One of the most searched dividend stocks on Synvestable, J.P. Morgan Equity Premium Income (JEPI) employs a sophisticated covered call strategy that aims to generate substantial passive income while mitigating downside risks—but does JEPI's disadvantages outweigh it's benefits?

The JPMorgan Equity Premium Income ETF (NYSE:JEPI) was introduced in 2020, designed to provide investors with extra premium income from a growth-oriented portfolio.

This actively-managed fund invests in a defensively-structured portfolio, grounded in meticulous fundamental analysis, and employs a disciplined options strategy using out-of-the-money S&P 500 index call options to produce regular monthly income.

With an attractive and alluring 7.3% yield, investors have been piling into the JEPI dividend as a cornerstone of their portfolio strategy—but is it all for naught?

In this article we're going to explore the reliability of the JEPI dividend and determine if the high yield is worth it in lieu of total returns from the S&P 500.

Advantages

- Defensively positioned

- Substantial dividend yield

Disadvantages

- Lacks tax efficiency

- Contains stocks that are currently overvalued

- Payouts have decreased and lack stability

- JEPI underperformed S&P 500 in total returns

Defensively Positioned & Substantial Yield

JEPI's approach involves managing a defensively-oriented equity portfolio that aims for a low correlation with the S&P 500, while methodically selling one-month call options against the index.

Options are traded in weekly segments to minimize path dependency, focusing on 30-delta calls to balance capturing index gains and earning option premiums. Instead of directly shorting options, the fund utilizes equity-linked notes (ELNs) that replicate the economic effects of call writing.

We're the best app in finance—Register using your Google Account. Just click the GIF!

While ELNs introduce additional counterparty risks, J.P. Morgan mitigates this by only dealing with globally reputable financial institutions, subject to stringent risk assessments.

The result is an annualized JEPI dividend yield of 7.3% based on its March distribution of $0.3452. Prior to this payment, JPMorgan reported the ETF's 12-month rolling dividend yield as 8.5%.

Lacks Tax Efficiency

While ELNs may offer favorable tax treatment on equity returns, they could be less beneficial for options income, particularly for investors in higher tax brackets who might prefer more tax-efficient alternatives.

Nonetheless, the fund's overall distribution frequently places it among the top performers in its category, making it appealing to those in lower tax brackets.

Generally, covered-call funds may not be the most effective long-term investments due to capped upside potential and vulnerability to significant market downturns, which could diminish long-term total returns.

Despite this, covered-call funds offer a straightforward alternative for investors looking to delegate this complex strategy, potentially alleviating the challenges of managing it independently.

Contains Stocks That Are Currently Overvalued

The portfolio composition of the fund may not be as conservative as suggested, given that its top five holdings include tech giants like Amazon.com, Inc. (AMZN), Microsoft Corporation (MSFT), and Meta Platforms, Inc. (META).

Although some stocks within the top ten holdings are more traditionally defensive, the leading position held by The Progressive Corporation (PGR) has almost doubled in recent months.

According to JPMorgan, JEPI's portfolio trades at a forward P/E ratio of 21 times earnings estimates, mirroring the S&P 500's valuation. However, despite similar valuation levels, the ETF has not demonstrated superior performance nor can it be deemed defensive with such a high P/E ratio.

With nearly $34 billion in assets, the fund's substantial size may be hindering its ability to generate exceptional income and achieve returns that match or exceed the market.

