Synvestable conducted a quantitative experiment that reveals the ONE factor that drives stock prices—and it ain't earnings!

Behind the scenes here at Synvestable, we're constantly doing quantitative experiments and finding new ways of looking at the market.

More recently, we've been doing a series of quantitative experiments using everything from stochastic equations to signal processing—yes, as in radio signal processing.

One of these experiments we found to be so interesting that we wanted to share its results because it turned everything we understand about markets on its head.

Why Markets Are Biased Upwards

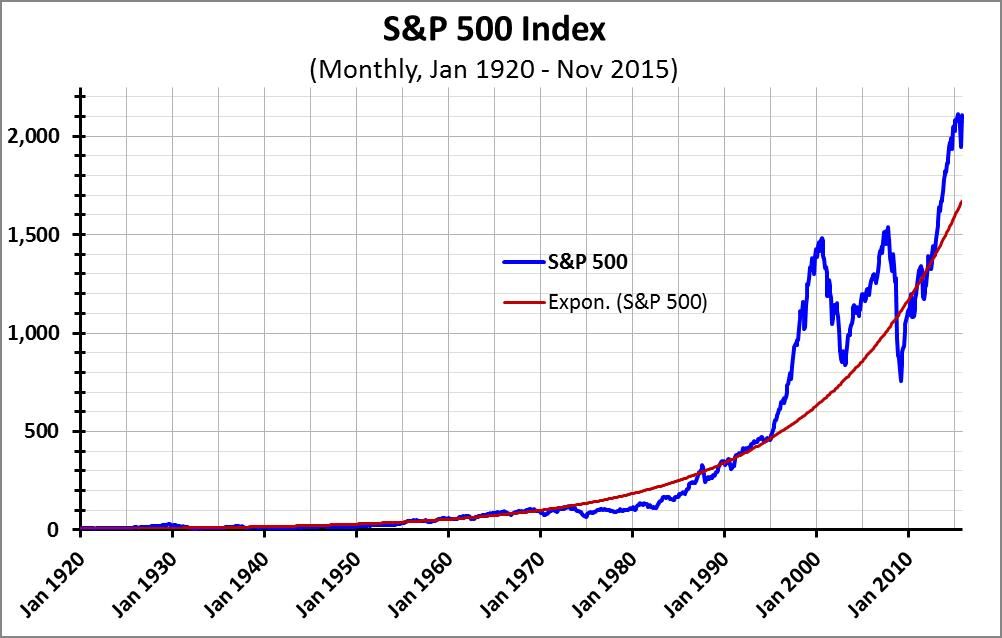

If you look at the long-term trend of the S&P 500, you'll notice its biased upwards.

Economists and investment professionals will say that this reflects overall economic growth in the market, and how over the long-term stock prices and market indices reflect underlying business fundamentals.

Today, we're going to flip that assumption it's head and say while that makes a lovely bedtime story, it's clearly not the case.

What we've discovered here at Synvestable is that a stock's tendency to trend upwards is actually an emergent property of Brownian Motion—or randomness—under low volatility conditions.

At first glance, this may not make much sense—how does pure randomness trend upwards?

It's simply a matter of numerical expansion within a narrow-ranged channel—and it has nothing to do with economic expansion at all. It is a mathematical law of the universe of how systems evolve under specific statistical conditions.

Below is the experiment we did in Python that proves this...

