Pick Your Slopes Carefully And Wear A Helmet

June 2022 experienced one of the largest spikes in volatility this year—and given the current movement in the VIX, we can certainly expect more in the near term.

In fact, as of today, the recession probability indicator on Synvestable Premium shows a severe spike in likelihood of a recession as the Fed continues to try to taper runaway inflation with rate hikes.

So the question from here becomes the obvious:

How bad is this going to get?

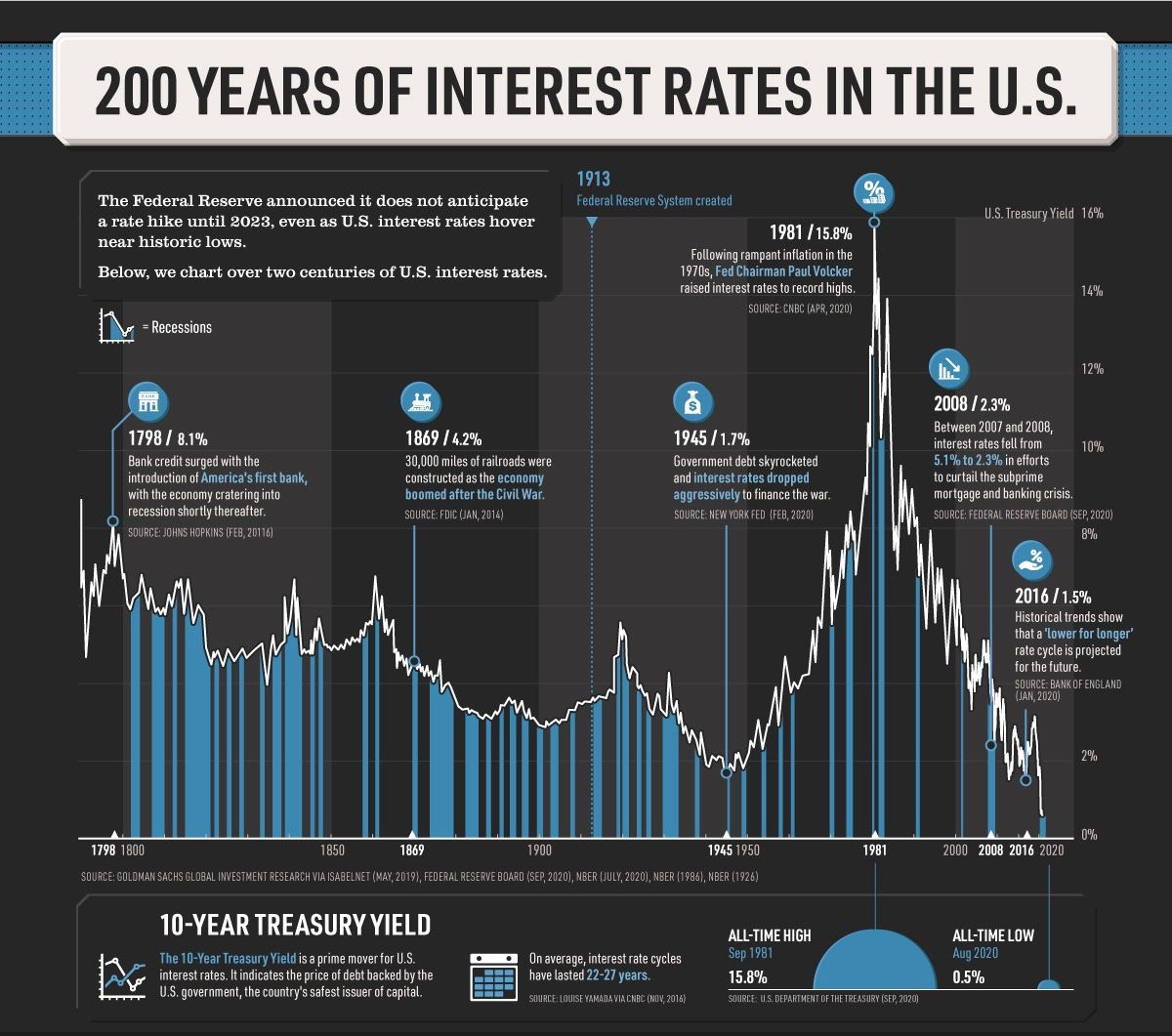

In order to better understand where we may end up, it's important to understand some fundamental mechanics of the economy and also learn from the past how rising interest rates affect the country.

