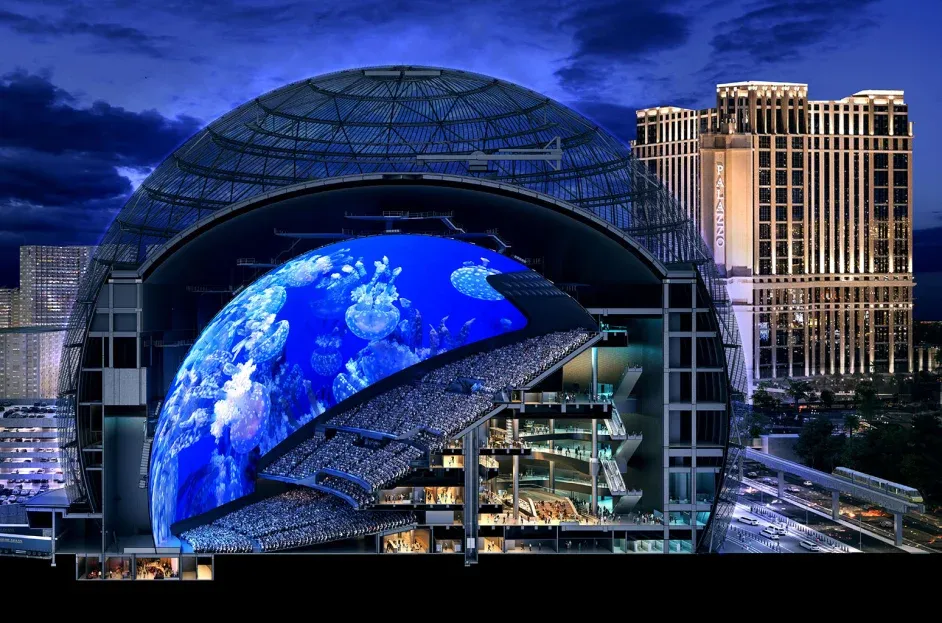

The Sphere in Las Vegas has runway until about late 2024 until they’re facing bankruptcy. Could this be an opportunity for one of the most unlikely of buyers to swoop in for the save?

The Sphere, Las Vegas’ newest eye-catching attraction, has posted a $98.4 million loss for the fiscal quarter, which would be expected given it only recently opened.

What isn’t expected is the simultaneous departure of CFO Gautam Ranji.

The New York Post reported that Ranji suddenly quit after a bout of yelling and screaming from CEO James Dolan. Ranji, who had been on the job for 11 months, will be replaced on an interim basis by Greg Brunner, the company's senior vice president, according to the filing.

The Sphere—currently owned by Sphere Entertainment Co. (SPHR)—currently has a cash runway until about late 2024, and then they’re facing bankruptcy.

