Smart finance isn't just a buzzword; it's a comprehensive lifestyle that encompasses managing money efficiently—we explore the 7 Essential Habits for developing a smarter financial lifestyle.

In today's rapidly changing economic landscape, achieving financial success requires more than just earning a steady income—it demands smart financial habits. Smart finance isn't just a buzzword; it's a comprehensive lifestyle that encompasses managing money efficiently to secure both present and future financial stability.

Here, we delve into the 7 Essential Habits that can set individuals towards a smart finance lifestyle.

1. Budgeting with Precision

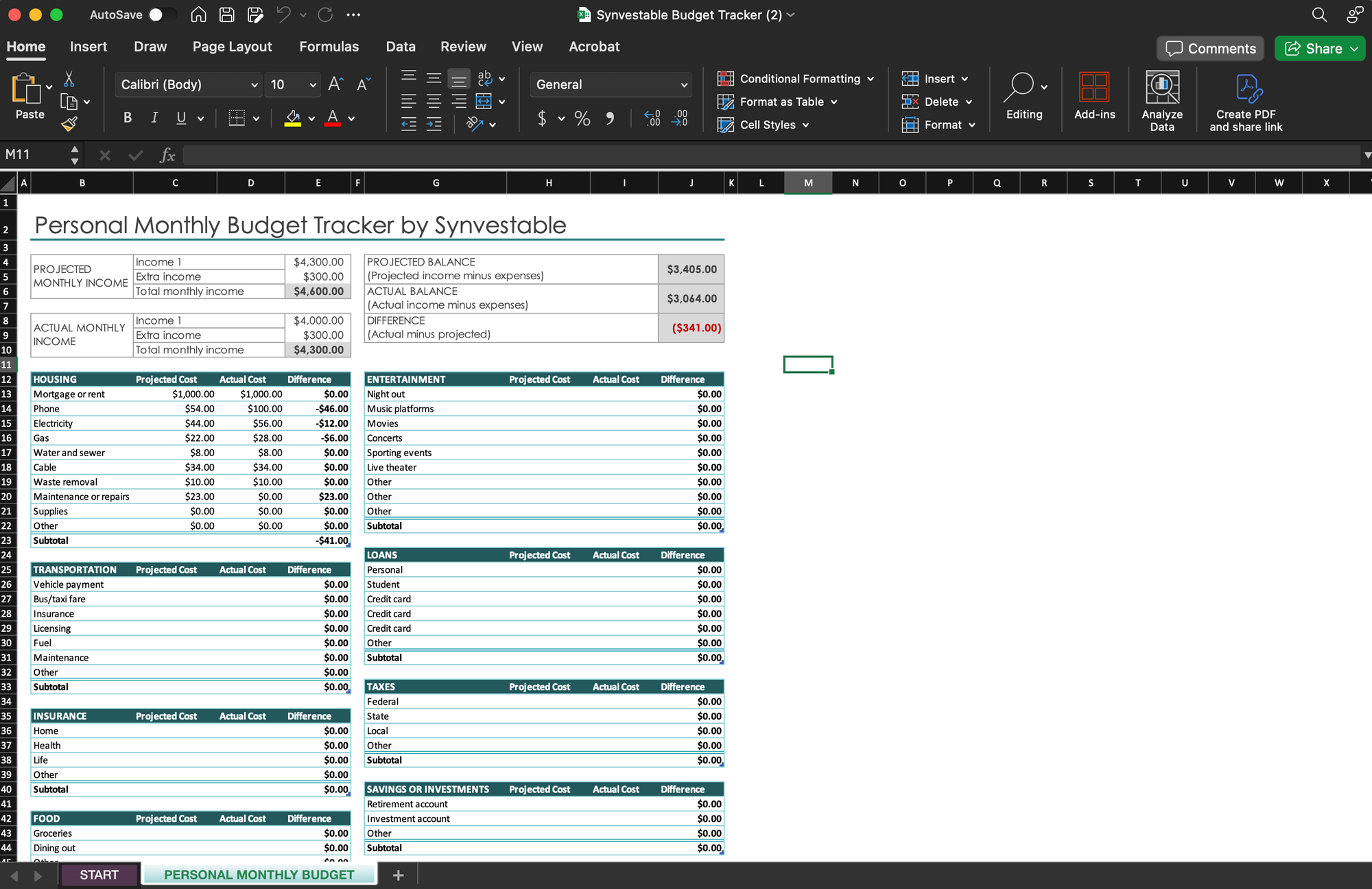

The cornerstone of smart finance is precise budgeting. Knowing where every dollar goes is crucial. This habit involves tracking daily expenses against a predetermined budget.

