With the AMD stock being down 30% from it's all time highs, is AMD ready for growth in the era of AI? We examine their fundamentals and reveal a sneak peak at this cycle's Synsense prediction.

Shares of Advanced Micro Devices (AMD) have experienced a dramatic fluctuation in 2024. The stock initially surged following optimistic projections related to artificial intelligence (AI) sales early in the year. However, after the first-quarter update, reality tempered these gains, and shares are now down about 30% from their peak in the spring.

AMD Stock Performance in 2024

- Current Price: $166.33

- Market Cap: $266 billion

- Day's Range: $164.47 - $168.49

- 52-Week Range: $92.74 - $227.30

- Volume: 45,141,176

- Average Volume: 61,947,671

- Gross Margin: 39.12%

AI Expectations and Reality

Entering 2024, CEO Lisa Su and her team were increasingly optimistic about AI chip sales, projecting $2 billion in accelerated-computing sales, which was later raised to $3.5 billion. This significant, though not massive, new market represented a substantial opportunity for AMD, which had $22.8 billion in sales over the last 12 months. The new MI300 accelerated-computing system became AMD's fastest product to reach $1 billion in revenue, achieving this milestone in just two quarters.

Click to Read the Full Article at the Stock Market Learning CenterDespite initial excitement, the $3.5 billion outlook for 2024 AI sales was not increased during the first-quarter update. Furthermore, second-quarter guidance was underwhelming, with expected revenue of $5.7 billion—up 4% from the prior quarter and 6% year-over-year.

Comparing AMD and Nvidia

Unlike Nvidia, whose data-center AI revenue has shown exponential growth, AMD's focus differs. Since the acquisition of Xilinx in early 2022, the primary reason for optimism about AMD has been its potential for rising profit margins.

The recent bear market significantly impacted AMD sock, especially in consumer spending on PCs and laptops. The client revenue segment reported an operating profit of $86 million in the first quarter, with a margin of only 6%. However, there is substantial room for improvement as consumer PC spending stabilizes.

While AMD's data center AI chips have not offset weaknesses in other business areas like embedded (Xilinx) and gaming (video game consoles), they have contributed to profit-margin expansion. Data center operating margins were 23% in the first quarter, compared to 11% the previous year.

Data Center Market

The data center segment is currently AMD's most critical market. The global data center market is projected to grow at a CAGR of 6.56% through 2028. Within this market, the AI segment, which drives data center revenues, is expected to expand at a CAGR of 17.30% from 2023 to 2030. For the period 2022-2026, spending on AI-centric systems is expected to grow at a CAGR of 27%. Consequently, in the updated valuation model, data center revenue will grow by 27% from 2024 to 2026 and subsequently at a rate of 17.30%.

Client, Gaming & Embedded Processors

This segment includes CPUs and GPUs for PCs and gaming consoles, as well as embedded processors used in appliances. The worldwide PC market is expected to grow at a CAGR of 9.1% through 2029, while the global embedded processors market is projected to grow at a CAGR of 8.12% through 2031.

