Our simple 4-Step Guide to consistently finding the best dividend paying stocks.

Passive Income — The Ultimate Goal of Investing

The ultimate goal for any investor is to have diversified passive income streams that consistently produce reliable cashflow.

This means it's never too early or too late to take advantage of one of the best vehicles for passive income out there—dividend stocks.

Dividend investing is one of the most overlooked aspects of investing today simply because investor appetite for Factor Growth has increased exponentially over the years.

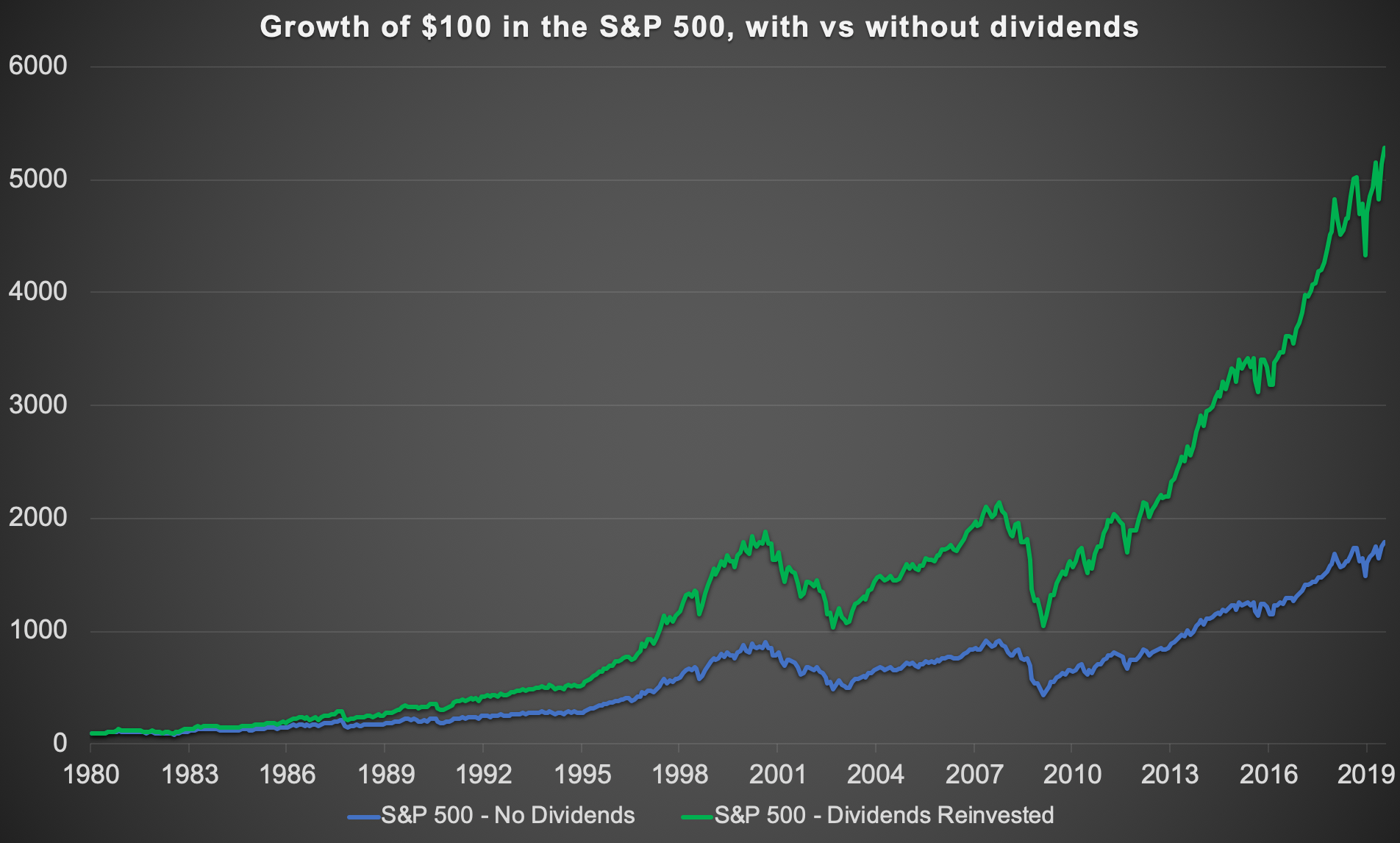

But growth without dividends is meaningless—and the difference in long-term returns is clear below.

