Exchange-traded funds (ETFs) have become an increasingly popular investment vehicle in recent years. As of 2021, there were over 7,000 ETFs available globally, with a total net asset value of over $9 trillion.

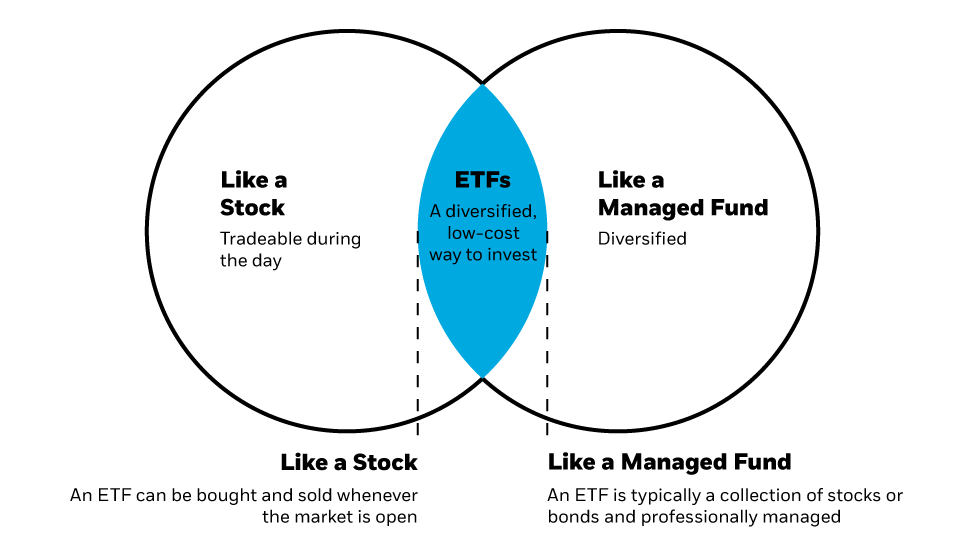

An ETF is a type of investment fund that is traded on a stock exchange and provides investors with exposure to a diversified portfolio of assets, such as stocks, bonds, commodities, and currencies.

In this article, we will discuss:

1) What is an ETF

2) Differences Between ETFs and Mututal Funds

3) Differences Between ETFs and Index Funds

4) Important Considerations When Buying ETFs

5) Risk Implications of Buying ETFs

6) How To Analyze an ETF

What is an ETF

An ETF is a type of investment fund that is designed to provide investors with exposure to a diversified portfolio of assets. ETFs are similar to mutual funds in that they pool together money from investors to buy a portfolio of assets. However, ETFs differ from mutual funds in that they are traded on a stock exchange, like individual stocks.

ETFs are generally structured as open-end funds or unit investment trusts (UITs). Open-end funds issue and redeem shares on demand, while UITs issue a fixed number of shares that are redeemed at a later date. Most ETFs are structured as open-end funds.

ETFs can invest in a wide range of assets, including stocks, bonds, commodities, and currencies. Some ETFs are designed to track the performance of a specific index, such as the S&P 500 or the Nasdaq 100, while others may focus on a specific sector, such as technology or healthcare.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Differences Between ETFs and Mutual Funds

ETFs and mutual funds are both investment funds that pool together money from investors to buy a diversified portfolio of assets. However, there are several key differences between the two types of funds:

First, ETFs are traded on a stock exchange, like individual stocks, while mutual funds are not. This means that ETFs can be bought and sold throughout the trading day, while mutual funds can only be bought and sold at the end of the trading day at the net asset value (NAV) price.

Second, ETFs are generally more tax-efficient than mutual funds. When an investor sells shares in a mutual fund, the fund must sell assets to generate cash to pay the investor, which can trigger capital gains taxes. In contrast, when an investor sells shares in an ETF, they sell them on the stock exchange to another investor, which does not trigger a taxable event for the fund.