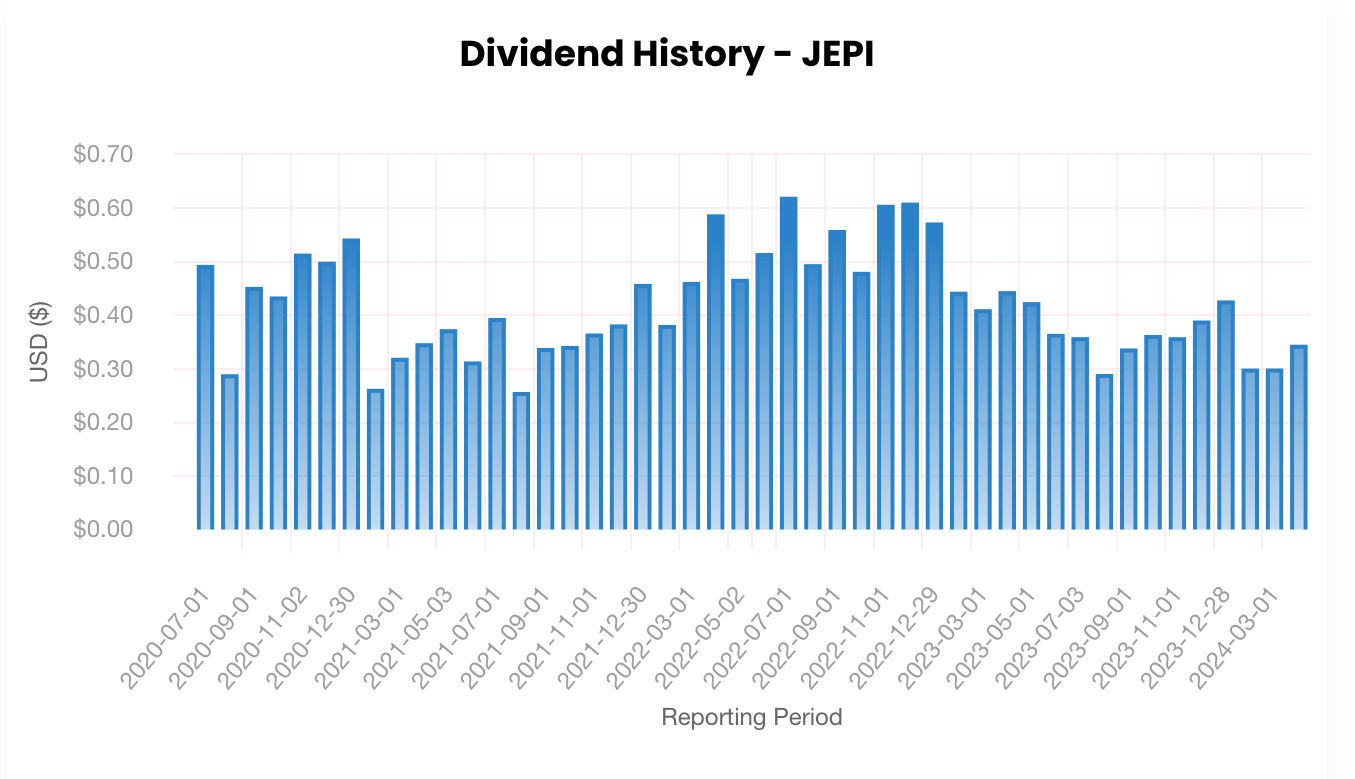

Payouts Have Decreased And Lack Stability

A significant concern with the ETF is the decline in dividend payouts. Income investors generally seek stable dividends, yet JEPI's monthly distributions, which reached as high as $0.60 in several months of 2022, saw a dramatic 50% reduction by mid-2023.

One major problem might be dividend investors' lack of awareness regarding the volatility in monthly distributions. The ETF experiences considerable fluctuations in the premium income generated through its options overlay strategy. This volatility, coupled with a high portfolio turnover rate of 190%, has led to instability in the payouts.

We're the best app in finance—Register using your Google Account. Just click the GIF!