The results are clear—stocks in the S&P 500 that pay dividends compound exponentially more than stocks that do not.

But when it comes to dividend investing, it's important to know how to discern between great dividend paying stocks and stocks to avoid.

So we put together this easy, four-step guide on what you absolutely NEED to know when looking for great dividend stocks.

The 4 Step Guide To High Dividend Investing

The four steps to successful dividend investing are below, we'll go through why each is important and how you can implement each in the easiest way possible.

- Find Companies With High Dividend Yields

- Check Each Company For Financial Health

- Check The Dividend History

- Understand Your Own Tax Implications

Find Companies With High Dividend Yields

The first step to finding great dividends starts with the yield.

The dividend yield tells you the return on investment from the dividend payout relative to the price of the stock.

The dividend yield essentially tells you how much bang you're getting for your invested buck in terms of an annual payout.

Dividend yields can range from 0% as high as 14-18%. Obviously the larger the dividend yield, the more you're getting paid to just hold the stock, however a high yield comes with a few caveats that we'll show you in Step 3.

Using AT&T as as example, we can see that the current dividend yield is currently over 6%. Not bad! A great candidate for a high-yield dividend investment.

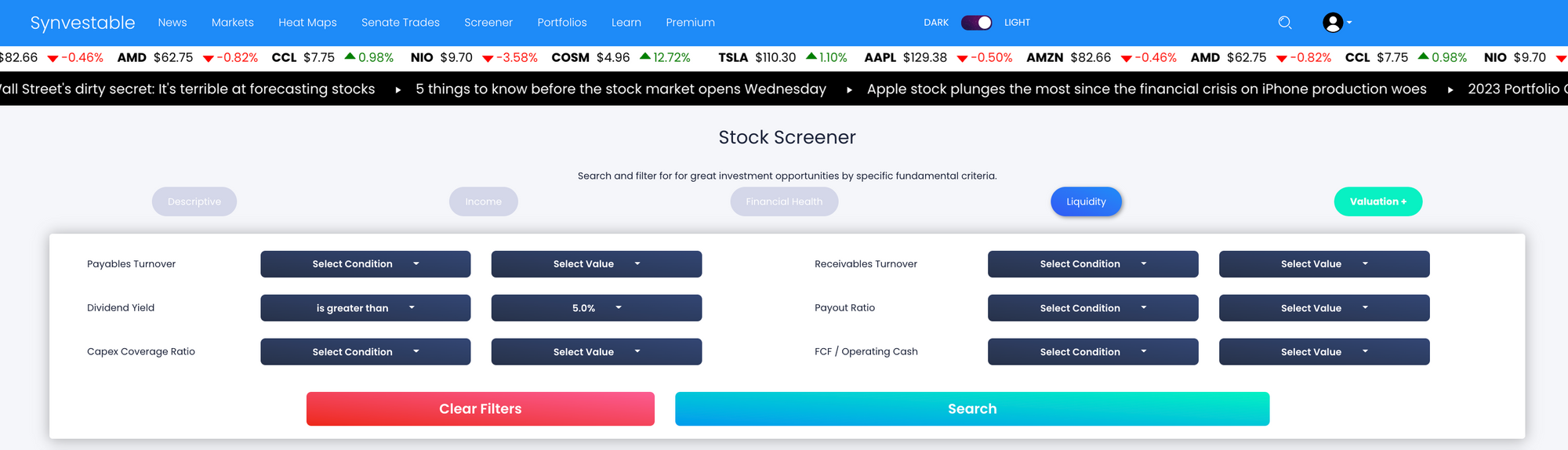

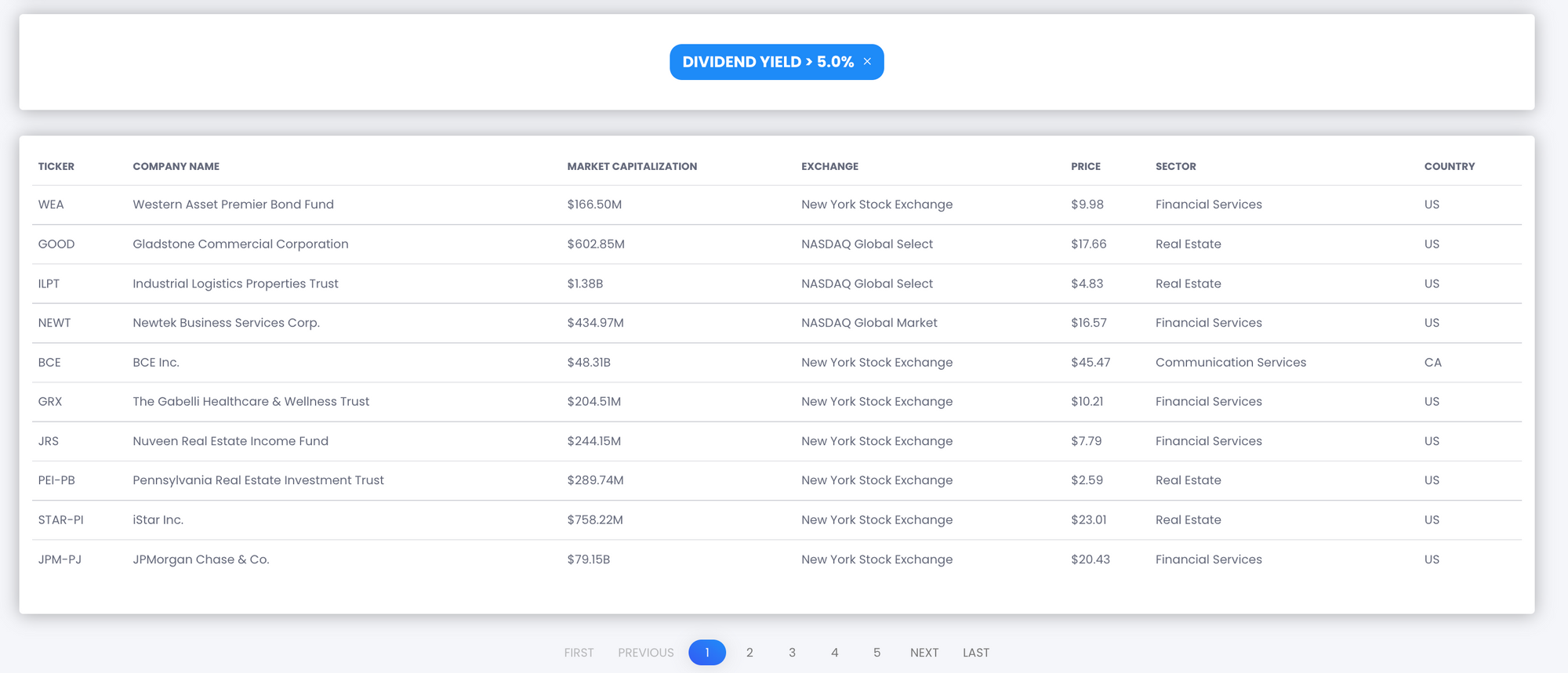

In fact you can find a ton of great dividend companies using our free stock screener—just click the liquidity tab, enter a dividend yield higher than 5%, and voilà—all your high dividend stocks in one list.

Now that we have a list of high-dividend paying investment candidates, we can move to Step 2 for each company.