Third, ETFs typically have lower fees than mutual funds. ETFs have lower expense ratios because they are passively managed, which means they track an index rather than having a fund manager actively selecting individual securities. In contrast, mutual funds are actively managed, which means they have a fund manager who selects individual securities, which leads to higher fees.

Differences Between ETFs and Index Funds

An index fund is a type of mutual fund or ETF that tracks the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. The main difference between an ETF and an index fund is how they are traded.

ETFs are traded on a stock exchange, like individual stocks, while index funds are bought and sold at the end of the trading day at the NAV price.

This means that ETFs can be bought and sold throughout the trading day, while index funds can only be bought and sold at the end of the trading day.

Important Considerations When Buying ETFs

When considering buying an ETF, there are several important factors to consider, including the expense ratio, the liquidity of the ETF, the underlying index or assets the ETF tracks, and the investment objective of the ETF:

Expense ratio: The expense ratio is the annual fee that the ETF charges to cover its operating expenses. It is important to compare the expense ratios of different ETFs to ensure that you are getting a good value for your investment.

Liquidity: The liquidity of an ETF refers to how easily it can be bought and sold on the stock exchange. Highly liquid ETFs tend to have narrow bid-ask spreads and high trading volumes, which means that investors can buy and sell shares at prices that closely reflect the underlying value of the ETF.

Underlying Index or Assets: It is important to understand the underlying index or assets that an ETF tracks. Some ETFs track broad-based indices, while others may focus on specific sectors, regions, or asset classes. Understanding the underlying assets can help investors to determine the potential risks and returns of an ETF.

Investment Objective: ETFs may have different investment objectives, such as growth, income, or value. It is important to consider your own investment goals and risk tolerance when selecting an ETF that aligns with your investment strategy.

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

Risk Implications of Buying ETFs

Like any investment, ETFs carry certain risks. Some of the risks associated with ETFs include market risk, tracking error risk, and liquidity risk.

Market Risk: ETFs are subject to market risk, which means that the value of the ETF can fluctuate with changes in the overall market. This can be influenced by a variety of factors, such as economic conditions, geopolitical events, and industry-specific factors.

Tracking Error Risk: ETFs that track an index can have a tracking error, which means that the ETF may not perfectly replicate the performance of the index it is tracking. This can be due to factors such as trading costs, fees, and the timing of purchases and sales of the underlying assets.

Liquidity Risk: Highly specialized ETFs or ETFs with less liquidity can be subject to liquidity risk, which means that investors may not be able to buy or sell shares of the ETF at the prevailing market price.

Portfolio Risk: Mixing ETFs into your portfolio will change the risk metrics of your portfolio. This is because ETFs are essentially their own portfolios, so while you may have a perfectly diversified portfolio, introducing ETFs can throw off that diversify under the hood.

Hidden Risk: This is a broader category which can be anything from solvency of the investment management company who run the ETF, to other hidden risks within the ETFs portfolio such as swaps, options, or other derivatives that may be used within the ETF portfolio.