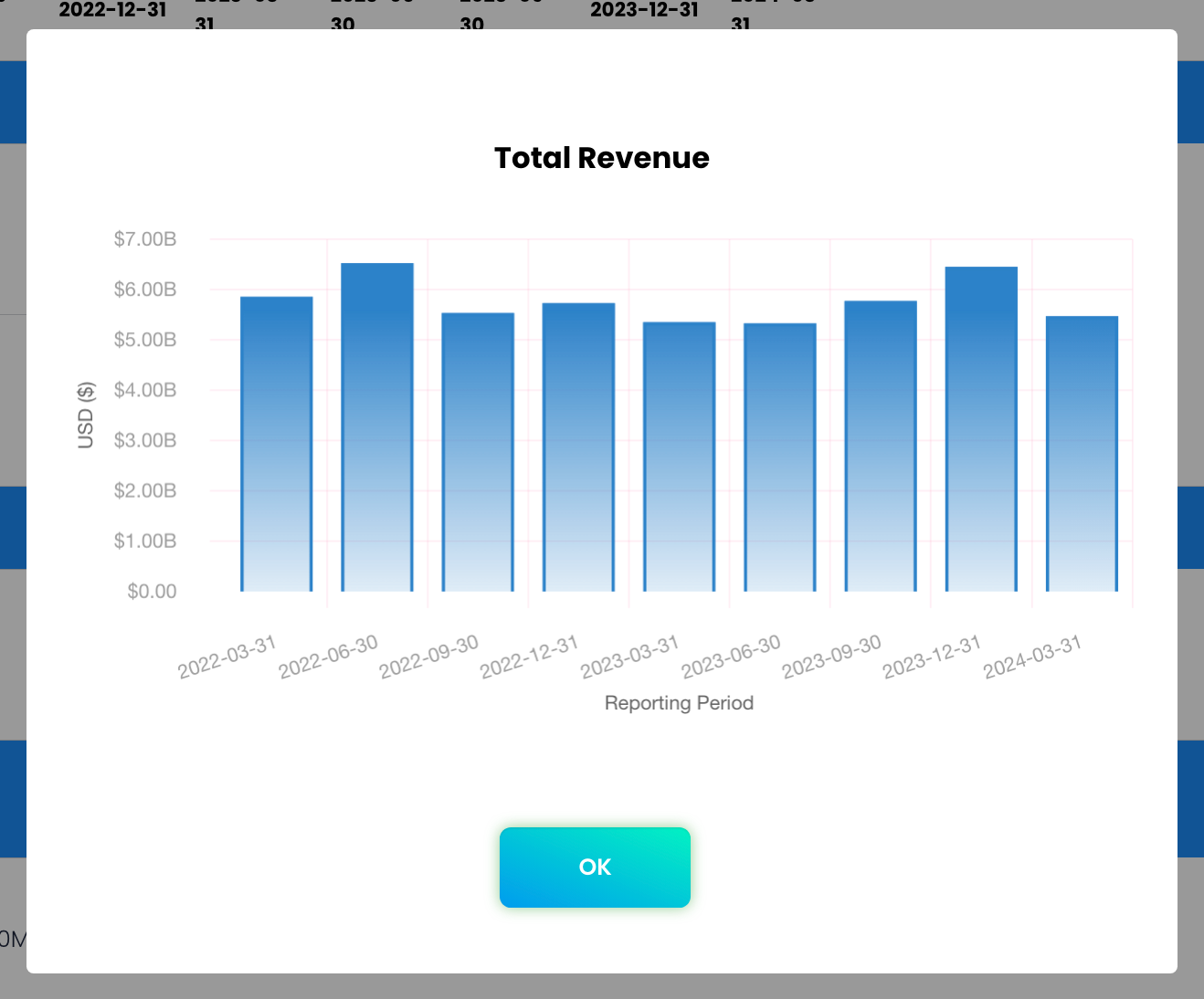

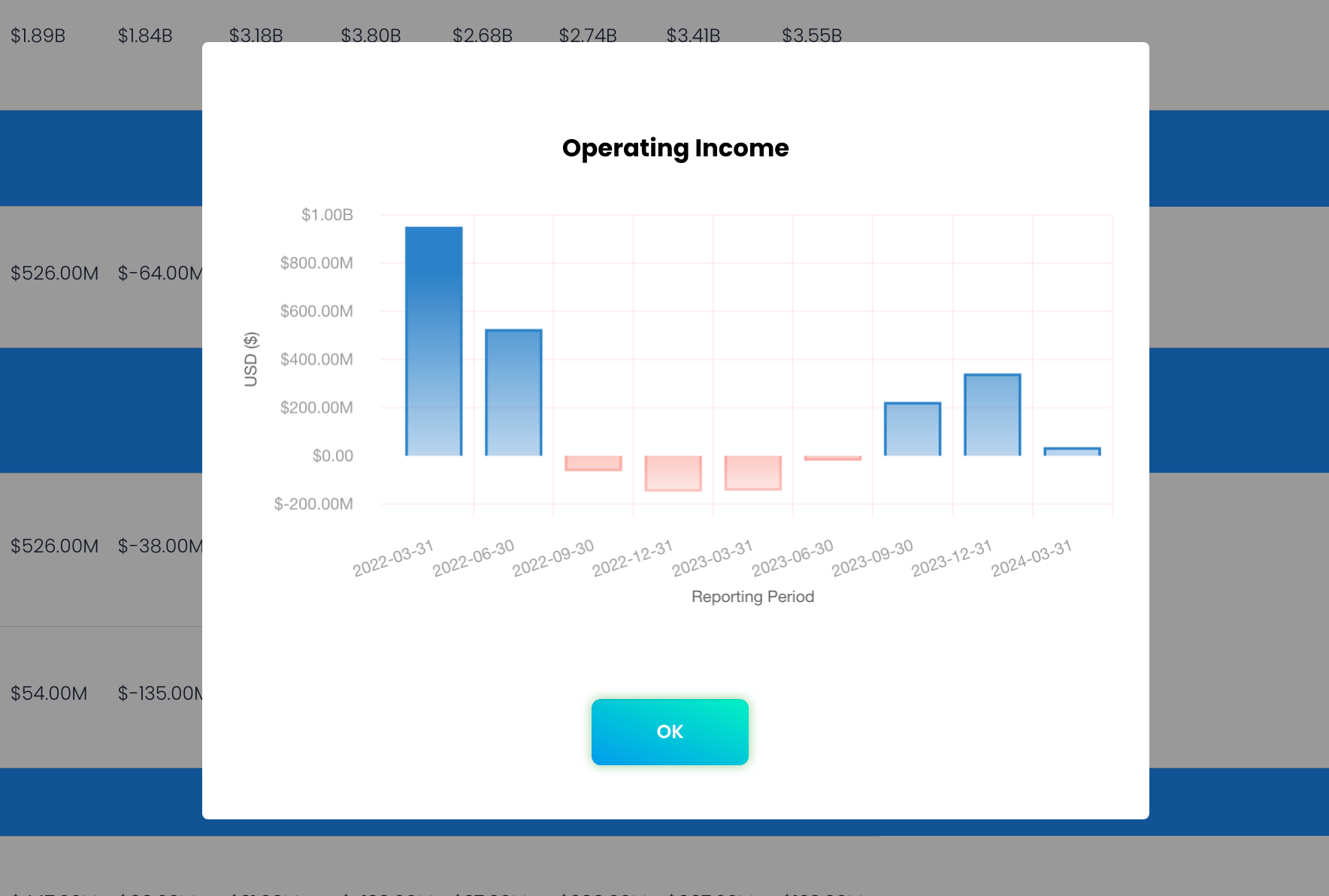

Financials

Since 2017, AMD stick has been growing at an annual pace of 55.3%, with net income increasing by 448%.

However, operating income has been decreasing at a 36% annual pace due to a significant slump starting after 2021. From Q3 2023 to Q4 2023, revenue grew by 2.57%, operating income surged by 501%, and net income increased by 310%.

Margins improved, with the operating margin increasing from -0.36% to 1.77% and the net income margin rising from 0.94% to 3.77%. The balance sheet for AMD tock remains strong, with cash reserves nearly unchanged at $5.78 billion, slight increases in short-term debt (from $1.14 billion to $1.39 billion) and long-term debt (from $1.715 billion to $1.717 billion).

Free cash flow decreased slightly by about $50 million to $1.57 billion, reducing the FCF margin from 7.3% to 6.9% due to a decrease in cash from operations (from $1.85 billion to $1.66 billion).

