When it comes to making investment decisions, finding the right stocks to buy can be a daunting task.

Investors seek strategies that not only offer potential for growth but also minimize risks. In this article, we explore a powerful investment factor called factor momentum, which aims to identify stocks with the potential to deliver exceptional returns.

By leveraging the key concept of momentum, this strategy focuses on the stocks to buy that are capturing key trends and patterns exhibited in their price.

Synvestable Factor Investing Series - Part 3

This we'll be the third article in our 6-Part Factor Investing Series. We'll go over exactly what factor-style investing is and how you can apply factor momentum as an investment strategy. We'll go over specifically:

- What is Factor Style Investing

- What is Factor Momentum

- What Creates Momentum in Market Prices

- Key Metrics of Factor Momentum

- Legendary Investors in Factor Momentum

- Books on Factor Momentum

- Risks Involved with Factor Momentum

- Implementing Factor Momentum

- Extending Factor Momentum With Other Factors

So let's without first ado—let's see how we can find stocks to buy with factor momentum. But first...

What is Factor Style Investing

Factor style investing—also known as factor-based investing—is an investment strategy that focuses on targeting specific factors or characteristics that are believed to drive stock returns.

Factors represent systematic sources of risk and return that can be persistent and pervasive across different asset classes and time periods.

Factors can include various attributes or characteristics of stocks such as:

- Value

- Market Cap

- Growth

- Momentum

- Quality

- Low volatility

These factors are believed to have a long-term impact on stock performance and can be used to construct portfolios or investment strategies.

Factor-style investing involves selecting stocks or securities based on their exposure to one or more factors. Investors may choose to overweight or underweight certain factors based on their investment objectives, risk appetite, and market outlook.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Today's article will be focused on factor momentum and how you can create thematic portfolios around stocks with trending momentum.

It's important to note that with any factor-style investing, it is based on the premise that factors can influence stock returns over the long term, but their performance can be cyclical and subject to market conditions.

What is Factor Momentum

Factor momentum is a factor-based investing strategy that aims to capitalize on the persistence of price trends in stocks. It is based on the belief that stocks that have exhibited strong performance in the past will continue to outperform in the near future, while stocks that have underperformed will continue to underperform.

Momentum is driven by the market's tendency to underreact or react slowly to new information, causing trends to persist.

What Creates Momentum in Market Prices

Several factors influence momentum investing, including:

Price Trends: Momentum investing relies on the observation that stocks that have shown positive price trends in the past tend to continue rising, while stocks with negative trends tend to keep declining. This factor looks at the magnitude and duration of price movements.

Reversals: Momentum investors also consider the potential for reversals in stock prices. Reversals occur when stocks that have performed well begin to decline, or stocks that have underperformed start to rise. Identifying potential reversals is crucial for managing risk and avoiding losses.

Market Regimes: Momentum strategies can perform differently depending on the prevailing market conditions. Different market environments may favor certain types of stocks or sectors. Adapting momentum strategies to changing market regimes is essential for optimizing performance.

Risk Management: Momentum investing involves taking on higher levels of risk due to the potential for large price swings. Effective risk management techniques, such as position sizing, stop-loss orders, and portfolio diversification, are important to mitigate risk and protect capital.

Key Metrics of Factor Momentum

To identify and evaluate factor momentum opportunities, investors can consider the following key metrics:

Price Performance: Analyze the historical price performance of stocks over a specified period, such as the past six to twelve months. Look for stocks that have exhibited strong positive price trends and outperformed their peers or the broader market.

Relative Strength: Measure the relative strength of stocks by comparing their price performance to a benchmark or index. Stocks with high relative strength indicate strong momentum compared to their peers.

Moving Averages: Use moving averages, such as the 50-day or 200-day moving average, to identify trends in stock prices. Stocks trading above their moving averages may indicate positive momentum.

Trading Volume: Monitor trading volume patterns to assess the level of investor interest and participation in a stock. High trading volume during price increases can indicate strong momentum.

