Michael Burry, famed 'Big Short' investor—shorts the market but mistakenly makes the same bet twice! Here's why...

Today on Synvestable, you may have noticed an interesting news story coming through the live headlines feed:

Michael Burry—famed investor who shorted the 2008 housing market, reveals a huge short position against the market.

This is all well and good—every investor will always have their own thoughts as to what they think the market will do, bullish or bearish...

However using Synvestable, today we'll show why the strategy he executed for this idea couldn't have been worse, and why it pays for itself several times over to use a quantitative platform like Synvestable to analyze how positions interact before committing to them!

Why Make The Same Bet Twice, Michael?

To clarify, what we mean is that regardless of what he thinks the market will do, the way he implemented this strategy makes no rational sense.

As the article shows, Burry shorted the market by buying PUTS against the Spyder S&P 500 ETF (SPY) with an undisclosed expiration and strike price.

However, he also bought PUTS on the Q's (QQQ) which is an ETF that tracks the NASDAQ—this logically makes no sense because he essentially just made the same bet twice!

Here's why...

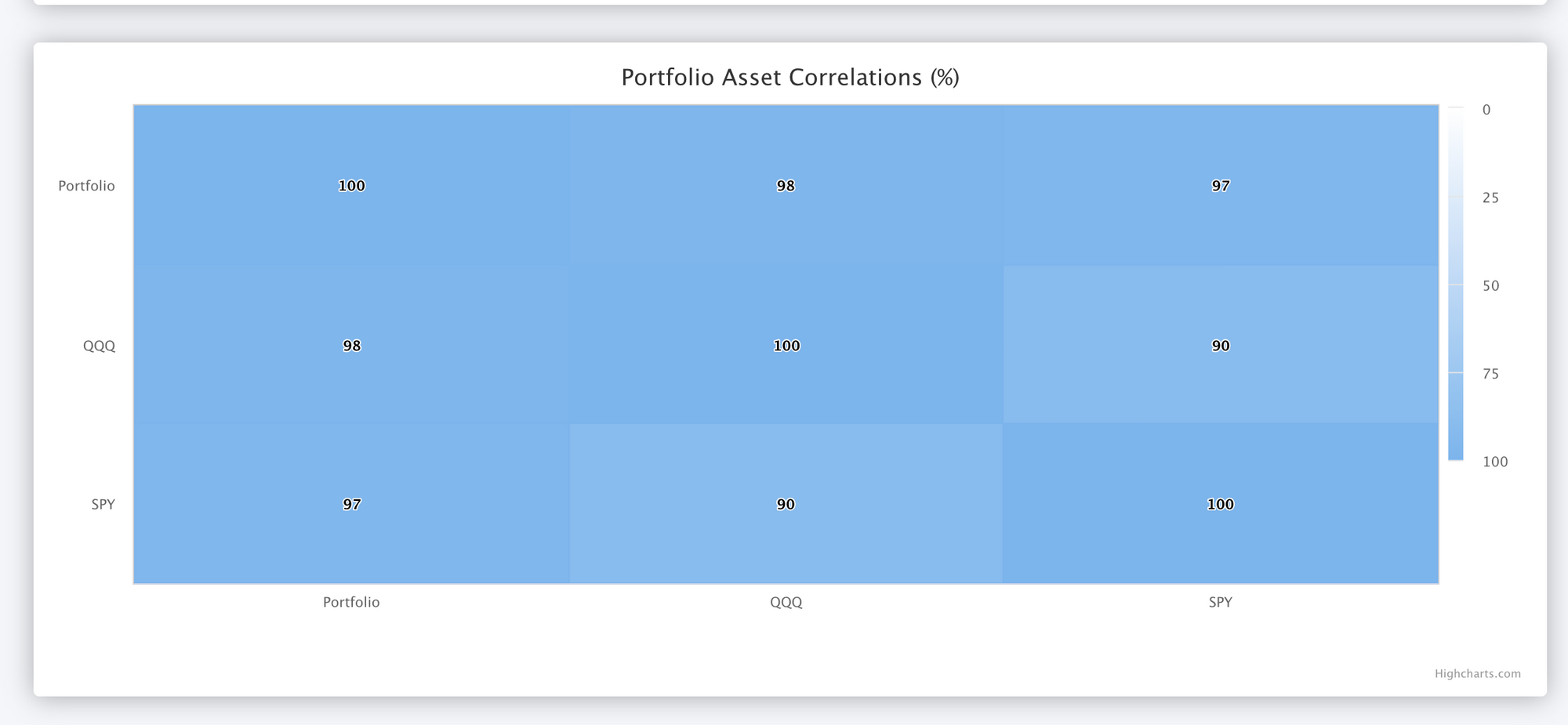

Using Synvestable's Quant Premium plan, we created a model portfolio containing both the Q's and SPY, below is the asset correlation matrix from the performance section of the portfolio—as you can see, the Q's and the SPY are almost 100% correlated to each other.

This means that Burry gains absolutely no statistical advantage in shorting the Q's and the SPY together—statistically speaking, it's essentially just doubling down on your first bet.

This makes intuitive sense as well—after all, 79 out of the 100 stocks in the NASDAQ are also in the S&P 500—by shorting the SPY, you've already shorted the majority of the NASDAQ!

This is one of the core tenets of why Synvestable exists—it's not just what you invest in, but how you invest in it that matters most.

It's not just what you invest in, but how you invest in it that matters most.

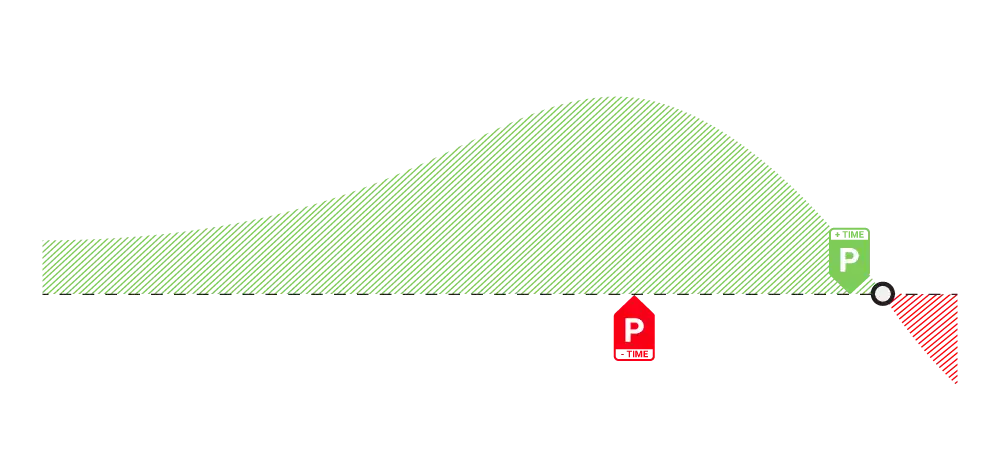

If Burry thinks the market is going to drop, a better strategy would have been take the second half of that bet and hedge the short term with a diagonal spread—buy long duration PUTS as your main bet, while selling shorter term duration PUTS at a different strike price to credit the position against a move in the opposite direction.

Then with that credit from the diagonal spread, buy short term duration U.S Treasuries for income to further pad the position if the market continues to grind up, giving you ample time to unwind if you're wrong on timing.

This is why it pays to use a quantitative platform like Synvestable—to make sure you're not unknowingly making the same bet twice!

Carl Icahn got crushed recently shorting the market, time will tell if Michael Burry will do better—because if he's wrong, our analysis shows he'll be double wrong!

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!