History of Rising Interest Rates In The U.S.

While rising interest rates have not always lead to a recession, one thing to note is that immediately following a recession, interest rates have typically fallen.

This is because historically, central banks use interest rates as a means of cooling or heating the overall economy by controlling the availability of credit to facilitate transactions.

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

Ray Dalio provides an excellent example of how the Economic Machine works and how interest rates affect the overall economy below (13:47)

But what does this mean for stocks when interest rates rise?

Generally, when interest rates rise, asset prices fall. This goes for stocks, real estate, and speculative assets.

This is because when credit is readily available, there is more disposable cash for market participants to make transactions. This leads to speculation which eventually leads to market bubbles.

When things get overheated, we can either grind down—or crash down.

So we know that the Federal Reserve plans on steadily increasing interest rates for the remainder of 2022—what will the overall effect of this be for the stock market going forward?

A Normalized Outlook for 2022

If all things remain the same, the money supply will continue to shrink, which means inflation will begin to taper and the dollar will start to get stronger.

We're actually already starting to see this happen now with USD in the currency markets.

This is exactly what the Fed wants to see is a stronger dollar relative to the cost of assets and goods and services. This in effect will cause prices to fall relative to the dollar and essentially cool the craziness that occurred from 2020, which was fueled by the lowest interest rates in the history of the United States at 0.5%.

So if things stay the same, we're in for a controlled and sustained bear market until the Fed begins to shift its monetary policy.

But what if it's not enough?

Is there some systematic risk that could cause a crash in the stock market of larger proportion?

