It may seem a bit dramatic to label a developing banking crisis as a potential financial Armageddon, but then again, maybe it isn't.

Off the news of the Federal Reserve and Jerome Powell raising the interest rate on federal funds an additional 25 basis points yesterday, the implications rising interest rates are having on the financial sector are dire.

The truth is the U.S. financial system is facing a contagion right now that even the mainstream financial media does not completely understand, but sideline experts have been talking about for years now—as far back as 1994 and 2013.

In this article, we're going discuss three key things about the developing contagion:

- What you already know about - Declining Treasury Portfolios, SVB failure, etc.

- What you don't know about - Interest Rates Swap, FX Swaps, Swaptions, etc.

- The implications of the later combined with the former.

We'll also talk about how a Mexican billionaire predicted this exact financial contagion back in 2013.

Those 2008 Derivatives — They're Back...

"Financial history doesn't repeat itself,

but it does rhyme."

If you're not familiar or remember what a derivative is, here's a simple definition.

A derivative is a tradable financial instrument that derives its value from something else, but with a lot more leverage.

For an example, a CALL option represents 100 shares of a stock for a specified duration of time, but cost a fraction of the price with exposure to the same gains or losses if you had actually bought the equivalent 100 shares.

There's more risk involved in using derivatives because the leverage involved can cause massive swings in value. If you know what you're doing, they can also be used as a directional hedge.

For example, you buy a 100 shares of Microsoft stock at $200 and also buy a long-dated PUT at $200—a downward directional bet.

That way you're exposed only to the upside of the 100 shares Microsoft stock and have insurance on the downside from the PUT, the equivalent short position of 100 shares.

Derivatives Come In All Different Flavors

While options are pretty straight forward to understand at a basic level, their mathematics for analysis become complicated, often involving stochastic calculus if you really want to understand your position exposure.

Derivatives come in all different flavors—you can make a derivative involving anything if you really want to...

I could underwrite you a call option on 100 vats of vanilla ice cream, with the derivative declining in value relative to how fast the ice cream melts.

All you'd need to value such a derivative is the market price of vanilla ice cream, the temperature of the room it's sitting in, and the expiration date of the milk.

You could then graph the value of this plain-vanilla derivative along a continuum using a function.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

From Ice Cream To Interest Rates

In fact, that is what high finance is all about nowadays—making markets for exotic financial instruments, often "over the counter", which means not traded on an exchange, but using an investment bank as the central processing party.

In the past, banks would use derivatives to hedge their positional exposure—if a bank holds a lot of mortgages assets on their balance sheet, they can package those into a mortgage-backed security (MBS) and sell off those mortgages in bulk to hedge funds.

This moves them off their balance sheet and decreases their negative delta exposure to the real estate market in the event of a housing downturn.

However, banks started to use derivatives as a form of making profits along the way, rather than just using them as hedges—one such derivative called interest rate swaps is forming the basis for our next major financial crisis.

Swap, Swaptions, Bear Stearns, Oh My...

One of the most widely used derivatives in banking is the interest rate swap. You may have heard of a credit default swap (CDS), one of the smoking guns in the 2008 Great Financial Crisis—but what exactly is a swap?

It's actually exactly what it sounds like, it's a derivative contract who's value changes based on the transfer of risk from one party to another. One party swaps their risk exposure with a counterparty for a payable premium.

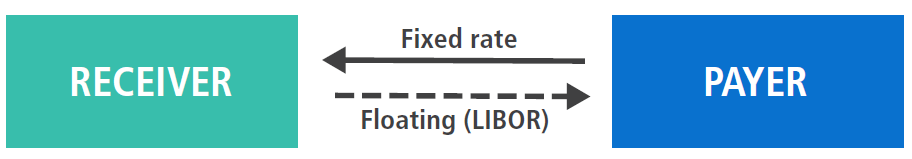

Interest rate swaps are pretty straight forward—in the example below one party is swapping variable interest rate risk (LIBOR) with another party and pays a fixed premium for that consideration.