Legendary Investors in Factor Momentum

Several renowned investors have utilized momentum strategies in their investment approaches. Some notable investors include:

Richard Driehaus: Richard Driehaus is known for his successful implementation of momentum investing. He focused on identifying stocks with strong price trends and positive earnings surprises. Driehaus believed that the market's momentum effect could lead to outsized returns.

Jim Simons: Jim Simons, the founder of Renaissance Technologies, is recognized for his quantitative approach to investing. His firm's strategies incorporate momentum factors in their models, emphasizing the importance of capturing trends in stock prices.

Cliff Asness: Cliff Asness, the co-founder of AQR Capital Management, has extensively researched and implemented momentum strategies. Asness has contributed to the academic literature on momentum investing and demonstrated its effectiveness as a factor in generating excess returns.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Books on Factor Momentum

If you're interested in delving deeper into factor momentum investing, consider the following books:

"Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk" by Gary Antonacci: This book explores the dual momentum investing approach, combining relative strength momentum with absolute momentum. Antonacci provides insights into the history, theory, and practical application of momentum investing.

"Quantitative Momentum: A Practitioner's Guide to Building a Momentum-Based Stock Selection System" by Wesley R. Gray and Jack R. Vogel: This book offers a comprehensive guide to building and implementing momentum-based stock selection systems. It covers the concepts, data sources, and strategies involved in quantitative momentum investing.

"Momentum Masters: A Roundtable Interview with Super Traders" by Mark Minervini: In this book, Mark Minervini interviews successful momentum traders to gain insights into their strategies and approaches. The book provides real-life examples and practical advice for implementing momentum investing techniques.

Risks Involved with Factor Momentum

Factor momentum investing comes with its own set of risks and considerations:

Reversals: Stocks that have exhibited strong momentum can experience sudden reversals, leading to losses. It is essential to monitor potential reversals and implement risk management techniques to mitigate the impact of sudden price declines.

Market Turbulence: Momentum strategies may underperform during periods of market turbulence or sudden shifts in investor sentiment. Changes in market conditions can affect the persistence of trends and impact momentum-based strategies.

Volatility: Momentum stocks can be more volatile than other investment styles. The rapid price movements associated with momentum can result in higher levels of volatility and larger price swings.

Transaction Costs: Frequent trading and portfolio turnover, common in momentum strategies, can lead to higher transaction costs. These costs can erode returns, especially for smaller portfolios.

Implementing Factor Momentum

To implement factor momentum investing effectively, consider the following steps:

- Define Strategy: Determine the specific factors and metrics you will use to identify momentum opportunities. Set clear criteria for stock selection and establish rules for portfolio rebalancing.

- Research and Analysis: Conduct thorough research and analysis to identify stocks with strong momentum. Utilize price charts, fundamental data, and quantitative tools to assess the potential for continued price appreciation.

- Risk Management: Implement risk management techniques, such as position sizing, diversification, and stop-loss orders, to protect against potential reversals and manage downside risk.

- Regular Monitoring: Continuously monitor the performance of momentum stocks and adjust your portfolio based on changing market conditions or shifts in price trends.

