Growth is one of the most popular factors in factor-style investing—but how do we recognize a true growth stock?

Famed investor Phillip Fisher once said, “I think it is more conservative in the long run to be in a company that is really progressing and really has an edge.”

And if rings true with you, then this week's article will certainly be of interest as it will focus on everyone's favorite types of stocks—growth stocks.

“I think it is more conservative in the long run to be in a company that is really progressing and really has an edge.” - Phillip Fisher

Growth stocks or factor growth fits into a paradigm today known as factor-style investing.

This is because market performance based on such factors can shift, with the market favoring one factor more than other factors depending upon the prevailing economic conditions.

Synvestable Factor Investing Series - Part 2

This we'll be the second article in our 6-Part Factor Investing Series. Today, we'll go over exactly what factor-style investing is and how you can apply factor growth as an investment strategy. We'll go over specifically:

- What is Factor Style Investing?

- Are All Stocks About Growth?

- Risks Involved with Factor Growth

- Legendary Growth Stocks Investors

- The Best Books on Growth Stocks

- The Key Financial Metrics for Factor Growth

- Extending Factor Growth With Other Factors

So let's without first ado—let's dive in to growth stocks. But first...

What is Factor Style Investing?

Factor style investing, also known as factor-based investing, is an investment strategy that focuses on targeting specific factors or characteristics that are believed to drive stock returns.

Factors represent systematic sources of risk and return that can be persistent and pervasive across different asset classes and time periods.

Factors can include various attributes or characteristics of stocks such as:

- Value

- Market Cap

- Growth

- Momentum

- Quality

- Low volatility

These factors are believed to have a long-term impact on stock performance and can be used to construct portfolios or investment strategies.

Factor-style investing involves selecting stocks or securities based on their exposure to one or more factors. Investors may choose to overweight or underweight certain factors based on their investment objectives, risk appetite, and market outlook.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Today's article will be focused on growth stocks and how you can create thematic portfolios around company's with highly-anticipated growth.

It's important to note that with any factor-style investing, it is based on the premise that factors can influence stock returns over the long term, but their performance can be cyclical and subject to market conditions.

Are All Stocks About Growth?

Believe it or not, not all types of investing are about growth—some investment styles are about income or like in our previous article on factor value—value realization.

While growth stocks and value stocks both attempt to deliver capital gains, their methodology for doing so differs drastically—value stocks are about value realization, while growth stocks are about value appreciation.

Value stocks are about value realization, while growth stocks are about value appreciation.

Factor growth focuses on identifying companies with strong growth prospects, which typically exhibit higher revenue and earnings growth rates compared to the broader market. These growth-oriented companies tend to operate in industries that are poised for expansion, driven by technological advancements, changing consumer preferences, or disruptive innovations.

Factor growth attempts to deliver the following benefits when it comes to portfolio design:

Potential for High Returns: Historically, growth stocks have outperformed the broader market during periods of economic expansion. Investing in well-managed companies with strong growth potential can lead to substantial capital appreciation over the long term.

Portfolio Diversification: Growth stocks can provide diversification benefits to an investment portfolio. They often have low correlations with value stocks or other investment styles, which means their performance may not align with the broader market. Incorporating growth stocks in a diversified portfolio can help mitigate risk.

Capitalizing on Future Trends: Growth stock investors have the opportunity to capitalize on emerging trends and industries that are poised for significant growth. Whether it's renewable energy, e-commerce, artificial intelligence, or healthcare technology, growth investing allows investors to be part of the growth story.

Compounding Wealth: As growth companies reinvest their earnings back into the business, shareholders can benefit from the compounding effect. Over time, this compounding can result in substantial wealth creation, especially for long-term investors.

Risks Involved with Factor Growth

There are some inherent risks involved with growth stocks, and the mostly are focused around the following areas:

Volatility: Growth stocks tend to be more volatile than value stocks or the overall market. Their high valuations and investor expectations make them susceptible to larger price swings in response to market fluctuations or company-specific news.

Market Sentiment Shifts: A change in market sentiment or macroeconomic conditions can impact growth stocks disproportionately. During periods of market downturns or increased economic uncertainty, growth stocks may experience more significant price declines.

Valuation Concerns: High valuations can be a double-edged sword. If a growth stock fails to meet lofty growth expectations, it may experience a sharp decline in its share price as investors adjust their valuations. Assessing the underlying fundamentals and valuations is crucial to avoid overpaying.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Legendary Growth Stocks Investors

Below are some renown investors who's investing style centered around factor growth:

Thomas Rowe Price Jr: Thomas Rowe Price Jr was the founder of T. Rowe Price Associates, a renowned investment management firm. Price focused on growth investing and is credited with pioneering the concept of growth stocks. He believed in conducting thorough research and identifying companies with strong growth potential and competitive advantages.

