Before you tie the knot, ask your partner about these 5 things — 43% of married Americans admitted to lying about them later.

When love is in the air, and as you prepare to say your vows, it's time to have an open discussion about money with your future spouse.

According to a recent survey conducted by CNBC, financial infidelity is a common issue, with 43% of Americans in relationships admitted to withholding or lying about financial matters.

To start your marriage on the right track, here are five important financial conversations to have before you tie the knot:

- Sharing Your Money Perspectives

- Addressing Outstanding Debt

- Income and Spending Transparency

- Unveiling Credit Scores

- Setting Financial Goals

Sharing Your Money Perspectives

While it's essential not to judge your partner's spending habits, it's worth sitting down and discussing the financial lessons you each learned while growing up. Even if money was not openly discussed in your families, the way money was handled around you likely influenced your financial beliefs.

Ask your partner about their parents' spending habits, their family's attitude towards debt, and whether money was seen as abundant or scarce. This conversation becomes even more crucial if you come from different cultural or socioeconomic backgrounds, as your money norms may differ. While you may not entirely agree on saving and spending, understanding each other's money psychology can provide valuable insights into why your partner handles money the way they do.

Addressing Outstanding Debt

Among couples, 8% admit to lying about or withholding information regarding their debt. Although pre-marriage debt doesn't legally bind both partners, it can significantly impact your joint finances. Whether you plan to merge your finances or work towards shared goals, your debt obligations affect your ability to save and spend.

Start by listing each partner's debt balances, interest rates, and payment terms. Together, decide on a strategy to pay off the debts. The two popular methods are the debt snowball (paying off debts from smallest to largest) and the debt avalanche (prioritizing debts with the highest interest rates). Ultimately, the most effective method is the one you both agree on, so discuss your options and work together to tackle the debt.

Income and Spending Transparency

The survey reveals that 14% of couples have lied about their income, while 23% have concealed their spending. Your respective incomes and spending habits directly impact the available funds for building your life together. By openly sharing your current income and expenses, you can determine if you have enough money and, if not, brainstorm solutions.

Couples often have different perspectives on discretionary expenses. To address this, consider allocating an equal amount of personal spending money to each partner per month. This way, both parties agree on the amount of discretionary spending, even if individual purchases may not align with one another's preferences.

Unveiling Credit Scores

Around 12% of couples have hidden or lied about their credit scores. While marital status doesn't affect credit scoring, your individual scores can still have an impact. For instance, when applying for a mortgage, both partners' credit scores usually come into play. If one partner has poor credit and concealed it, it may lead to higher interest rates or even rejection, causing resentment.

It's crucial for both of you to check your credit scores and identify where you stand. If improvement is needed, create a joint plan to build credit together. This may involve reducing debt, setting up automatic payments, or disputing any errors on your credit reports.

Setting Financial Goals

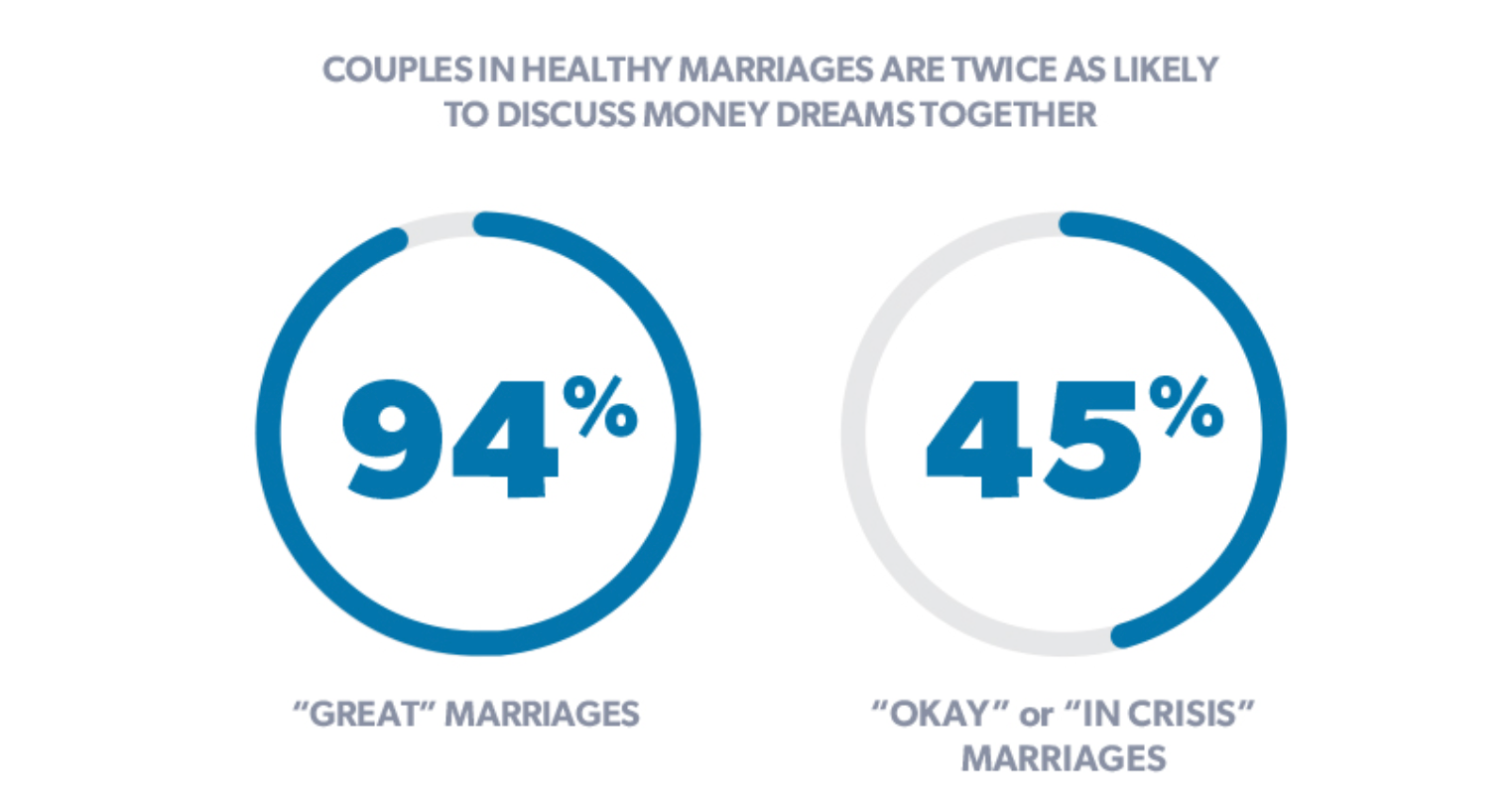

While money can be a source of stress, it can also be exciting to plan for the future. Discuss your individual aspirations that require financial resources, such as buying a home (with a median price of $342,000 in 2023, according to Zillow), embarking on a dream vacation, or starting a business. While accomplishing everything may not be feasible, don't dismiss any ideas just yet. Choose one or two goals and establish a tangible first step towards achieving them as a team.

According to recent data from the U.S. Census Bureau, almost 60% of American adults live with a spouse or partner. Building honesty and openness around finances, even if it feels uncomfortable at times, can lay a strong foundation for your household.

Register For Free in Seconds! Click The Image

Did you enjoy this analysis? It was super easy to do using a free account on Synvestable, the absolute best app in finance.

Register in 3 seconds using your Google Account!