How Pure Randomness Can Trend Upwards

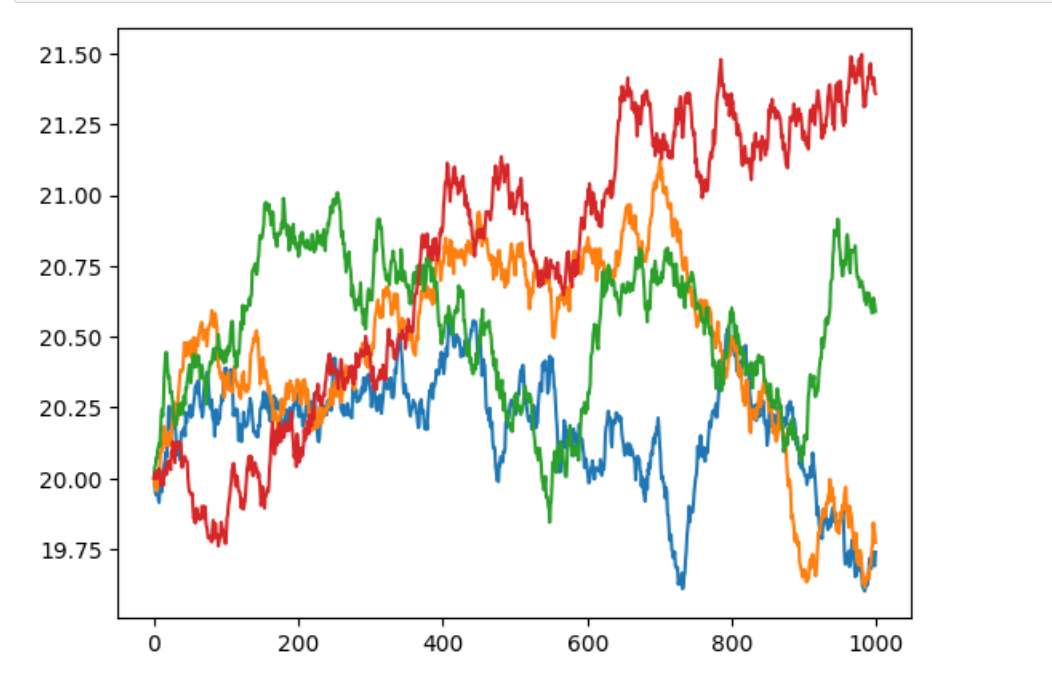

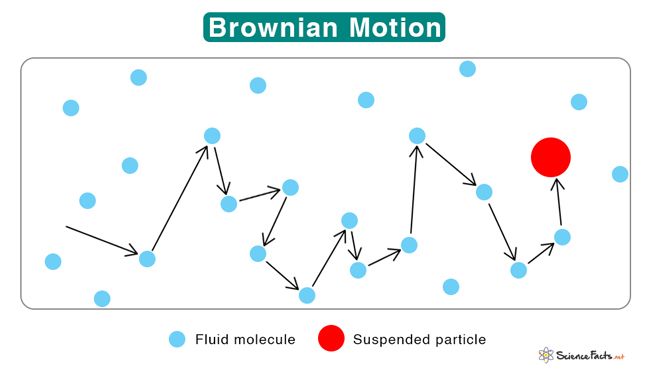

Below are plots of pure Brownian Motion—the same type of random motion that is observed in gases and molecular particles and how they bump against each other.

If you're not familiar with the term, Brownian Motion serves as the basis of how systems evolve in everything from physics and chemistry to economics.

For this experiment, we created 5 different "stocks" with no businesses or economics attached to them—their price history was generated using pure randomness.

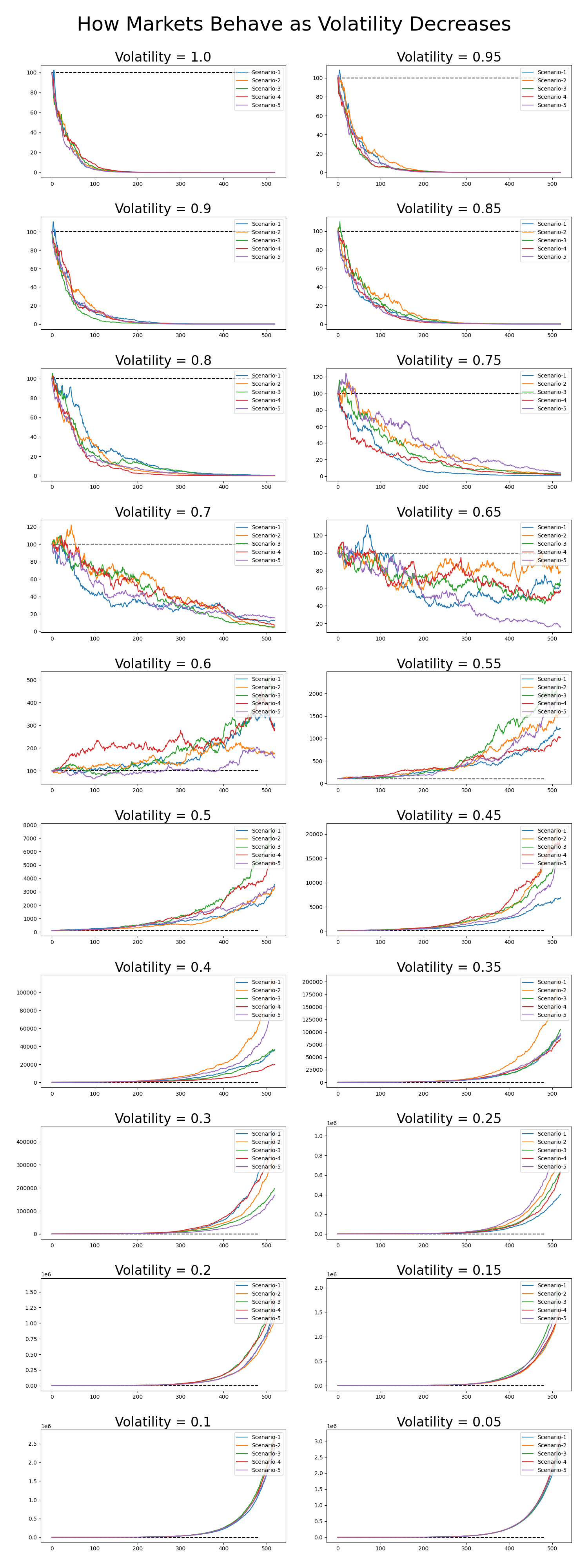

We generated their price history randomly 20 times, each time lowering the volatility or variance by 0.05, taking the system from 100% volatility down to almost zero volatility.

As volatility (variance) converges toward zero, you'll see that each one of the "stocks" series begin to trend upwards more and more...

And the interesting part is that not a single one of these "stocks" reported earnings, flashy news, or share buybacks—yet price history began to trend upwards over time specifically because of low volatility.

We found this pretty amazing, and it explains why success in the market translates to 'time in the market'—it essentially comes down to a stock surviving long enough within low volatility conditions for its price history to evolve.

And this makes intuitive sense as well—the S&P 500 has increased 168,685.07% since 1920—has corporate America really 168,685.07% of economic value to their companies and world economies? Doubtful.

Instead what this potentially shows instead is that the stories around corporate fundamentals are what affect human behavior—which in turn—affect volatility.

The horse always leads the cart, and the horse in this case is human behavior and our propensity to listen to storytelling—while the cart is market prices.

If volatility is the lever that controls trending, then the storytelling and media coverage around fundamentals is the hand the pushes and pulls the lever.

The key takeaway is this—if you can find stocks with low volatility and sound fundamentals for longevity, then it's not a question of if the stock will go up, but just a matter of how much time you allow it.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!