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

The Case For A Crash in Late 2022

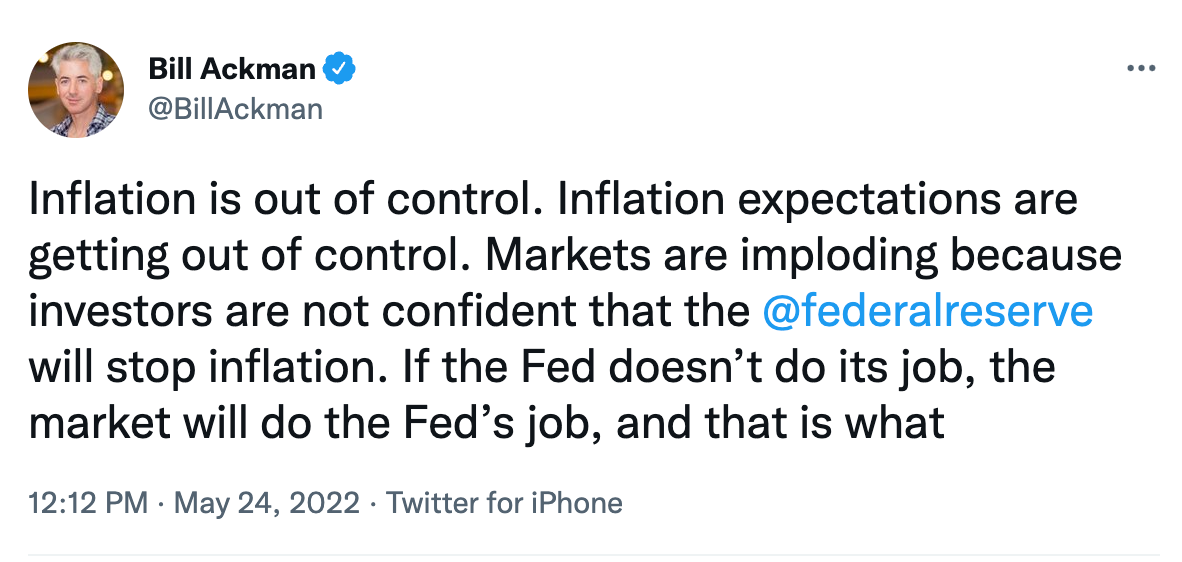

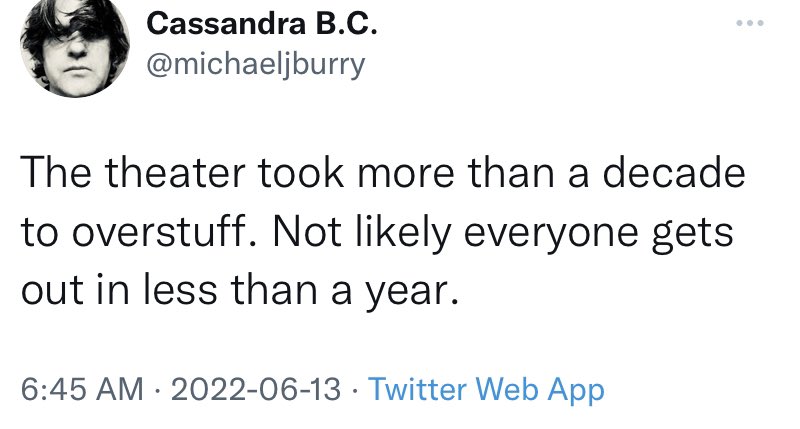

If you follow major asset managers like Ray Dalio, Bill Ackman, or Michael Burry, you'll have already probably seen their recent warnings of the potential for a market collapse.

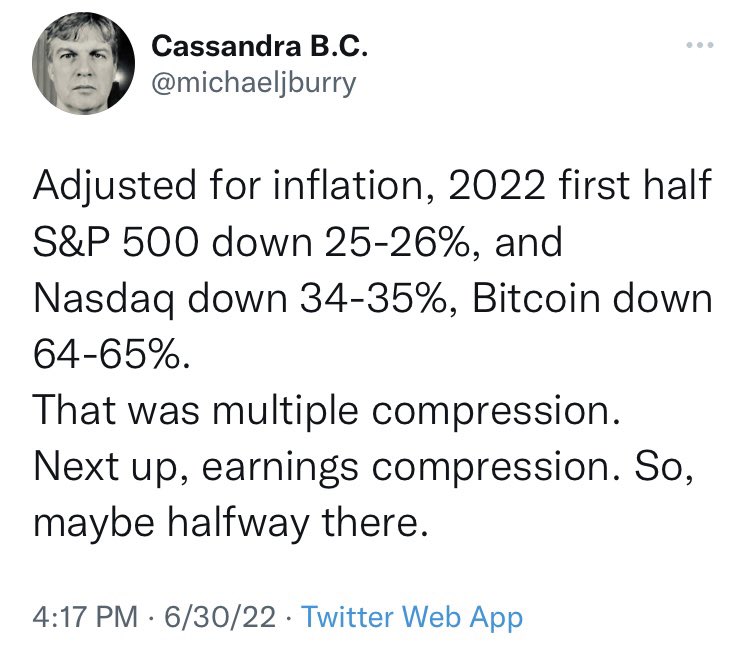

While Bill Ackman makes the case for a potential market collapse due to the Federal reserve not being aggressive enough with markets, Michael Burry sites another potential reason.

Burry is siting the fact that while bubbles take time to inflate, they can take just as long to deflate.

According to Burry, accounting for the 25-26% drop in the S&P 500, he would expect another 25% to finish the full drop.

If the stock market does continue to drop, then now is the time to perfect time to be building cash reserves and doing research on which quality companies are going to make it into your portfolio for 2023.

Synvestable's new prediction cycle starts tomorrow July 6th.

We'll be highlighting some of the more interesting predictions created by the models later in the week.

To find great companies and opportunities with first-grade in-depth company analysis on the entire S&P 500, check out our Retail Premium Plan on Synvestable.com

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For Stock Insights!

And a chance to win FREE shares of stock.

DISCLOSURE: Synvestable does not have any vested stake in the above mentioned companies, nor does Synvestable represent any stocks mentioned in this article as professional financial advice. Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com