Check Each Company For Financial Health

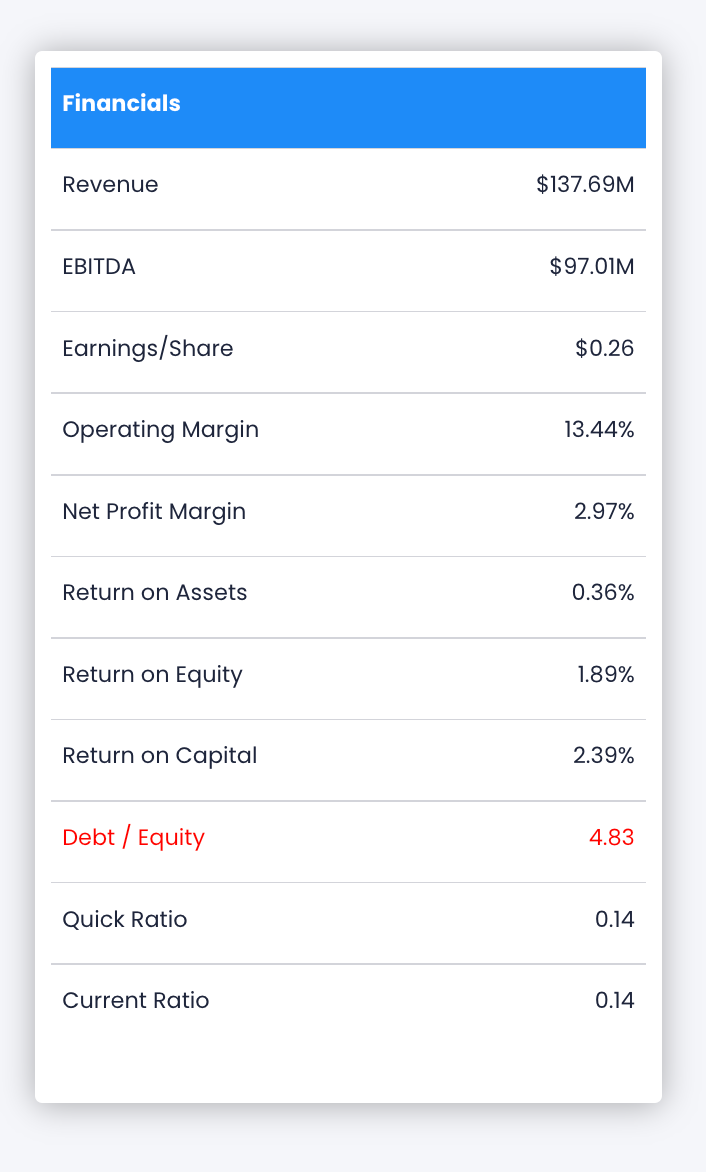

With our high-dividend list we can now click into each company and do some further analysis as to the sustainability of their dividend.

We'll want to look the overall financial health of each company.

Some things to consider:

- Is the company profitable?

- Is revenue growing?

- Is the price/earnings ratio reasonable?

- Is debt/equity reasonable?

- Are earnings growing consistently?

Synvestable will highlight all of these for you.

Any areas that are cause for concern will be highlighted in red.

Any areas that are of interest will be highlighted in green.

For example, looking at the second company on our list, Gladstone (GOOD), we can see their capitalization structure is a cause for concern in regards to financial stability.

This may pose as a potential risk area to future dividend payouts.

As we go through our list, we begin to see some great candidates remaining that we can add to a model dividend portfolio for some further analysis.

