Charlie Munger, Warren Buffett's business partner and vice chairman of Berkshire Hathaway, is known for his sharp wit and no-nonsense investment philosophy.

Munger once quipped that all intelligent investing is value investing—acquiring more than you are paying for.

Value investing today fits into a paradigm today known as factor-style investing.

This is because market performance based on such factors can shift, with the market favoring one factor more than other factors depending upon the prevailing economic conditions.

Synvestable Factor Investing Series - Part I

This we'll be the first article in our 6-Part Factor Investing Series. Today, we'll go over exactly what factor-style investing is and how you can apply factor value as an investment strategy. We'll go over specifically:

- What is Factor Style Investing?

- What is Value Investing?

- Legendary Value Investors

- The Best Books On Value Investing

- The Key Financial Metrics for Value Investing

- Extending Factor Value With Other Factors

So let's without first ado—let's dive in to value investing.

But first...

What is Factor Style Investing?

Factor style investing, also known as factor-based investing, is an investment strategy that focuses on targeting specific factors or characteristics that are believed to drive stock returns.

Factors represent systematic sources of risk and return that can be persistent and pervasive across different asset classes and time periods.

Factors can include various attributes or characteristics of stocks such as:

- Value

- Market Cap

- Growth

- Momentum

- Quality

- Low volatility

These factors are believed to have a long-term impact on stock performance and can be used to construct portfolios or investment strategies.

Factor style investing involves selecting stocks or securities based on their exposure to one or more factors. Investors may choose to overweight or underweight certain factors based on their investment objectives, risk appetite, and market outlook.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Today's article will be focused on factor value and how you can create thematic portfolios around undervalued companies with long-term growth prospects to regularly outperform the market.

It's important to note that with any factor-style investing, it is based on the premise that factors can influence stock returns over the long term, but their performance can be cyclical and subject to market conditions.

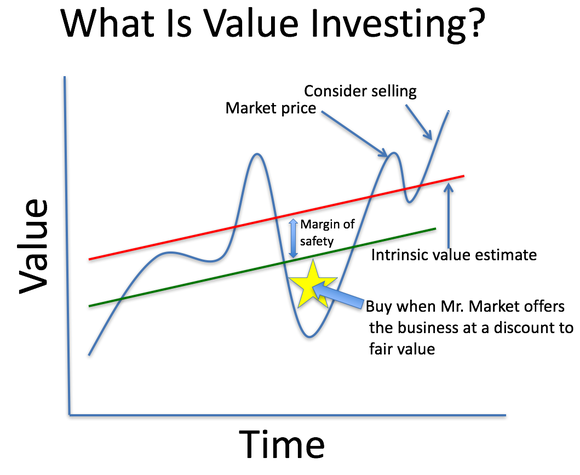

What Is Value Investing Today?

Value investing is an investment strategy that focuses on identifying undervalued stocks or securities in the financial markets.

The underlying principle of value investing is based on the belief that the market occasionally mis-prices assets, creating opportunities for investors to buy those assets at a discount.

Value investors typically look for stocks or securities that are trading at prices lower than their intrinsic value or the true worth of the underlying company or asset.

They seek out companies that may be temporarily undervalued due to market factors, such as negative sentiment, economic conditions, or industry trends, but have strong fundamentals and potential for long-term growth.

To determine the intrinsic value of an asset, value investors employ various fundamental analysis techniques.

This involves examining a company's financial statements, analyzing its earnings, cash flow, and assets, evaluating its competitive position within the industry, and assessing its management team and overall business prospects.

Once a value investor identifies a stock or security that they believe is undervalued, they will typically purchase it with the expectation that its price will eventually reflect its true value.

This may involve holding the investment for an extended period of time until the market recognizes the value and the price appreciates accordingly.

Pro Tip: Synsense Advisor can create many value portfolios for you in seconds that you can then tweak, backtest, and edit to your own liking.