How To Analyze an ETF

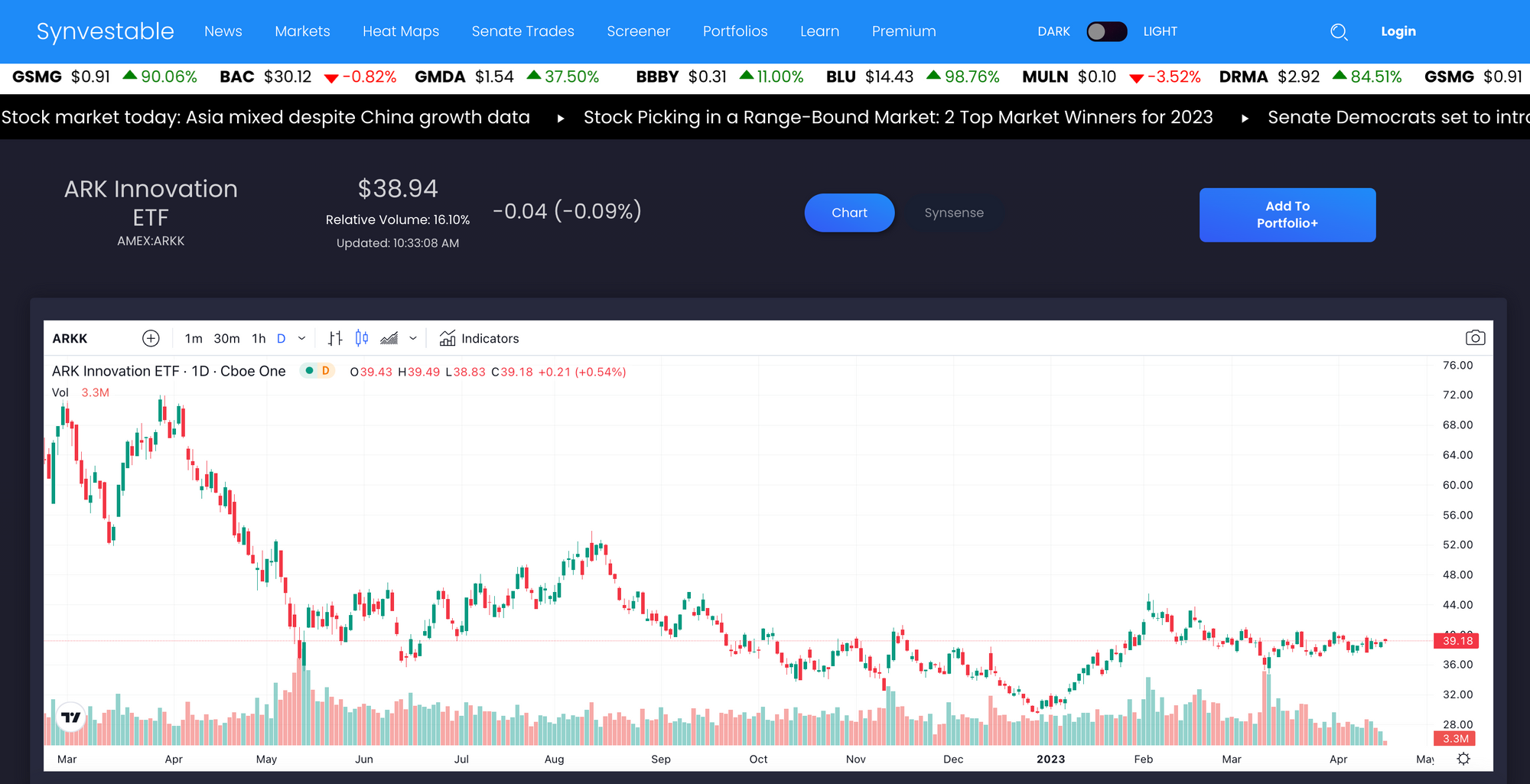

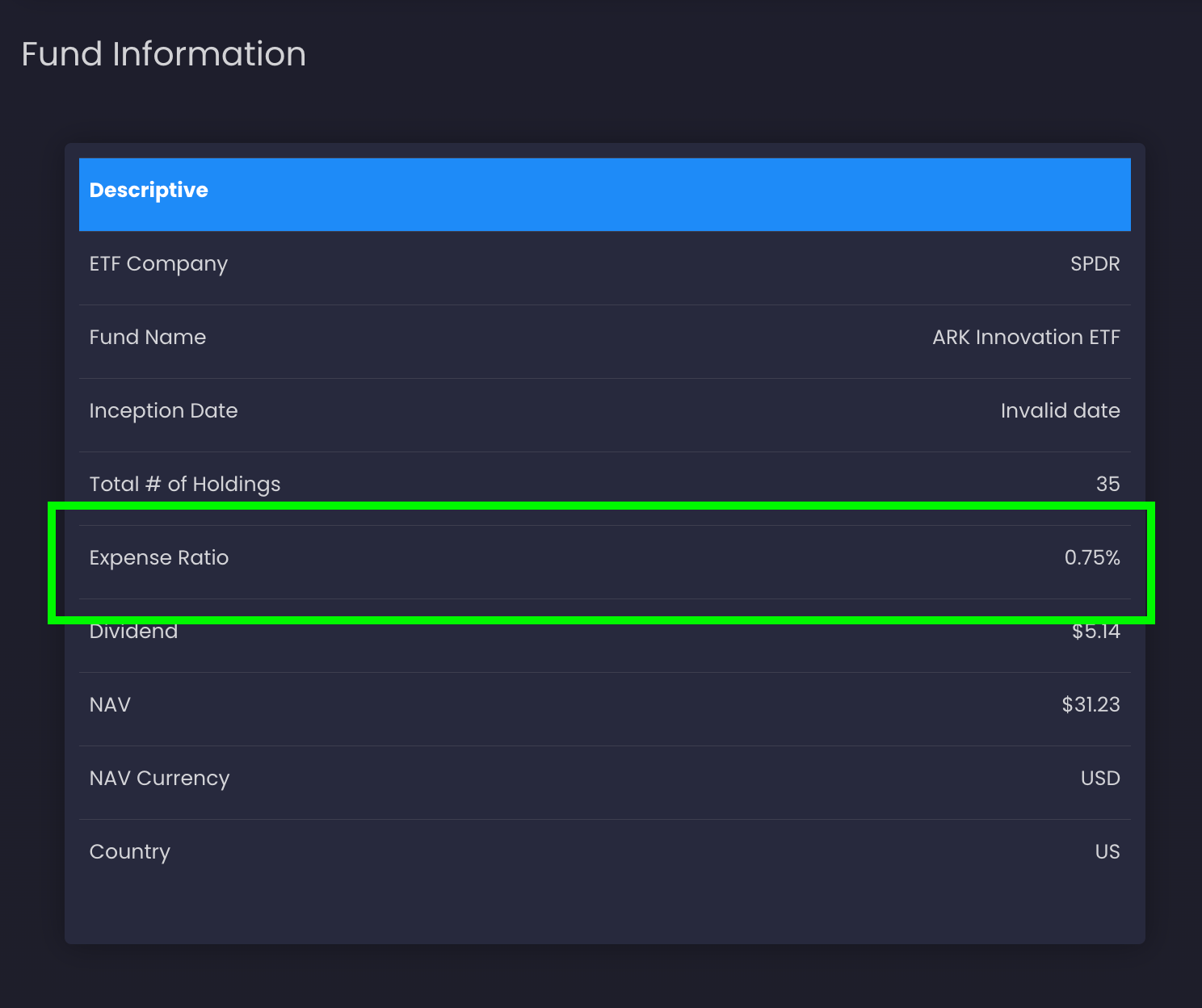

When analyzing an ETF, there are several factors to consider, including the expense ratio, the performance of the underlying index or assets, the diversification of the portfolio, and the liquidity of the ETF. Luckily, Synvestable makes this easy with our new ETF features, we'll use the Ark Innovation ETF (ARKK) as an example.

Expense ratio: The expense ratio is an important factor to consider when analyzing an ETF. Lower expense ratios can lead to higher returns over time, as they reduce the amount of money that the fund deducts from your investment to cover operating expenses.