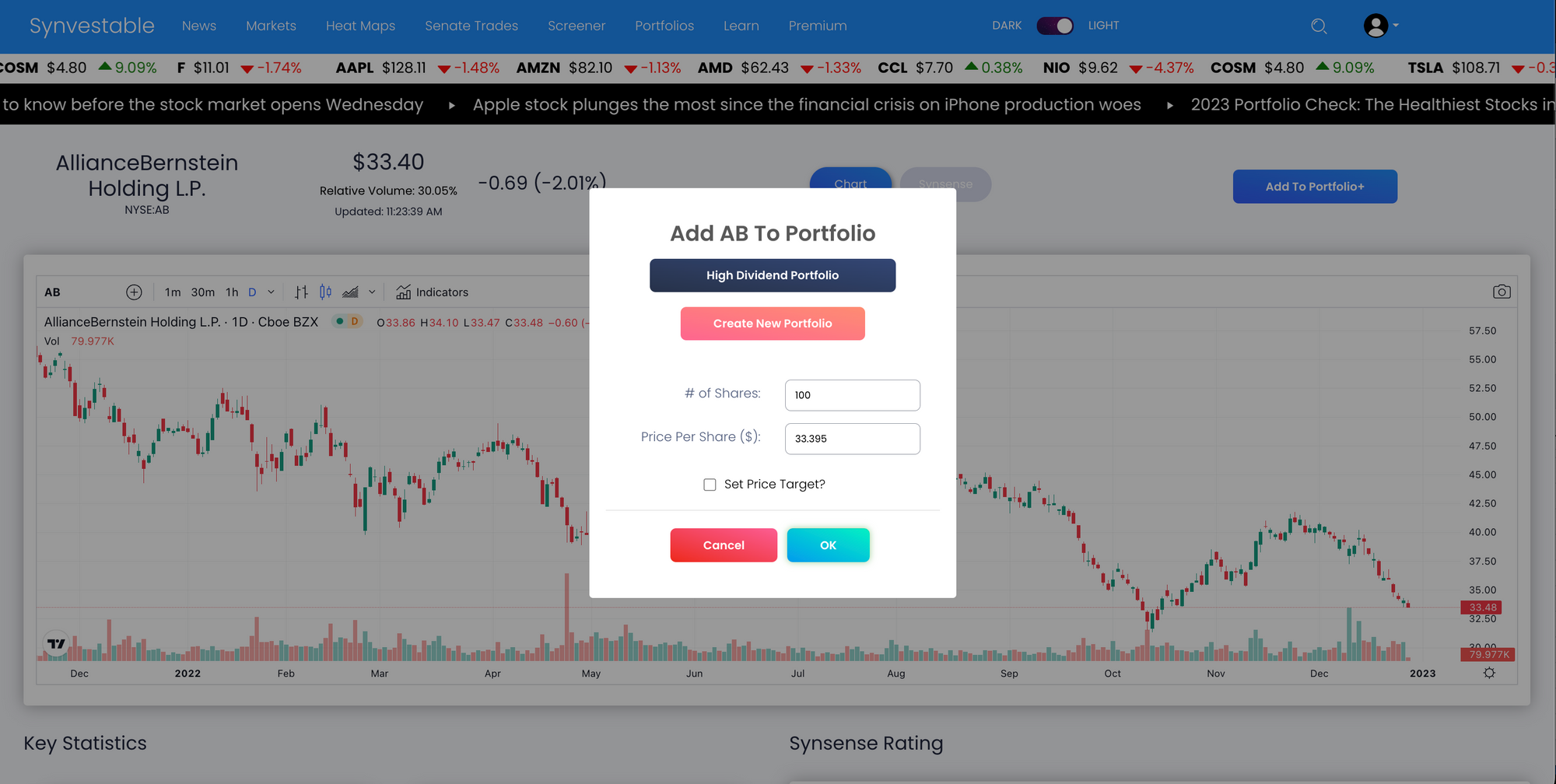

For example, one great company that meets all of our financial health criteria listed above is AllianceBernstein (NYSE:AB)

To move to Step 3 in our process, we create a model dividend portfolio and add some shares of AllianceBernstein to dig deeper.

In fact, we can do this for as many companies as we'd like from our screener list so we have a portfolio of many different companies to move to Step 3 all at once.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Check The Dividend History