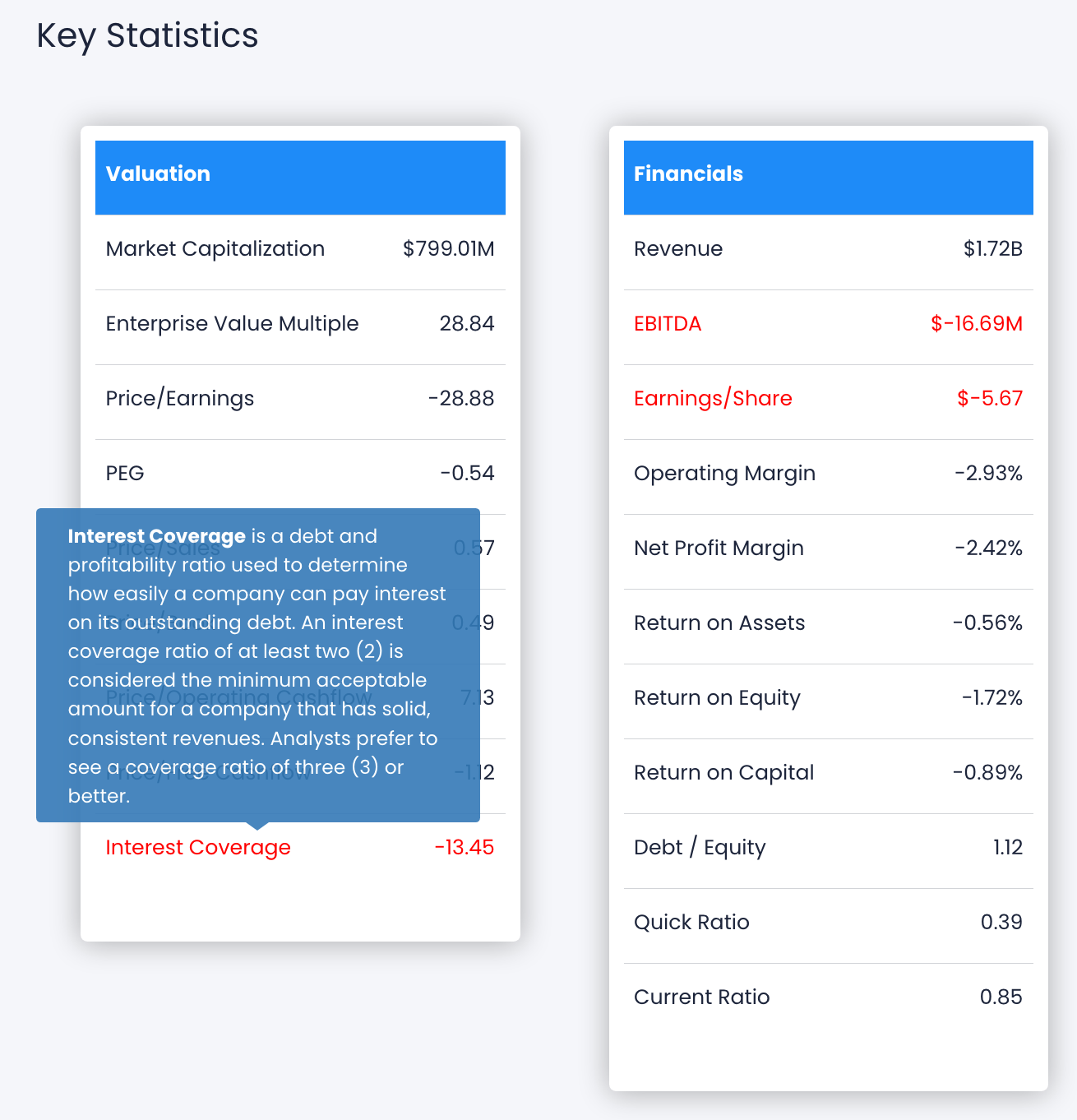

Synvestable shows a -13.45 interest coverage ratio for SPHR—that number is hard to comprehend for a coverage ratio and very rare. It means just the interest payments alone on SPHR's debt servicing is over 13x larger than their operating profit (EBIT).

If the Sphere can't pull their financials together by late 2024, we see a high probability for the most seemingly unlikely of buyers to swoop in—Amazon (AMZN).

A Sphere Acquisition Opportunity

Why Amazon? First, because Amazon has been having their AWS Re:Invent conference in Vegas for the last 11 years.

Re:Invent is where every year, Amazon Web Services takes over Las Vegas to announce new cloud product offerings, company presentations, cloud education opportunities, and vendor meet-and-greets.

So not only would having the premiere amphitheater of Las Vegas supplement Amazon's conference space that usually spans 6 different hotel properties with over 60,000 attendees, but the technology of the Sphere would lend itself to showcasing the latest in AI and cloud native technologies.

And when the conference is not being held, the Sphere would give Amazon a competitive advantage in the media/communications vertical for hosting live events and concerts where they could apply analytics for developing AI in audio generation, facial recognition, and crowd biometrics in ways that no other company would be able to.

The Sphere would prove to be the ultimate testing laboratory for what could eventually be known Emotional AI—and yup, you read that here first—AI models dedicated to the understanding of what drives crowd psychology, human emotion, and the overall excitement of live shows and conferences.

Imagine a machine learning laboratory where AI could actively train on predicting audience engagement and emotional resonance by being fed multi-dimensional data such as the effects of vocal intonation, rhythm, tempo, pyrotechnics, audio/visual effects, choreography, time between songs and all their relative effects on crowd engagement and emotion.

AI in the past has already been used as far back as 2003 to predict hit songs from companies like Hit Song Science, but the company didn't have the funding or capital base to thrive.

You could effectively converge your AI down to what really drives the “it” factor in entertainment superstars like Michael Jackson or Taylor Swift. It could be the birthplace of something even more wild than Amazon owning the Sphere—Amazon Records—where new artists could be developed in-house by working with the Sphere’s AI to better develop their songs, shows, and artistic personas—delivering maximum audience impact every single show.

You could effectively converge your AI down to what really drives the “it” factor in entertainment superstars like Michael Jackson or Taylor Swift.

Simply said—Amazon owning the Sphere would have the potential to become the Greatest Show on Earth and completely transform the entertainment industry.

A Foretelling Nudge

The 2023 AWS Re:Invent Conference ran from November 17th to December 1st, and while AWS's presence dominated the Las Vegas strip, they made one strategic PR mistake—they forgot to buy up the Sphere's advertising for that week.

Instead, Google Cloud swooped in and starting running ads 24/7 during the entire week of the AWS conference.

Imagine all of your conference attendees in breakout sessions learning about all the latest and greatest things your cloud is offering, only to walk outside and see one of your largest competitors offerings staring you in the face 24 hours a day—yikes!

The publicity stunt by Google Cloud's marketing team was nothing short of genius, and we can only imagine what the internal marketing meetings at AWS were like the following week...

You can be certain that Google Cloud's stunt was a top priority for internal discussions—and that some people definitely got an earful by executives.

The Sphere & Cloud Computing Synergy

There's little to no question of that the Sphere is the center of attention in Las Vegas and will continue to be with the potential to house millions of visitors per year and drive significant revenue opportunities.

But even more than that, it offers a laboratory to innovation within the field of machine learning to really learn the intricacies of human behavior.

Because of that, there's a high likelihood that if the Sphere's current corporate structure does need to declare bankruptcy in 2024, you can expect Amazon, Microsoft, Google, or even Oracle to be some of the first acquisition suitors to swoop in with a buy out price.

And with the Sphere's market capitalization of only $800M, shareholders of the cloud computing giants would face little to no dilution in an all-stock acquisition.

The Sphere is just too big of an opportunity for any of the cloud providers to ignore—it's the ultimate data center.

Even the first display ever ran by the Sphere—Hello World—is a hat tip to the first program software engineers learn to build when they are learning a new programming language.

All foretelling signs that the the Sphere could end up being one of the most important laboratories for artificial intelligence in the near future.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!