AI Will Change How You Invest

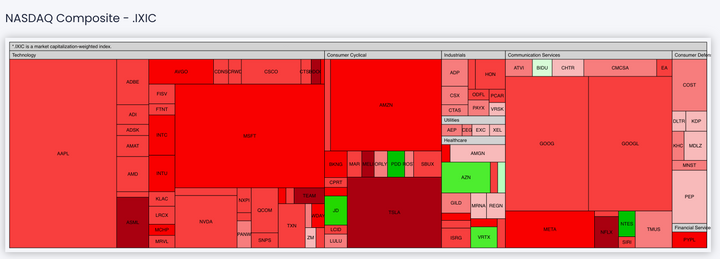

Artificial intelligence (AI), once confined to the realm of science fiction, is now making split-second investment decisions worth millions of dollars. As 2024 unfolds, individual investors face a pressing question: Can AI unlock unprecedented financial returns, or does its rapid adoption bring risks that could redefine the investment landscape?

AI-powered