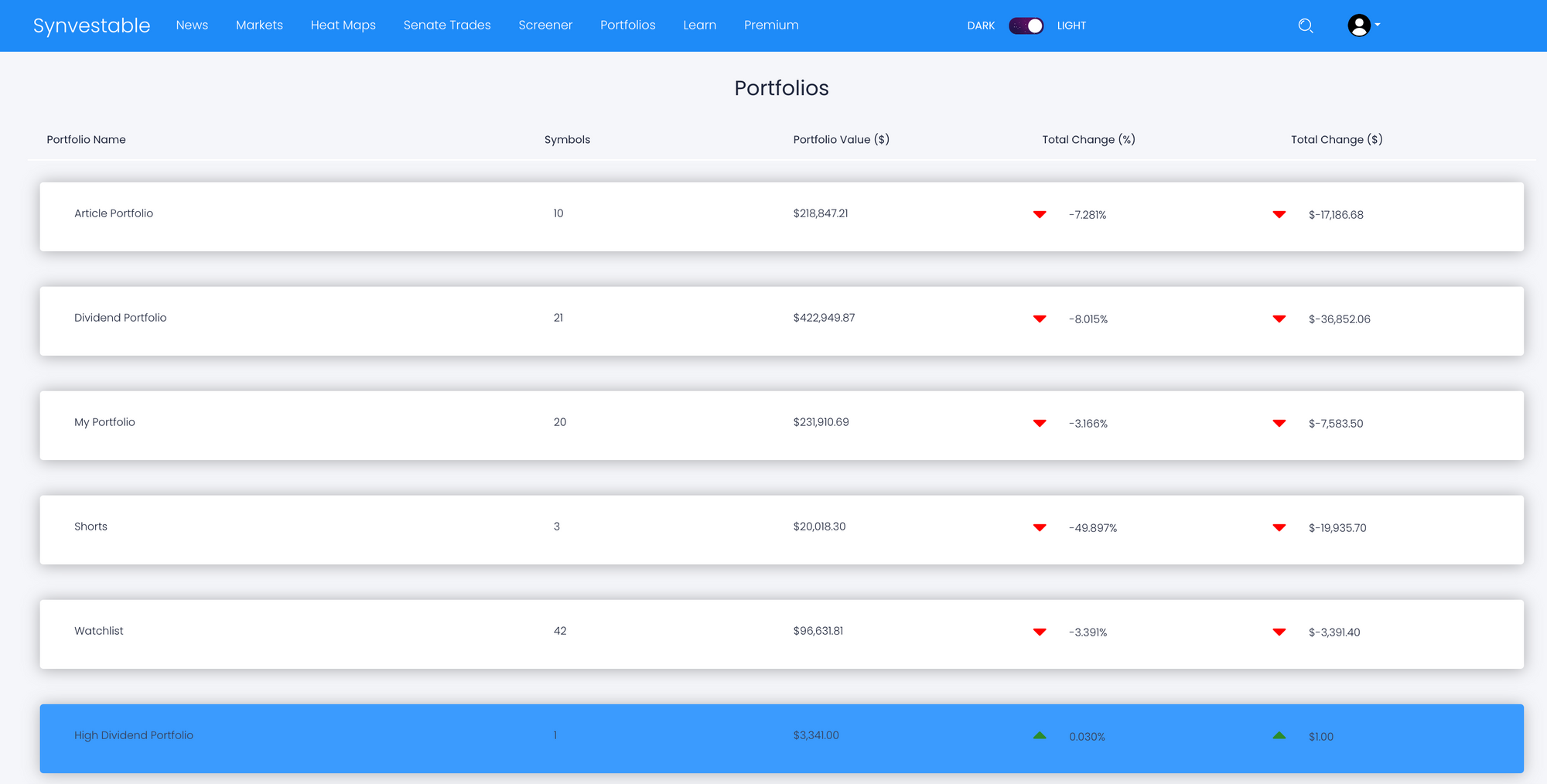

Now that we have a portfolio of various companies that passed our financial health checks, we can see just how reliable their dividend histories are.

