Yes, you can still write off your private jet—see how in our Ultimate Guide For Maximizing 1031 Exchanges.

The 1031 exchange, derived from Section 1031 of the Internal Revenue Code (IRC), facilitates the exchange of one property for another, allowing for the deferral of capital gains taxes.

In essence, a 1031 exchange allows for the exchange of investment properties without immediate tax consequences.

By deferring taxes due, you can continue to grow your investments tax-deferred, with potential tax obligations deferred until a later date. When executed correctly, there is no limit to the frequency of 1031 exchanges an investor can undertake.

But with 1031 Exchanges being so intricate, what do we need to know?

- What asset types qualify for 1031 exchanges?

- What's "the napkin test" and how does it affect our tax scenario?

- And yes! Your private jet can still be written off after the 2017 TCJA changes.

We present to you our Ultimate Guide To The 1031 Exchange, if it's not in this article, it's not anywhere else on the internet.

In this guide, we'll cover:

- What You Need To Know For 1031 Exchange

- Asset Types Qualifying For A 1031-Exchange

- The Four Types of 1031 Exchange

- Understanding Personal Property Restrictions

- Ineligible Properties

- Stacking 1031 Exchange With Other Tax Strategies

What You Need To Know For 1031 Exchange

According to IRS.gov, there are number of restrictions and qualifications investors must know to qualify for a 1031 exchange. There are as follows:

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

How to Use the Napkin Test in a 1031 Exchange

The napkin test serves as a quick and straightforward way to assess your position in a 1031 exchange transaction concerning asset value, equity, and debt.

If your aim is to defer capital gains taxes entirely in a potential exchange, you'll need to exchange equal across or equal up, thus avoiding triggering a taxable event.

Here's an illustration of how the napkin test can guide you in evaluating your position in a 1031 exchange.

| Original Asset | Replacement Asset |

Value | $3 million | $4.5 million |

Equity | $1 million | $1 million |

Mortgage | $2 million | $3.5 million |

Keeping in mind the "equal across or equal up" guideline, it's evident that in this scenario, the exchangor is upgrading both in terms of fair market value and mortgage debt, thus avoiding the creation of any taxable boot in the exchange.

However, let's consider a situation where the investor decreases the mortgage debt in the replacement asset. Any loan amount below the original $2 million would lead to a taxable mortgage boot.

Boot refers to the "unlike" property received in an exchange. It includes cash, personal property, or any reduction in mortgage debt following an exchange, all of which are taxable. By anticipating the possibility of taxable boot, the exchangor can adjust the transaction structure before finalizing the deal.

"Mortgage boot" occurs when an exchangor decreases the loan amount or debt through the exchange. For example, if the loan on the original property amounted to $1,000,000 and the loan on the acquired property is $900,000, there would be $100,000 of mortgage boot, potentially subject to taxation.

Similarly, regarding equity, the exchangor cannot enhance their financial position in the exchange. Therefore, they must roll over the entire $1 million in equity or face taxes on any amount less than the full $1 million.

Investors do have the option to offset any mortgage boot in an exchange by injecting cash into the deal. For instance, if the new loan amount is $1.9 million, the exchangor can contribute $100,000 in cash to avoid any taxes from the mortgage boot. However, when it comes to equity, it must be a one-to-one match; you cannot increase the replacement property's loan amount to offset any equity withdrawn from the exchange.

Asset Types Qualifying For A 1031 Exchange

As it turns out, a 1031 exchange does not necessarily apply only to residential real estate. In fact, there are a variety of asset types a 1031 exchange can be applied to. Here the most common ones investors can use apply Section 1031.

Commercial & Industrial

Investors have the opportunity to utilize a 1031 exchange to transition into commercial properties, including industrial and manufacturing facilities like an distribution facility, a self-storage facility, a warehouse, a retail shopping center, or an office building.

Residential

Investors have the option to use a 1031 exchange to transition into residential multifamily properties, which may include 300-unit class A luxury multifamily facilities, 55+ active living communities, or student housing properties.

Register using your Google Account. Just click the GIF!

Agriculture

Investors have the opportunity to utilize a 1031 exchange to transition from farmland to residential multifamily properties, or vice versa. This means that farm owners can sell their farmland and reinvest the proceeds into residential multifamily communities, or investors can exchange their multifamily properties for farmland.