The receiver receives a fixed rate for the equivalent dollar value exposure to the variable floating point rate. As the variable rate increases or decreases, the payer continues to pay the fixed rate to the receiver, but the value of the underlying swap contract changes in value.

If the payer had not entered this contract and interest rates increased, then the payer would have to pay more in interest payments.

Instead, the risk is swapped with the receiver—the payer continues to pay a fixed rate, and the cash-out value of the swap contract increases for the payer, off-setting the difference in rates.

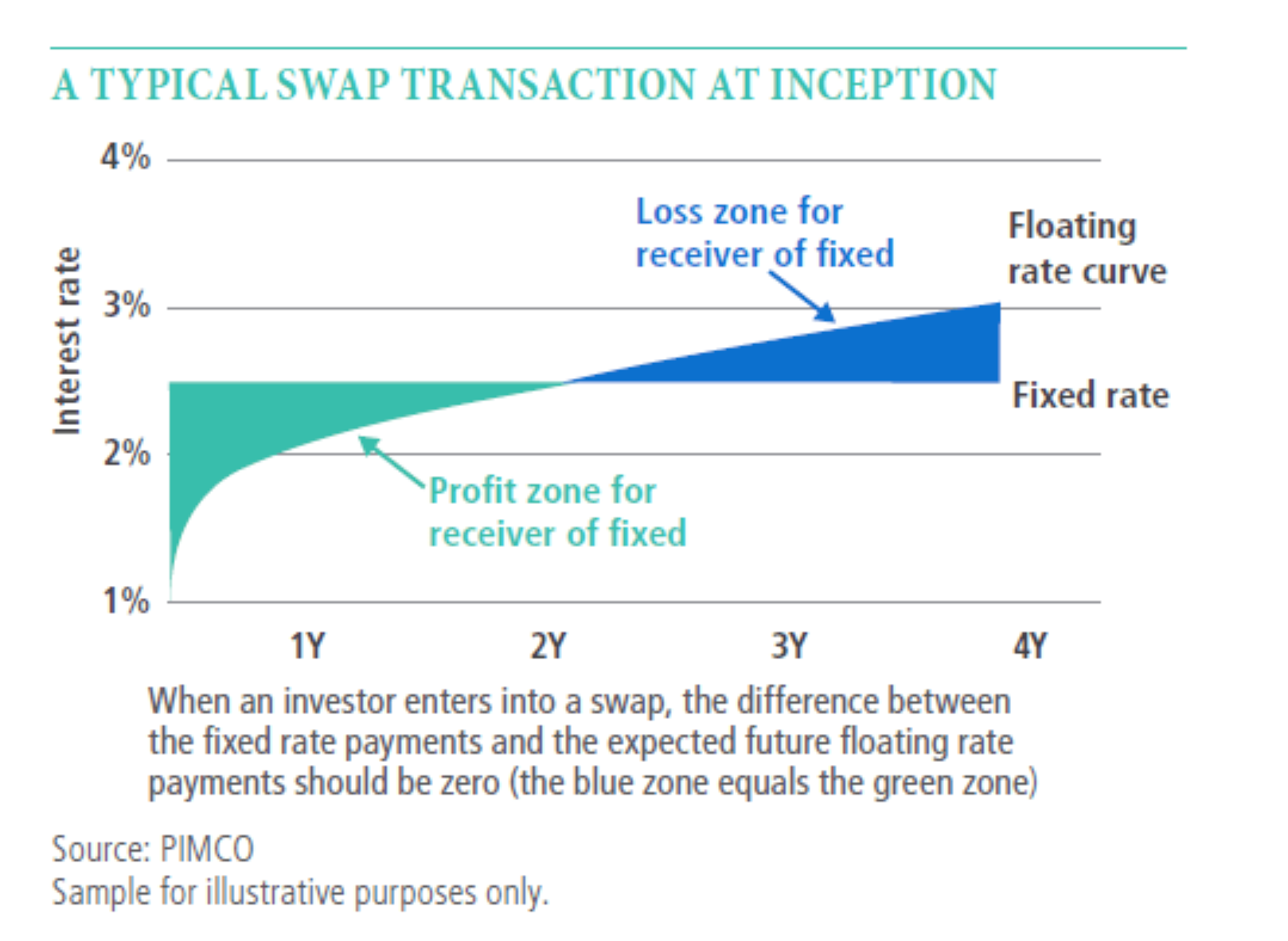

Below is graph of how the value of an interest rate contract profit curve looks for both the receiver and the payer of an interest rate swap. You can also see how a bank marks the value of an interest rate swap here.