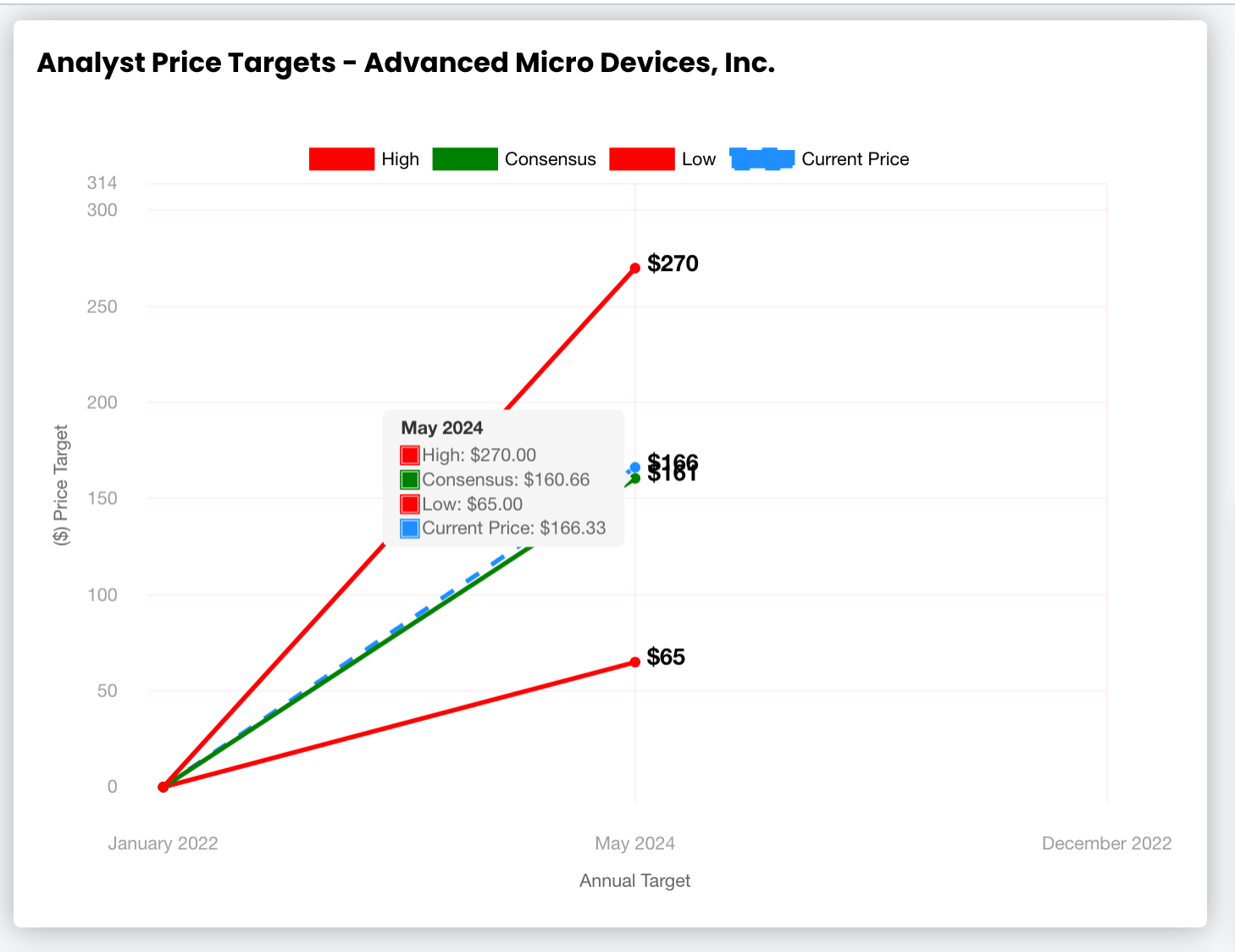

Analysts' Estimates

Revenue is also projected to grow at double digits until 2027, with a subsequent slowdown. For 2024, the average revenue estimate is $25.82 billion, increasing to $32.47 billion in 2025 for AMDstock.

Profitability and Future Prospects

AMD still has work to do to return to its peak profitability levels of 2022. If the company resumes a positive trajectory, shares could be reasonably valued at 46 times forward P/E, though perhaps not an outstanding bargain.

Considering the recent fluctuations, it might be wise to disregard the all-time highs reached in the spring and view the current situation as a reset rather than a dip. While the long-term potential remains, cautious optimism is advised.