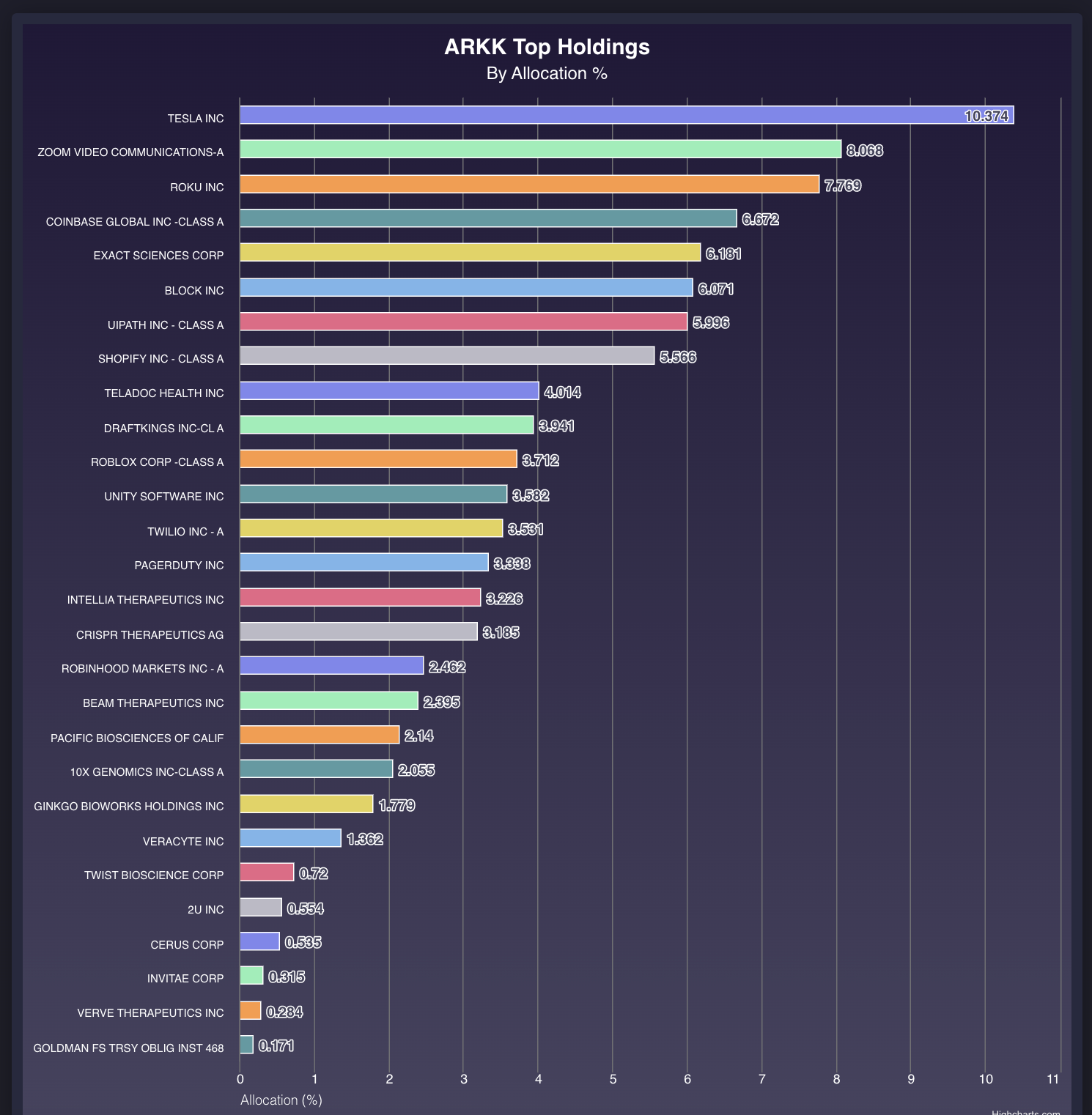

Top Holdings: The performance of the top holdings held by the ETF is also an important factor to consider. Investors should evaluate the top holdings of the ETF and their historical performance to determine whether the ETF has a track record of achieving its investment objective. You can use our Top Holdings By Allocation Chart to do this quite easily.