Companies use this type of arrangement to manage their cashflows, market participants also use them to speculate on interest rates.

Banks underwrite these derivatives and serve as the counterparty to the company or other entity wanting to enter into the swap. The bank would receive fixed payments and assume the floating point risk, reflected in the swap contract's value.

In a normal environment, if a bank started to lose money on an interest rate swap, they could can set up a countervailing swap – essentially a mirror image of the original swap – with a different counterparty to “cancel out” the impact of the original swap.

But in the current interest rate environment environment—banks can't do that.

This Time Is Different—No, Really.

In the previous example, if a bank is losing money on a swap, they could write a mirror image swap with another counter party to hedge their floating point rate exposure—however, that doesn't work in an environment with rapidly increasing interest rate hikes, such as what has been happening since 2022.

That's because even if they establish a countervailing swap, the original swap's loss position will always be greater than the new swap's position offset.

Even worse is that these contracts are not marked to market in real-time. The value of the contract is often not reset or marked to market for 30 days, 6 months, or a year. This means that banks are sitting on swap losses that they may not have even calculated yet.

This means that banks are sitting on swap losses that they may not have even calculated yet.

Now let's expand the problem—multiply that loss by thousands and thousands of interest rate swaps, throughout the entire financial system, coupled with 9 consecutive interest rate hikes of 25-75 basis points, and we have all the ingredients for mounting exponential losses on chained derivative positions across the entire financial sector.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

How Big Is The Problem?

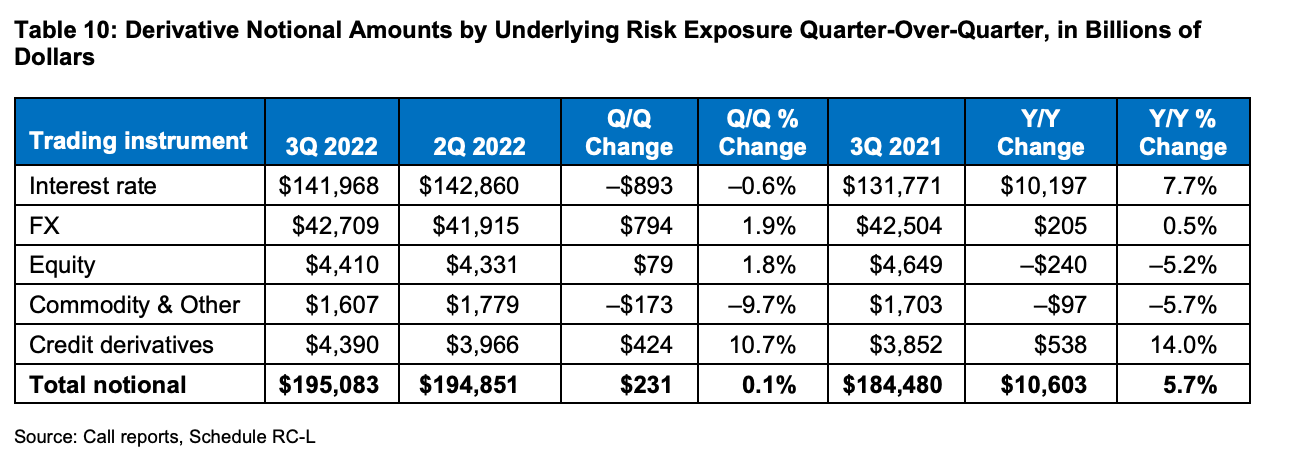

Right now, data is showing that interest rate swaps make up more than 80% of the value of all derivative contracts signed by U.S. commercial banks, totaling about $141 trillion in notional value.