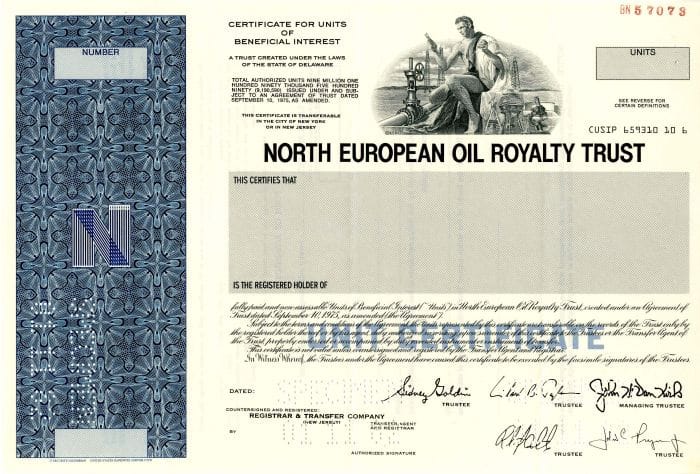

Oil, Gas and Mineral

Investors have the option to utilize a 1031 exchange to transition from traditional Ownership of property can be transitioned into oil and gas investments, such as working interests or royalty interests. We've assisted clients in selling long-held inherited royalty interests and reinvesting in income-generating multifamily properties.

Interests in oil, gas, and mineral estates, along with water and ditch rights, qualify for 1031 exchange tax deferrals due to their perpetual nature. Perpetual interests are typically conveyed through leases, royalties, and production payments.

For federal tax purposes, mineral leases are regarded as real property interests and thus eligible for 1031 tax deferred treatment. These leases grant the lessee the right to extract minerals for a specified period, with the lessee bearing the costs of discovery and extraction.

Similarly, royalties are considered real property interests and qualify for 1031 exchange tax deferral treatment. Unlike leases, royalties do not involve operating interests or production costs. Instead, the holder of the royalty receives a percentage interest in the extracted materials for the duration of the property's life.

Production payments, however, are not eligible for 1031 exchanges. They represent a right to the extracted materials at a predetermined value, paid from a percentage of the removed minerals. Unlike royalties, production payments are finite and based on specified production levels rather than being perpetual.