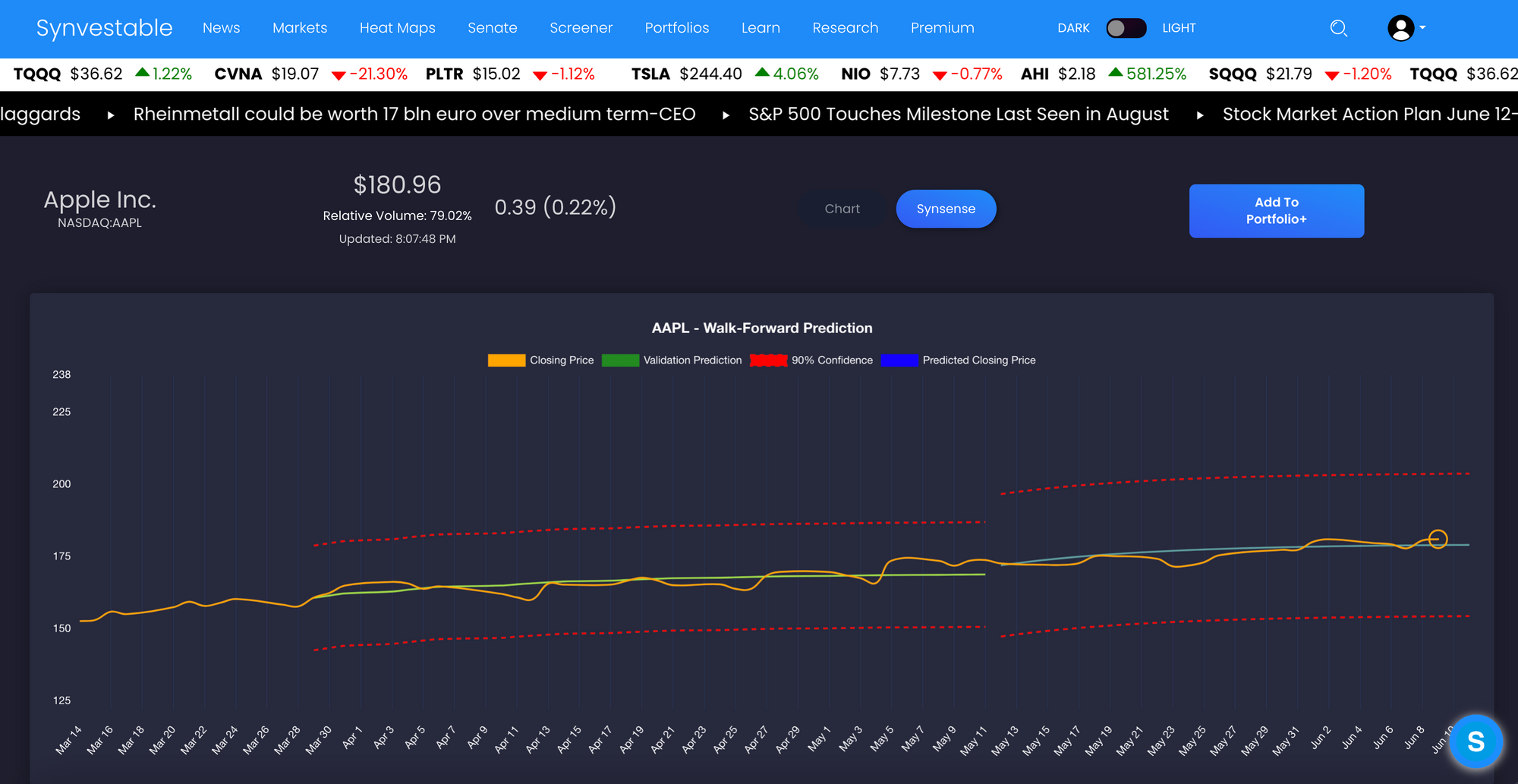

Pro-Tip: You can use our Synsense Predictions to help forward predict if a trend is likely to continue. Momentum plays a large factor in our prediction models and its used by major quantitative hedge funds around the world.