Peter Lynch: Peter Lynch is widely regarded as one of the most successful growth investors of all time. As the former manager of the Fidelity Magellan Fund from 1977 to 1990, Lynch achieved an average annual return of approximately 29%. His investment approach focused on finding undervalued, high-growth companies with sustainable competitive advantages, coined as "tenbaggers" (stocks that increased in value tenfold).

Pro Tip: Synsense Advisor can create growth portfolios in the style of any legendary growth investor. Check it out!

Mary Meeker: Mary Meeker is a renowned venture capitalist and former Wall Street analyst. She gained prominence as the "Queen of the Internet" during the dot-com era for her accurate predictions and understanding of emerging technologies. Meeker is known for her annual Internet Trends report, which provides valuable insights into the digital landscape and identifies investment opportunities in high-growth sectors.

William J. O'Neil: William J. O'Neil is the founder of Investor's Business Daily and is known for his CAN SLIM investing methodology. O'Neil emphasized the importance of investing in companies with accelerating sales and earnings growth, strong institutional sponsorship, and chart patterns that indicate favorable price momentum.

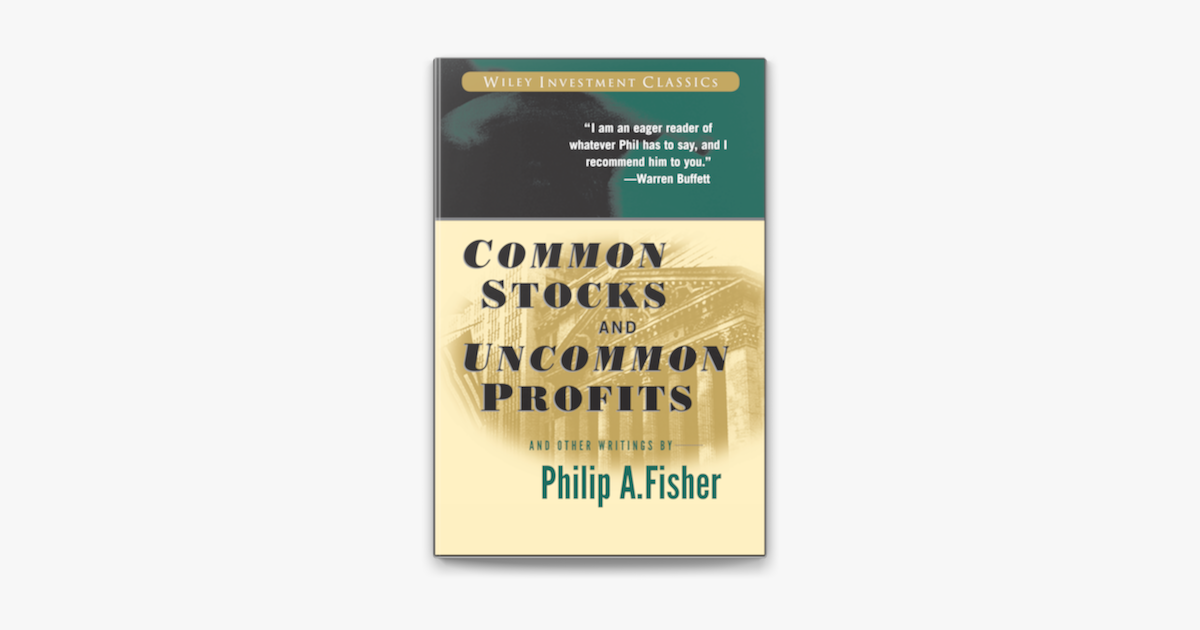

Philip Fisher: Philip Fisher, author of the influential book "Common Stocks and Uncommon Profits," was a prominent growth investor. He focused on long-term investments in companies with strong management teams, innovative products or services, and sustainable competitive advantages. Fisher's investment philosophy emphasized the importance of understanding a company's potential for long-term growth.

Cathie Wood: Cathie Wood, the founder and CEO of ARK Invest, has gained significant attention in recent years for her focus on investing in disruptive technologies and innovative companies. Wood's investment strategies target high-growth sectors such as artificial intelligence, genomics, robotics, and renewable energy. Her active management approach has resulted in impressive returns and has made her a leading figure in growth investing.

The Best Books on Growth Stocks

Below is a compiled list of some of the most well known books on investing in growth stocks and factor growth opportunities:

"Common Stocks and Uncommon Profits" by Philip Fisher: Philip Fisher's classic book provides insights into his investment philosophy, focusing on growth investing. He emphasizes the importance of understanding a company's competitive advantages, management quality, and long-term growth prospects.