By monitoring spending patterns, individuals can identify unnecessary expenditures and reallocate funds towards savings or investments. Budgeting apps and tools can simplify this process, providing real-time insights into your financial health.

Pro Tip: Download our FREE monthly budget planner for Excel here.

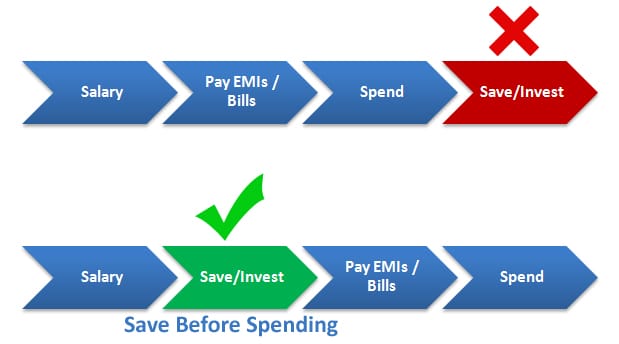

2. Prioritizing Savings

A key habit for smart finance is prioritizing savings. Before spending on non-essential items, it's wise to set aside a portion of income into a savings account. Financial advisors often recommend the "pay yourself first" strategy, which involves automatically directing a percentage of your paycheck into savings or investment accounts. This ensures that saving becomes a non-negotiable part of your financial routine.

3. Building and Maintaining Good Credit

Credit scores play a pivotal role in financial opportunities, affecting the ability to secure loans with favorable terms, rent apartments, and sometimes even land jobs. Building good credit involves making timely payments, keeping credit balances low, and managing credit accounts wisely.

Regularly checking credit reports for errors and understanding the factors that affect your credit score are essential practices.

We're the best app in finance—Register using your Google Account. Just click the GIF!

4. Continuous Learning

The financial world is ever-evolving, and staying informed is vital. This can mean reading books, following financial news, or even taking courses on personal finance management.

Knowledge is power when it comes to investments, taxes, and new financial technologies that can offer more efficiency in managing your finances.

For a great guide on how to succesfully up your financial acumen, check out the Blueprint Investing Formula

5. Creating Financial Goals

Setting short, medium, and long-term financial goals gives direction to financial endeavors. Whether it's saving for a down payment on a house, planning for retirement, or setting up an emergency fund, having clear objectives helps to stay focused and measure progress.

Periodically reviewing and adjusting these goals as life circumstances change ensures they remain relevant and achievable.

6. Mindful Spending

Mindful spending involves reflecting on the value and necessity of each purchase. This habit encourages individuals to differentiate between wants and needs, reducing impulsive buying.

Before making a purchase, consider its impact on your financial goals. Asking questions like "Do I really need this?" or "Is there a more cost-effective alternative?" can lead to more thoughtful spending decisions.

See our guide on developing a proper budgeting plan here.

7. Investing Wisely

Investing is a crucial aspect of smart finance, accessible to everyone thanks to technological advancements. Platforms like Synvestable are transforming how individuals approach investing by offering tools to discover new investment opportunities, create diversified portfolios, and leverage artificial intelligence for strategic insights.

Synvestable simplifies the investment process, making it suitable for both novices and experienced investors. Users can start by exploring a variety of investment options available on Synvestable, including stocks, bonds, ETFs, and alternative assets. The platform's intuitive interface makes it easy to navigate through different markets and find investments that match one's risk tolerance and financial goals.

Working with AI to Build Your Financial Future

One of the standout features of Synvestable is its AI-driven insights. The platform utilizes sophisticated algorithms to analyze market data and user preferences to offer personalized investment recommendations. This technology assists users in optimizing their allocation strategies, ensuring that their portfolios are well-positioned to capitalize on market conditions and achieve long-term growth.

Moreover, Synvestable provides educational resources and real-time analytics, empowering users to make informed decisions. Whether you're looking to start small or expand your investment horizon, Synvestable equips you with the tools necessary to navigate the investment landscape confidently and efficiently.

By integrating smart technology with traditional investing principles, Synvestable helps its users build a solid financial future.

We're the best app in finance—Register using your Google Account. Just click the GIF!