Synsense Prompt Example: Create a model portfolio of 20 value stocks that provide an adequate margin of safety and long-term growth potential across various sectors.

Alternative Prompt Example: Create a model portfolio of 5 Etfs that have a focus around value investing.

Legendary Value Investors

There have been several famous investors who have employed value investing principles and achieved significant success.

Here are some well-known value investors and recommended books on their investment styles.

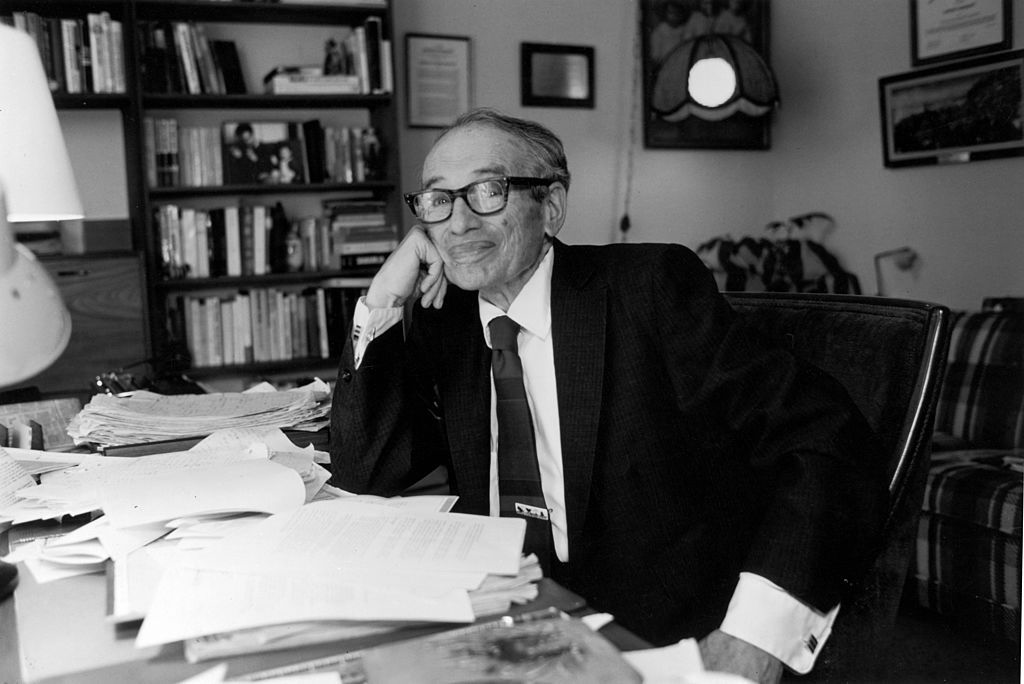

Benjamin Graham: Considered the father of value investing, Benjamin Graham authored the book "The Intelligent Investor" and mentored Warren Buffett. He emphasized the importance of fundamental analysis, margin of safety, and investing with a long-term perspective.

Warren Buffett: Regarded as one of the most successful investors of all time, Warren Buffett is the chairman and CEO of Berkshire Hathaway. His investment approach is heavily influenced by value investing principles, focusing on undervalued companies with strong fundamentals and long-term growth potential.

