When it comes to dividend investing or even just having companies in your portfolio that pay a dividend, there's specific dividend data that you need to be paying attention to.

In the article we'll go over the key dividend data that you need to watch:

- The Declaration Date

- The Ex Dividend Date

- The Record Date

- The Payment Date

- A Simple Dividend Example

- Special Situations

- Implications of Selling Stock

This guide will help you understand how you receive dividends from stocks, and important dates to know in the dividend cycle.

To understand if a dividend is applicable to you, it is crucial to consider two significant dates, namely the record date (or "date of record") and the ex-dividend date (or "ex-date")

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

The Declaration Date

This is the date the company actually declares the dividend amount to be paid per share. Typically there will be four of these declaration dates in the company's fiscal year and adding up all four of these amounts equals the total annuald dividend payout per share.

The Record Date

When a company declares a dividend, it specifies a record date when you must be listed as a shareholder on the company's books to receive the dividend. This date is also used by the company to identify shareholders who will receive proxy statements, financial reports, and other essential data.

The Ex-Dividend Date

Once the record date is set, the ex-dividend date is determined according to the specific stock exchange's regulations that the company trade on.

Key Point: This can be thought of as the cut-off date where you will need to own shares before the company records the dividend on the record date.

Generally, the ex-dividend date is established one trading day before the record date. If you purchase a stock on or after the ex-dividend date, you will not receive the next dividend payment, and the seller gets the dividend instead.

However, if you purchase the stock before the ex-dividend date, you are entitled to the dividend.

Key Point: If you purchase a stock on or after the ex-dividend date, you will not receive the next dividend payment, and the seller gets the dividend instead.

The Payment Date

This is the date that the declared cash payment per share is actually disbursed to shareholders. It will appear in your brokerage cash balance on the date of payment, usually before the market open.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