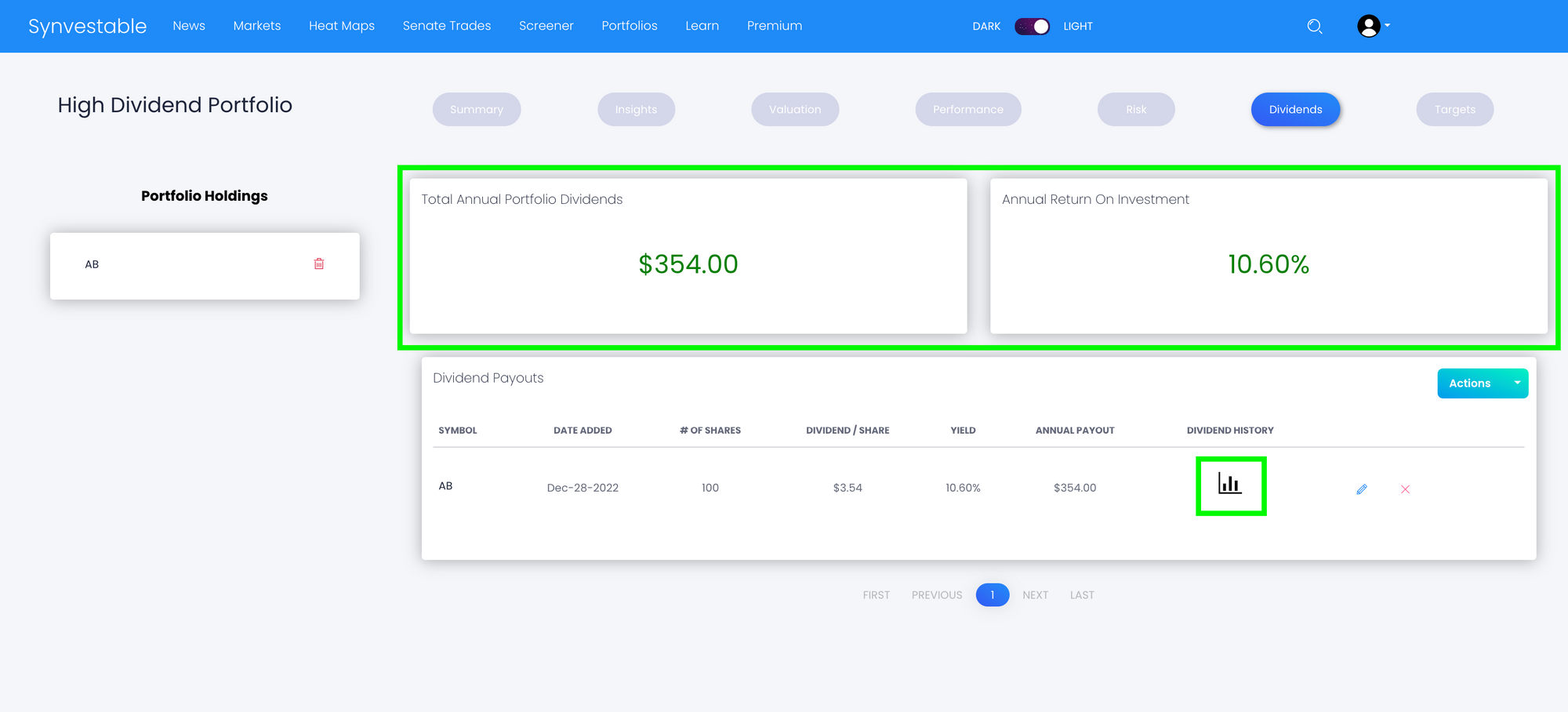

As an example, here we click on the Portfolios tab, and click into the example portfolio we created for AllianceBernstein.

From here we can click on the Dividends Tab, where we can see the total weighted dividend yield from all our positions, as well as the expected annual payout of the portfolio.

