For investors looking to diversify their portfolios with a mix of steady dividends, potential for growth, and competitive advantages, Pepsi products represent a compelling opportunity.

In the ever-evolving landscape of the beverage industry, PepsiCo stands out as a dominant force, renowned for its extensive array of products and innovative strategies. For investors looking to diversify their portfolios with a mix of steady dividends, potential for growth, and competitive advantages, Pepsi products represent a compelling opportunity.

We'll delve into the investment prospects of Pepsi products, focusing on key aspects such as dividends, growth potential, profitability, and the competitive landscape, with a spotlight on notable products like Pepsi Nitro and Pepsi Zero.

Understanding PepsiCo’s Portfolio

PepsiCo’s product line is diverse, encompassing not only soft drinks but also a wide range of snacks and beverages that cater to a global market. Among its most innovative offerings are Pepsi Nitro and Pepsi Zero, each targeting unique consumer segments and preferences. Pepsi Nitro, the first nitrogen-infused cola, offers a novel drinking experience with a smoother texture, appealing to consumers looking for an alternative to traditional sodas. On the other hand, Pepsi Zero caters to health-conscious individuals seeking zero-calorie options without sacrificing flavor.

Pepsi Nitro: Innovation in Texture and Experience

Pepsi Nitro was launched as the world’s first nitrogen-infused soft drink, offering a unique velvety texture...

. This product caters to the growing segment of consumers looking for a premium drinking experience in their colas. By investing in such innovative products, PepsiCo taps into new consumer trends and opens up additional revenue streams.

Pepsi Zero: Meeting Health-Conscious Demands

Pepsi Zero addresses the increasing consumer demand for healthier beverage options. With zero calories and robust flavor, Pepsi Zero has carved out a significant niche in the diet cola market. This product not only appeals to health-conscious consumers but also aligns with global health trends advocating for reduced sugar consumption.