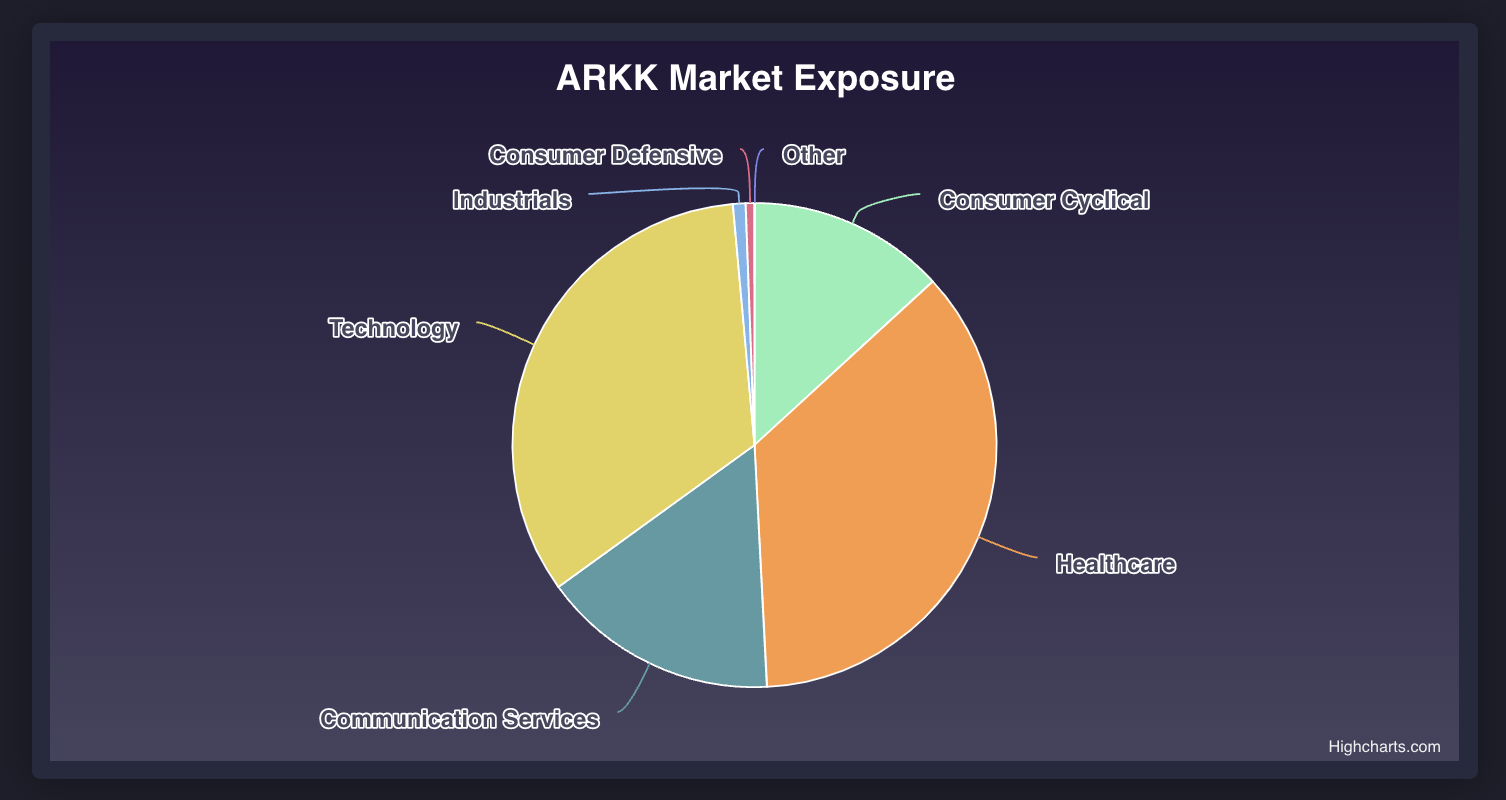

Diversification: ETFs are designed to provide investors with exposure to a diversified portfolio of assets. However, it is still important to evaluate the diversification of the portfolio to ensure that it aligns with your investment goals and risk tolerance. Again, Synvestable makes this very easily using the Market Exposure chart on any ETF's page.