Foreign exchange swaps, which are also interest rate sensitive derivative products, represent another $42 trillion.

As a comparison, the enter federal budget of the United States is only $6.2 trillion.

While notional values alone won't tell us much about how directionally exposed the banks are to floating point interest rate risks on their swaps, we do know that 60% of US regulated banks hold a net-long interest rate exposure through derivatives, meaning they would suffer from a rise in bond yields.

“The amount of interest-rate risk banks have remains locked inside a black box...even a sophisticated investor who reads all the footnotes to bank financial statements cannot determine how much money they are making on interest-rate bets or how much exposure they have.”

- Frank Portnoy,

University of San Diego, Morgan Stanley

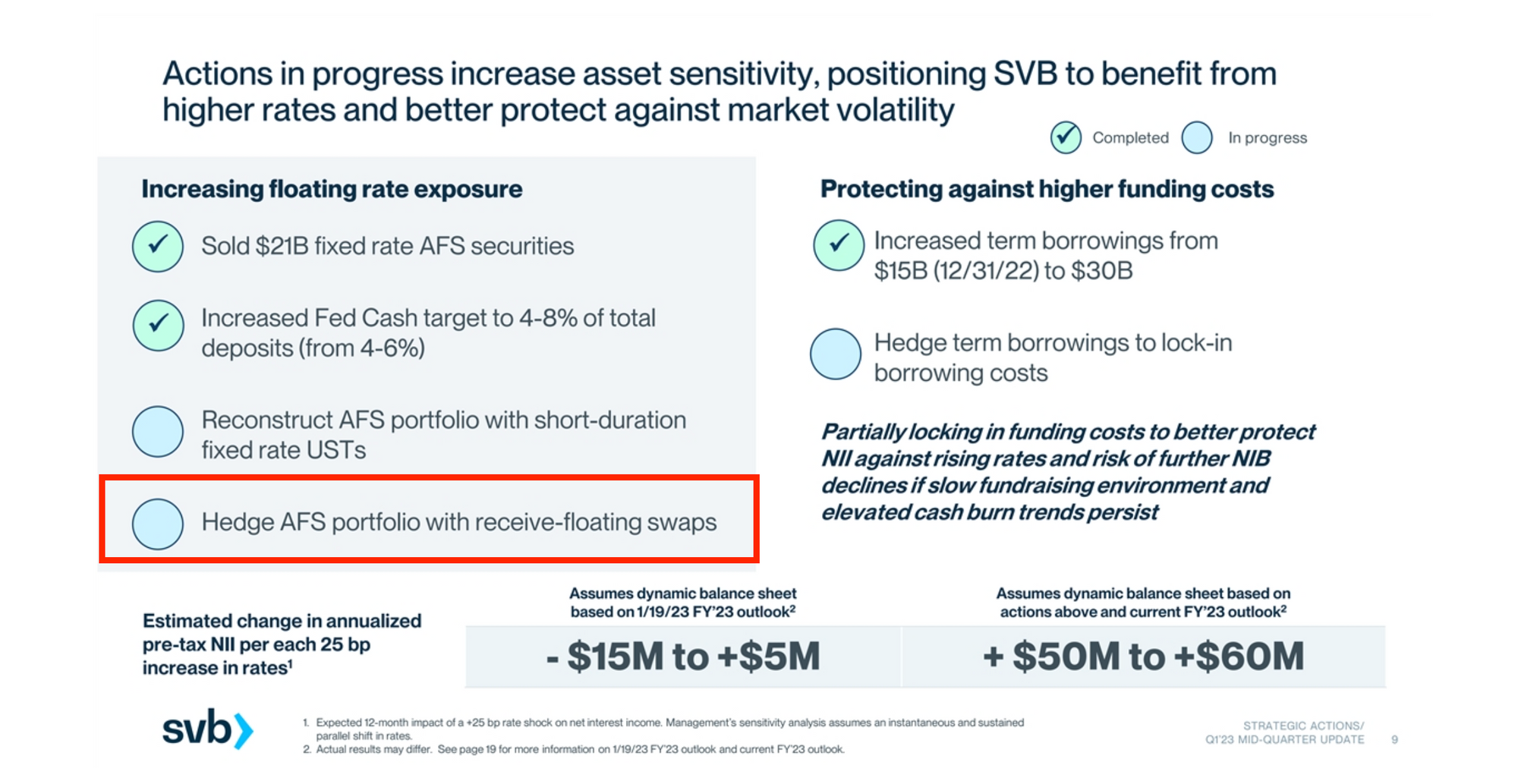

Looking at SVB's pitch deck for their mixed-shelf capital raise just days before they collapsed, we can see that floating-point interest rate risk was one of the main reasons for the capital raise.

From this point alone, we can reasonably assume that SVB was heavily exposed to not only losses on the U.S. Treasury positions on the AFS portfolio, but also on their receive-fixed swap positions—about $27.7 billion in notional value on their books.

This notional value pails in comparison to what still lies beneath in the financial system.

According to the “Quarterly Report on Bank Trading and Derivatives Activities” of the Office of the Comptroller of the Currency, a total of 1,211 insured U.S. national and state commercial banks and savings associations held derivatives, but 88.6% of these were concentrated in only four large banks:

- J.P. Morgan Chase ($54.3 trillion)

- Goldman Sachs ($51 trillion)

- Citibank ($46 trillion)

- Bank of America ($21.6 trillion)

- Wells Fargo ($12.2 trillion)

Losses on swaps caused by higher long-term rates can either directly hit a bank’s income statement or erode its equity before crimping future earnings, depending on how the contracts are characterized under accounting rules.

Didn't We See This Coming?