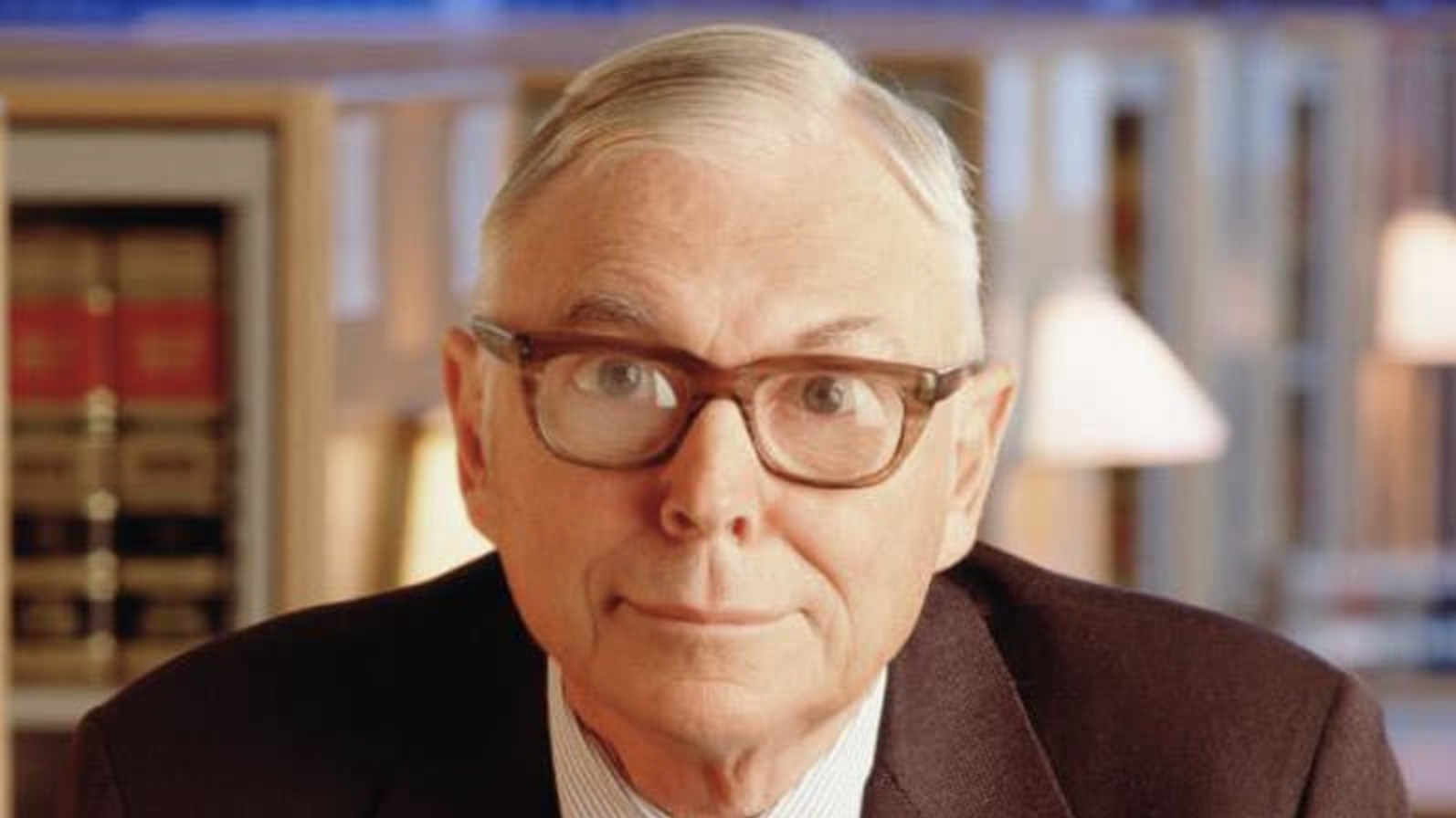

Charlie Munger: Charlie Munger is the vice chairman of Berkshire Hathaway and has been a close business partner of Warren Buffett for many years. He shares Buffett's value investing philosophy and is known for his analytical thinking and emphasis on rational decision-making.

Seth Klarman: Seth Klarman is the founder of Baupost Group, a renowned hedge fund. He is recognized for his deep value investment approach and focus on margin of safety. Klarman is known for his disciplined and patient approach to investing.

Joel Greenblatt: Joel Greenblatt is an investor, professor, and author. He developed the "Magic Formula" investment strategy, which combines value and quality factors to identify undervalued stocks with high earnings potential. Greenblatt's approach has gained significant attention in the investment community.