Extending Factor Momentum With Other Factors

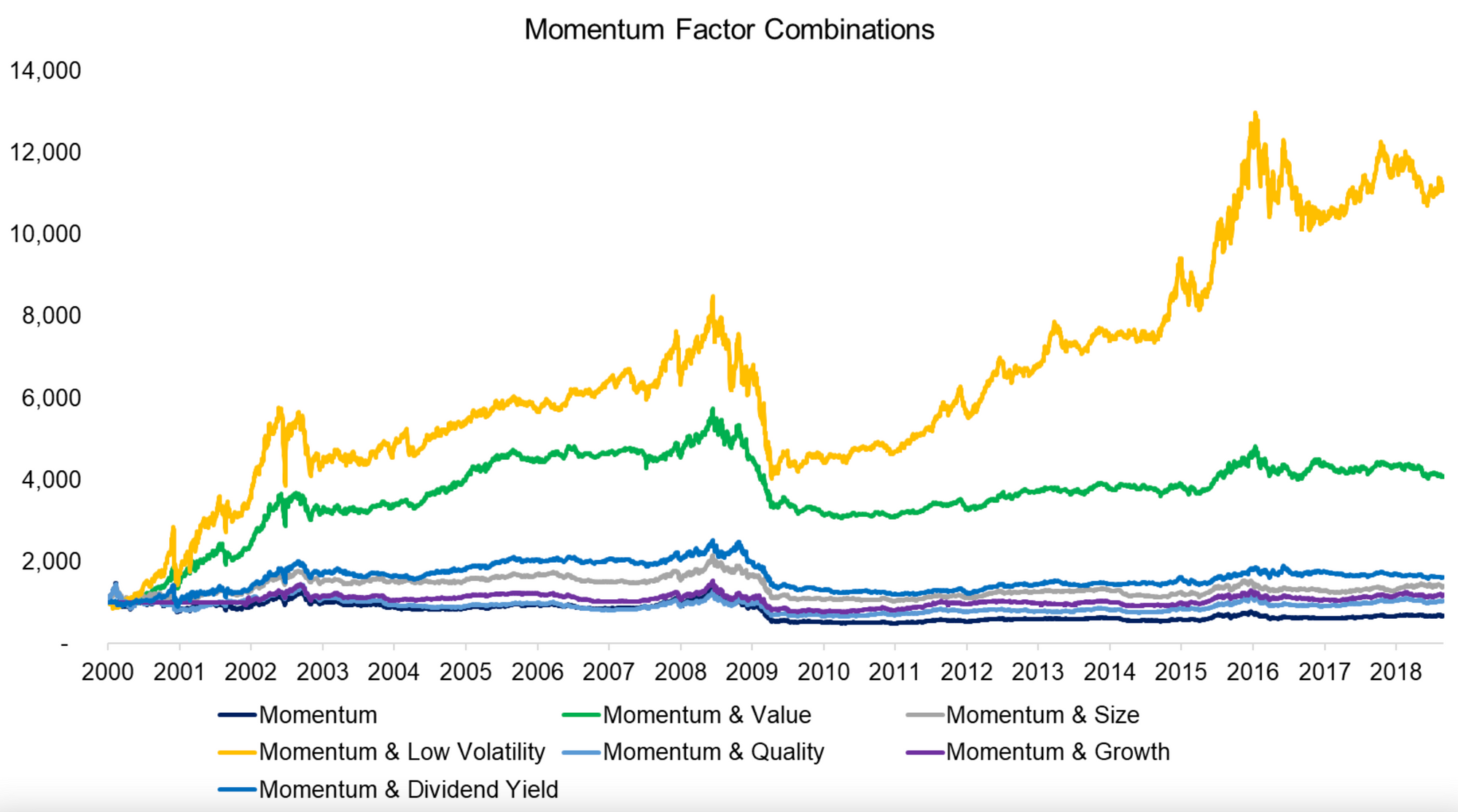

Looking at the performance of momentum stocks dating back to 2000 and using the financial metrics listed above, we can see that using just momentum alone underperforms than if you're combining factors.

You can also combine momentum with quality, growth, and value factors for outsized returns—which is exactly what we did in our Blueprint Investing Formula.

Our e-book outlines over 25+ quantitative factors—combining financial metrics from value, quality, momentum, and growth factor styles—the result of which created us a simple framework that continues to beat the market when combined with a proper portfolio strategy.

Get the the special research that still beats the market.

Stay tuned on this series when we go into the next type of factor style investing—factor quality. Subscribe or register for free below and you'll be registered to receive all our posts and Factor Style Series via email.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!