This indicator says the S&P 500 could grind up as much as 10% by year end according to data dating back to 1928—but how accurate is it?

The S&P 500 has risen over 11% year-to-date, prompting major Wall Street brokerage firms to raise their price targets for the stock market today.

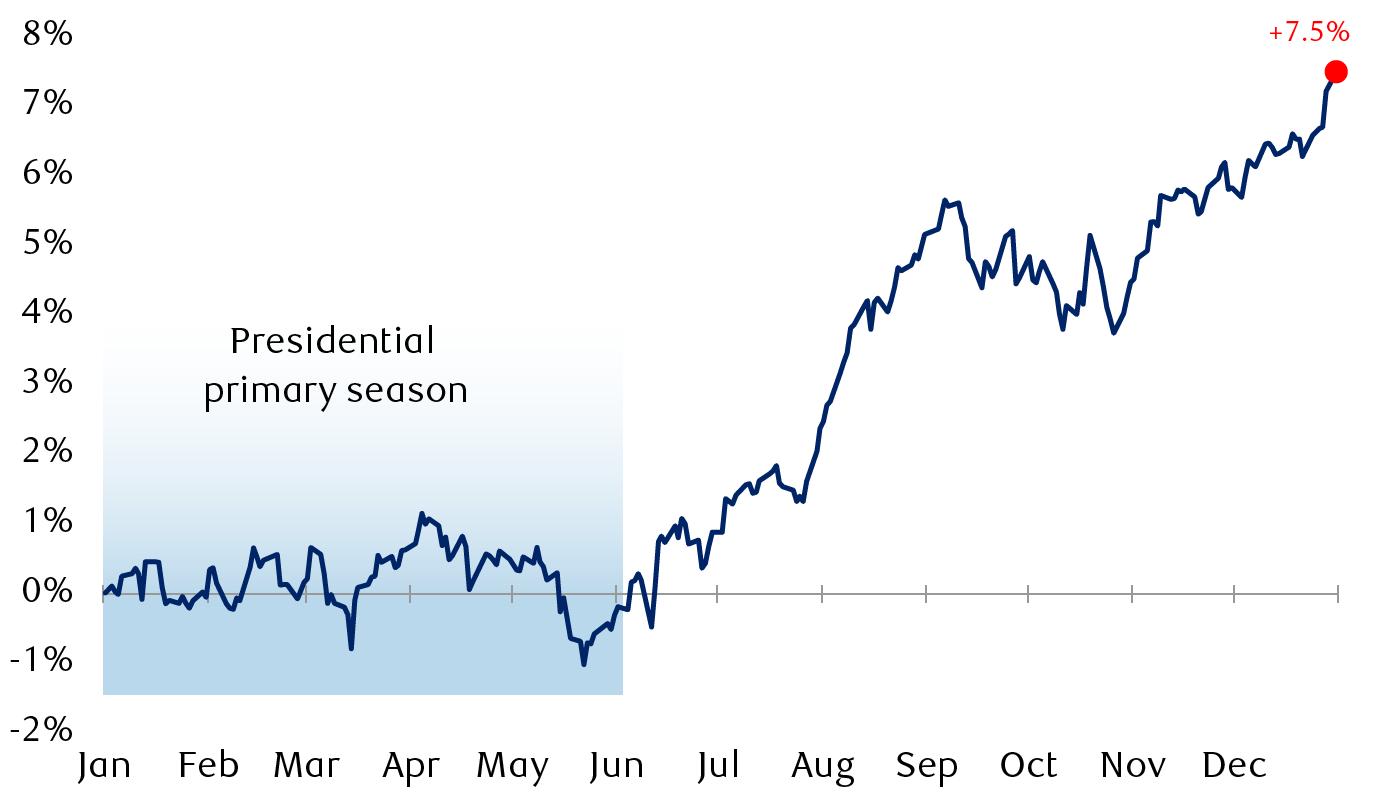

Historical data indicates that when the S&P 500 gains 10% or more in the first 100 days of the year, it often continues to climb. Bank of America analysis shows that the average return for the rest of such years is 7.5%, with a median of 9.3%.