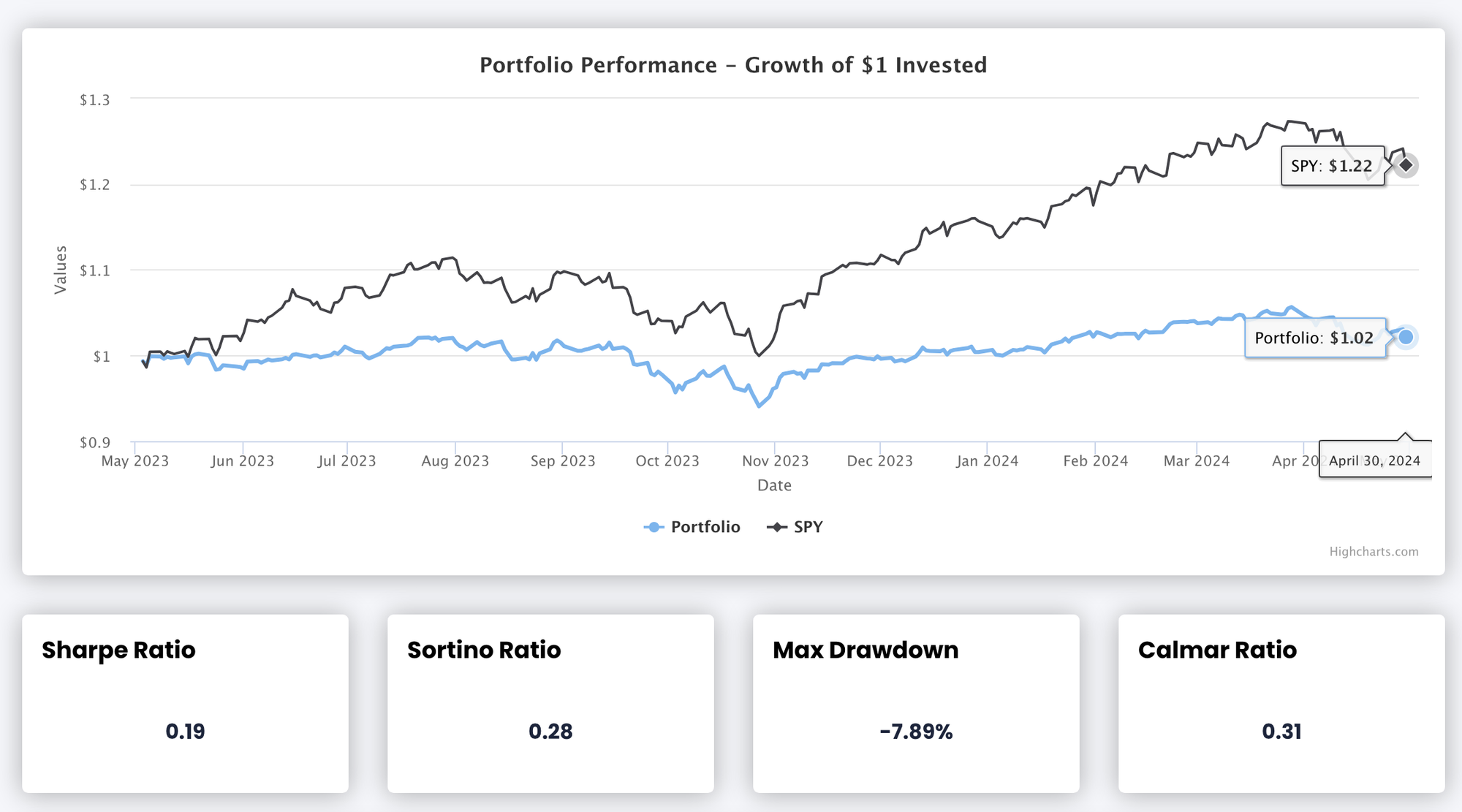

JEPI Underperformed S&P 500 in Total Returns

In addition to inconsistent income generation, JEPI has struggled to match the capital returns of the S&P 500 index, despite its allocation to some of the index's most aggressive stocks.

This underperformance is partly due to 20% of the portfolio having capped returns because of the ELN call options strategy. Over the past three years, the ETF has experienced negative price returns, while the S&P 500 index has risen nearly 30%.

The ultimate outcome is that the total return of the ETF significantly lags behind the S&P 500, even though it holds aggressively valued stocks from the index. The portfolio managers employ a riskier options strategy intending to boost income. However, the ETF’s performance falls short compared to an investor who simply invests directly in the S&P 500 index.

Our Overall Summary

The main point for investors to consider is that the JPMorgan Equity Premium Income ETF might not offer advantages over simply investing in the S&P 500 Index. The fund employs a covered call ETF strategy aimed at generating premium income; however, it has not only provided weak capital returns but also suffers from highly volatile monthly dividends.

JEPI does not represent a low-risk alternative to a savings account, as 80% of the fund is exposed to equity risk. Ultimately, the ETF tends to underperform the S&P 500, employing a complex ELN call option strategy. Often, the simplest approach—directly investing in the benchmark index—proves to be the best investment strategy.

We're the best app in finance—Register using your Google Account. Just click the GIF!