Howard Marks: Howard Marks is the co-founder and co-chairman of Oaktree Capital Management. He is known for his value-oriented approach to distressed debt and contrarian investing. Marks emphasizes the importance of understanding market cycles and taking advantage of mispriced assets.

Mohnish Pabrai: Mohnish Pabrai is an investor and fund manager known for his deep value investing style. He follows the principles of Warren Buffett and has achieved notable success by investing in undervalued stocks with strong competitive advantages.

Each investor may have their unique approach, but they all share a common focus on identifying undervalued assets and investing with a long-term perspective.

Which leads us naturally to their best writings.

The Best Books on Value Investing

Here are some highly regarded books that delve into the investing styles and philosophies of the above individuals.

"The Intelligent Investor" by Benjamin Graham - This classic book by Graham serves as a comprehensive guide to value investing, covering topics such as fundamental analysis, margin of safety, and the principles of intelligent investing.

"The Essays of Warren Buffett: Lessons for Corporate America" edited by Lawrence A. Cunningham - This compilation of Buffett's annual shareholder letters provides valuable insights into his investment principles, management philosophy, and approach to long-term investing.

"Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger" edited by Peter D. Kaufman - This book offers a collection of Munger's speeches and writings, presenting his wide-ranging wisdom, investment strategies, and the importance of multidisciplinary thinking.

"Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor" by Seth A. Klarman - Although not directly focused on Klarman's investing style, this book explores the concept of margin of safety in depth, emphasizing its importance in value investing and risk management.

"The Little Book That Beats the Market" by Joel Greenblatt - Greenblatt introduces his "Magic Formula" investment strategy in this book, explaining how investors can identify undervalued stocks with high earnings potential by focusing on a combination of value and quality factors.

"The Most Important Thing: Uncommon Sense for the Thoughtful Investor" by Howard Marks - Marks shares his insights on investing in this book, covering topics such as risk assessment, market cycles, contrarian thinking, and the importance of second-level thinking.

"The Dhandho Investor: The Low-Risk Value Method to High Returns" by Mohnish Pabrai - Pabrai outlines his value investing philosophy and approach, drawing inspiration from Buffett and other successful investors, and provides practical insights into how to generate consistent returns with a margin of safety.

The Key Financial Metrics for Value Investing

Value investors consider various financial metrics when evaluating potential investments. Here are some key financial metrics that are often important to value investors:

Price-to-Earnings Ratio (P/E Ratio): The P/E ratio is a commonly used valuation metric that compares a company's stock price to its earnings per share (EPS). A low P/E ratio may indicate that a stock is undervalued relative to its earnings potential, although it is important to consider other factors as well.

Price-to-Book Ratio (P/B Ratio): The P/B ratio compares a company's market price per share to its book value per share, which represents the net asset value of the company. A low P/B ratio suggests that the stock may be undervalued, as investors are paying less for the company's assets on a per-share basis.

Dividend Yield: Dividend yield is the annual dividend payment per share divided by the stock price. Value investors often look for companies that pay dividends and have a solid dividend yield. A higher dividend yield may indicate that the stock is undervalued, as investors are earning a higher return relative to the price paid for the stock.

Return on Equity (ROE): ROE measures a company's profitability by comparing its net income to shareholders' equity. A higher ROE indicates that the company is generating more profits from its shareholders' investment, which is often desirable for value investors seeking companies with strong financial performance.

Debt-to-Equity Ratio: The debt-to-equity ratio assesses a company's financial leverage by comparing its total debt to shareholders' equity. Value investors generally prefer companies with lower levels of debt, as excessive debt can increase financial risk and impact a company's ability to weather economic downturns.

Free Cash Flow: Free cash flow represents the cash generated by a company after deducting operating expenses and capital expenditures. Value investors often look for companies with strong and consistent free cash flow, as it indicates the company's ability to generate cash and potentially reinvest in the business, pay dividends, or reduce debt.