Latest Financial Results

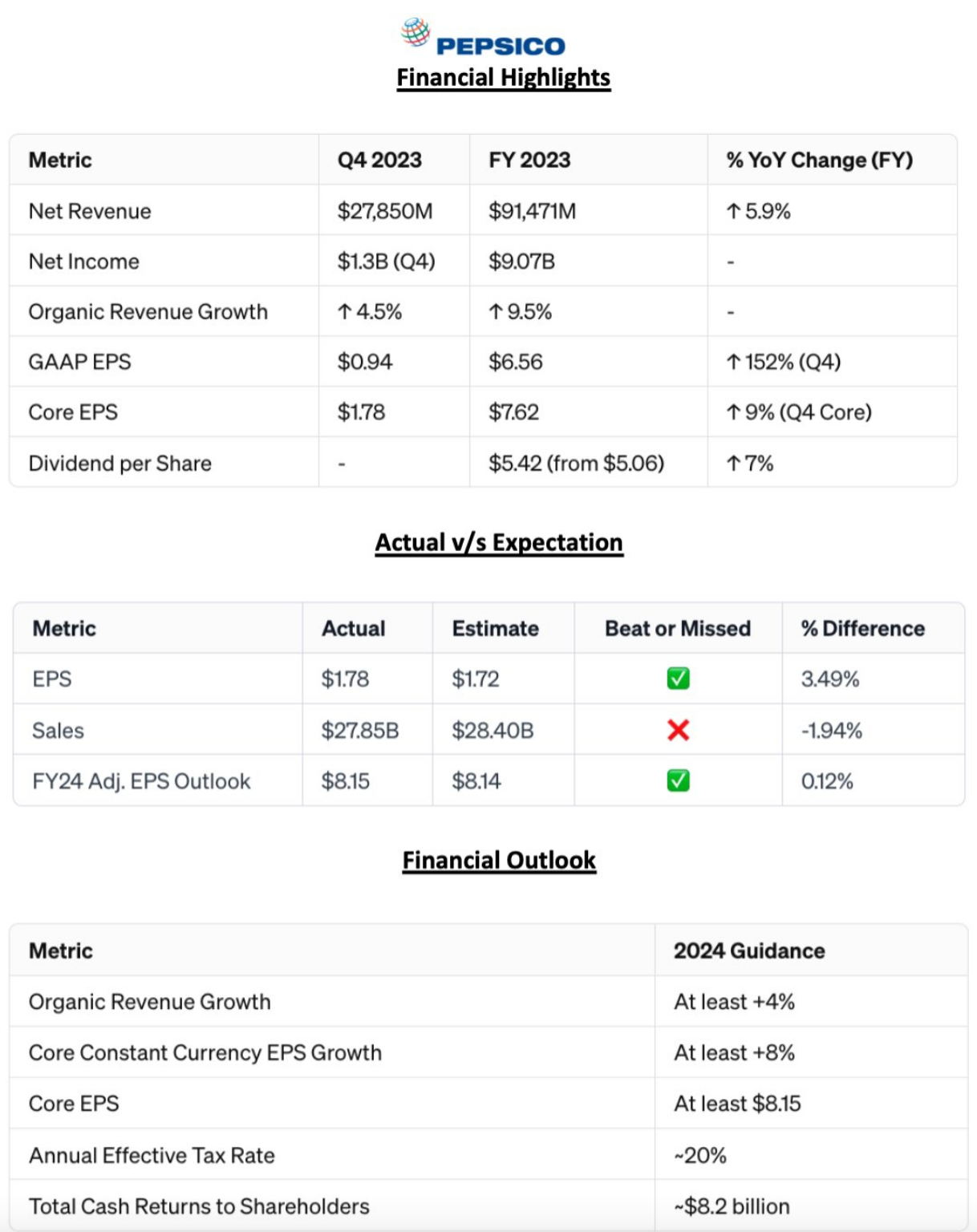

The recent PepsiCo Q4 and Full-Year Results revealed a mixed bag, with bottom-line estimates surpassing Wall Street expectations, but top-line figures falling short of consensus levels.

PepsiCo's non-GAAP EPS exceeded estimates, coming in at $1.78, surpassing consensus by $0.06 per share. However, Q4 sales amounted to $27.85 billion, marking a 0.5% decline year-on-year and missing estimates by $520 million.

The overall Q4 performance appeared lackluster, with a 0.5% sales decrease and declining volumes across all operating categories.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Despite volume challenges, PepsiCo demonstrated positive EPS growth due to its pricing leverage. Notably, organic pricing increased across most segments, except for the Pacific region.

For the full year, similar trends persisted, with slight volume declines offset by a 9% increase in organic pricing. However, concerns arise regarding the sustainability of this trend.

To ensure long-term bottom-line growth, PepsiCo's management must stimulate consumer demand and reignite volume growth across its product portfolio. Fortunately, the company boasts a solid track record of overcoming such hurdles, posting positive annual EPS growth in 16 out of the last 20 years.

Management discussed plans to increase marketing efforts, particularly for Frito-Lay, and highlighted the restoration of supply chains in snack categories to 100% efficiency. These measures are expected to enhance advertising ROI and drive volume growth.

However, PepsiCo faces challenges in the snack sector due to health food trends and competition from Coca-Cola's superior distribution network. Yet, the company's brand equity positions it well to capitalize on product portfolio enhancements over time.

While low-to-mid single-digit organic pricing power continues to support earnings, PepsiCo aims for at least 4% organic revenue growth and 8% core constant currency EPS growth in 2024.

Considering historical performance and valuation, fair value for PepsiCo shares lies in the 21-22x P/E range. This suggests the potential for high single-digit total returns, albeit with low volatility and predictable cash flows.

Dividend Raise

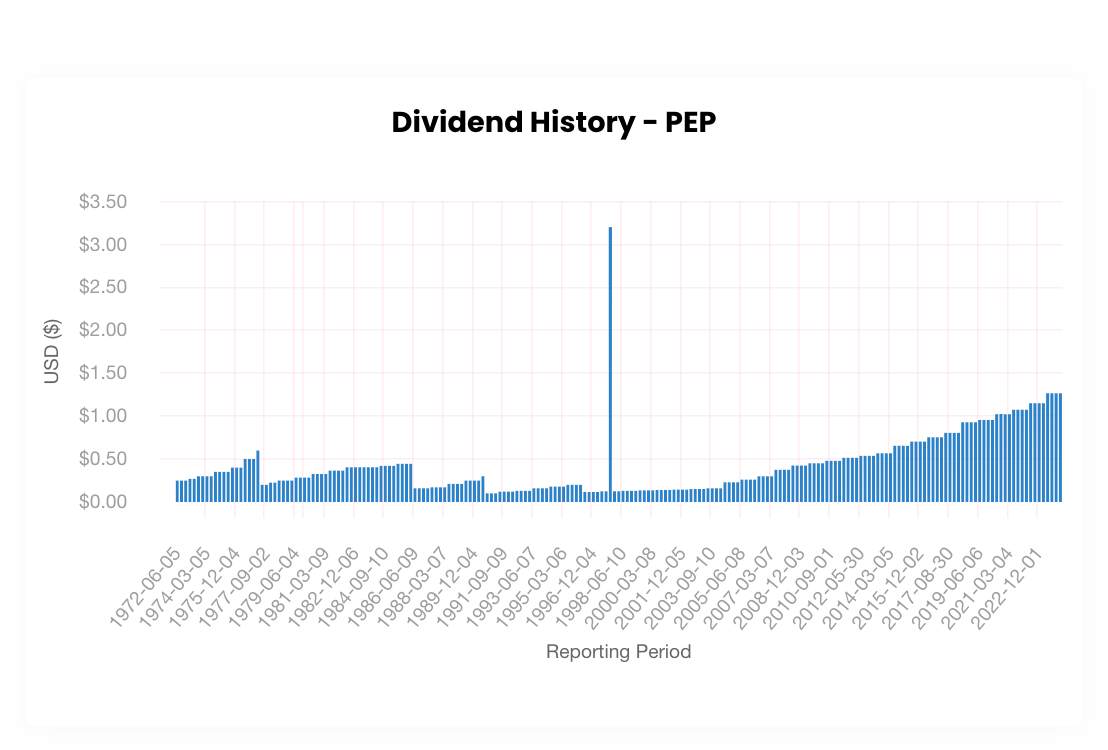

Exciting as PepsiCo’s CELH stake and impressive long-term EPS compounding record may be, the primary reason for owning this stock lies in its burgeoning dividend.