"One Up On Wall Street" by Peter Lynch: Peter Lynch, renowned for his successful tenure at the Fidelity Magellan Fund, shares his investment strategies in this popular book. Lynch discusses how individual investors can identify and invest in high-growth companies before Wall Street catches on. He provides valuable insights on stock selection, industry analysis, and the importance of staying informed.

"The Little Book That Still Beats the Market" by Joel Greenblatt: In this book, Joel Greenblatt introduces the concept of "magic formula" investing, which combines factors of value and quality. Greenblatt outlines a straightforward approach to investing in growth stocks that are also attractively priced, aiming to achieve above-average returns.

"The Little Book That Makes You Rich: A Proven Market-Beating Formula for Growth Investing" by Louis Navellier: In this book, Navellier presents his growth investing strategy, which involves focusing on companies with strong earnings growth, sales growth, and positive analyst revisions. He explains how investors can identify high-growth stocks and achieve market-beating returns.

"100 Baggers: Stocks That Return 100-to-1 and How to Find Them" by Christopher W. Mayer: This book focuses on identifying stocks that have the potential to deliver exceptional returns, often referred to as "100 baggers" (stocks that increase 100 times in value). It delves into the qualities and characteristics of these high-growth stocks and provides insights into finding and holding such investments.

The Key Financial Metrics for Factor Growth

Identifying growth stocks relies on a few keys factors related to both financial metrics and qualitative company factors:

Rapid Revenue and Earnings Growth: Growth stocks are known for their ability to deliver robust revenue and earnings growth rates. Investors are attracted to these companies because these companies' expansion often outpaces the broader market, leading to potential outsized returns.

Innovative and Disruptive Business Models: Many growth stocks operate in industries that are undergoing significant transformations. They often employ innovative business models, disruptive technologies, or offer unique products or services that have the potential to reshape industries and generate substantial growth.

High Valuations: Due to their promising growth prospects, growth stocks often trade at higher valuations compared to their peers. Investors are willing to pay a premium for the anticipated future earnings growth, which can make valuing growth stocks a challenging task.

Minimal or No Dividends: Instead of distributing profits to shareholders in the form of dividends, growth companies typically reinvest their earnings into expanding their businesses, driving further growth. This approach allows them to allocate resources towards research and development, marketing, or acquisitions to fuel future growth.

Pro Tip: Synvestable company page provides Premium Members with all of these metrics as well as visualized company financials for quickly scanning revenue and earnings growth.