A Simple Dividend Example

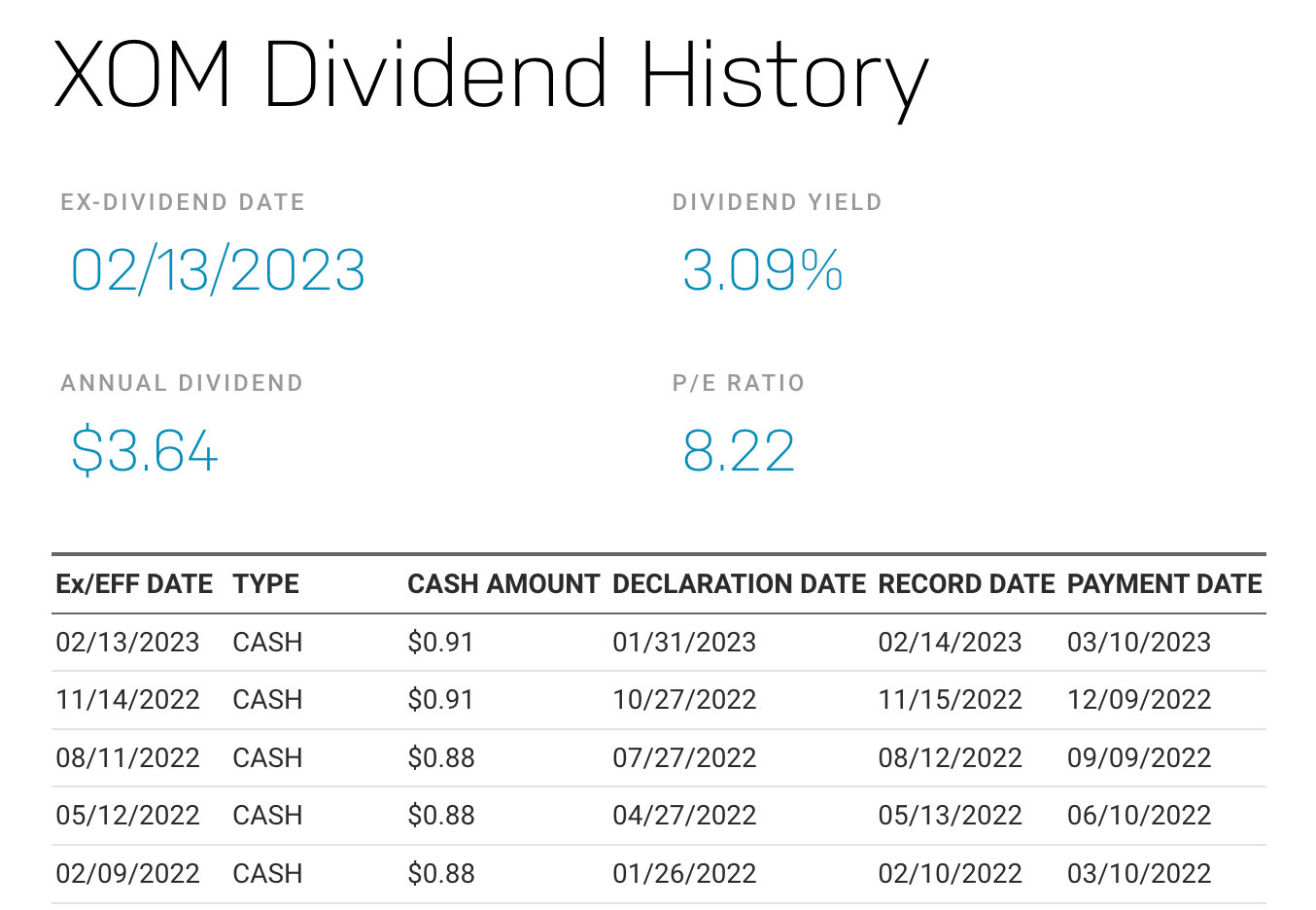

For instance, on January 31st, 2023, Exxon Mobil (XOM) declares a dividend payable to its shareholders in the amount $0.91 per share, this is the declaration date.

In order to receive the $0.91 per share payout to your brokerage account, you need to own the stock before February 13, 2023—the ex-dividend date.

The company records all shareholders who will receive the dividend on February 14, 2023, the record date. At this point if you sell your shares in XOM, you would still receive the declared dividend payment.

Finally, on March 10th, 2023 you will have received the cash amount per share directly to your cash balance in your brokerage account, this is the payment date. For example, if you own 10 shares of XOM, you will receive $9.10 added to your brokerage cash balance on March 10th.

Special Situations

In cases where the dividend is equivalent to 25% or more of the stock's value, special rules apply to determine the ex-dividend date. In such cases, the ex-dividend date is postponed until one business day after the dividend payment date.

Therefore, the ex-dividend date for a stock that's paying a dividend equal to 25% or more of its value in the above example would be October 4, 2017.

Sometimes, a company may choose to pay dividends in the form of stock instead of cash. This type of dividend may be additional shares in the company or its subsidiary that's being spun off.

The procedures for stock dividends may differ from those of cash dividends. In such cases, the ex-dividend date is determined as the first business day after the stock dividend payment date.

Implications of Selling Stock

If you sell your stock before the ex-dividend date, you also waive your right to the stock dividend. The sale comprises an obligation to deliver any shares obtained due to the dividend to the buyer of your shares.

If you hold your stock through the market open on the ex-dividend date, you are still entitled to the next dividend payment.

Oftentimes, a stock will experience some selloff on the ex-dividend date on the market open because investors can take profits from capital gains and still receive the next dividend payment.

However, if the dividend payment is in the form of stock, you will need to wait until after the payment date to sell your shares.

Hence, it's crucial to note that the first trading day after the stock dividend payment date is usually when you can sell your shares without the obligation to deliver the additional shares.