Annually, PEP unveils its forthcoming dividend raise during its Q4 report, which can be perplexing for many investors as the dividend technically remains undeclared, with investing sites displaying its previous annual payment.

However, in the Q4 report, PEP declared, “We also announced a 7 percent increase in our annualized dividend, starting with our June 2024 payment, which represents our 52nd consecutive annual increase, and we plan to repurchase approximately $1 billion worth of shares.”

Once the Q2 payment is officially declared, the $5.42 annual payment will be realized, equating to a ~3.2% yield relative to PEP’s prevailing share price.

A 3% yield coupled with high single-digit growth prospects strikes the perfect balance between yield and growth. While a 3% yield may be lower than the ~5.2% yields found on short-term bonds presently, the focus here isn’t on immediate yield but rather its compounding potential.

A yield growing at a 7% rate doubles every decade, offering substantial long-term benefits. For investors with extended investment horizons, a 3% yield expanding at a 7% pace surpasses a stagnant 5% yield in terms of overall value.

Growth Trajectory Via Acquisitions

PepsiCo could potentially enhance its market presence through mergers and acquisitions if needed to boost revenue growth. PepsiCo holds approximately an 8.5% stake in Celsius (CELH), a company in the energy/fitness drink sector that has seen significant stock appreciation, increasing by over 4,900% in the last five years. However, a recent report from Bank of America noted a slowdown in demand trends and stagnating market share for Celsius, alongside its highly volatile share prices due to speculative valuation.

There is a possibility of significant price corrections for high-Beta stocks like Celsius during market downturns, which could provide an opportunity for PepsiCo to increase its stake. This scenario is reminiscent of Coca-Cola's partnership with Monster Beverage (MNST), where Coca-Cola owns about 20% of MNST shares, an investment that has appreciated significantly. This partnership allowed Monster Beverage to benefit from Coca-Cola’s extensive distribution network.

The increasing consumer interest in caffeine and energy drinks, evidenced by new market entrants like McDonald's with its CosMc's chain, suggests a growing market. PepsiCo, with its robust financial health and significant net income, could strategically expand its presence in the energy drink sector, potentially offsetting adverse trends affecting soda sales. This approach would involve leveraging its A+ rated balance sheet, despite a relatively high debt load compared to its cash reserves.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Competitive Landscape and Advantages

The beverage industry is fiercely competitive, with major players like Coca-Cola and smaller niche companies constantly vying for market share. PepsiCo’s competitive advantage lies in its extensive product portfolio, which includes not only beverages but also snacks, allowing for cross-promotion and bundled sales. Additionally, its global distribution network is among the most extensive in the industry, ensuring Pepsi products are available in virtually every country.

Moreover, PepsiCo’s commitment to sustainability and corporate responsibility appeals to a growing demographic of consumers and investors who prioritize environmental and social governance (ESG) factors in their investment decisions. This focus not only enhances the company's brand reputation but also mitigates regulatory and operational risks.

Investment Considerations

When considering a mature company like PepsiCo, where average fundamental growth rates align with historical multiples, the attached value to shares appears fair. Over the past 20 years, PepsiCo’s average price-to-earnings (P/E) ratio has been around 21x. Historical data shows that, aside from deviations during the Great Recession and the post-COVID-19 market surge, PepsiCo’s shares have consistently traded close to this 21x average.

It is important to note that historical performance is not an indicator of future returns. However, analysis suggests that a fair value for PepsiCo and its peers is within the 21-22x range. If PepsiCo maintains a 21x multiple, the projected $8.15 per share earnings for 2024, along with forward dividend expectations, could lead to a high single-digit compound annual growth rate (CAGR) in total returns.

Although 8-9% total returns might not seem thrilling, they imply a doubling of investment approximately every 8.5 years. This steady compounding potential, coupled with PepsiCo’s low beta and predictable cash flows, positions it as a stable investment. PepsiCo is not a quick wealth generation stock, but its stability provides assurance during market downturns and balances the higher volatility of more growth-oriented investments.

Investors often find value in mature, stable companies like PepsiCo during market downturns, prioritizing investments that offer peace of mind and consistent growth.

Pepsi Products — A Portfolio Cornerstone

Investing in Pepsi products presents a multifaceted opportunity characterized by steady dividends, potential for growth, and a strong competitive position. With innovative products like Pepsi Nitro and Pepsi Zero, PepsiCo continues to adapt to consumer trends and expand its market share.

For those looking to enhance their investment portfolios with a mix of growth and stability, PepsiCo represents a refreshing choice. As always, investors should consider their own financial goals and consult with financial advisors to ensure that their investment choices align with their long-term objectives.

We're the absolute best app in finance—Register using your Google Account. Just click the GIF!