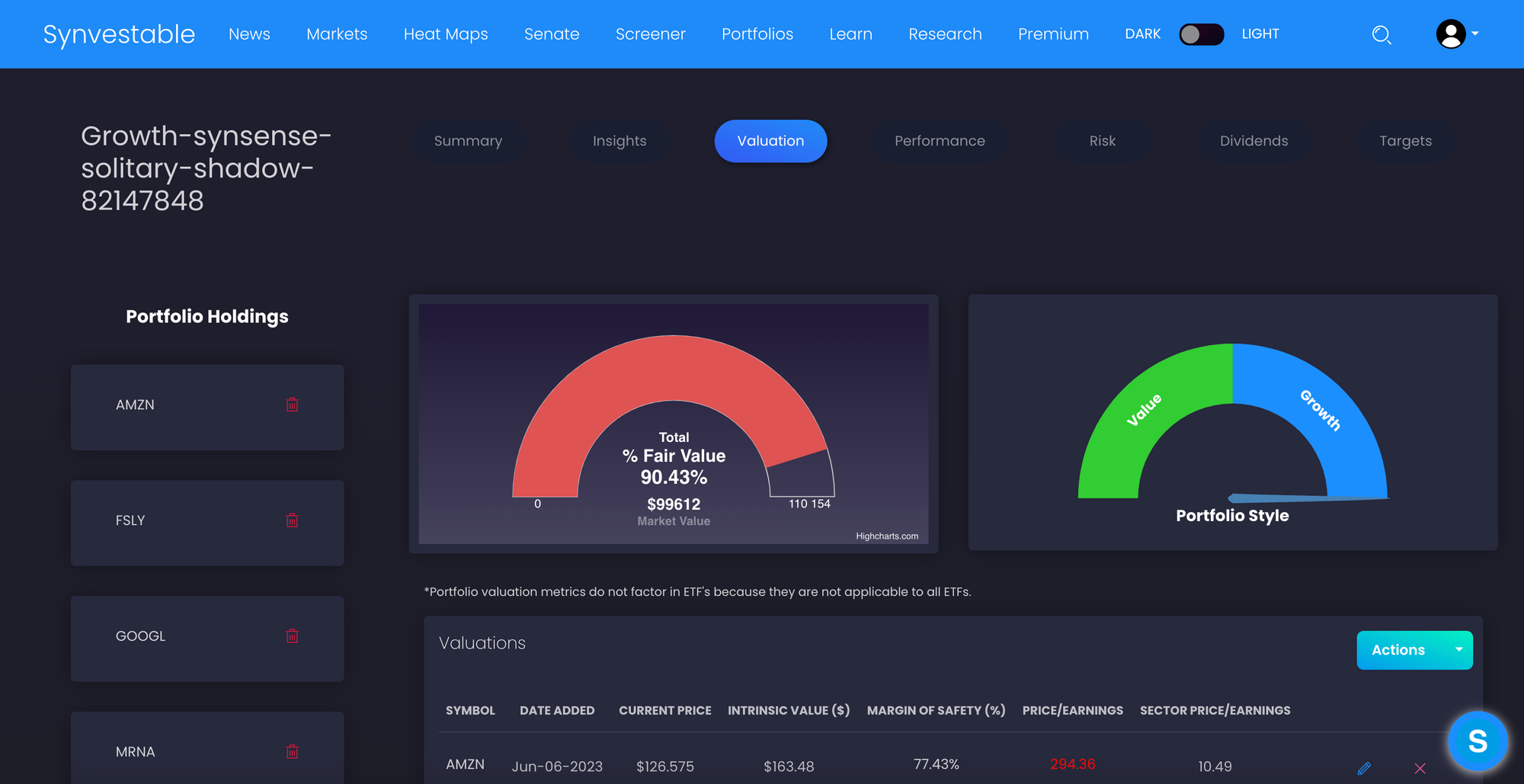

You can also use the Portfolio Valuation section to ensure that your overall portfolio style is utilizing factor growth.

Extending Factor Growth With Other Factors

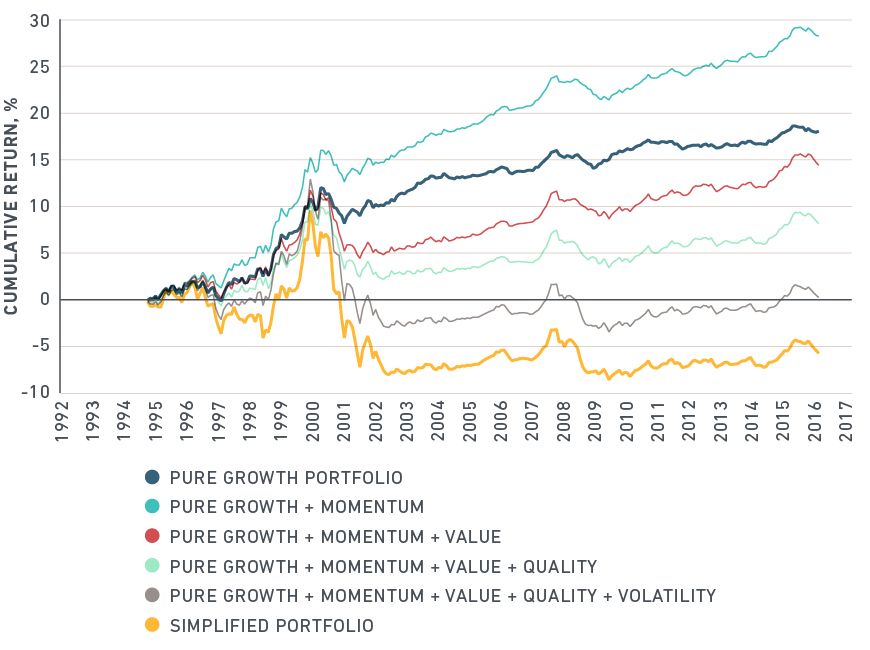

Looking at the performance of growth stocks dating back to 1992 and using the financial metrics listed above, we can see that using just growth alone underperforms than if you're combining factors.

You can also combine growth with quality, momentum, and value factors for outsized returns—which is exactly what we did in our Blueprint Investing Formula.

Our e-book outlines over 25+ quantitative factors—combining financial metrics from value, quality, growth factor styles—the result of which created us a simple framework that continues to beat the market when combined with a proper portfolio strategy.

Get the the special research that still beats the market.

Stay tuned on this series when we go into the next type of factor style investing—factor momentum. Subscribe or register for free below and you'll be registered to receive all our posts and Factor Style Series via email.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!