When the S&P 500 gains 10% or more in the first 100 days of the year, it usually continues to climb.

The 10.4% gain year-to-date in 2024 ranks as the second-best start in an election year since 1928, which saw a 12.5% increase. Further bolstering the positive outlook, when the S&P 500 has increased in the first 100 days of a presidential election year, it has continued to rise 93% of the time, with an average return of 10.1% and a median return of 7.5%. This suggests a potential year-end target for the S&P 500 of 5819 and 5686, respectively.

Overall, historical trends for all election years (including midterms) show the index up 88% of the time, with average and median returns of 8.8% and 8.5%, indicating a possible S&P 500 range of 5756 to 5739 by the end of 2024.

Top 4 Things You Can Do Right Now

While markets, the economy, and life itself can be unpredictable, having a plan can help you navigate uncertainty and achieve your goals. Here are a few key points to consider when reviewing and updating your plan for 2024.

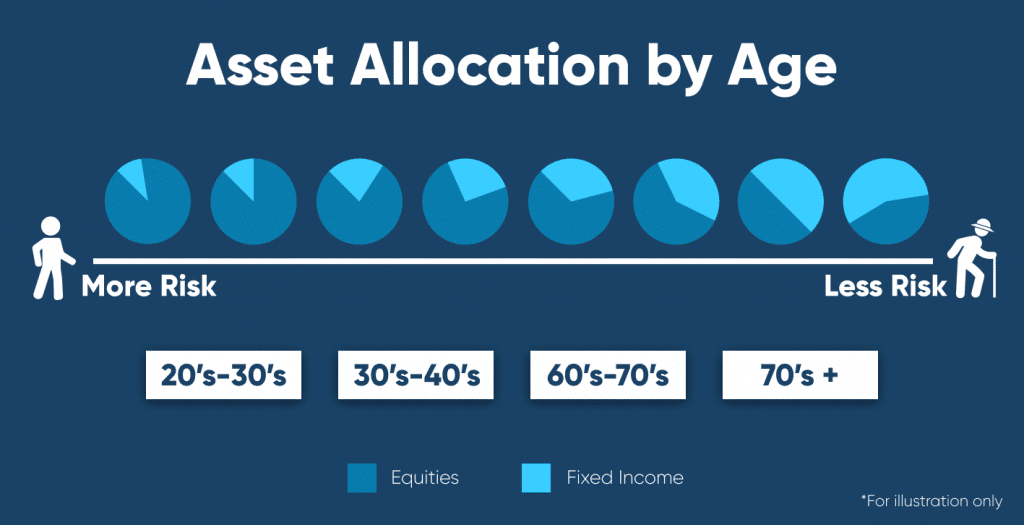

Review Your Portfolio's Foundation

Begin by reassessing the fundamental structure of your portfolio. Your investment strategy should reflect a harmonious balance between your risk tolerance, investment horizon, and financial objectives. Thus, the long-term target allocations within your investment strategy serve as a neutral benchmark for your portfolio design.