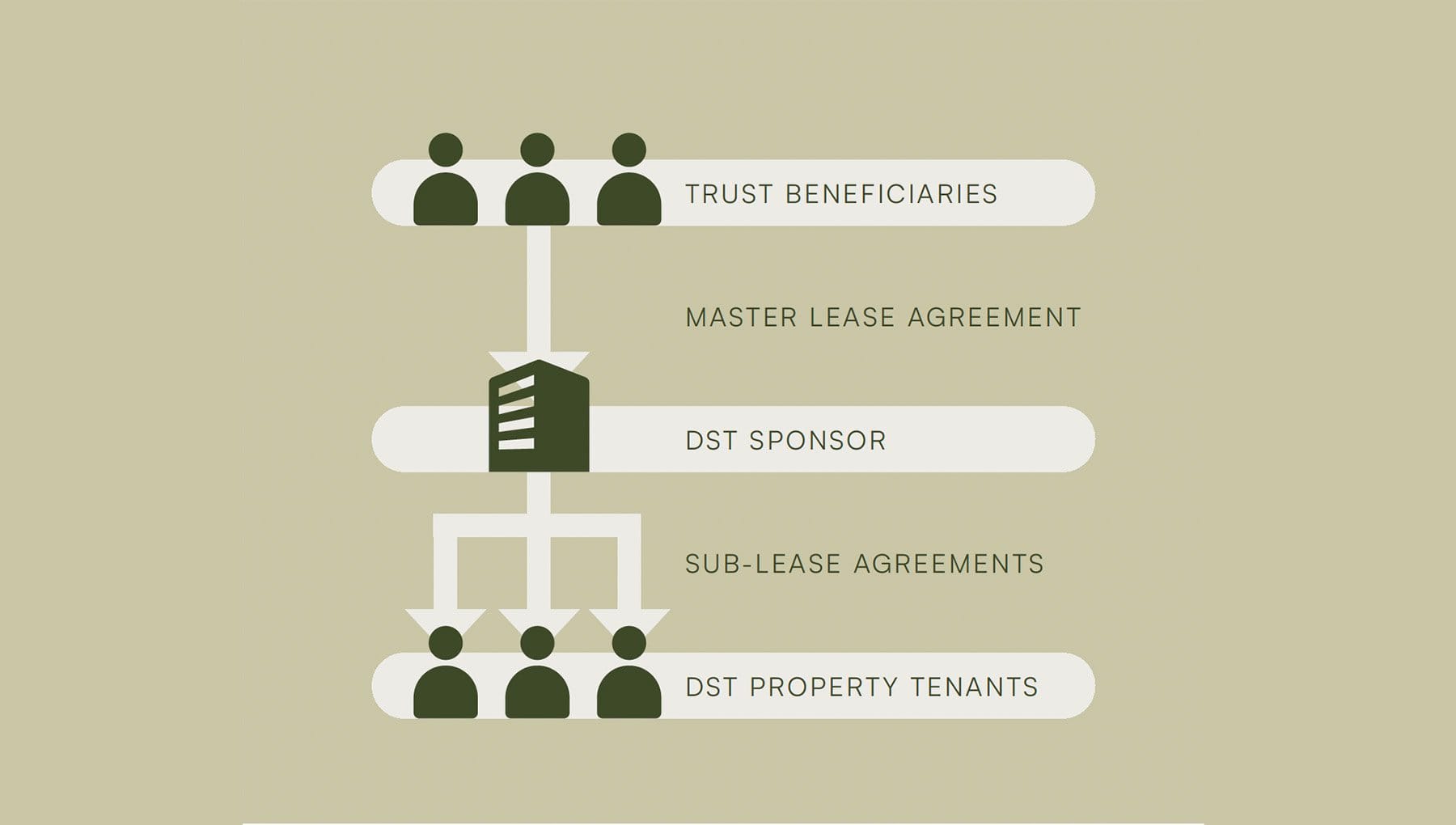

Delaware Statutory Trusts (DSTs)

Investors have the opportunity to utilize a 1031 exchange to transition from traditional property ownership to Delaware Statutory Trusts (DSTs) encompassing various asset classes, including multifamily properties or self-storage facilities.

Tenants in Common 1031 exchanges allow property owners to defer capital gains when replacing a fractional interest in a cash flowing property. It is a form of direct ownership that is not affected by the IRC §1031(a)(2)(D) exclusion as long as the co-tenants or owners are not treated as partners for income tax purposes.

Register using your Google Account. Just click the GIF!

Tenants in Common (TICs)

Investors can leverage a 1031 exchange to transition into Tenant-in-Common (TIC) ownership of properties spanning various asset classes. These include self-storage units, industrial facilities leased by prominent companies like Amazon or Costco, and even senior care facilities.

Tenant In Common (TIC) interests provide investors with an opportunity to participate in property ownership, even if they cannot afford the entire property independently. For instance, they might own a fraction of a commercial strip mall or a building leased to a major tenant like Walgreens.

It's essential to recognize that most TIC investments necessitate the investor to have "Accredited" Investor status. This means having a net worth exceeding $1,000,000 (excluding the personal residence) and an income surpassing $200,000 in each of the last two years, or if investing jointly with a spouse, a combined income exceeding $300,000. While differing from Delaware Statutory Trusts, TIC investments share many similarities.

Conservation Easements

Conservation easements and land trusts are established when a property owner transfers some or all rights to a qualified conservation non-governmental organization or government entity, either for a specific duration or in perpetuity. As the owner of the easement, the designated utility, government, or conservation entity holds the legal authority to prevent any development that contravenes the terms outlined in the easement agreement specific to the piece of land.

Certificates of Trust or Beneficial Interests

While there has been a longstanding legal restriction on conducting 1031 exchanges involving "certificates of trusts and beneficial interests," it is feasible to facilitate exchanges involving properties held by trusts. However, when arranging exchanges involving trusts, it is imperative to ascertain which taxpayer holds ownership of the property for tax purposes. Neither the trust's grantor nor its beneficiaries are permitted to procure the replacement property under their individual names.

Vacation Rentals

Vacation rental properties eligible for 1031 exchanges encompass a variety of options, from coastal homes, rentals, and condominiums to lakeside cottages and inland condominiums. Each presents investors with the chance to retain the property as an investment, benefiting from potential appreciation and the ability to deduct yearly expenses and depreciation. For vacation homes eligible for 1031 exchanges, personal use must not exceed 14 overnights or 10 percent of the days rented per year.

The IRS has outlined these criteria as a clear benchmark for vacation property owners and their advisors. While exchanges of vacation properties can occur within timeframes shorter than those specified in IRS Rev. Proc. 2008-16, they may be subject to IRS scrutiny.

Timber Rights

Perpetual timber rights, allowing unlimited harvesting of standing timber, are akin to water and mineral rights in terms of being classified as real property rights according to state law. When dealing with timber, a deed must be conveyed rather than a contract or bill of sale. It's crucial to avoid pre-established cutting contracts, as they could classify the timber as personal property, which does not qualify as "like-kind" to real property. In many states, it's possible to separate timber interests from the land title. Consequently, timber deeds and land deeds can be exchanged independently, resulting in a simple fee interest in real property. Through a 1031 exchange, it's possible to convert a timber deed into real property while maintaining ownership of the original land.

Leasehold timber rights spanning thirty years, whether entailing the extraction of timber or a direct grant of timber rights, are eligible for exchange for other real property. Each 1031 exchange must undergo a thorough review on a case-by-case basis.

The Four Types of 1031 Exchange

Simultaneous Exchange

At times, the sale of the previous property and the acquisition of the new property are completed in one continuous closing process, known as a simultaneous 1031 exchange. Before the 1980s, all 1031 exchanges followed this simultaneous model.