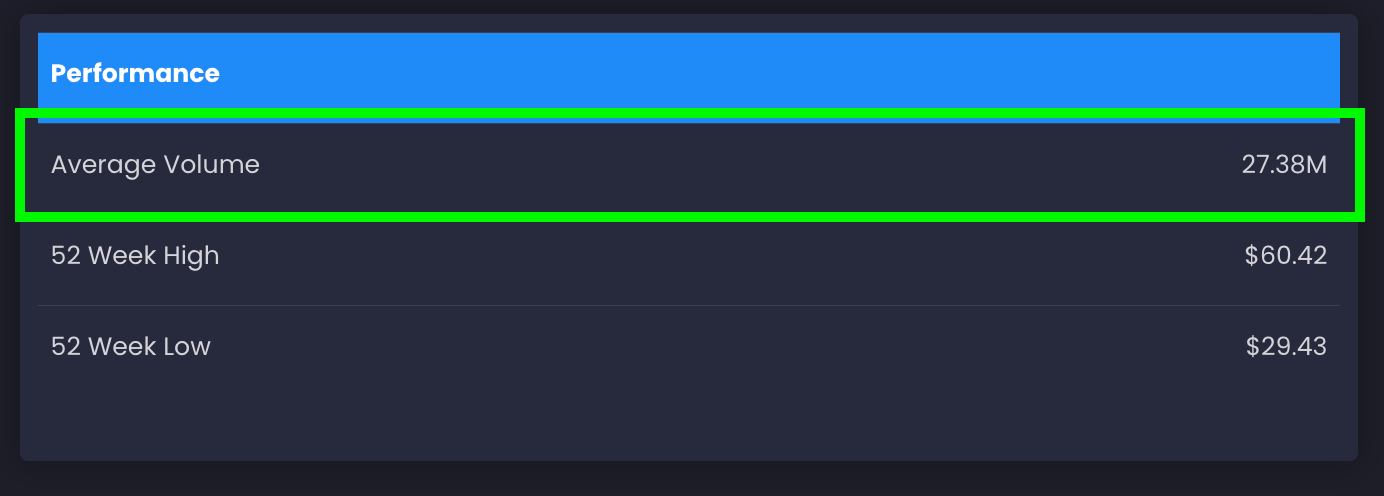

Liquidity: Finally, the liquidity of the ETF is an important factor to consider. Investors should evaluate the bid-ask spread and trading volume of the ETF to ensure that they can buy and sell shares at prices that reflect the underlying value of the ETF. Synvestable will intelligently highlight average volume in red all stocks and ETFs that have low liquidity.

Putting It All Together

ETFs have become an increasingly popular investment vehicle in recent years, providing investors with exposure to a diversified portfolio of assets that can be bought and sold on a stock exchange.

ETFs differ from mutual funds and index fund in several key ways, including their structure, trading flexibility, and tax efficiency. When considering buying an ETF, investors should consider factors such as the expense ratio, liquidity, underlying index or assets, and investment objective.

You can use Synvestable's ETF metrics and tools to analyze any tradable ETF and get a deeper perspective as to its implications on your overall portfolio.

Register For Free in Seconds! Click The Image

The absolute best app in finance. Register in 3 seconds using your Google Account!

Subscribe For FREE Stock Insights!

And a chance to win free shares of stock.

DISCLOSURE: Synvestable is a financial media provider only and is providing the above data for research purposes only. Please consult your financial advisor before investing as investing carries the risk for potential loss of capital. For more information, please consult our Terms of Use on www.synvestable.com