Enhance Diversification Efforts

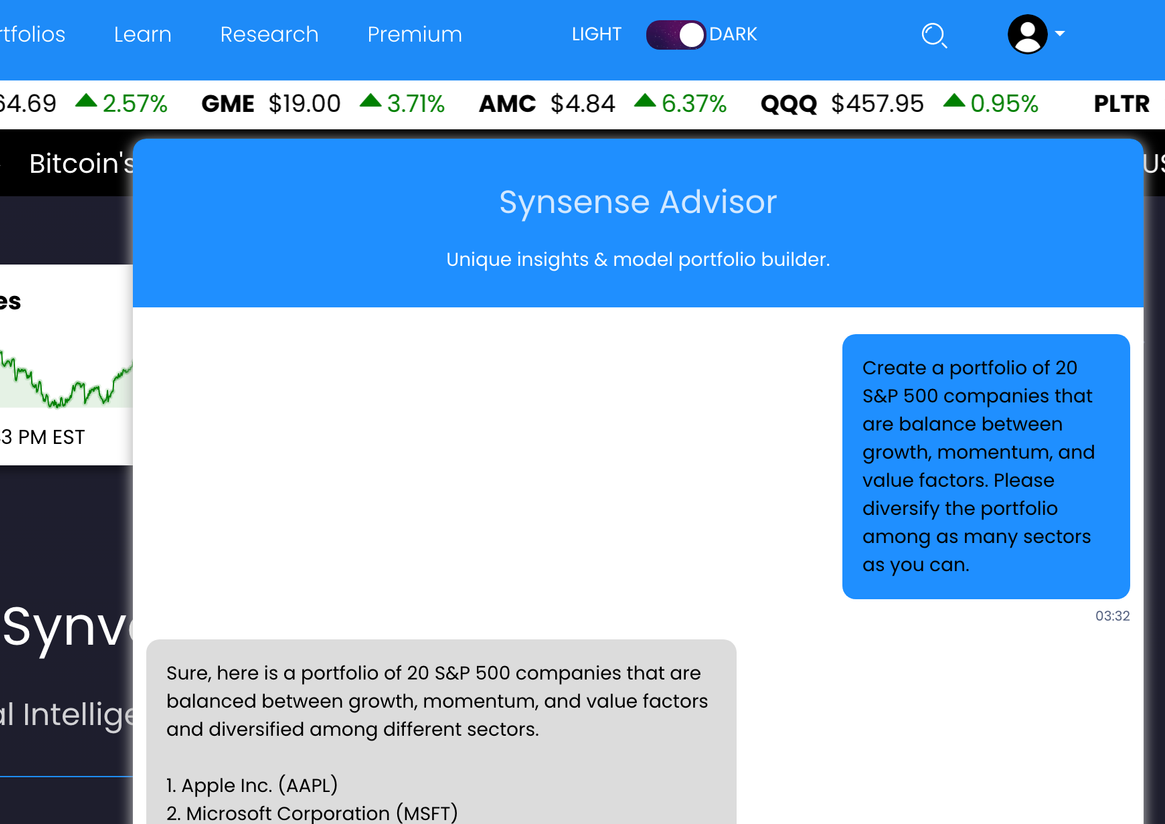

In 2023, market performance was predominantly driven by a narrow subset of growth-oriented mega-cap stocks. As Wall Street anticipates a more balanced performance distribution moving forward, it is crucial to deepen your diversification strategy. Engage with Synsense Advisor to discover strategic asset allocation recommendations based on your current scenario.

This approach can ensure you are well-positioned to reap the benefits of diversification, supporting a more broad-based and sustained market upswing in the upcoming months.