The exposure to rising interest rates has been well-known as the majority of banking institutions hold zero hedges against rising interest rates—and why should they? We've had declining interest rates since the 1980's.

However, many sidelines analysts and even foreign billionaires warned us years ago. As Michael Snyder wrote in a 2013 article titled “A Chilling Warning About Interest Rate Derivatives:”

Hugo Salinas Prince mentioned to King News that same year:

"I think we are going to see a series of bankruptcies. I think the rise in interest rates is the fatal sign which is going to ignite a derivatives crisis. This is going to bring down the derivatives system (and the financial system)." - Hugo Prince

"There are (over) one quadrillion dollars of derivatives and most of them are related to interest rates. The spiking of interest rates in the United States may set that off. What is going to happen in the world is eventually we are going to come to a moment where there is going to be massive bankruptcies around the globe." - Hugo Prince

Where do we go from here? Time will tell, but there's no question that all the pieces are in places for a massive credit crunch that stands to make the 2008 Great Financial Crisis pail in comparison

Sources:

- "Most Regional Banks Haven't Hedged Rising Interest Rates" https://www.ifre.com/story/3801079/most-us-regional-banks-havent-hedged-rising-rates-report-pknzgrcws1

- "Rising Rates Seen Squeezing Swaps Income at Biggest Banks" https://www.bloomberg.com/news/articles/2013-09-26/rising-rates-seen-squeezing-swaps-income-at-biggest-banks#xj4y7vzkg

- "The Looming Quadrillion Dollar Derivatives Tsunami"

https://scheerpost.com/2023/03/12/ellen-brown-the-looming-quadrillion-dollar-derivatives-tsunami/ - "A Chilling Warning About Interest Rate Derivatives" https://www.investing.com/analysis/a-chilling-warning-about-interest-rate-derivatives-178503

- "Dollar Debt in FX Swaps & Forwards: Huge, Missing, and Growing" https://www.bis.org/publ/qtrpdf/r_qt2212h.pdf

- "SVB Q12023 Mid-Quarter Update" https://www.sec.gov/Archives/edgar/data/719739/000119312523064680/d430920dex992.htm

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!