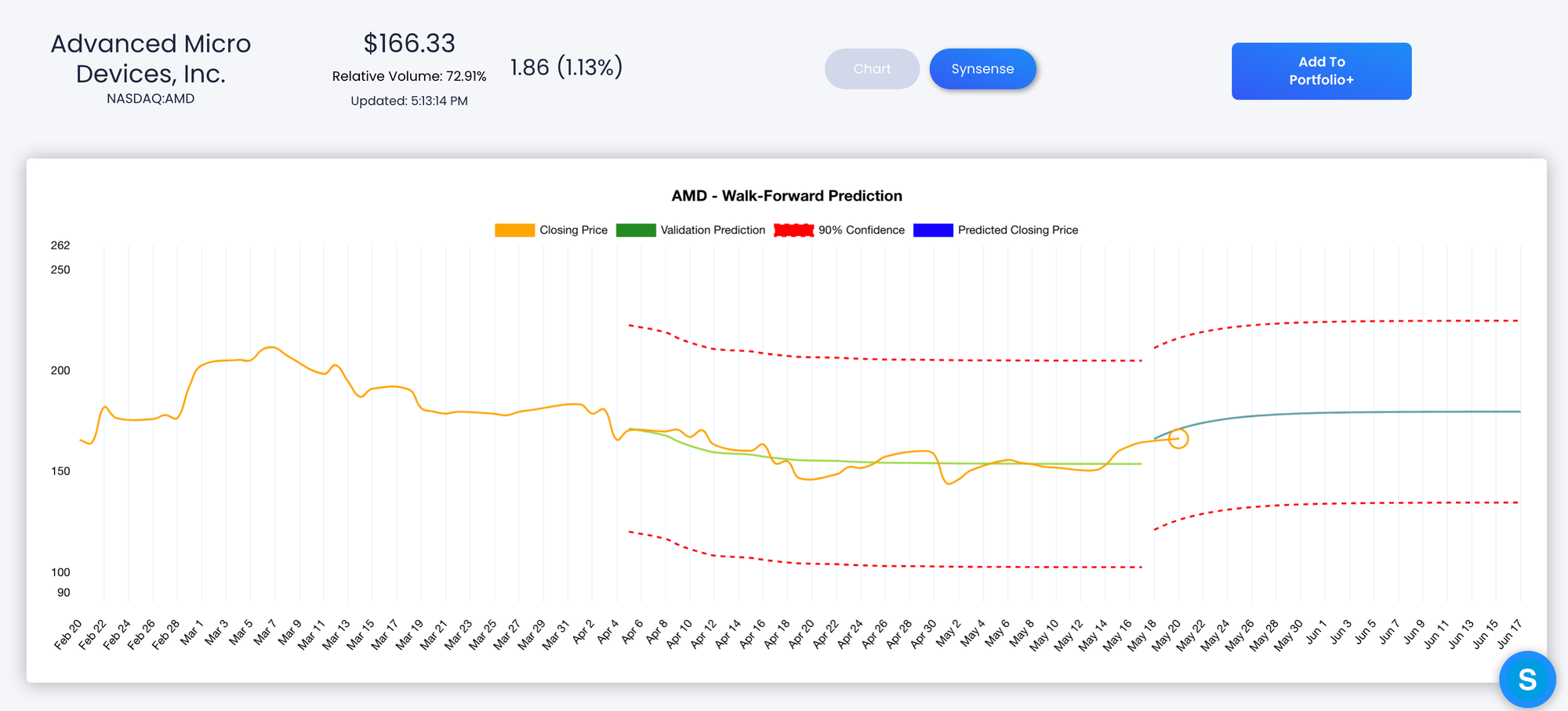

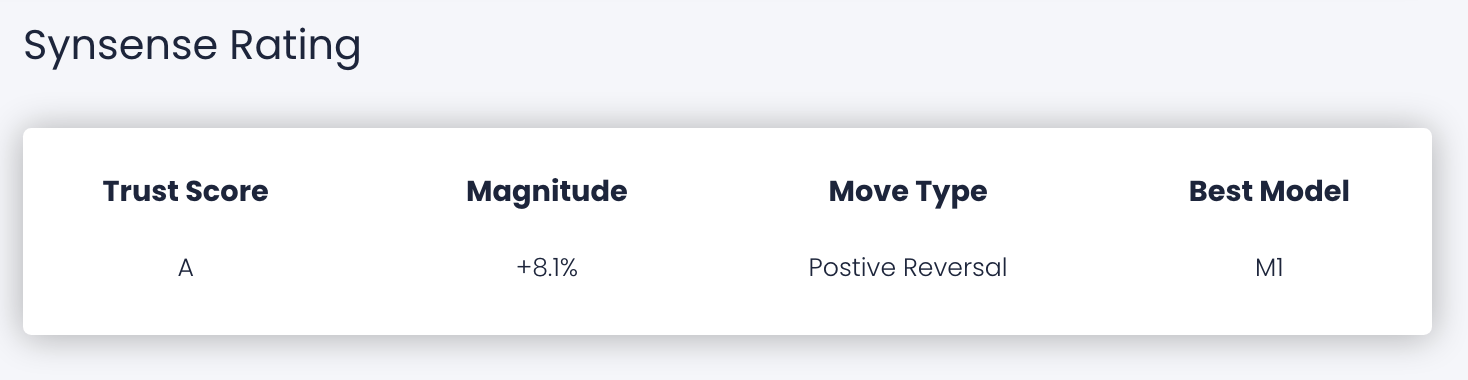

Synsense Prediction

Synsense is predicting a reversal move upwards to about $179 with last period's prediction being just about spot on.

Want more predictions? Check out Synvestable Premium for predictions on over 10,000 tradable tickers. Register for FREE below for tons of free content as well!