Optimize Portfolio Positioning Across Equity Sectors

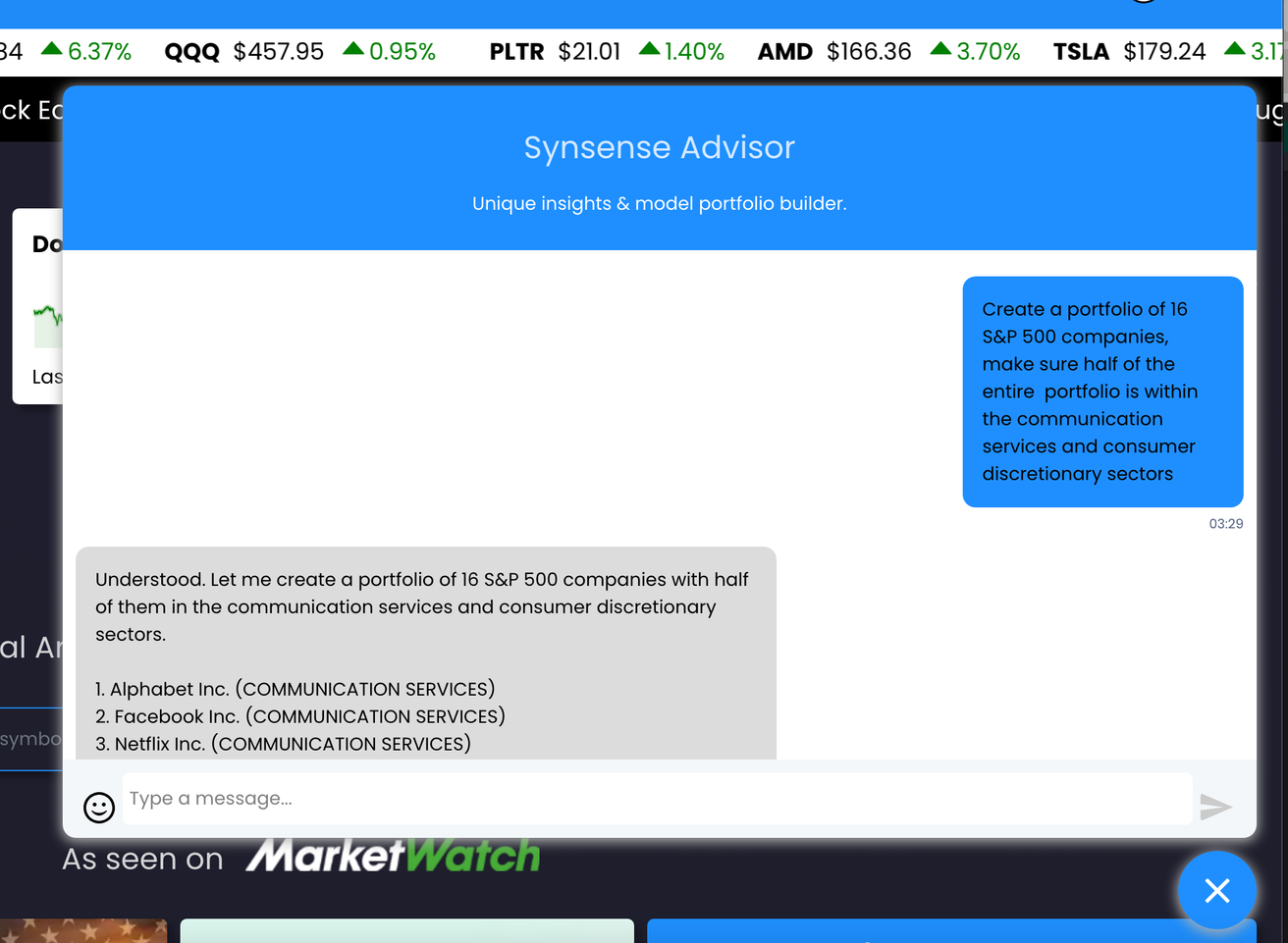

With expectations of moderated economic and consumer strength in 2024, recent trends indicate pockets of resilience. Wall Street anticipates consumer spending and moderating inflation to bolster sectors such as communication services and consumer discretionary. Consequently, it may be prudent to overweight these sectors within your portfolio. Conversely, consider underweighting the financial services sector due to concerns within commercial real estate, tighter credit standards, and the likelihood of declining interest rates.

Synsense Advisor can also assist with both of these strategies.

Adjust Allocations to Long-Term Bonds and Minimize Credit Risk

Should economic growth and inflation decelerate as projected, interest rates are expected to trend lower, and credit spreads may widen. In this scenario, it is advisable to reduce overweight positions in cash and short-term bond investments to mitigate reinvestment risk.

Targeting slightly higher allocations to long-term bonds can better align your portfolio with the anticipated economic landscape, optimizing returns while managing exposure to credit risk.

Implementing these actions, grounded in the current market outlook, can enhance your portfolio's resilience and potential for growth amidst evolving economic conditions.

What's going on in the stock market today? Check out Synvestable Live for premium news and coverage on over 10,000 tradable tickers. Register for FREE below!