However, in modern practice, the majority of 1031 exchanges involve closings that are staggered by several hours or a few days. This is permissible because the purchaser has up to 180 calendar days to finalize the transaction. It is recommended that if the closings involve different title companies or attorneys, at least one day should be allotted for the transfer of 1031 exchange funds. Typically, the wire transfer occurs within fifteen minutes of initiation.

Register using your Google Account. Just click the GIF!

Improvement Exchange

A Improvement Exchange empowers investors to tailor-make their replacement property to match their exact specifications. Whether it's minor repairs or elaborate ground-up construction, investors can customize their properties to their liking. This exchange option offers savvy investors various opportunities, including enhancing properties they already own.

However, it's crucial to ensure that the replacement property meets the exchange value requirement, often referred to as the "Napkin Test." This means that once improvements are finished, the replacement property must have equal or greater value than the relinquished property.

Reverse Exchange

A reverse 1031 exchange is a tax deferment tactic used when, for various reasons, the replacement property needs to be acquired before the relinquished or old property is sold. It's a more intricate process than a forward 1031 exchange, demanding meticulous planning. Nonetheless, the timeline of a reverse exchange adheres to the standard 1031 exchange rules.

Delayed Exchange

The delayed exchange is a common and straightforward process in which the exchangor relinquishes their property before acquiring a replacement property. In this scenario, the exchangor first transfers ownership of their current property, known as the "relinquished" property. Subsequently, they acquire the property they wish to own, referred to as the "replacement" property.

Before initiating the delayed exchange, the exchangor is responsible for marketing their property, finding a buyer, and completing a sale and purchase agreement.

Within 45 days of transferring the relinquished property, the exchangor must identify the replacement property they intend to acquire. They negotiate the purchase terms with the seller and execute a purchase and sale agreement.

Understanding Personal Property Restrictions

The 2017 Tax Cuts & Jobs Act excluded personal property from 1031 treatment. If you're selling personal property like a business and generating gains, exploring a Qualified Opportunity Fund (QOF) could provide tax advantages. Additionally, you might reduce your tax liability by expensing the purchase when replacing the asset with new.

Pro- Tip: Download our 27 Loopholes Used By The Ultra Elite research for an in-depth guide on how to set up a Qualified Opportunity Fund.

However, the legislation permits a full 100% deduction for business expenditures, including aircraft purchases, provided they were placed into service after September 27, 2017, and there was no prior written binding contract for the aircraft acquisition before that date.

The criteria for an aircraft exchange closely resemble those of a real property exchange and include the following:

- Both the relinquished aircraft and the replacement aircraft must be utilized in a trade or business, or held for investment purposes.

- The relinquished and replacement aircraft must meet the like-kind requirement as outlined in the regulations.

Aircraft exchanges can take two forms:

- A forward like-kind exchange involves selling the relinquished aircraft before acquiring the replacement aircraft.

- A reverse like-kind exchange occurs when the replacement aircraft is obtained before selling the relinquished one. This method is quite common in aircraft exchanges, as owners often secure the new aircraft first to ensure uninterrupted access to aerial transportation before completing the sale.

Refer to the Act, §13201(h) for details. It's important to note that taxpayers have the option to opt out of the 100% expensing and instead choose to depreciate an aircraft using other available depreciation methods.

Register using your Google Account. Just click the GIF!

The Tax Cuts and Job Acts generally eliminated the exchange of personal and intellectual property and instead classified certain property types as immediately expensable under Section 179.

We will create another post in the future covering all these changes, but for now, just know that while your business aircraft does not qualify for a 1031 Exchange, it is immediately expensable under the right conditions.

Ineligible Properties

Under IRC §1031, the following properties are ineligible for tax-deferred exchange treatment:

- Stock in trade or other property primarily held for sale, such as property held by a developer, "flipper," or dealer.

- Securities or other evidences of indebtedness or interest.

- Stocks, bonds, or notes.

- Interests in a partnership.

- Choses in action, which are rights to receive money or other property through judicial proceeding.

- Foreign real property for U.S. real property.

- Goodwill of one business for goodwill of another business.

- Property solely used as a primary residence, or the portion exclusively used as such.

- Personal Property (effective January 1st, 2018)

Stacking 1031 Exchange With Other Strategies

Secret IRS files and court cases reveal the top US income-earners and how their tax rates vary more than their incomes.

We take deep dive into the 27 most used strategies the ultra-wealthy use to pay little to no taxes.

These are tax strategies that billionaires used to qualify for a stimulus check in 2020.

By the end of this tax adventure, you’ll fully understand why wealth and income are two completely different things.

Get Our Exclusive Research Below — For A Limited Time Only

Register using your Google Account. Just click the GIF!