Earnings Growth: Value investors consider a company's historical and projected earnings growth. Sustainable and consistent earnings growth over time may suggest that the company has a competitive advantage and potential for future value appreciation.

Margin of Safety: While not a specific financial metric, the concept of margin of safety is essential to value investors. It involves buying stocks at a price significantly below their intrinsic value, providing a cushion against potential downside risks and increasing the potential for future gains.

Pro Tip: Synvestable provides a margin of safety indicator to all our Premium Members via the Buffett Indicator for companies—and by the Portfolio Fair Value indicator in the valuation section.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Extending Factor Value With Other Factors

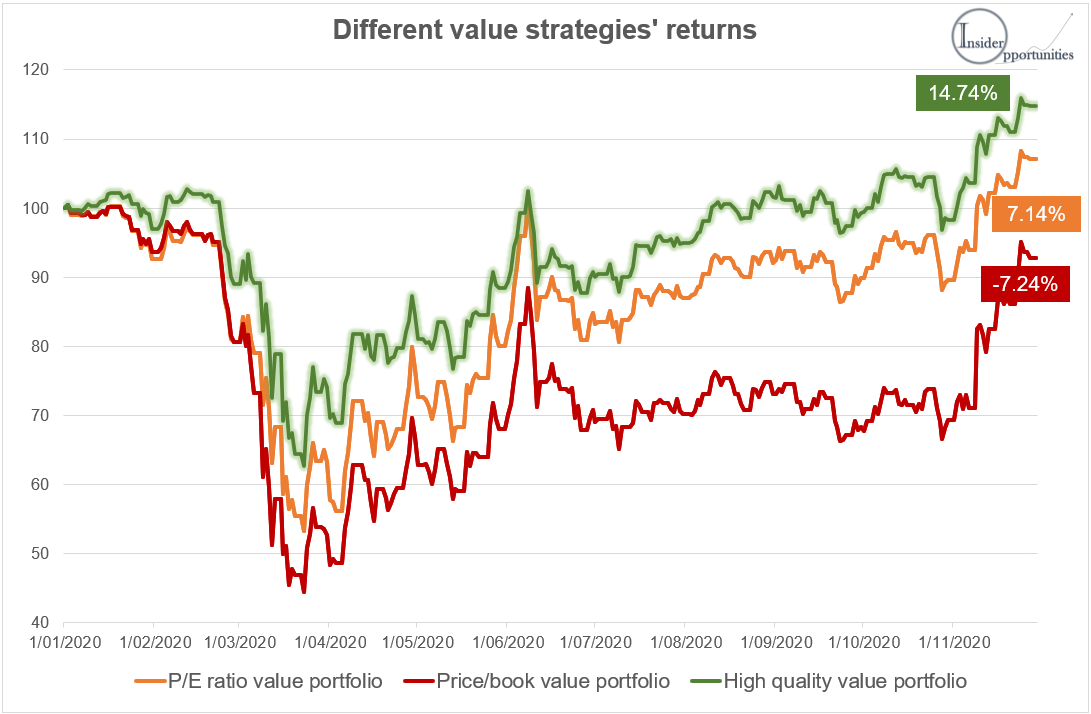

Looking at the performance of value stocks dating back to 2020 and using the financial metrics listed above, we can see that using just value alone underperforms than if you're combining factors.

You can also combine value with quality, growth, and momentum factors for outsized returns—which is exactly what we did in our Blueprint Investing Formula.

Our e-book outlines over 25+ quantitative factors—combining financial metrics from value, quality, growth factor styles—the result of which created us a simple framework that continues to beat the market when combined with a proper portfolio strategy.

Get the the special research that still beats the market.

Stay tuned on this series when we go into the next type of factor style investing—factor growth. Subscribe or register for free below and you'll be registered to receive all our posts and Factor Style Series via email.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!