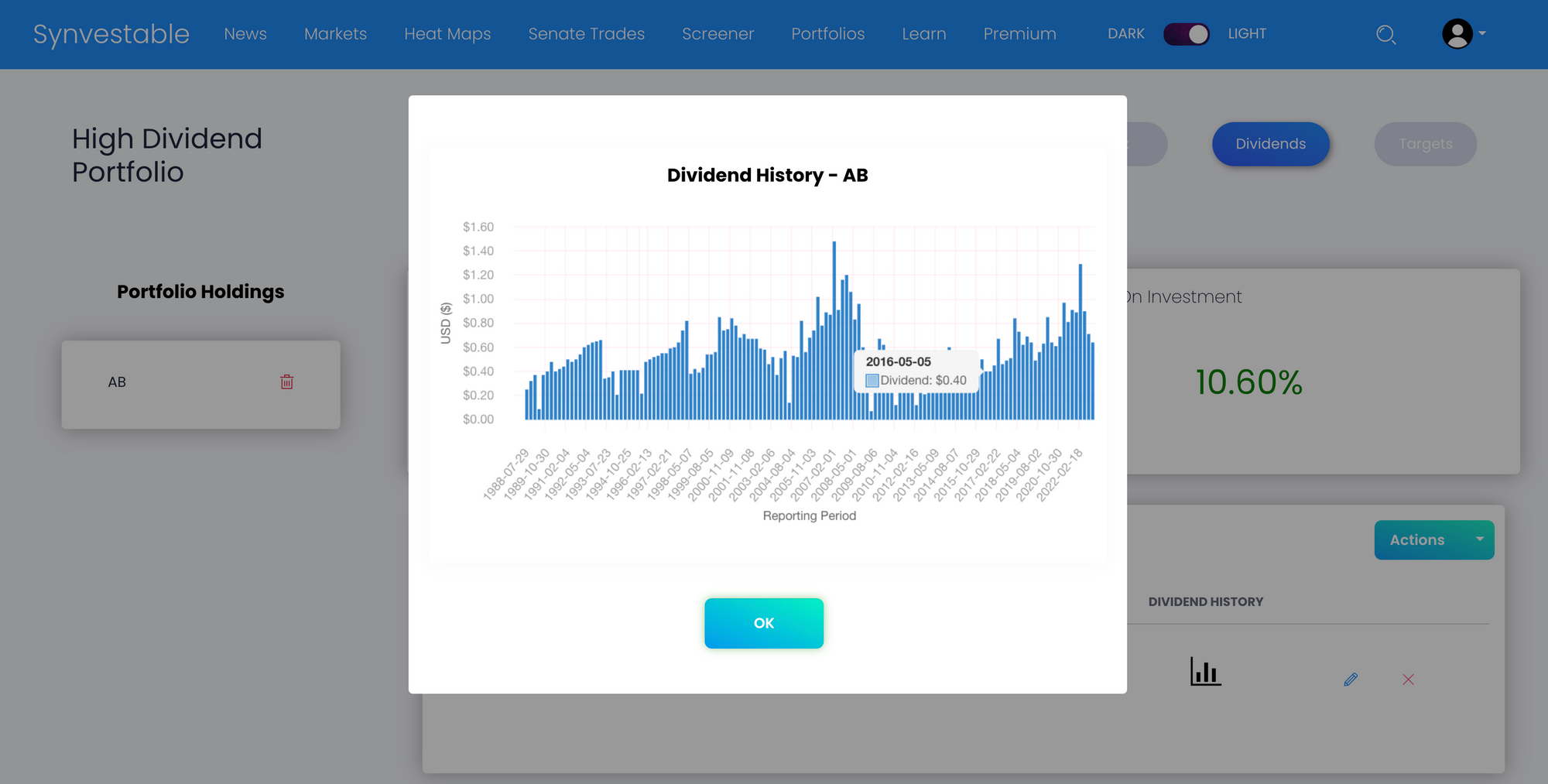

We can then click the Dividend History icon to see what AllianceBernstein's dividend history actually looks like.

Looking at AllianceBernstein's dividend history, we can see some variation in the dividend, but overall long-term growth in the the quarterly payout.

We can also see that the current dividend yield is in line with the average payout which is around $.40-.70 per quarter.

Dividends are typically paid out quarterly, with the total payouts adding up to the amount specified by the yield.

As an example, AllianceBernstein's annual dividend payout per share is $3.54 (10.60% yield), which is paid in four quarterly payments throughout the year, anywhere from $.49-$1.29 per quarterly payment.

With a reliable and growing dividend, this makes AllianceBernstein a reliable candidate for our high-yield dividend investment portfolio—a great find for us!

Understand Your Own Tax Implications

Now that you're gone through Steps 1-4 and have a portfolio of high-quality high-dividend stocks, it's important to understand the year-end tax implications when it comes to dividend investing.

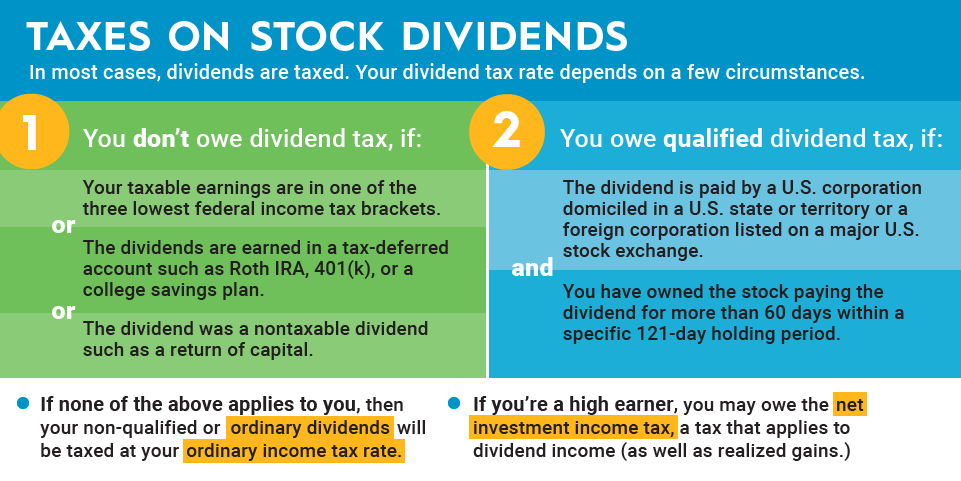

Below is a table that can help you understand exactly how dividends are taxed, but there are some distinctions we should highlight.

The IRS classifies dividends into one of two categories—ordinary dividends and qualified dividends.

According to IRS.gov:

"Dividends can be classified either as ordinary or qualified—ordinary dividends are taxed as ordinary income, qualified dividends meeting specific requirements are taxed at a lower capital gain rate. The company paying the dividend is required to correctly identify each type and amount of dividend for you on Form 1099-DIV." - IRS.gov

In other words, the company paying the dividend is responsible for identifying whether the dividend is qualified or ordinary, and will be reflected on the tax documents provided by your broker at the end of every tax year.

The important takeaway is that ordinary dividends are taxed as ordinary income—so if you fall into a higher tax bracket, the tax implications for ordinary dividends is larger than if you're in a lower tax bracket.

Of course, your accountant can help you understand exactly how your brokerage tax document is structured, as well as any special considerations you'll need to know about your own personal financial scenario.

These Dividend Stocks Are A Must See

Today you learned how to find high dividend paying companies and if they're reliable. You also learned how your unique situation determines your tax implications for your dividend portfolio.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!