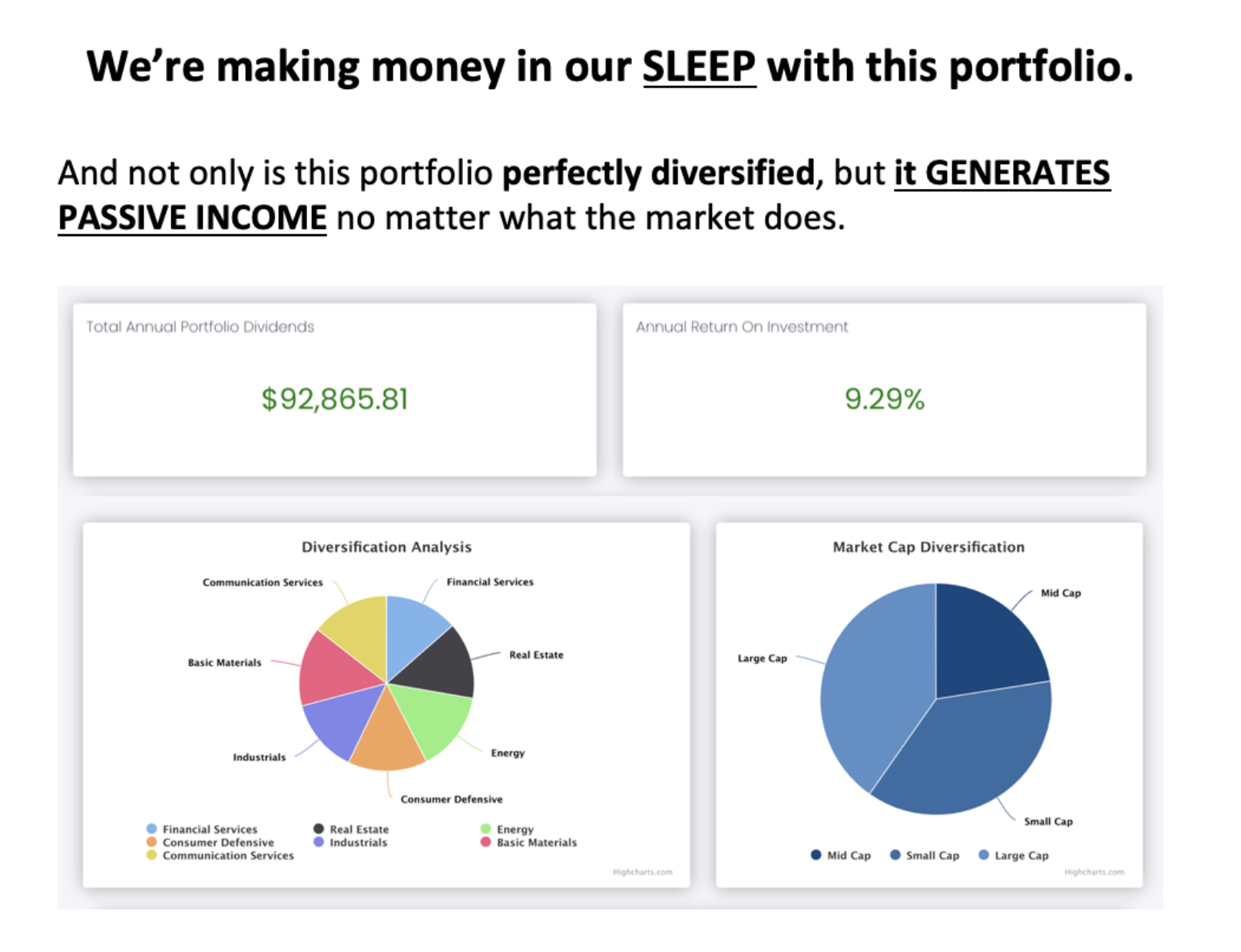

Get The Ultimate Guide on Dividend Income

And the best part is that it's perfectly diversified and pays over 9.2% annually just in dividends.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

DISCLOSURE: Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com