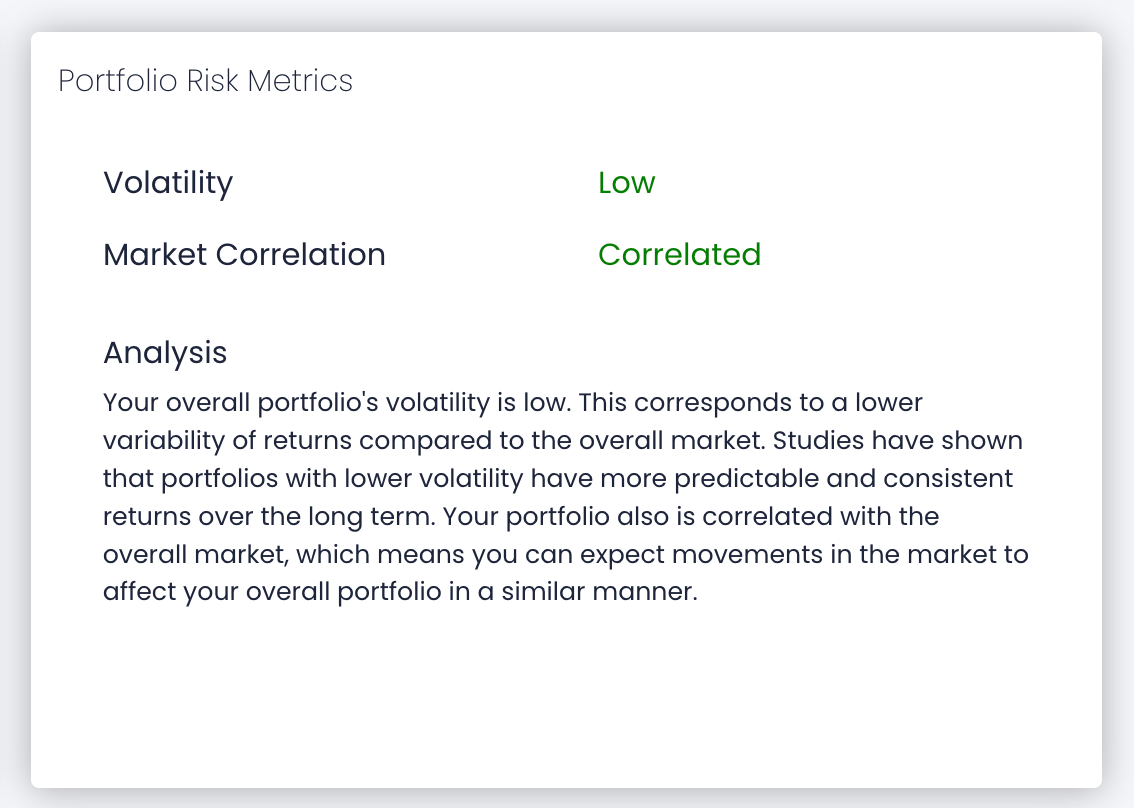

While the concept of risk is hard to factor in stock analysis and valuation, one of the most popular indicators is a statistical measure called beta. Analysts often use it when they want to determine a stock's risk profile.

Beta is a measure of a stock's volatility in relation to the overall market. By definition, the market, such as the S&P 500 Index, has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the market.

For example, we can see the beta for Amazon, Inc. (AMZN) is 1.19, which indicates that according to Amazon's price history, Amazon moves with the S&P 500, but just a little further in both directions.

- A stock that move more than the market over time will have a better higher than 1.0.

- If a stock's move is more muted than the market, the stock's beta is less than 1.0.

- High-beta stocks (2.0+) are inherently riskier but potentially provide higher return potential; while low-beta stocks pose less risk but lower more predictable returns.

Beta is a component of the capital asset pricing model (CAPM), a component of Modern Portfolio Theory which is used to calculate the expected return of equity investing. The CAPM formula typically uses the total average market return (S&P 500) and the beta of the stock to determine the expected rate of return investors should expect for taking the risk.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

You can monitor beta at the individual stock level, and you can also monitor beta at the portfolio level.

3. Portfolio Diversification

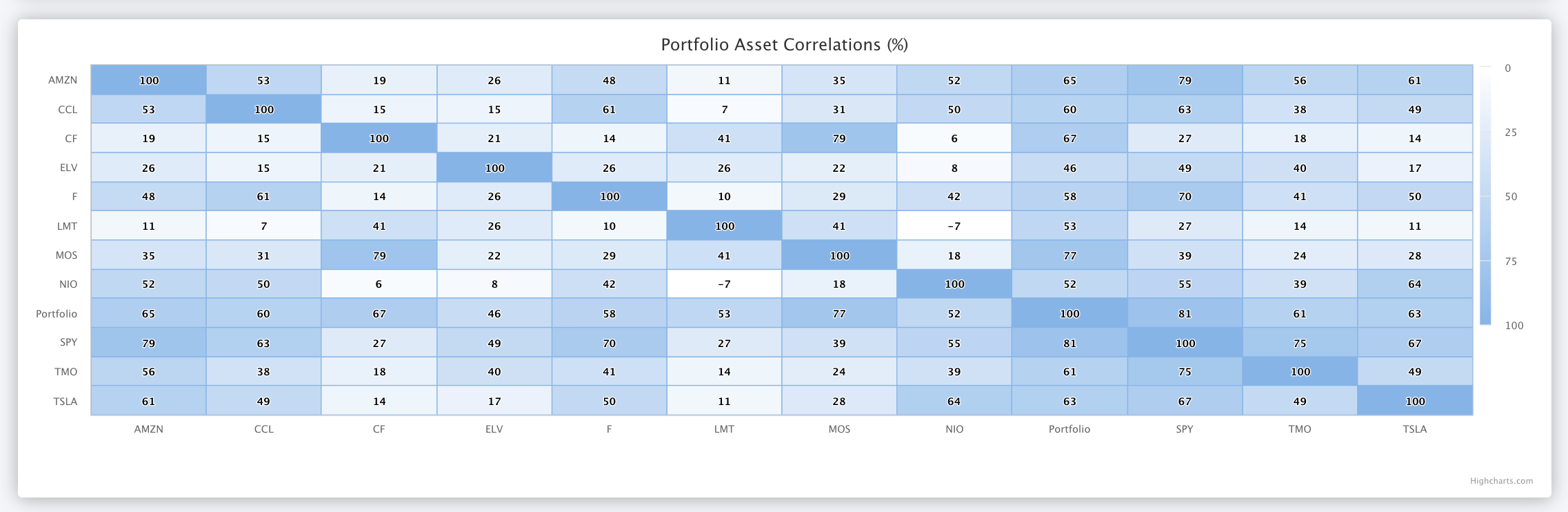

Diversification is the only free lunch investors get when it comes to reducing risk in their portfolios. The process of diversification includes investing in various cross-sections of companies within different industries, market caps, and sectors, but as well as across asset classes, such as stocks, REIT's, ETF's, and ETN's.

If you're not sure diversified you are, you can build your portfolio in Synvestable and then use the Auto-Diversification feature, which will automatically recalculate all your portfolio weightings by sectors or market cap.

This also means investing in assets that are not as correlated to one another. Here's an example of a portfolio built on Synvestable that uses the Asset Correlation Matrix to determine how correlated each position in the portfolio is to each other.

The main idea is to select various assets and securities with different behavior profiles toward systematic market risk—this hedges against the impact of any negative conditions that could adversely affect your portfolio.

Don't Let Years of Lost Compounding Cost You

Get the the special research that still beats the market.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

DISCLOSURE: Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com